XRP’s Institutional Gains May Counter Retail Sentiment Decline

XRP/USDT

$2,480,132,667.31

$1.3653 / $1.27

Change: $0.0953 (7.50%)

-0.0099%

Shorts pay

Contents

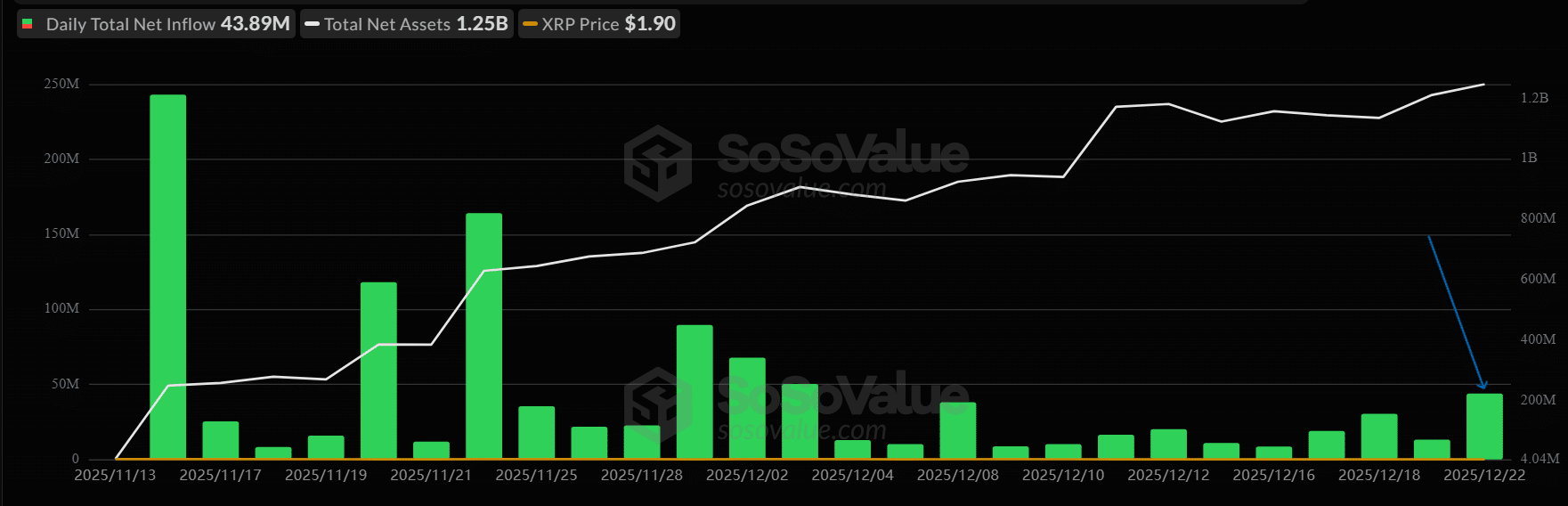

XRP ETF inflows reached $43.89 million over the past two weeks, signaling strong institutional interest despite declining retail sentiment. This marks six consecutive weeks of gains for XRP-linked products, highlighting a key divergence where capital flows counter negative social media buzz around XRP’s price stability.

-

XRP ETFs saw uninterrupted inflows since launch, totaling over $1.2 billion cumulatively.

-

Social sentiment for XRP dropped below historical averages amid flat prices and retail pessimism.

-

Institutional adoption grew with XRPL hosting abrdn’s $3.8 billion tokenized fund, backed by Ripple’s $5 million investment.

XRP ETF inflows surge $43.89M in two weeks despite negative sentiment—explore institutional adoption on XRPL and its impact on XRP’s market structure. Stay informed on crypto trends today.

What are XRP ETF inflows and why are they increasing?

XRP ETF inflows refer to the capital entering exchange-traded funds tied to XRP, the cryptocurrency associated with Ripple’s payment network. These inflows have surged to $43.89 million over the past two weeks, extending a streak of six weeks without outflows and pushing cumulative totals past $1.2 billion. This growth occurs even as XRP’s price remains flat, underscoring institutional confidence in the asset’s long-term utility for cross-border transactions and blockchain-based finance.

How is institutional RWA expansion boosting XRPL adoption?

Real-world asset (RWA) tokenization on the XRP Ledger (XRPL) is advancing institutional involvement, with recent developments like Archax enabling access to abrdn’s tokenized U.S. dollar money market fund. This fund, drawn from abrdn’s $3.8 billion U.S. dollar Liquidity Fund (Lux), marks the first such offering on XRPL and includes a $5 million contribution from Ripple to support RWA strategies. According to data from Ripple’s announcements, this integration enhances settlement speeds and compliance, reducing operational costs for institutions by up to 50% in some cross-border scenarios.

The collaboration between Archax and Ripple focuses on regulated on-chain capital markets, allowing seamless tokenization of traditional assets. Duncan Moir, Senior Investment Manager at abrdn, noted, “The next evolution of financial market infrastructure will be driven by broader adoption of digital securities.” He emphasized XRPL’s institutional-grade features, such as built-in compliance tools and high throughput, which process over 1,500 transactions per second. This move aligns with broader trends in decentralized finance, where tokenized funds grew by 300% in 2025 per reports from Chainalysis, positioning XRPL as a leader in bridging traditional and blockchain finance.

Further, the initiative addresses key pain points in legacy systems, like settlement delays averaging 24-48 hours in traditional markets. By shifting to XRPL, institutions gain near-instant finality, improving liquidity and capital efficiency. Ripple’s strategy here supports over 100 financial institutions worldwide using its technology, with XRPL’s decentralized exchange handling billions in monthly volume, as tracked by XRPL explorers.

Frequently Asked

Questions

What causes the divergence between XRP retail sentiment and institutional inflows?

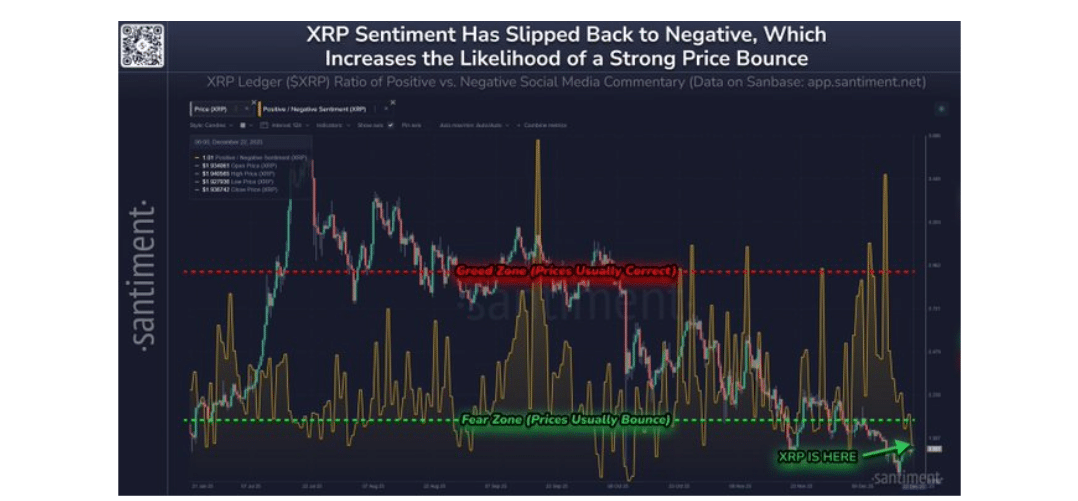

The divergence stems from retail traders reacting to short-term price stagnation, leading to negative social media commentary and reduced participation. In contrast, institutions focus on XRP’s utility in payments and tokenization, driving steady ETF inflows of $43.89 million in recent weeks. Data from Santiment shows sentiment dipping below zero, while SosoValue reports consistent capital accumulation by large investors.

Is institutional adoption on XRPL changing XRP’s market outlook?

Yes, institutional adoption via XRPL is enhancing XRP’s role in global finance, with tokenized assets like abrdn’s fund attracting regulated capital. This counters retail pessimism by emphasizing long-term infrastructure gains, such as faster settlements and lower costs. As voice search trends highlight, XRP’s integration with real-world assets positions it for sustained growth in a maturing crypto ecosystem.

Key Takeaways

- XRP ETF inflows hit $43.89 million: Over two weeks, these gains reflect institutional resilience amid flat prices, building on a $1.2 billion cumulative total.

- Social sentiment declines sharply: Retail confidence wanes with negative commentary, but this hasn’t deterred capital flows into XRP products.

- RWA tokenization advances XRPL: abrdn’s fund launch with Ripple’s backing signals broader adoption—monitor for efficiency improvements in institutional finance.

Conclusion

XRP ETF inflows and institutional RWA expansion on XRPL demonstrate a robust counter to deteriorating retail sentiment, with $43.89 million in recent gains and tokenized funds underscoring real utility. As divergences like this play out, XRP’s market structure could stabilize through sustained institutional demand. Investors should watch ongoing developments in blockchain infrastructure for potential shifts in the coming months.

Retail confidence often weakens when prices remain flat, a period when institutions typically increase exposure. In recent weeks, Ripple [XRP] has shown a growing divergence between institutional activity and broader market sentiment.

On social media, commentary around XRP turned sharply negative, reflecting rising pessimism among retail traders. Yet, capital continued to flow into XRP-linked investment products.

XRP ETFs recorded $43.89 million in inflows over the past two weeks, marking their strongest stretch since launch. This extended their winning streak to six consecutive weeks without any outflows.

The divergence highlights a critical inflection point where sentiment and capital flows are moving in opposite directions.

Could institutional adoption outweigh deteriorating sentiment pressure in XRP’s near-term market structure?

Institutional RWA expansion strengthens XRPL adoption

On the 25th of November, Archax enabled access to UK asset manager abrdn’s tokenized U.S. dollar money market fund on the XRP Ledger.

The fund is part of abrdn’s $3.8 billion U.S. dollar Liquidity Fund (Lux) and represents the first of its kind on XRPL. Ripple contributed $5 million to the fund as part of its broader real‑world asset strategy.

This launch expanded XRPL’s role in institutional decentralized finance and real‑world asset tokenization.

It also built on Archax and Ripple’s ongoing collaboration to deliver regulated capital markets infrastructure on‑chain.

The initiative is designed to improve settlement efficiency and reduce operational friction for institutional participants. As Duncan Moir, Senior Investment Manager at abrdn, explained:

“The next evolution of financial market infrastructure will be driven by broader adoption of digital securities,”

He earlier highlighted efficiency gains from moving investment and settlement processes fully on-chain. The XRP Ledger was cited for its institutional-grade functionality and built-in compliance features.

Sentiment deterioration contrasted with ETF inflows

At press time, XRP Social Sentiment fell well below historical norms, as negative commentary intensified across trading platforms.

Retail participation weakened as pessimism increased, even while institutional-facing developments continued progressing quietly.

Source: Santiment

The sentiment shift reflected declining retail confidence in XRP’s short-term price prospects.

Despite this, XRP recorded $43.89 million in ETF inflows on the 23rd of December, the highest level over the prior two weeks. XRP ETFs have continued attracting capital without interruption since launch, indicating sustained institutional participation.

Source: SosoValue

Cumulative ETF inflows surpassed $1.2 billion, highlighting continued institutional accumulation despite retail disengagement.

Final Thoughts

- XRP institutional adoption and ETF inflows strengthened despite sharply deteriorating social sentiment.

- The divergence left XRP positioned between sentiment-driven pressure and sustained institutional demand.

Comments

Other Articles

XRP’s Bullish Positioning May Weather $1B Escrow Release

January 1, 2026 at 06:02 PM UTC

XRP ETF Inflows and RWA Growth Signal Potential Amid Stagnant Price

January 1, 2026 at 10:47 AM UTC

XRP ETF Inflows Hit $1.16B as Standard Chartered Eyes $8 Potential Amid Whale Selling

January 1, 2026 at 04:48 AM UTC