Aave Founder: DeFi 50 Trillion $ Abundance Tokenization

AAVE/USDT

$212,608,196.71

$119.89 / $109.91

Change: $9.98 (9.08%)

+0.0006%

Longs pay

Contents

AAVE Founder Stani Kulechov's DeFi Vision

Aave's founder Stani Kulechov stated that DeFi could benefit from abundance assets worth 50 trillion dollars by 2050 (such as solar energy), and their tokenization would create a new onchain collateral class. According to RWA.xyz data, currently about 25 billion dollars worth of real-world assets have been tokenized on the blockchain; these are mainly US Treasury bonds, stocks, commodities, private credit, and real estate.

Source: Meltem Demirors

Kulechov shared on X that rare assets will grow but the tokenization of abundance assets will have the biggest impact. He predicted that solar energy could capture a 15-30 trillion dollar share in this 50 trillion dollar market. As an example, he emphasized that a 100 million dollar solar project could be tokenized to borrow 70 million dollars for reinvestment, thereby increasing capital efficiency. A similar approach applies to batteries, robotics, vertical farming, lab-grown food, semiconductors, and 3D printing. Aave is the largest lending protocol with 27 billion dollars TVL according to DeFiLlama; the most borrowed assets are Tether USDT, Ether (ETH), and wrapped ETH (wETH).

AAVE Recent Developments: Grayscale ETF Application

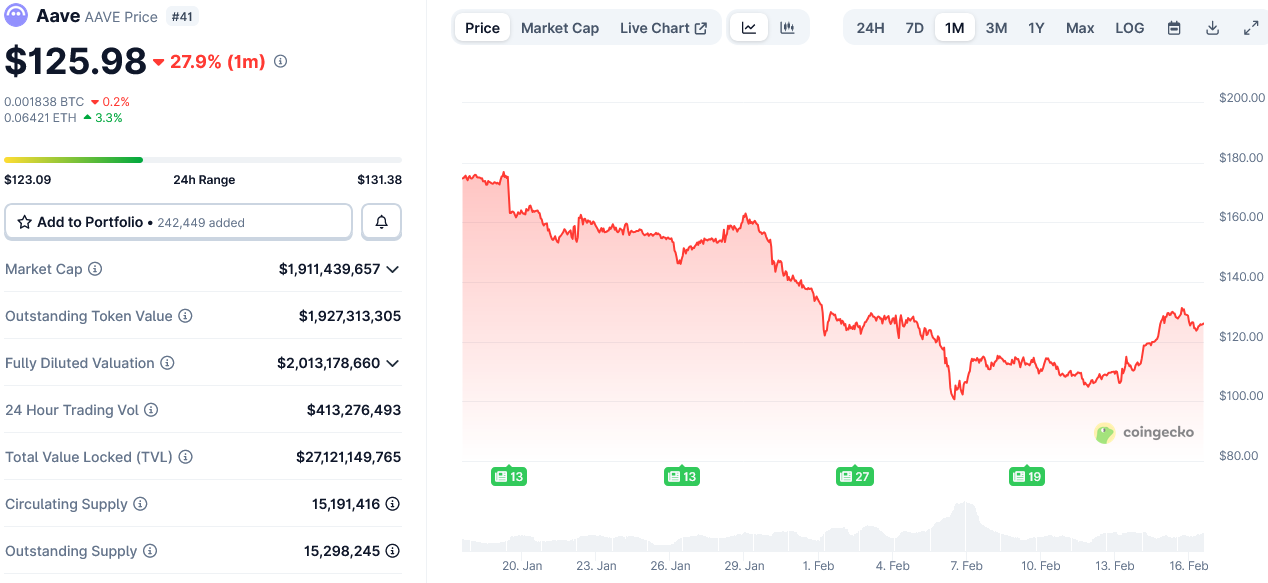

Grayscale has filed an S-1 for an AAVE ETF; this could accelerate the AAVE token's integration into traditional markets. Tomasz Stanczak's departure from the Ethereum Foundation could trigger DeFi-focused changes in the ecosystem. The AAVE token has fallen to 125.98 dollars with a 15.2% drop in recent months, 81% below its all-time high. Current price: 125.57$, 24h: -4.01%.

AAVE key metrics and price changes over the last month. Source: CoinGecko

AAVE Technical Outlook

RSI: 46.31 (neutral), Trend: Downtrend, Supertrend: Bearish. EMA 20: 125.90$. Supports: S1 122.40$ (strong), S2 115.65$. Resistances: R1 145.77$ (strong), R2 136.31$. Click for AAVE detailed analysis and AAVE futures. The Spot AAVE market should be monitored.