Zcash Plunges 21% in Market Sell-Off, Potential Slide to $300 Looms

ZEC/USDT

$444,176,201.48

$223.96 / $203.50

Change: $20.46 (10.05%)

+0.0004%

Longs pay

Contents

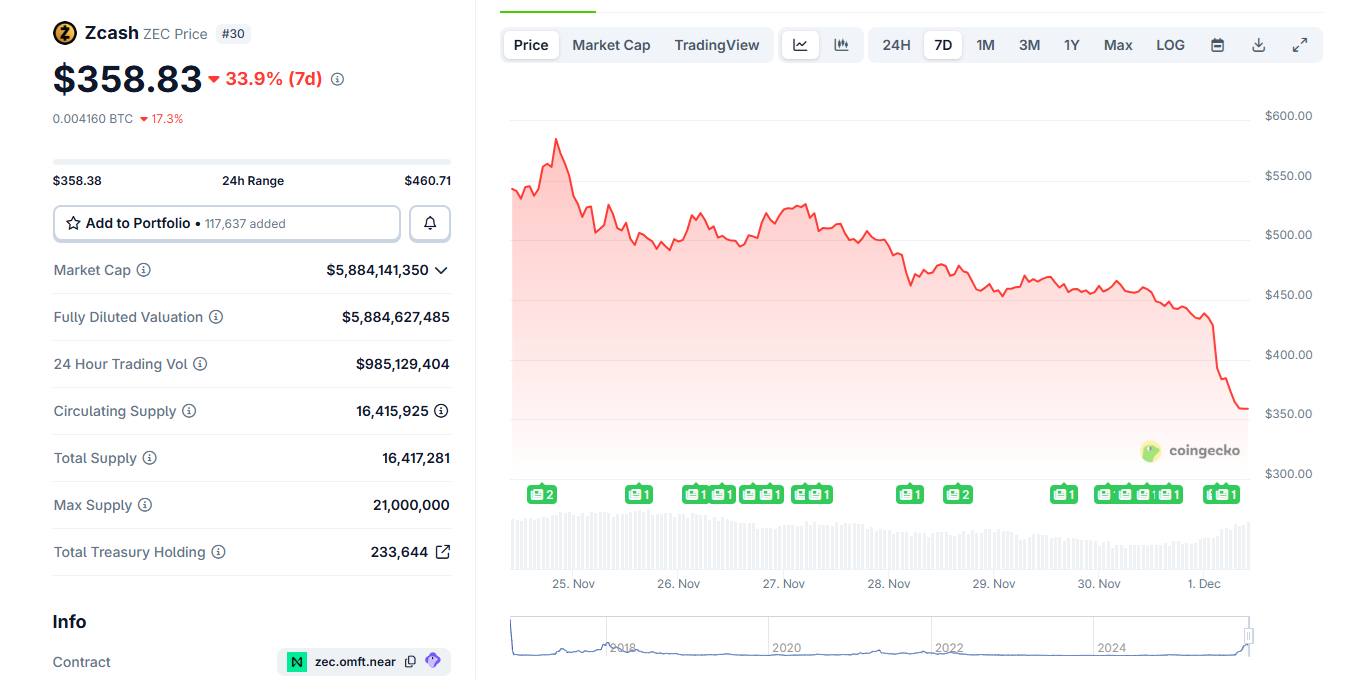

The Zcash price crash in 2025 saw ZEC drop over 21% to $360.35, triggered by broader market declines led by Bitcoin’s losses. This breakdown below the $440 support level liquidated over $6 million in long positions, signaling potential further slides to $340 or below $300 amid rising short interest.

-

ZEC’s rapid 21% plunge during Asian and early European trading hours erased recent gains above $700.

-

Trading volumes spiked only during the sell-off, indicating fading momentum after a brief relief rally.

-

Short positions surged to 45% of open interest, below $500 million, with whales aggressively betting against recovery; Polymarket odds for $1,000 by year-end fell to 8%.

Discover the causes behind the Zcash price crash and its impact on privacy coins in 2025. ZEC’s 21% drop highlights market risks—stay informed on crypto trends and protect your investments today.

What Caused the Zcash Price Crash in 2025?

The Zcash price crash in 2025 stemmed primarily from broader cryptocurrency market downturns, with ZEC unable to resist the pull of Bitcoin’s declines. On Monday, ZEC plummeted over 21% within hours, breaking through the critical $440 support level and settling at $360.35 during Asian and early European trading sessions. This event followed a period of relative strength for ZEC, but escalating short positions and liquidated longs amplified the fall, erasing gains from its recent rally above $700.

Zcash crashed along with the market, no longer providing a relief rally, as the price broke the $440 support level. | Source: CoinGecko.

Zcash crashed along with the market, no longer providing a relief rally, as the price broke the $440 support level. | Source: CoinGecko.The crash also underscored vulnerabilities in ZEC’s recent uptrend, which had briefly defied market pressures. Trading volumes for ZEC had been tapering in the preceding week, only surging during this intense selling pressure. Analysts from platforms like CoinGecko noted that the rally’s sustainability was questionable, as it relied heavily on short squeezes rather than fundamental drivers. This Zcash price crash liquidated more than $6 million in long positions, pressuring traders who had bet on continued upward momentum.

Contributing to the sentiment shift was a statement from Ethereum co-founder Vitalik Buterin, who advised cryptocurrency communities to avoid token-based governance models to prevent governance-related pitfalls. While not directly targeting Zcash, this commentary rippled through privacy-focused assets, adding to the bearish outlook. ZEC’s open interest dipped below $500 million, with short positions climbing to over 45% of total positions—up from a low of 30% earlier in the month. This surge in bearish bets contrasted with previous short squeezes that had fueled ZEC’s ascent.

In the derivatives market, platforms like Hyperliquid showed aggressive shorting activity. Data indicates that 13 out of 20 major whales initiated short positions at various levels, some even accepting negative fees to capitalize on the anticipated slide. Conversely, remaining long whales faced mounting losses; one prominent holder absorbed a $4.4 million unrealized deficit but added collateral to hold out for a potential reversal. Such dynamics highlight the high-stakes tug-of-war in ZEC’s trading environment.

How Is the Altcoin Season Impacting Zcash’s Decline?

The Zcash price crash aligns with a broader unraveling of altcoin season momentum, as the altcoin season index retreated to 26 points from higher levels. ZEC, which had been a key driver in pushing the index upward, lost ground against Bitcoin, trading below 0.005 BTC. This relative underperformance raised suspicions of whale-driven pumps, where large holders may have exited positions after short liquidations artificially inflated prices. Supporting data from market trackers shows ZEC’s rally was one of the few bright spots, but its collapse has deepened concerns over altcoin sustainability.

Privacy coins as a category suffered significantly, with their total market capitalization falling below $17 billion. Zcash relinquished its position as the leading privacy coin to Monero (XMR), which gained over 9% in the past week to trade above $418. XMR’s resilience—being the only privacy coin in positive territory—offers a counter-narrative, potentially positioning it as the new outlier against market trends. However, experts caution that XMR’s uptick echoes ZEC’s earlier patterns, and the Zcash experience may temper enthusiasm for sustained rallies in the sector. According to on-chain analytics from sources like Glassnode, privacy coin volumes have shifted, with XMR capturing more interest amid regulatory scrutiny on traceable assets.

The liquidation cascade during ZEC’s drop wiped out longs down to the $360 range, setting the stage for possible retracement to $440 if shorts ease. Yet, persistent market weakness could drive prices toward $340 or even sub-$300 levels. Traders are monitoring Hyperliquid and Polymarket for signals; the latter platform’s prediction market now pegs ZEC reaching $1,000 by year-end at just 8%, a sharp decline from 42% in November. This reflects eroded confidence, as short sellers who previously capitulated now dominate positioning.

Broader market context plays a pivotal role. Bitcoin’s dominance has risen amid the altcoin pullback, squeezing liquidity from smaller caps like ZEC. Historical patterns suggest that privacy coins often amplify Bitcoin’s moves, but ZEC’s decoupling attempt failed spectacularly. Financial analysts from firms like Messari emphasize that without renewed institutional interest or positive regulatory developments, such crashes could become more frequent in volatile 2025 conditions.

Frequently Asked Questions

What triggered the ZEC liquidations during the crash?

The ZEC crash triggered over $6 million in long liquidations as prices broke the $440 support, cascading through Asian and European sessions. Rising short interest, now at 45% of open positions, overwhelmed bullish bets, leading to forced sales and amplified downside pressure, per data from derivatives platforms.

Is Zcash’s price drop a sign of altcoin season ending?

Yes, Zcash’s more than 21% decline signals weakening altcoin season, with the index at 26 points and ZEC falling below 0.005 BTC. Privacy coins lost market cap below $17 billion, but Monero’s 9% gain suggests selective opportunities amid the broader unraveling.

Key Takeaways

- Market Correlation Amplified Losses: ZEC’s 21% crash mirrored Bitcoin’s downturn, breaking key supports and liquidating $6M in longs without a counter-rally.

- Short Interest Dominates: With 45% of positions short and whales adding bearish bets on Hyperliquid, recovery odds like Polymarket’s 8% for $1,000 EOY reflect pessimism.

- Privacy Coin Shifts: ZEC lost top spot to XMR, which rose 9% to $418, highlighting potential for sector rotation but cautioning against unsustainable pumps.

Conclusion

The Zcash price crash in 2025 exemplifies the fragility of altcoin rallies amid dominant Bitcoin trends and rising short pressures, with ZEC’s slide to $360.35 underscoring support breakdowns and liquidation risks. As privacy coins navigate this downturn—totaling under $17 billion in market cap—investors should prioritize risk management and monitor shifts like Monero’s gains for emerging opportunities. Staying vigilant on market sentiment and avoiding over-leveraged positions will be key to weathering future volatility in the evolving crypto landscape.