XRP’s Shrinking Liquid Supply Amid Sell Pressure May Tighten Market

XRP/USDT

$2,480,132,667.31

$1.3653 / $1.27

Change: $0.0953 (7.50%)

-0.0099%

Shorts pay

Contents

XRP’s liquid supply is shrinking despite heavy selling pressure, with exchange balances near 1.5 billion tokens amid rising inflows to platforms like Binance. Over 6 million wallets hold 500 XRP or less, high accumulation costs, and escrows limit tradable supply, potentially amplifying price moves on demand recovery.

-

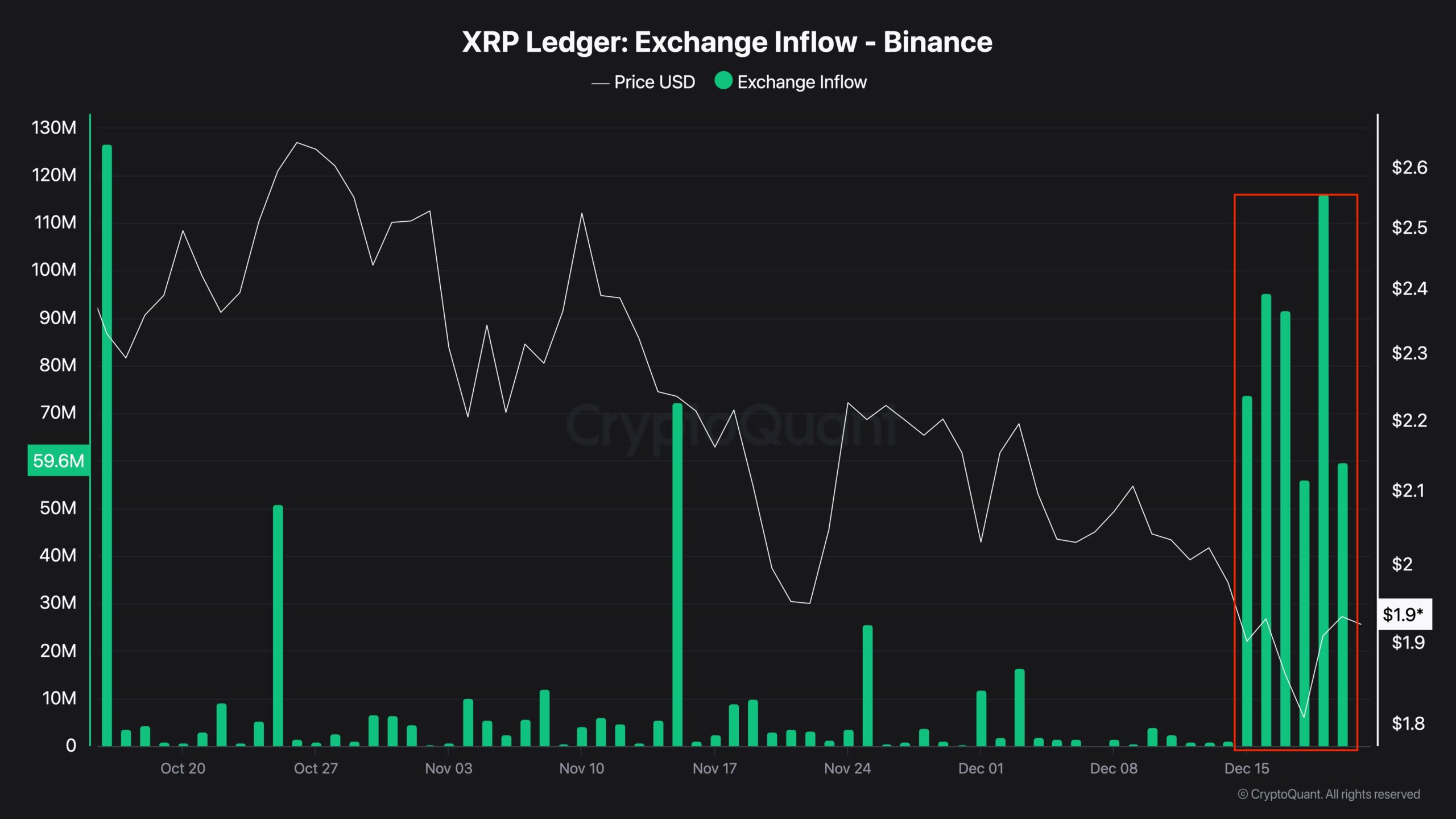

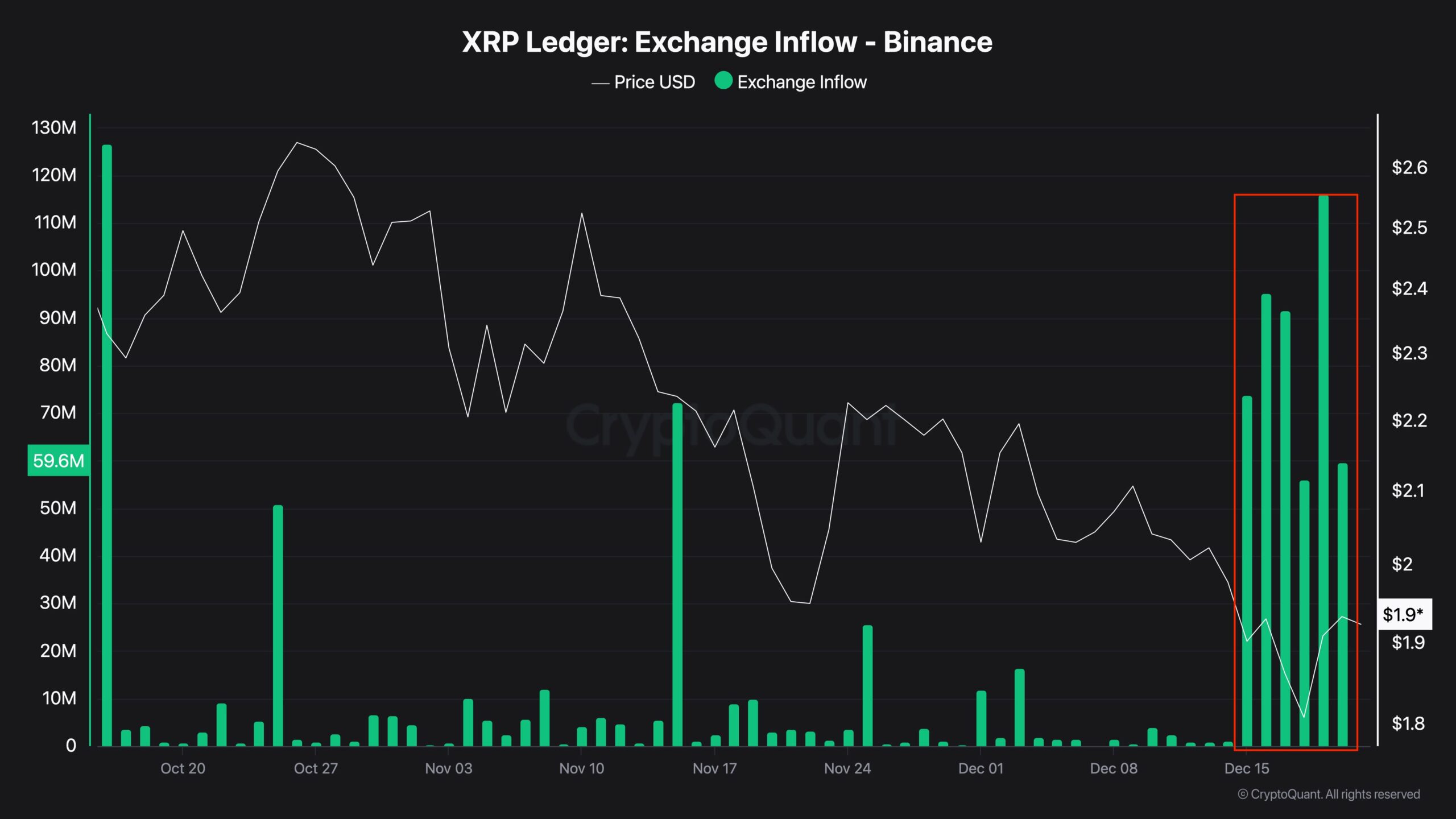

XRP exchange inflows surged to 35-116 million tokens daily from December 15, signaling strong sell intent.

-

Total exchange-held XRP dropped to around 1.5 billion despite price falling nearly 50% to $1.85.

-

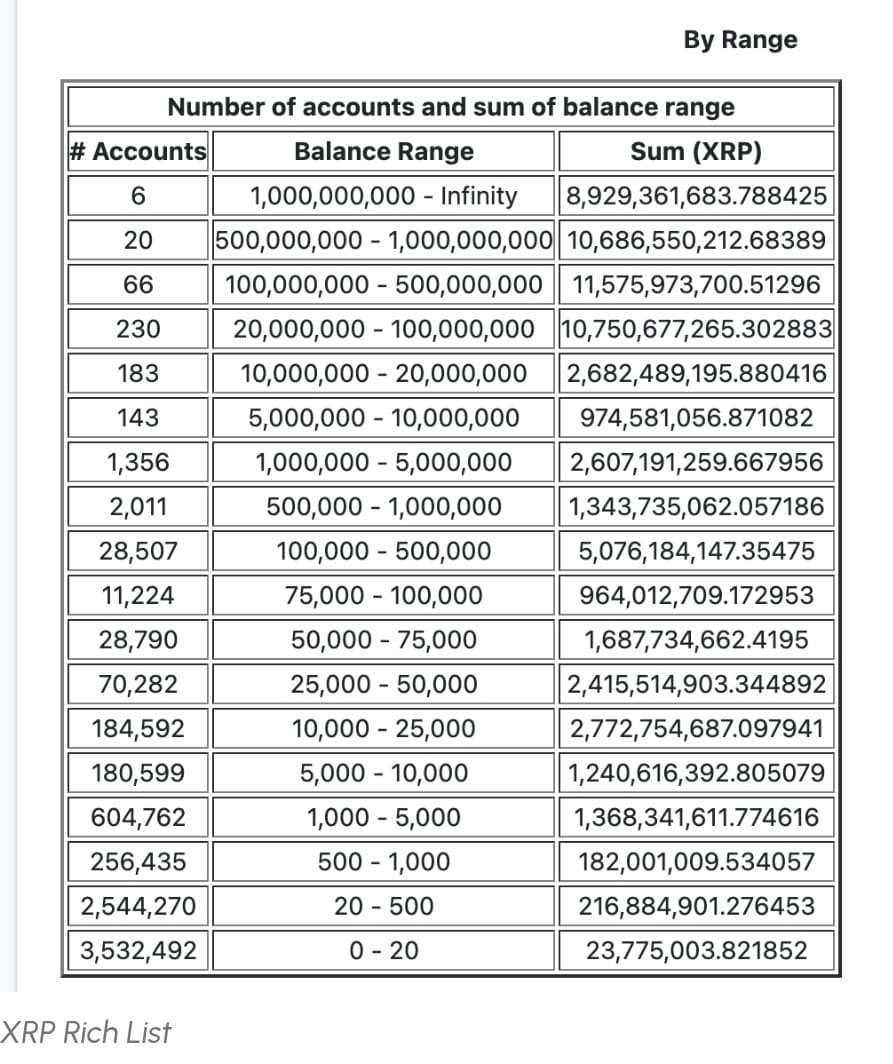

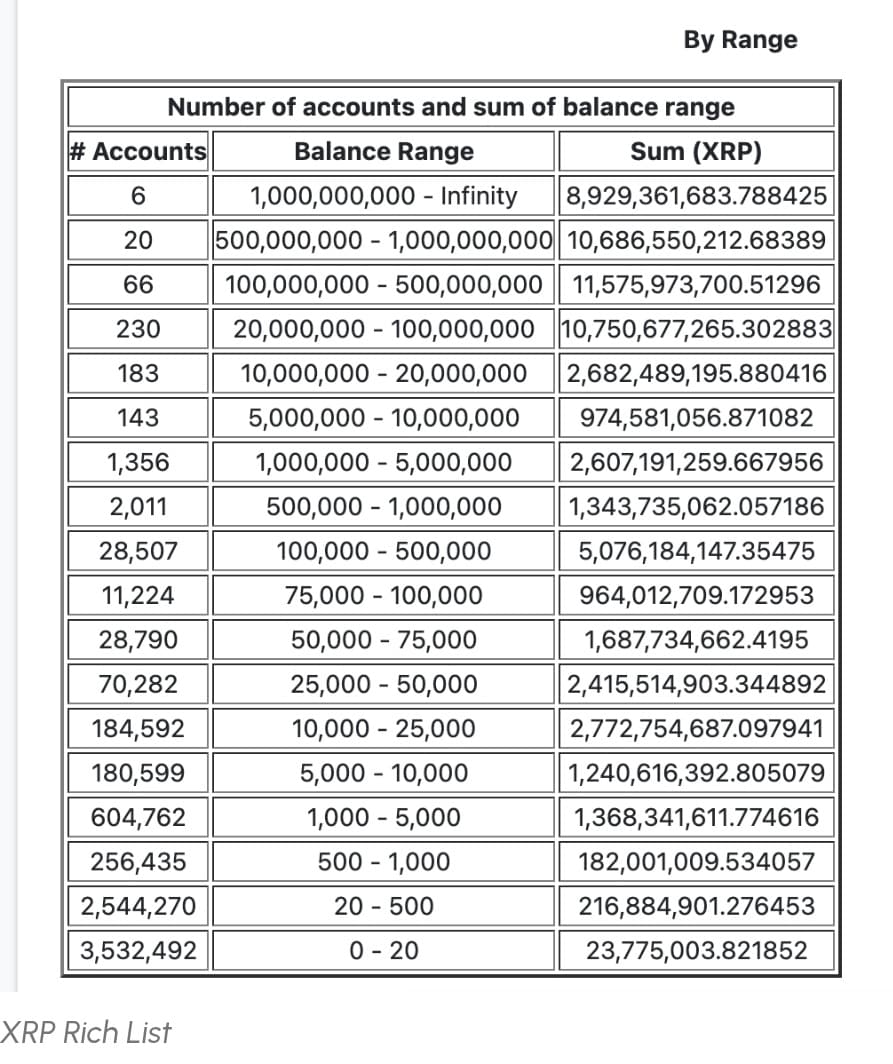

Over 6 million wallets hold 500 XRP or fewer; buying 1,000 XRP now costs $1,750, up from $500 last year per on-chain data.

XRP liquid supply tightens as sell pressure mounts but exchange balances shrink. Discover distribution gaps, rising costs pricing out retail, and implications for future demand surges. Read insights now!

What is driving XRP’s liquid supply to shrink amid high selling pressure?

XRP liquid supply is contracting even as traders rush to sell, with exchange reserves falling to approximately 1.5 billion tokens. Data from CryptoQuant indicates sharp inflows to Binance, the dominant XRP trading venue, peaking at 116 million XRP daily starting December 15. This dynamic stems from uneven distribution, where small holders dominate numbers but not volume, combined with protocol locks and elevated entry barriers for new buyers.

Ripple’s XRP may have a large total supply, but most of it isn’t easy to access or trade. Over six million wallets hold only small amounts, while the XRP that can actually move in the market is getting smaller.

If sell pressure falls and demand returns, this gap could become important. Here’s why.

The pressure to sell is HIGH!

XRP is facing heavy selling after a price drop. The token has fallen nearly 50%, sliding from highs around $3.66 to near $1.85.

This move was followed by a clear rise in Exchange Inflows, especially to Binance, which handles the largest share of XRP trading.

Source: CryptoQuant

After weeks of relatively stable activity, inflows picked up from the 15th of December. Daily Transfers to Binance jumped to between 35 million and 116 million XRP, so there was increased intent to sell.

Source: X

At the same time, total XRP held on exchanges has continued to fall, now sitting near 1.5 billion XRP. Traders are selling into weakness, even with the overall exchange supply shrinking.

How does XRP’s wallet distribution impact its liquid supply?

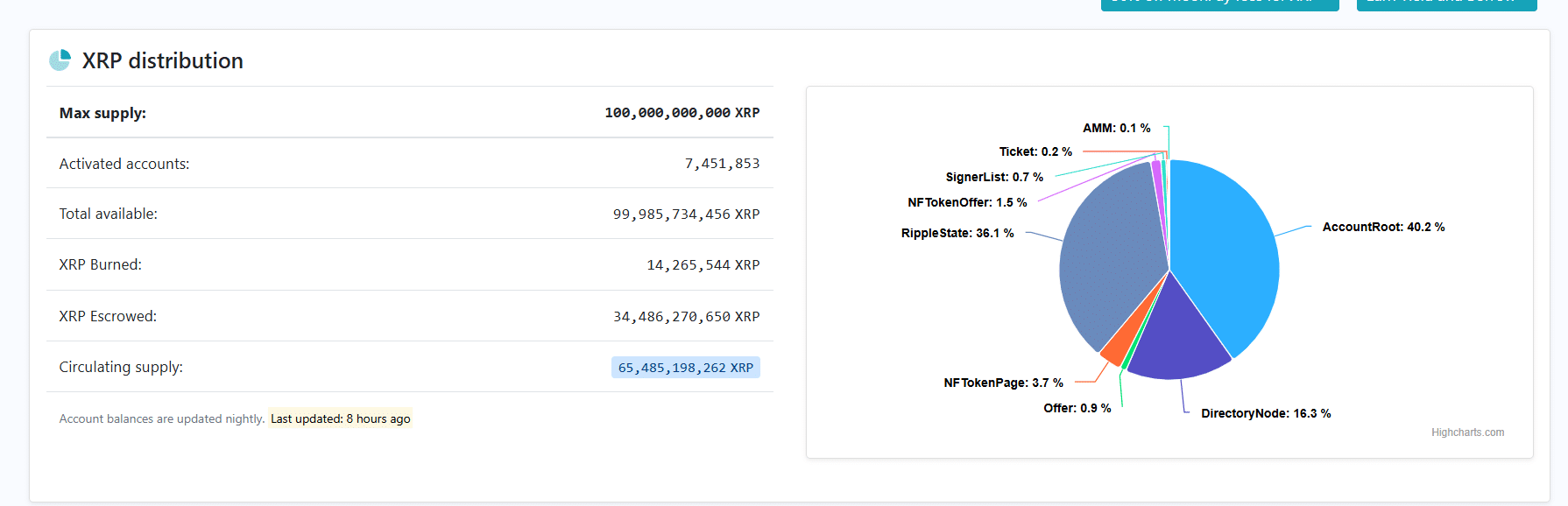

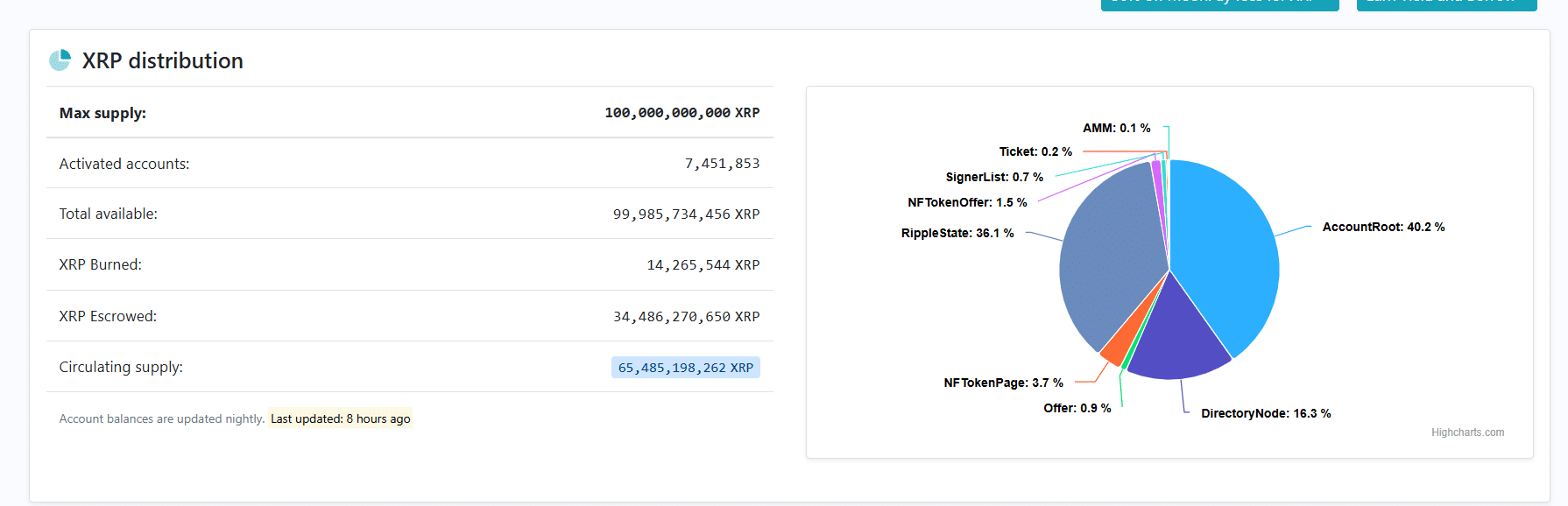

The way XRP is distributed helps explain who is feeling it most. Recent data from XRPScan reveals that more than 6 million wallets hold 500 XRP or fewer, placing most participants at the small-holder end of the spectrum. Wallets holding millions of XRP are few but control a large share of the supply. CryptoQuant metrics confirm exchange balances have declined steadily, underscoring reduced available liquidity.

Source: X

On paper, XRP’s circulating supply looks large, but the headline supply figures overstate how much XRP is actually liquid and tradable.

Source: XRPScan

XRP has also become far more expensive to accumulate. Buying 1,000 XRP now costs around $1,750, up from roughly $500 a little over a year ago. This rising entry cost limits how much new retail can buy during pullbacks, according to aggregated on-chain metrics. Network data further shows a significant portion of XRP is escrowed or locked via account reserves and protocol requirements, further constraining free-floating supply. As a result, smaller wallets hold minimal amounts, while acquisition barriers sideline retail buyers. This creates a pronounced liquidity gap in the XRP market.

Frequently Asked Questions

Why is XRP exchange supply decreasing while inflows increase?

XRP exchange balances fell to 1.5 billion tokens as traders sold into price declines around $1.85, per CryptoQuant data. Inflows to Binance spiked to 116 million XRP daily from mid-December, but overall reserves shrank due to faster outflows or off-exchange holding shifts.

What percentage of XRP wallets hold less than 500 tokens?

More than 6 million XRP wallets, representing the majority of addresses, hold 500 XRP or fewer, according to XRPScan rich list analysis. This skewed distribution means retail controls little tradable supply, tightening market dynamics on demand upticks.

Key Takeaways

- XRP sell pressure is intense: Inflows to exchanges like Binance hit 35-116 million XRP daily, yet balances dropped to 1.5 billion.

- Distribution skews liquidity: Over 6 million small wallets and whale dominance limit free supply per XRPScan.

- Retail priced out: 1,000 XRP costs $1,750 now; monitor for demand shifts that could accelerate price action.

Conclusion

XRP’s liquid supply continues to tighten amid heavy selling pressure and uneven wallet distribution, with exchange balances at historic lows despite inflows. Data from CryptoQuant and XRPScan highlight how small-holder prevalence, escrow mechanisms, and rising costs create a fragile balance. As market conditions evolve, reduced XRP liquid supply positions it for potential volatility—investors should track on-chain metrics closely for emerging demand signals.

Comments

Other Articles

XRP’s Bullish Positioning May Weather $1B Escrow Release

January 1, 2026 at 06:02 PM UTC

XRP ETF Inflows and RWA Growth Signal Potential Amid Stagnant Price

January 1, 2026 at 10:47 AM UTC

XRP ETF Inflows Hit $1.16B as Standard Chartered Eyes $8 Potential Amid Whale Selling

January 1, 2026 at 04:48 AM UTC