XRP Signals Potential Reversal at $1.85 Support Amid Bearish Trend

XRP/USDT

$2,480,132,667.31

$1.3653 / $1.27

Change: $0.0953 (7.50%)

-0.0099%

Shorts pay

Contents

XRP’s bearish trend appears to be ending as it rebounds from the $1.85 support level with a 6.50% daily gain, forming a bullish Morning Star pattern. Key accumulation at $1.75 reinforces this shift, though declining trading volume signals caution amid ongoing market pressures.

- XRP support at $1.75 holds strong with 1.80 billion tokens accumulated.

- XRP forms bullish Morning Star pattern after testing $1.85, hinting at trend reversal.

- Trading volume drops 52% to $3.65 billion, per CoinMarketCap data, despite 6.50% price rise to $2.03.

Discover how XRP’s bearish trend may be ending with a key support rebound and bullish signals. Explore technical insights and trader sentiment for informed crypto decisions today.

Is XRP’s Bearish Trend Ending?

XRP’s bearish trend shows signs of conclusion after a notable rebound from the $1.85 support level, marked by a 6.50% increase to $2.03. This movement follows a 29% decline in the broader market downturn, with on-chain data highlighting accumulation at lower levels. Technical indicators like the Morning Star pattern suggest potential reversal, though persistent selling pressure warrants close monitoring.

What Are XRP’s Key Support and Resistance Levels?

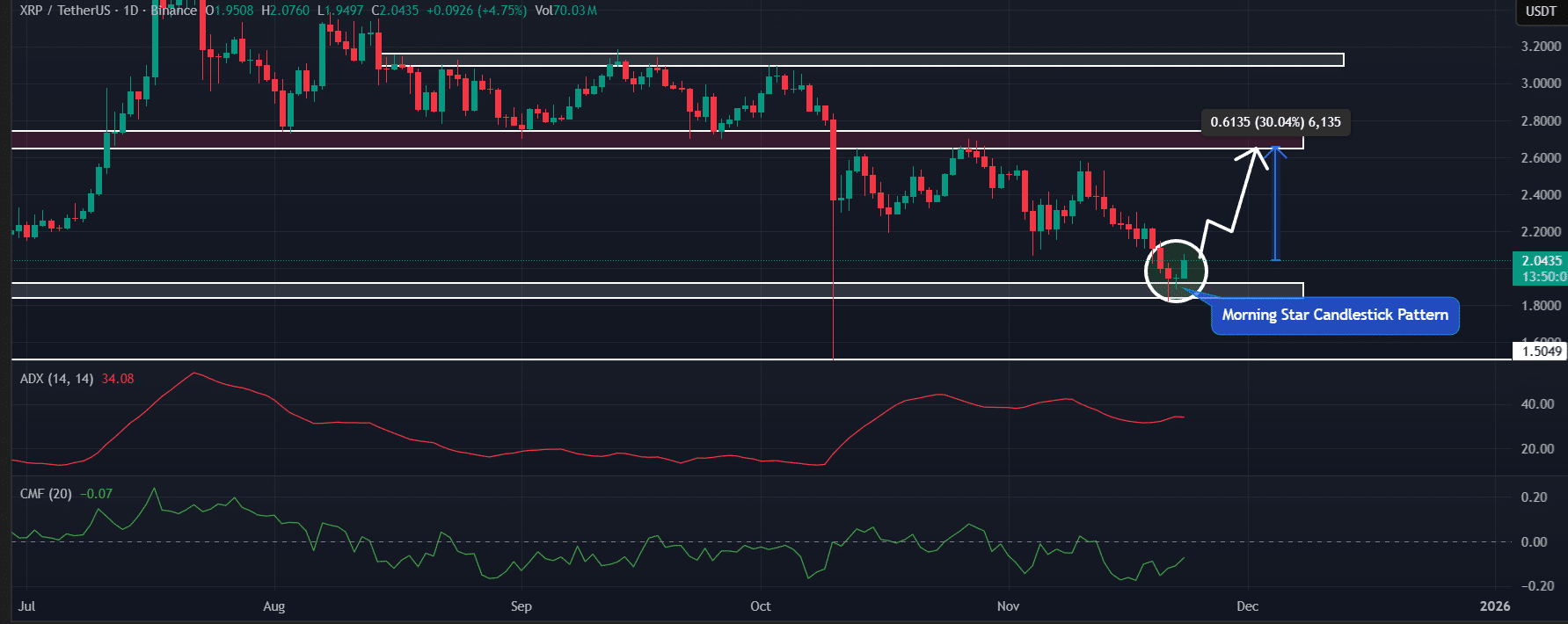

XRP’s primary support lies at $1.75, where 1.80 billion tokens have been accumulated by investors, according to on-chain metrics. This level has historically triggered reversals, bolstering its significance. Resistance emerges at $2.072, aligned with major liquidation zones holding $10.39 million in short positions. Data from TradingView illustrates the daily chart’s bullish Morning Star formation post-$1.85 test, while the Average Directional Index (ADX) exceeds 34.08, signaling robust momentum. However, the Chaikin Money Flow (CMF) at -0.07 indicates lingering capital outflow. Analyst observations on social platforms emphasize the $1.75 zone’s strength, drawing from past price actions. These levels guide traders in assessing breakout potential amid volatile conditions.

Source: TradingView

XRP remains below the 200-day Exponential Moving Average (EMA), confirming the overarching downtrend per technical evaluations. Yet, the recent uptick positions it for possible reversal if support holds. Market dynamics, including reduced exchange reserves, align with this optimistic view from institutional perspectives.

Frequently Asked Questions

What is the significance of XRP accumulation at $1.75 amid its bearish trend?

The $1.75 level represents a critical support where 1.80 billion XRP tokens were accumulated, indicating strong investor confidence. This accumulation, tracked via on-chain data, has historically led to price recoveries, potentially signaling the end of the bearish phase as buyers defend this zone against further declines.

Why is XRP’s trading volume declining despite the recent price rebound?

XRP’s trading volume has fallen 52% to $3.65 billion, even with a 6.50% price rise to $2.03. This drop reflects trader hesitation in a volatile market, as participants await confirmation of the bullish reversal before increasing activity, according to platform metrics.

Key Takeaways

- XRP’s key support at $1.75: Backed by 1.80 billion tokens accumulated, this level offers a foundation for potential reversals based on historical patterns.

- Bullish Morning Star formation: Emerging after the $1.85 test, this candlestick pattern, combined with ADX above 34, points to strengthening momentum despite CMF’s negative reading.

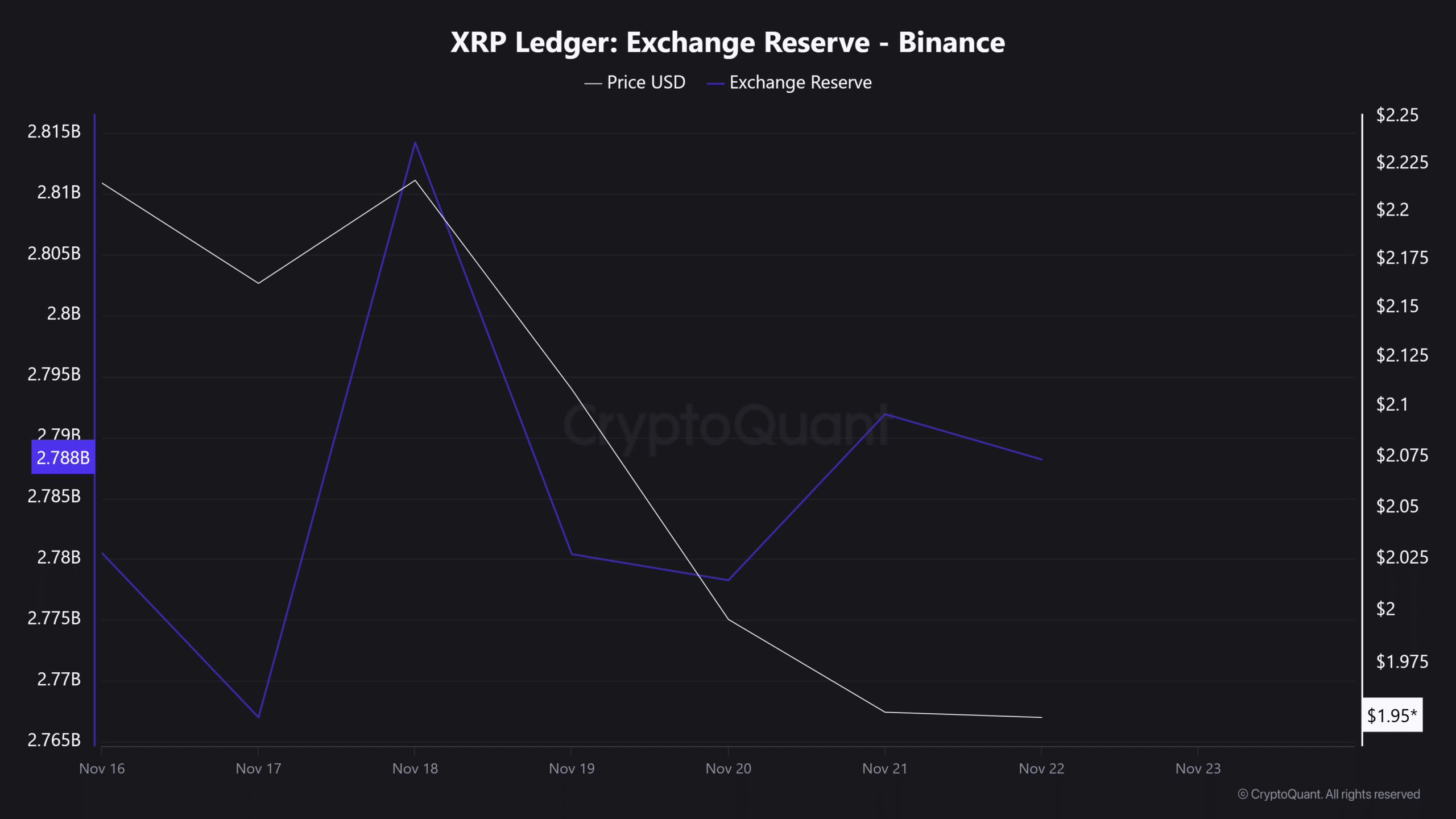

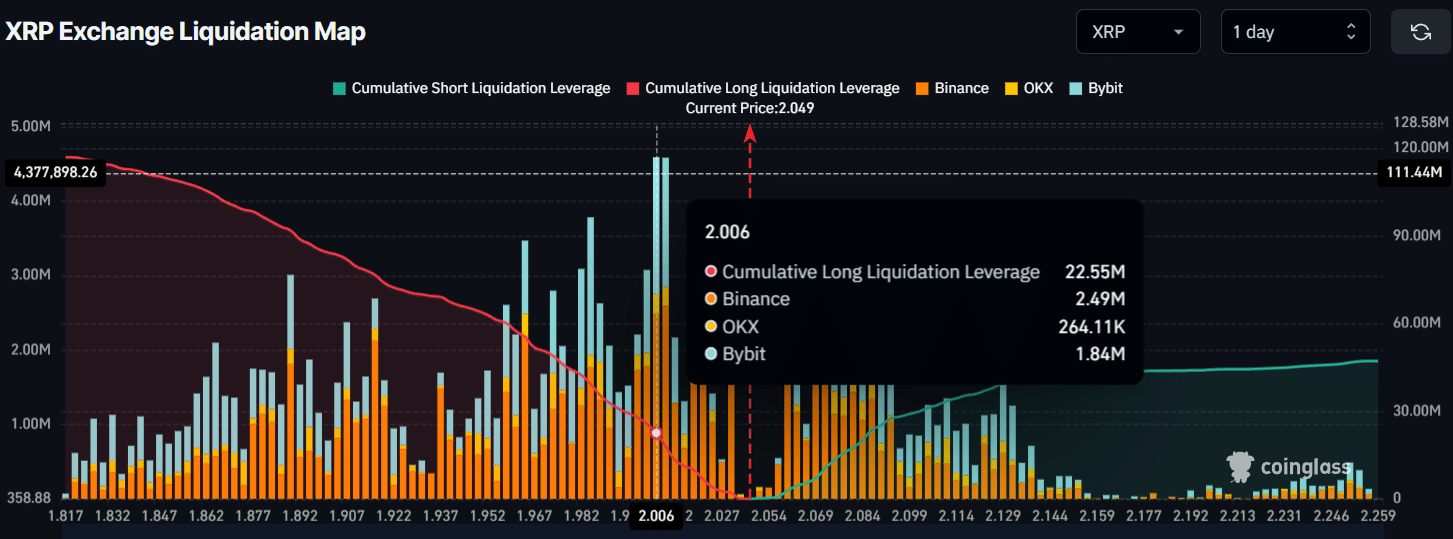

- Declining exchange reserves: A 3 million token drop on Binance signals accumulation into wallets, with rising long positions suggesting trader optimism; monitor liquidation levels at $2.006 and $2.072.

Source: CryptoQuant

The reduction in Binance reserves by 3 million tokens points to investors moving holdings off exchanges, a classic sign of long-term accumulation. This trend coincides with increasing long positions among intraday traders, per derivatives data, potentially amplifying upward pressure if sentiment improves.

Source: CoinGlass

Liquidation clusters at $2.006 and $2.072 encompass $22.55 million in longs and $10.39 million in shorts, creating pivotal barriers. Breaching these could accelerate volatility, with over-leveraged positions at risk. Overall, XRP’s fourth-largest market cap status underscores its influence, yet the 29% prior drop reminds of inherent risks in crypto trading.

Conclusion

XRP’s bearish trend may indeed be winding down, supported by key accumulation at $1.75 and bullish technical signals like the Morning Star pattern at $1.85. With declining exchange reserves and rising trader optimism, the asset’s path forward hinges on volume recovery and sustained momentum above resistance levels. Investors should track these developments closely for strategic positioning in the evolving crypto landscape.