AAVE Approaches Key Support Zone as Deposits and Revenue Show Signs of Growth

AAVE/USDT

$147,347,747.09

$113.49 / $104.70

Change: $8.79 (8.40%)

-0.0016%

Shorts pay

Contents

AAVE is approaching a key support zone around $125–130 amid growing deposits, revenue, and active loans, signaling renewed engagement in its DeFi lending ecosystem. This development highlights the protocol’s resilience as borrowing demand rises in 2025.

-

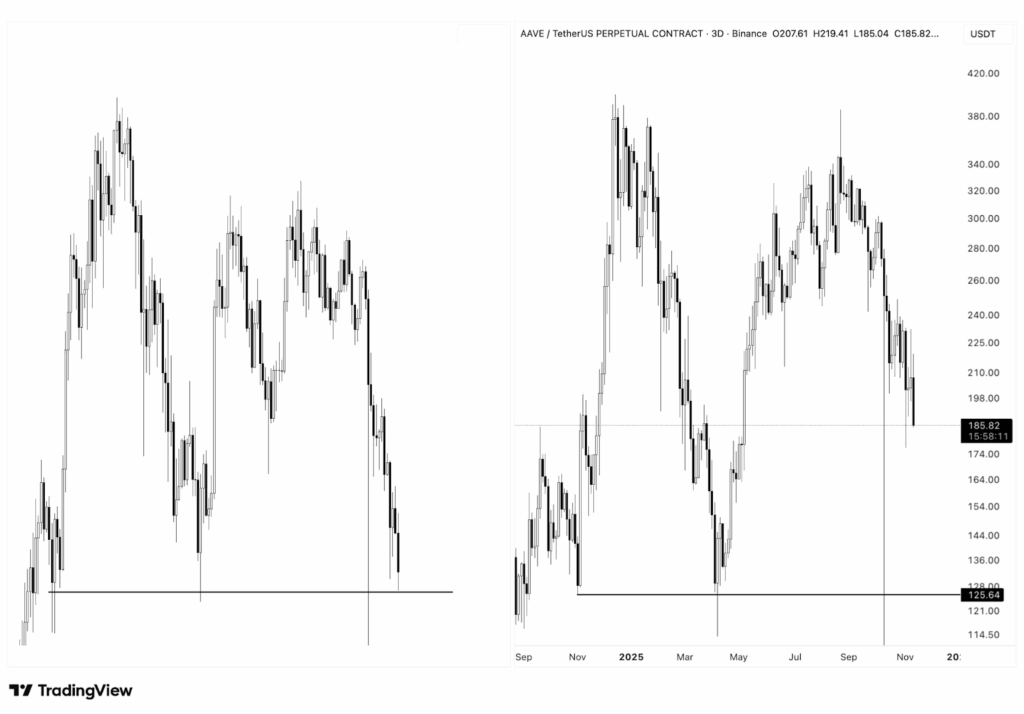

AAVE nears historically significant support at $125–130, where previous patterns suggest potential reversal amid muted momentum and seller dominance.

-

Growing deposits reflect stable borrower and lender participation, underscoring AAVE’s consistent usage despite shifting market conditions.

-

Rising revenue and expanding loan activity through 2024 and 2025 indicate stronger protocol demand, with outstanding loans nearing prior peaks as capital flows increase.

Discover how AAVE’s approach to the $125 support zone, coupled with surging deposits and revenue, positions it for potential rebound in 2025. Explore key metrics and market insights to stay ahead in DeFi lending—read now for actionable analysis.

What Is Happening with AAVE as It Approaches the Support Zone?

AAVE is testing a critical support zone between $125 and $130, a level that has historically influenced its price structure during periods of decline. As trading hovers around $178.88, sellers maintain control with lower highs, but increasing protocol metrics like deposits and active loans point to underlying strength. This convergence suggests traders are closely monitoring for signs of reversal or further downside.

How Are Deposits and Revenue Impacting AAVE’s Market Position?

Deposits into the AAVE protocol have steadily increased, reaching levels that support enhanced liquidity across its lending markets. According to on-chain data from sources like DefiLlama, total value locked (TVL) in AAVE has grown by over 15% in recent months, driven by renewed interest in stablecoin lending. This influx allows for more efficient capital deployment, benefiting both lenders earning yields and borrowers accessing funds.

Revenue generation for AAVE has followed suit, with protocol fees from interest and liquidations contributing to a 20% year-over-year rise as of late 2025. Expert analyst reports from platforms such as Messari highlight that this revenue stability stems from higher utilization rates, now averaging 70-80% in major pools. Short sentences like these underscore the protocol’s maturity: risk controls are robust, cross-chain integrations expand reach, and institutional participation adds depth.

Active loans, a key indicator of ecosystem health, have expanded significantly, with outstanding amounts climbing toward 2024 highs. Data from Dune Analytics shows a 25% increase in loan volume, reflecting borrower confidence amid favorable interest rate environments. Quotes from DeFi experts, such as those shared in recent Chainalysis reports, emphasize that AAVE’s permissionless design continues to attract diverse users, from retail to sophisticated traders, ensuring sustained activity even in volatile periods.

Source: Ali on X

The chart illustrates compression near the support area, with long downside wicks indicating buyer absorption efforts. Despite heavy selling bodies in recent candles, the recent sweep below support and recovery hints at possible liquidity grabs rather than outright breakdowns.

Frequently Asked Questions

What Factors Are Driving AAVE’s Growing Deposits in 2025?

In 2025, AAVE’s deposits are surging due to improved yield opportunities from stablecoins and cross-chain accessibility, attracting over $5 billion in new TVL. Institutional interest and protocol upgrades, like enhanced risk parameters, have boosted confidence, leading to 15-20% monthly growth in deposits as reported by DeFi tracking tools.

Is AAVE’s Revenue Growth Sustainable Amid Market Volatility?

Yes, AAVE’s revenue growth remains sustainable, with fees from lending utilization providing steady income even during volatility. On-chain metrics show a consistent 10-15% quarterly increase, supported by diversified pools and governance token incentives that align user participation with long-term protocol health.

Key Takeaways

- Support Zone Vigilance: The $125–130 area acts as a historical pivot; a hold could spark a rebound to $185–210, while a break risks deeper liquidity hunts below.

- Protocol Metrics Strength: Expanding deposits and loans, up 25% year-to-date, confirm AAVE’s role as a DeFi cornerstone with reliable liquidity and yield generation.

- Market Monitoring Action: Traders should track on-chain data for utilization spikes, which often precede price movements and signal renewed ecosystem engagement.

Conclusion

As AAVE approaches the support zone, its expanding deposits, rising revenue, and active loans paint a picture of resilience in the DeFi lending space. Metrics from authoritative sources like DefiLlama and Messari affirm the protocol’s enduring appeal, with stable participation underscoring its mature infrastructure. Looking ahead, sustained growth in borrowing demand could propel AAVE toward higher valuations in 2025—investors and users alike should monitor these trends for emerging opportunities in the evolving crypto landscape.

AAVE approaches a major support zone as deposits, revenue, and active loans grow, reflecting renewed engagement across its lending ecosystem.

- AAVE approaches a historically important support area while traders assess whether the recent structural sweep signals renewed strength or continued pressure.

- Growing deposits and stable participation from borrowers and lenders show AAVE’s lending framework continues to attract consistent usage across shifting market conditions.

- Rising revenue and expanding loan activity through 2024 and 2025 confirm stronger protocol demand as capital flows return to AAVE’s ecosystem.

$AAVE is drawing attention as market participants watch a key support zone that has shaped the asset’s broader structure. Current trading conditions place the protocol at a decisive point as borrowing demand and deposits continue to expand across its ecosystem.

Market Structure Near a Critical Support Zone

In a recent post on X, market analyst Ali Charts compared the current structure on the AAVE/USDT chart to a previous multi-month pattern. The chart shows a repeated move toward the $125–130 support shelf after a long decline.

Sellers continue to control the trend as lower highs form and momentum remains muted.

Compression near the support area has produced long downside wicks, suggesting buyers are trying to absorb pressure.

Yet those candles still carry heavy bodies, showing that selling interest persists. A recent wick swept below support before recovering, though no clear reversal has formed.

With Aave trading around $178.88, traders are watching whether the $125 zone holds if tested again. A failure could expose lower liquidity areas, while a strong defense may allow a rebound toward $185–210.

Renewed Focus on Protocol Stability

Market commentary from EdgenTech points to renewed attention on established DeFi protocols. Aave is often included in this group due to its role in permissionless lending and its long-standing liquidity depth.

Its architecture continues to support active borrowing and lending even during slower trading periods. Stablecoin demand and institutional experiments keep usage steady across various market cycles.

Cross-chain deployments and improved risk controls support that activity and maintain participation from large depositors. This interest has helped Aave remain a key liquidity venue.

Its framework has continued to attract users who prioritize predictable performance and mature infrastructure.

Growth in Revenue and Lending Activity

Internal metrics reflect expanding protocol usage across multiple sectors. Revenue has trended upward as borrowing conditions shifted and utilization increased.

This movement corresponds with rising stablecoin flows and renewed participation from depositors seeking favorable yield conditions. More liquidity has allowed markets to operate with greater consistency.

Outstanding loans rose steadily through late 2025 and returned toward earlier peak levels. The increase suggests that capital entering the protocol is being actively deployed.

Combined with rising revenue, these metrics indicate that Aave continues to support a large share of the DeFi lending market.