Vitalik Buterin's DeFi Criticism: AAVE USDC Dominance

AAVE/USDT

$147,347,747.09

$113.49 / $104.70

Change: $8.79 (8.40%)

-0.0016%

Shorts pay

Contents

Ethereum co-founder Vitalik Buterin emphasized that the true value of decentralized finance (DeFi) lies in transforming risk distribution and management. Criticizing yield-focused stablecoin strategies based on centralized assets, he noted that they do not reduce issuer and counterparty risk, especially in fiat-collateralized products like USDC. He outlined two paths aligned with DeFi's original ethos: ETH-collateralized algorithmic stablecoin, where risk can be shifted to market makers; and overcollateralized, diversified real-world asset (RWA)-collateralized algorithmic stablecoin, which can maintain the peg even if a single asset fails.

Source: Vitalik Buterin

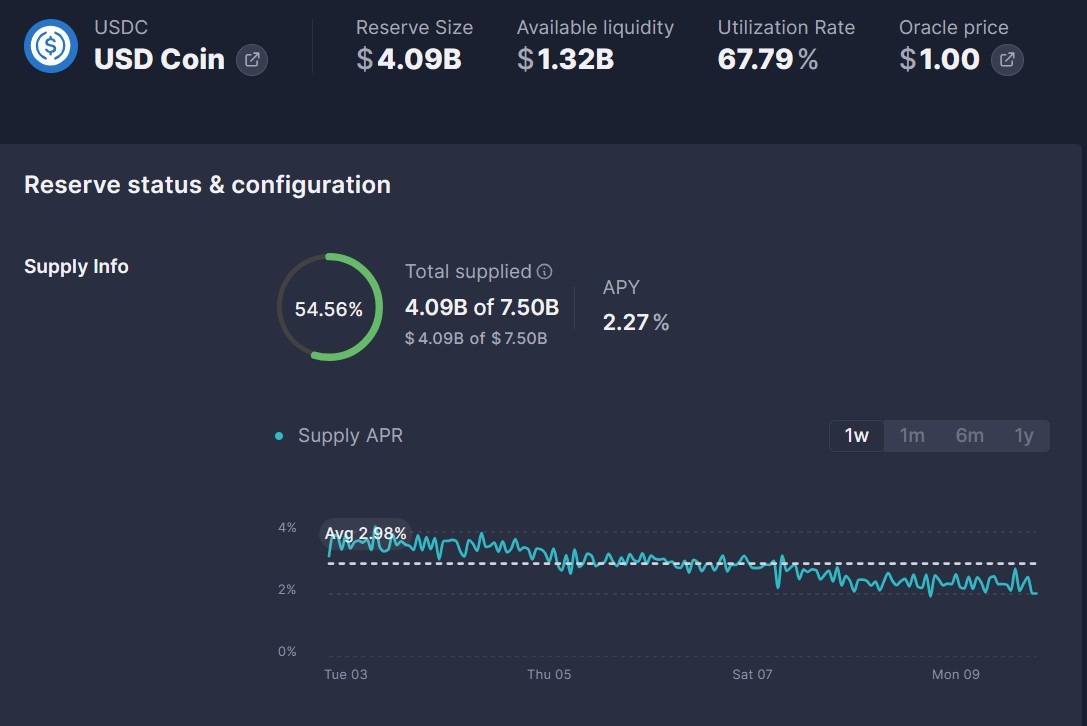

Buterin's comments coincide with USDC's dominance in Ethereum lending markets. In the AAVE detailed analysis, out of a total market of 36.4 billion dollars, 4.1 billion dollars of USDC has been supplied, with 2.77 billion dollars borrowed. In Morpho, three of the top five borrow markets are USDC denominated, the largest being 510 million dollars. In COMP futures, 382 million dollars of USDC is earning yield, 281 million dollars is borrowed, and 536 million dollars supports collateral. Buterin called for more resilient decentralized stablecoins, stating that current models do not fulfill DeFi's promise of risk decentralization.

USDC reserve status and configuration. Source: Aave

Critical Support and Resistance Levels for AAVE

AAVE price is currently at the 111.02 USD level, in a downtrend with a 2.70% drop in the last 24 hours. RSI at 31.98 is giving an oversold signal. Main supports:

- S1: 108.76 USD (Score: 76/100 ⭐ STRONG, -2.01% distance)

- S2: 92.25 USD (Score: 72/100 ⭐ STRONG, -16.88% distance)

Resistances:

- R1: 123.38 USD (Score: 71/100 ⭐ STRONG, +11.16% distance)

- R2: 147.57 USD (Score: 62/100 ⭐ STRONG, +32.96% distance)

Supertrend bearish, watch for close above EMA20 131.72 USD. Linked to ETH detailed analysis.

Frequently Asked Questions About AAVE

Will Vitalik Buterin's DeFi Criticism Affect AAVE?

Yes, USDC dependency may increase AAVE lending risks; ETH/RWA-collateralized models are recommended.

When Will AAVE Price Rise?

RSI oversold, recovery possible if R1 123 USD breaks; S1 may be tested if downtrend continues.

What is the Safest Stablecoin in DeFi?

According to Buterin, ETH-collateralized or overcollateralized RWA algorithmic stablecoins.