Zcash Rally Tops Solana Volumes, Privacy Narrative May Drive Further Gains

ZEC/USDT

$444,176,201.48

$223.96 / $203.50

Change: $20.46 (10.05%)

+0.0004%

Longs pay

Contents

Zcash achieved a 30% Santa rally in late 2025, surging 17% to $51.5 on December 27 despite Bitcoin’s flat performance. It surpassed Solana in perpetual futures volume at $2.9 billion, driven by the privacy sector’s 250% average returns.

-

ZEC recorded a 43% monthly gain, recovering half of its Q4 losses.

-

ZEC flipped Solana in global perpetual volumes, securing third place behind Bitcoin and Ethereum.

-

The privacy narrative led 2025 sectors with over 250% returns, per Artemis data, while memecoins lost 62%.

Zcash rally sparks 30% Santa surge, topping Solana in futures volume amid privacy boom. Shielded supply doubles; explore drivers, charts, and outlook for ZEC momentum today.

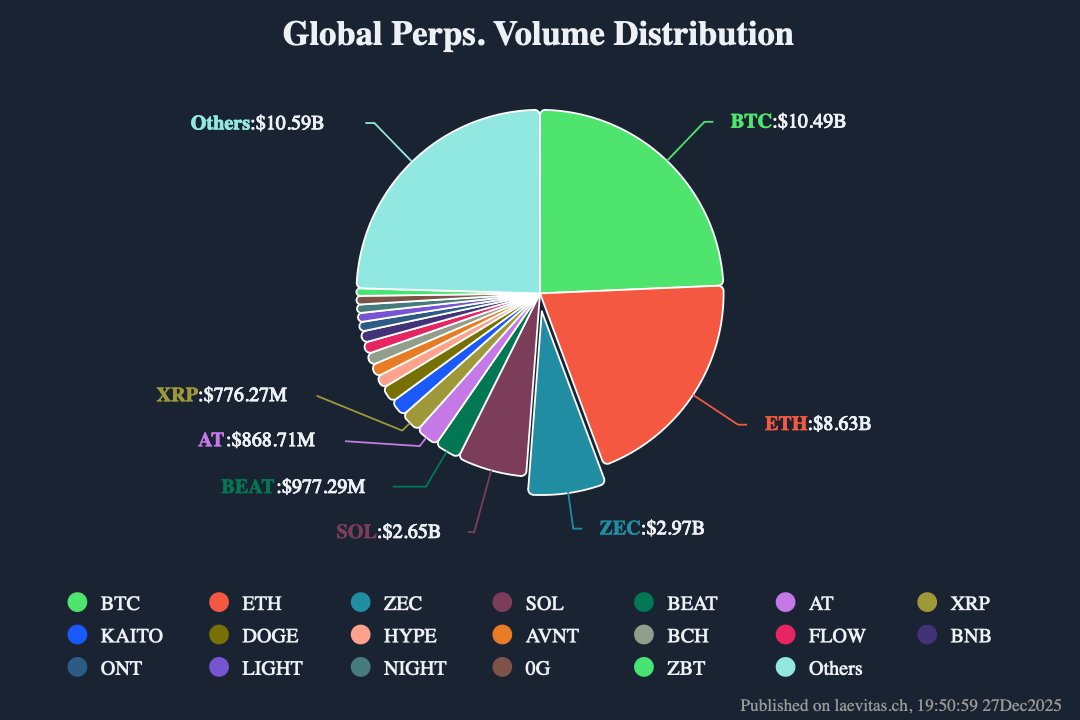

Source: Laevitas

What is driving the Zcash rally in late 2025?

Zcash rally in late 2025 stems from heightened speculative interest and strong fundamentals in privacy-focused cryptocurrencies. On December 27, ZEC jumped 17% to $51.5, part of a broader 30% Santa rally that erased half of its quarterly declines. Futures data highlights ZEC overtaking Solana with $2.9 billion in 24-hour perpetual volume, capturing 7% market share and ranking third after Bitcoin and Ethereum.

How did Zcash surpass Solana in perpetual futures trading?

Zcash’s perpetual futures volume hit $2.9 billion over the past day, edging out Solana’s $2.65 billion and securing the third spot globally. This shift reflects surging trader interest in ZEC amid Bitcoin’s sideways action. Data from market trackers underscores ZEC’s appeal in speculative positions, extending its edge beyond spot trading into derivatives markets. Privacy coins like ZEC and Monero have drawn volume as investors pivot from underperforming sectors.

Source: Artemis

Privacy narratives outperformed all sectors in 2025, averaging over 250% annual returns led by Zcash and Monero. In contrast, memecoins on Solana chains ranked ninth with a 62% average loss, dragging related assets lower.

Source: CoinMetrics

Shielded ZEC supply reached 5 million coins by late 2025, nearly doubling recently, signaling robust on-chain usage. Analyst Peter Costi attributed this to rising privacy demands: “The world is realising that the system is broken and more of our privacy is being stolen each day, this is why the shielded pool continues to grow.” He views the price upswing as a secondary outcome of shielded transaction growth.

Frequently Asked Questions

What factors led to Zcash surpassing Solana in speculative perpetual volumes?

Zcash overtook Solana as traders piled into privacy assets during the Santa rally. Global perpetual volume for ZEC hit $2.9 billion in 24 hours, ranking third overall. This reflects broader interest in privacy narratives outperforming memecoin sectors amid market rotations.

Why has the privacy coin narrative dominated cryptocurrency performance in 2025?

The privacy sector, anchored by Zcash and Monero, delivered over 250% average returns in 2025 according to Artemis data. Rising demand for shielded transactions and shielded supply growth to 5 million ZEC fueled this lead over loss-making memecoins.

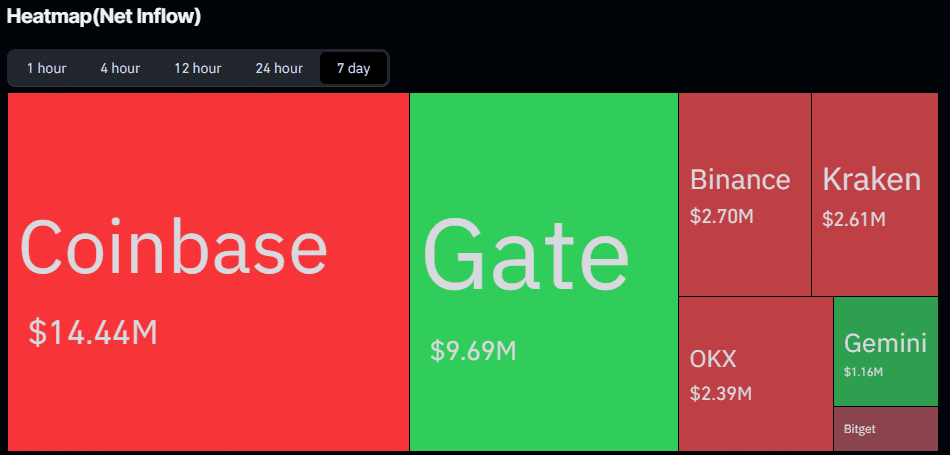

Source: Coinglass

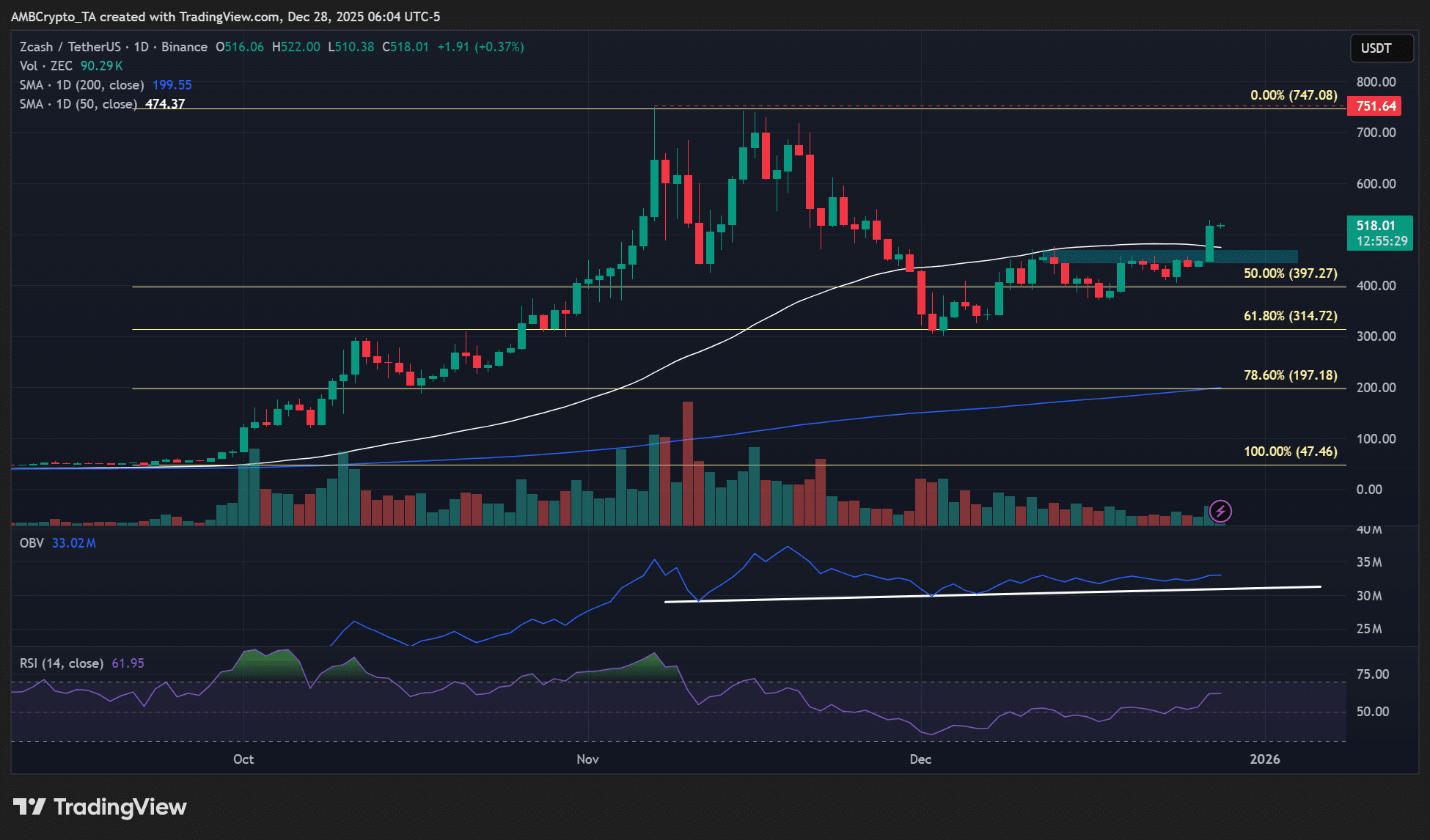

Source: ZEC/USDT, TradingView

Key Takeaways

- Privacy leadership: Zcash dominated 2025’s top-performing narrative with 250% returns versus memecoins’ 62% losses.

- Volume surge: ZEC’s $2.9B perpetual volume flipped Solana, indicating strong speculative demand.

- Bullish signals: Exchange outflows and 50-day MA reclaim point to potential targets above $600.

Conclusion

The Zcash rally in late 2025 highlights privacy coins’ resilience, surpassing Solana in futures volumes and leading sector returns. With shielded supply at 5 million ZEC and ongoing accumulation, momentum favors further gains if support at $45 holds. Monitor perpetual volumes and on-chain metrics for sustained Zcash strength ahead.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026