XRP’s Thinning Exchange Supply and ETF Inflows May Aid 2026 Positioning

XRP/USDT

$2,480,132,667.31

$1.3653 / $1.27

Change: $0.0953 (7.50%)

-0.0099%

Shorts pay

Contents

XRP shows strong positioning for 2026 with exchange balances dropping from 4 billion to 1.5 billion per Glassnode data, $1.14 billion in ETF inflows, and the Clarity Act set for early January markup, thinning sell-side liquidity and boosting institutional demand.

-

XRP exchange balances fell from 4 billion to 1.5 billion in 2025, signaling reduced sell-side pressure (Glassnode).

-

XRP ETFs attracted $1.14 billion in net inflows across five products, supporting on-chain demand.

-

Clarity Act markup in early January could clarify regulations, intensifying L1 competition including XRP.

Discover why XRP’s dip below $2 signals a reset, not breakdown. Explore declining balances, ETF gains, and Clarity Act impact for 2026 positioning. Stay ahead in crypto. (152 characters)

What is the 2026 outlook for XRP amid the Clarity Act?

XRP enters 2026 with robust fundamentals, including sharply reduced exchange balances and surging ETF inflows, positioning it favorably as the Clarity Act approaches markup in early January. This legislation aims to delineate speculation from regulation, potentially accelerating competition among Layer 1 blockchains like XRP. On-chain metrics indicate sustained demand, suggesting the recent price dip below $2 is a temporary reset rather than a bearish signal.

How have XRP exchange balances and ETF inflows evolved?

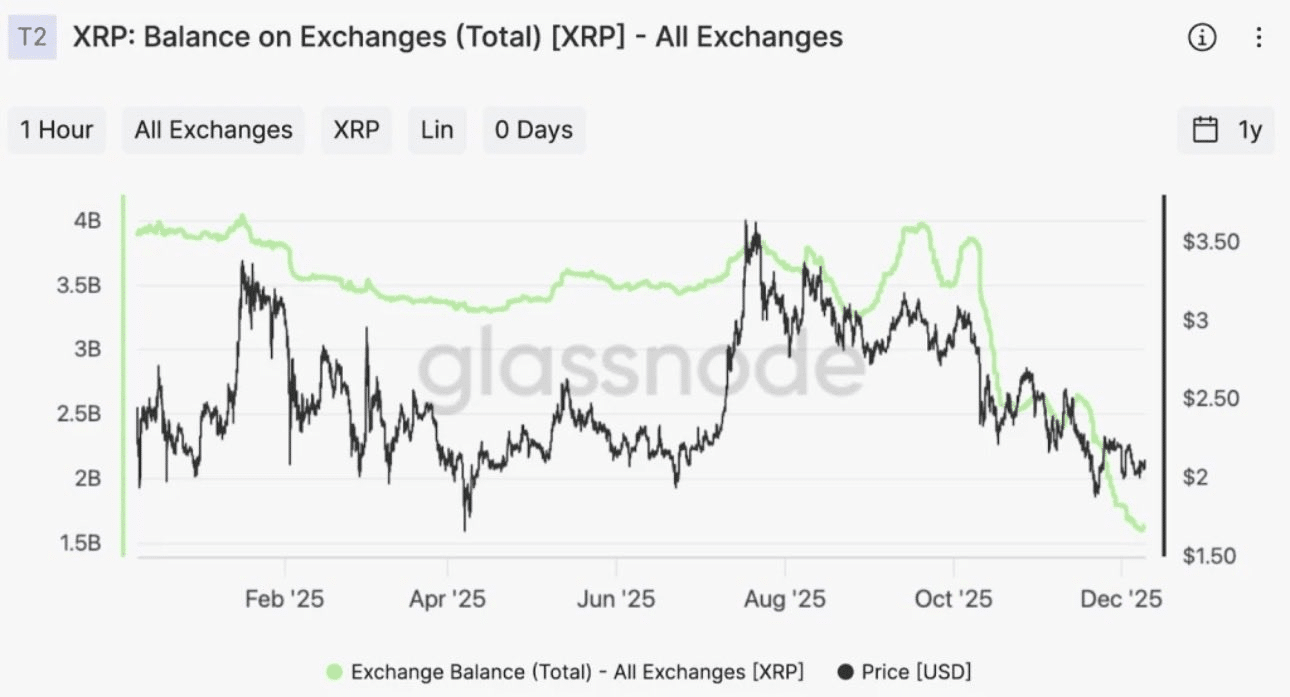

XRP balances on exchanges have declined significantly from approximately 4 billion tokens at the start of 2025 to around 1.5 billion currently, according to Glassnode data. This reduction in sell-side liquidity reflects accumulation by long-term holders.

Source: Glassnode

Concurrently, XRP exchange-traded funds have recorded $1.14 billion in cumulative net inflows across five products, underscoring growing institutional interest. These trends align with XRP’s strategic developments throughout 2025, enhancing its resilience in a challenging altcoin market.

Frequently Asked Questions

Why did XRP exchange balances drop to 1.5 billion in 2025?

XRP balances on exchanges fell from 4 billion to 1.5 billion due to sustained accumulation by holders, reducing available sell-side liquidity as per Glassnode metrics. This shift supports bullish on-chain demand amid broader market resets. (47 words)

Is the Clarity Act good news for XRP and Layer 1 tokens?

Yes, the Clarity Act, slated for markup in early January 2026, promises clearer regulatory boundaries between speculation and compliance, likely fostering competition among Layer 1 protocols like XRP. This could unlock new institutional participation and market stability.

The market anticipates heightened activity in 2026 for Layer 1 tokens, with XRP demonstrating relative strength. Solana has declined 40% year-to-date, while XRP’s drawdown stands at 12%, highlighting its outperformance.

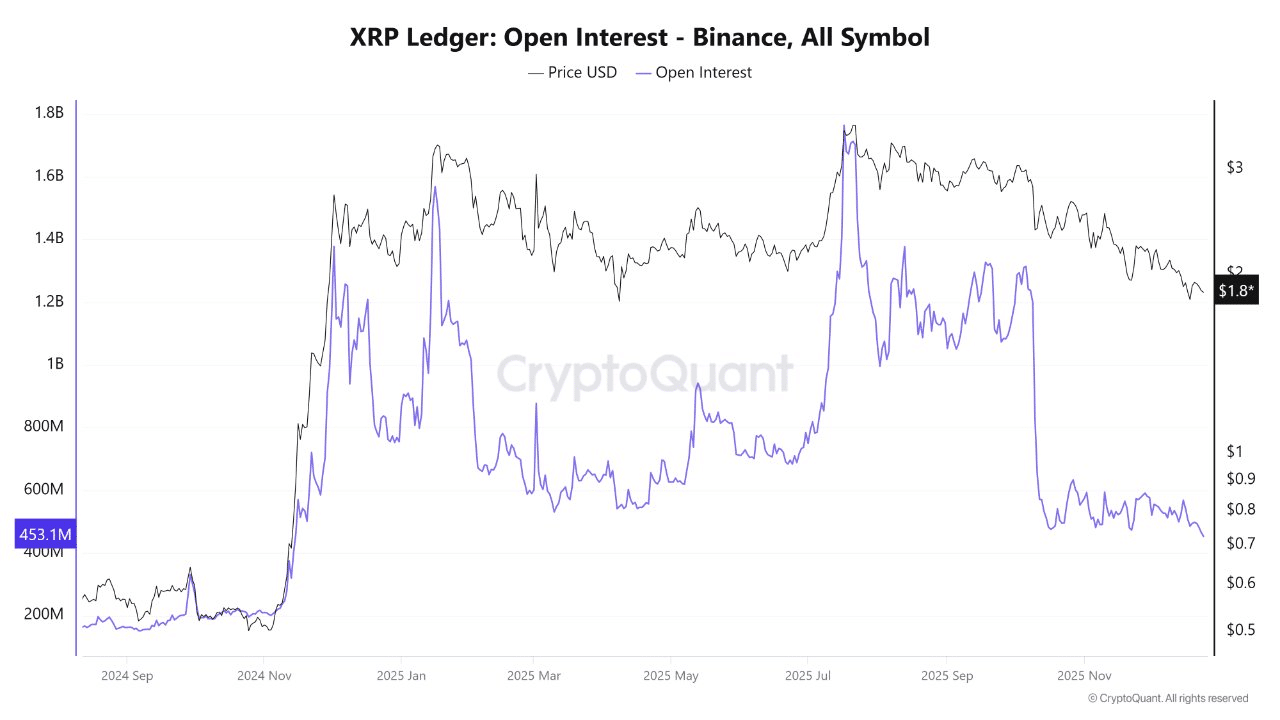

Source: CryptoQuant

XRP’s open interest on Binance has retreated to $453 million, the lowest since early 2024, indicating deleveraging that cleanses the structure for future upside. The Altcoin Season Index peaked at 80 before settling at 37, confirming limited rotation into alternatives, yet XRP holds firm.

Regulatory clarity via the Clarity Act could catalyze L1 adoption, with XRP’s roadmap execution in 2025 providing a solid foundation. Market hesitation persists, but XRP’s metrics suggest readiness for renewed momentum.

Key Takeaways

- Supply Squeeze underway: Exchange balances at 1.5 billion signal thinning liquidity and holder accumulation.

- Institutional Boost: $1.14 billion ETF inflows counterbalance market dips, enhancing demand.

- Regulatory Catalyst: Clarity Act positions XRP advantageously in L1 competition for 2026.

Conclusion

XRP’s 2026 outlook benefits from declining exchange balances, robust ETF inflows, and the Clarity Act’s potential to streamline regulations for Layer 1 tokens. With relative outperformance versus peers like Solana and a cleaned leverage profile, XRP appears set for leadership. Investors should monitor January developments closely for entry opportunities.