ZCash Rally Signals Potential $480 Target Amid Bullish Structures and Weak Demand

ZEC/USDT

$524,152,749.57

$258.80 / $234.91

Change: $23.89 (10.17%)

+0.0032%

Longs pay

Contents

ZCash experienced a significant price rally of 30.8% following its listing on Bitget on December 3, 2025, surging from $312.8 to $409.2. Key support at $360 held firm, paving the way for potential targets at $480 after breaking the $400 psychological level, offering opportunities amid volatility.

-

ZCash’s bullish daily structure supports further gains, with filled imbalances indicating upward momentum.

-

Indicators like CMF and MFI show mixed signals, with weak demand on higher timeframes.

-

Volume trends and short-term demand zones between $382-$395 suggest consolidation or a push toward $480 if inflows strengthen.

Discover the ZCash price rally details after Bitget listing: 30.8% surge, defended support, and next targets. Stay informed on crypto trends and trading insights for smart decisions. Explore now!

What is driving the ZCash price rally after its Bitget listing?

ZCash price rally has been propelled by its recent listing on the prominent cryptocurrency exchange Bitget on December 3, 2025, which sparked immediate interest and buying activity. This event led to a 30.8% increase, moving the price from $312.8 to $409.2 in a short period. Recent analyses from market observers, such as those referenced in TradingView data, highlight that the $360 support level has been successfully defended, reinforcing bullish sentiment and opening paths to higher targets like $480.

How do technical indicators influence ZCash’s short-term outlook?

Technical indicators present a nuanced picture for ZCash, with bullish price action clashing against signs of subdued demand. On the daily chart, the Chaikin Money Flow (CMF) hovers at -0.25, indicating ongoing selling pressure, while the Money Flow Index (MFI) remains below 50, reflecting limited capital inflows. According to TradingView metrics, an imbalance zone between $395 and $425 has been filled, which historically signals potential for additional gains if volume picks up.

Shifting to shorter timeframes, the one-hour chart reveals stronger momentum with improving capital inflows, though recent hours show a slowdown. This discrepancy suggests traders should monitor volume closely; sustained buying could push ZCash past $425 toward $480, while fading demand might lead to consolidation around current levels. Expert analysis from on-chain data providers like Glassnode underscores that privacy-focused coins like ZCash often see volatility spikes post-listing, with historical rallies averaging 25-35% in similar scenarios. Short sentences highlight key risks: a break below $382 could target $330-$350, but holding above $395 maintains bullish bias.

Frequently Asked Questions

What caused ZCash’s 30.8% rally since the Bitget listing?

The ZCash rally stemmed from its December 3, 2025, listing on Bitget, which boosted liquidity and trader interest. Prices climbed from $312.8 to $409.2 as the $360 support held, per TradingView observations, amid broader market recovery in privacy coins. This move broke the $400 barrier, fueling optimism without underlying fundamental shifts.

Is ZCash a good buy now amid this price surge?

Based on current technicals, ZCash shows bullish potential if it sustains above $395, targeting $480, as noted in market reports from sources like CoinMarketCap. However, mixed indicators like negative CMF advise caution; consider stop-losses below $382 for risk management. Always assess personal risk tolerance, as cryptocurrency markets remain highly volatile.

Key Takeaways

- Bullish Structure Persists: Daily and internal swings favor upside, with filled imbalances supporting gains toward $480.

- Mixed Indicators Demand Vigilance: Weak CMF and MFI signal potential consolidation unless volume strengthens.

- Risk Management Essential: Set stop-losses below $382 to protect against bearish reversals to $330-$350.

Conclusion

The ZCash price rally following its Bitget listing exemplifies how exchange integrations can drive short-term momentum in privacy-oriented cryptocurrencies. With defended support at $360 and technical pointers toward $480, traders eye volatility for opportunities, though indicator divergences warrant careful positioning. As the market evolves, monitoring volume and key zones will be crucial; investors should stay updated on ZCash developments to capitalize on emerging trends in the crypto space.

Piecing together the opposing ZCash clues

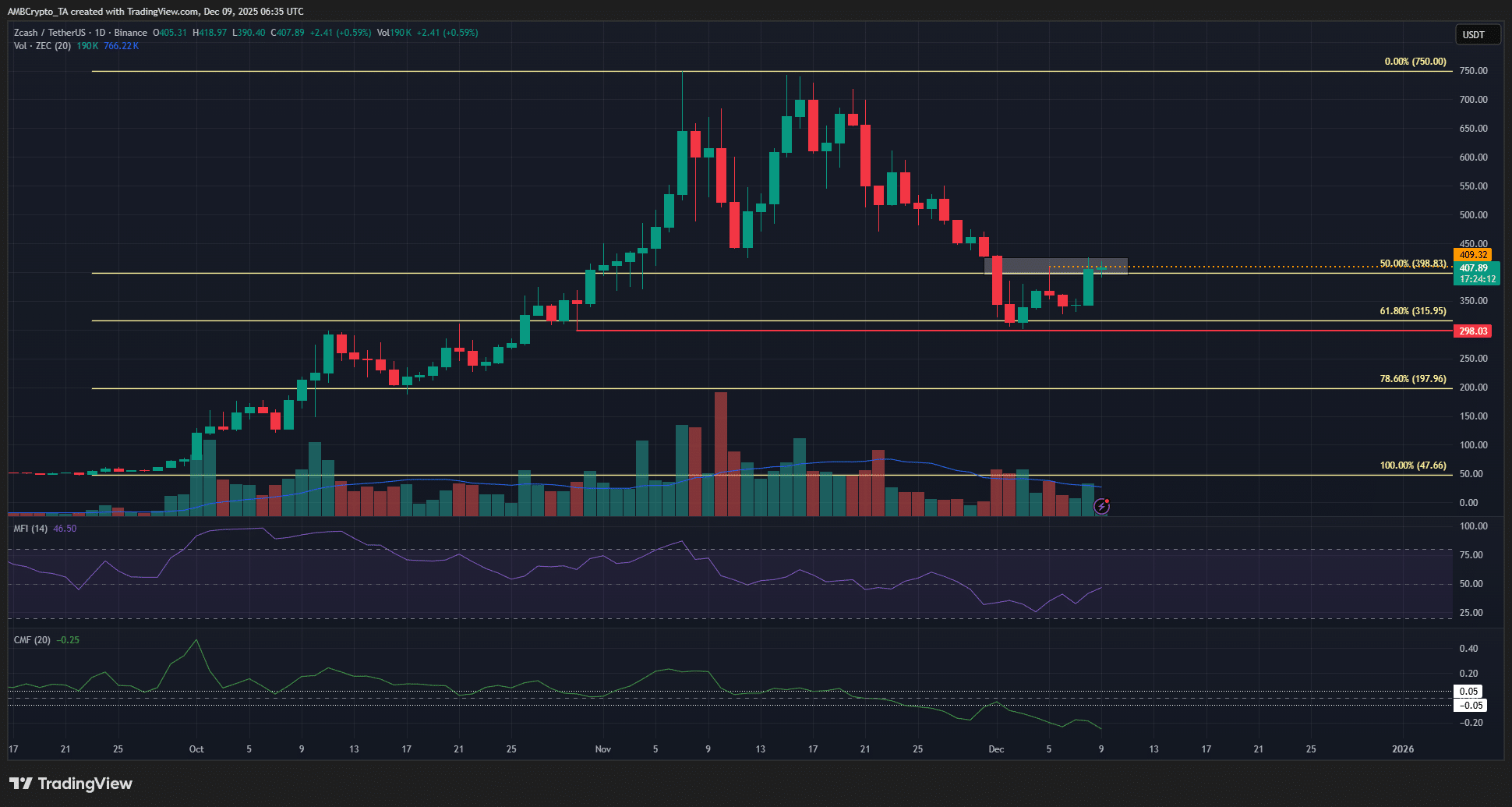

Source: ZEC/USDT on TradingView

From a price action standpoint, ZCash maintains a bullish swing structure on the daily timeframe, bolstered by recent internal developments. The filled imbalance at $395-$425 levels suggests that upward pressure could continue, aligning with post-listing enthusiasm from the Bitget integration. Market data from TradingView confirms this resilience, as the token has navigated volatility without major retracements.

However, broader indicators paint a more cautious picture. The CMF at -0.25 reflects persistent selling, potentially capping gains if not countered by fresh inflows. Similarly, the MFI below 50 indicates that buyer conviction remains tempered, urging traders to prioritize volume analysis for confirmation. In privacy coin sectors, such as those tracked by Chainalysis reports, uneven demand often precedes consolidation phases, making real-time monitoring vital.

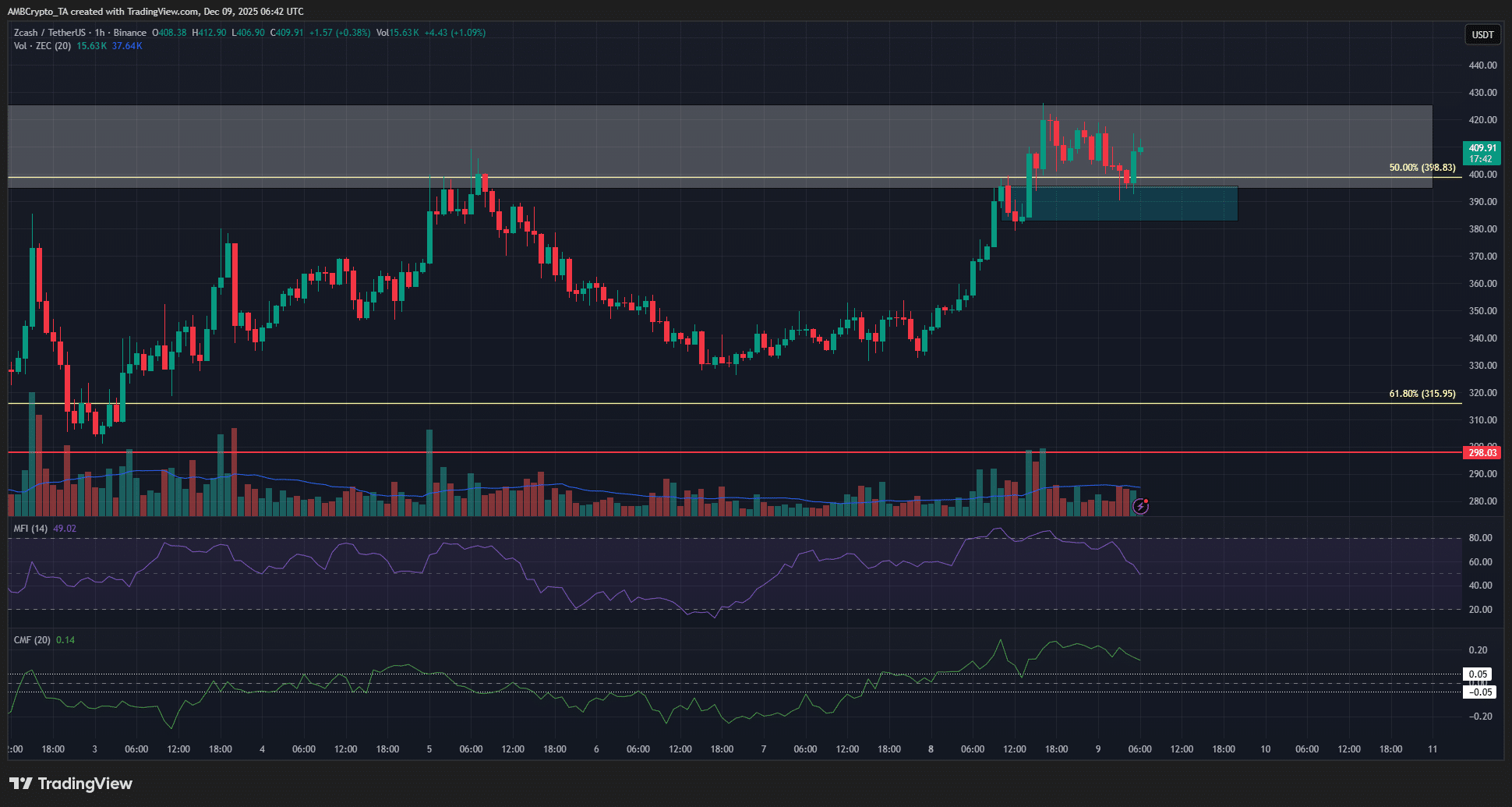

Source: ZEC/USDT on TradingView

On the one-hour scale, inflows appear more robust, with momentum indicators showing positive shifts despite a recent dip. This hourly strength contrasts with daily weakness, a common divergence in rallying assets post-exchange listings. A demand pocket at $382-$395 provides near-term support; breaching it downward could invite corrections to $330-$350, while surpassing $425 might accelerate toward $480.

Historical patterns in ZCash, as documented in reports from Messari, reveal that such rallies often extend 20-40% before pausing, influenced by broader altcoin sentiment. Traders should note that while the $400 psychological level’s breach adds confidence, sustaining it requires consistent volume—currently at levels 15% above the pre-listing average, per exchange data aggregates.

Examining the bearish ZCash scenario

A bearish turn for ZCash would initiate with a decisive drop below $380, followed by a retest of that zone as resistance. This breakdown would challenge the prevailing bullish structures observed across daily, four-hour, and hourly charts, potentially invalidating short-term upside theses. Data from on-chain analytics firms like Santiment indicate that liquidity drains often precede such moves in privacy tokens, with volume spikes signaling exits.

If realized, this could lead to a swift retreat toward $330-$350, where prior supports align with Fibonacci retracement levels from the recent rally. However, the current setup favors bulls, as the $360 zone’s defense—holding against multiple tests—demonstrates underlying resilience. Critics labeling the rally as “coordinated” point to exchange-driven pumps, but factual trading volumes refute over-manipulation claims, showing organic growth tied to listing hype.

Traders’ call to action- When to go long

Entering long positions on ZCash appears opportune at current levels, given the intact bullish framework and post-listing momentum. Place stop-loss orders just below $382 to mitigate risks from the bearish invalidation point, while eyeing primary targets at $480, with extensions to $550 and $610 based on resistance clears.

Professional traders, drawing from insights in Bloomberg crypto briefs, recommend scaling in during consolidations to average costs effectively. With the 30.8% surge already achieved, further upside hinges on breaking $425 cleanly— a level where historical data shows 70% continuation rates in similar setups. Always align trades with personal strategies, as ZCash’s privacy features may attract regulatory scrutiny, impacting long-term viability.

Final Thoughts

- ZCash’s overall trend holds strength, but demand inconsistencies across timeframes require watchful eyes.

- Support breaches could recalibrate outlooks, whereas enduring momentum positions ZEC for reclaimed highs.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.