ZeroLend is Shutting Down: BTC Products Suffer Losses

BTC/USDT

$15,625,149,390.75

$70,126.67 / $68,000.00

Change: $2,126.67 (3.13%)

-0.0011%

Shorts pay

Contents

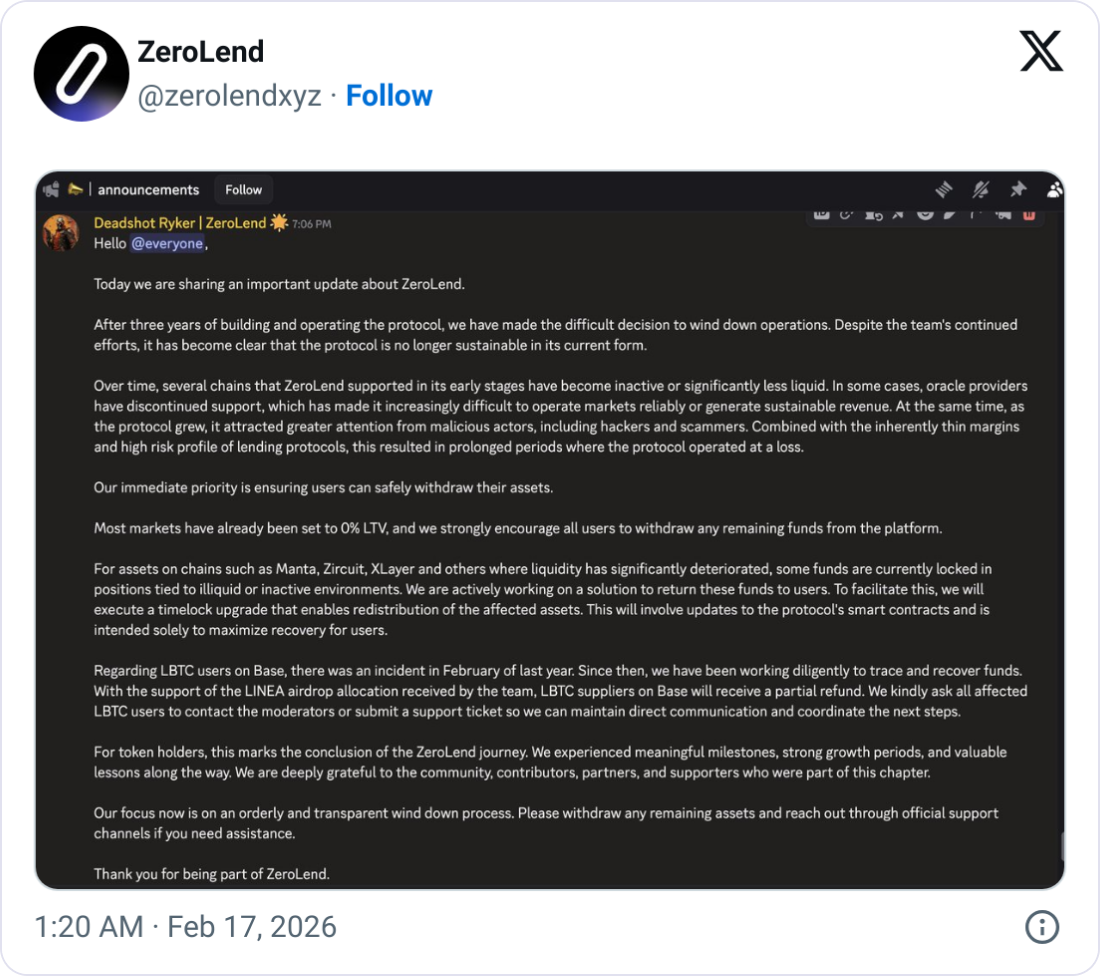

The decentralized lending protocol ZeroLend has decided to shut down completely due to low user numbers and liquidity on the blockchains it operates. Founder Ryker announced on X that the protocol has become unsustainable after three years of operations. ZeroLend, which focuses on Ethereum layer-2 chains, suffered losses due to the decreasing liquidity of these chains, oracle providers withdrawing support, and increasing hacker and scammer attacks. Problems in BTC detailed analysis products were particularly notable.

Source: ZeroLend

Users are advised to withdraw their remaining assets, but some funds are locked on chains with disrupted liquidity. ZeroLend plans to distribute these assets by updating the smart contracts. Partial refunds will be made to victims of the exploit in the Bitcoin (BTC) product on the Base chain last year. The protocol's total value locked (TVL) dropped from 359 million dollars in November 2024 to 6.6 million dollars. The ZERO token lost 34% value in the last 24 hours.

Metaplanet Loss in BTC Market

In parallel with these developments, Metaplanet announced a net loss of 619 million dollars in Bitcoin valuation; BTC assets reached 35,102 BTC. The Bitcoin weekly candlestick chart turned positive, rising 8% from its lowest level with 1 day 12 hours to weekly close.

BTC Technical Analysis and Supports

BTC price 68.442,89 USD, 24h change -0.02%, RSI 35.54 (oversold), trend downward. Supports: S1 65.454 USD (strong, -4.28%), S2 68.285 USD (strong). Resistances: R1 70.139 USD (strong, +2.57%). Follow BTC futures. EMA 20: 72.833 USD.