ABTC Shares Plunge Over 50% Amid Bitcoin Market Downturn

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

ABTC stock plunged over 50% in early trading due to a broader crypto market downturn, repricing mining and treasury stocks. American Bitcoin Corp, led by Eric Trump, saw shares hit $1.75, down 78% from its September high amid Bitcoin’s sharp pullback from $126,000.

-

ABTC shares dropped 51% on Tuesday, reaching an intraday low of $1.75.

-

The decline reflects ongoing volatility in crypto-linked equities as Bitcoin falls below $80,000.

-

Despite Q3 profitability with $3.47 million net income and 4,000 BTC holdings, market pressures persist, per Yahoo Finance data.

Discover why ABTC stock plunged amid crypto turmoil. American Bitcoin Corp faces sharp declines despite strong Q3 results—explore impacts on mining stocks and Bitcoin treasuries. Stay informed on market shifts.

What Caused the ABTC Stock Plunge?

ABTC stock plunge occurred as shares of American Bitcoin Corp tumbled more than 50% in early trading on Tuesday, driven by a persistent downturn in the broader cryptocurrency market. The company, a Bitcoin mining and treasury firm headed by Eric Trump, debuted on Nasdaq in early September via a reverse merger with Gryphon Digital Mining. This sharp decline highlights the vulnerability of crypto-exposed equities to Bitcoin’s price volatility, with no isolated catalyst but rather a culmination of sector-wide pressures.

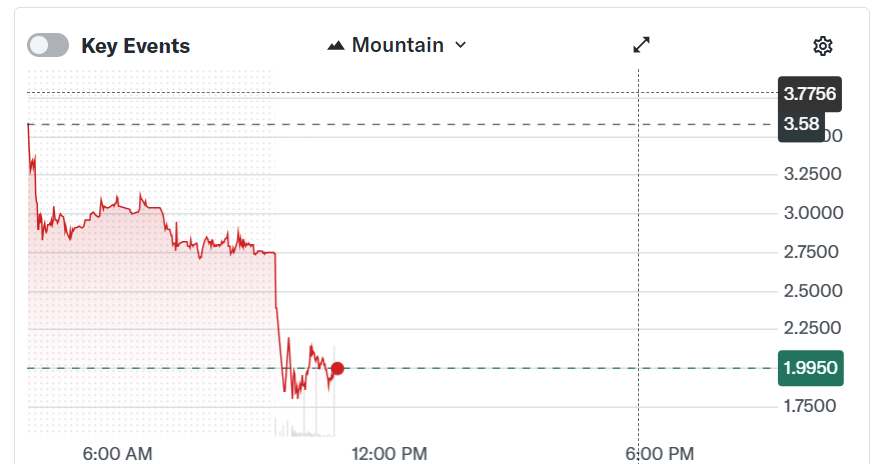

The stock’s fall to an intraday low of $1.75 represents a 51% drop for the day, according to data from Yahoo Finance. Overall, ABTC shares are now down approximately 78% from their post-listing peak of $9.31 on September 9. This unwinding underscores the spillover effects from the digital asset sector into related stocks, as investors reassess valuations amid heightened uncertainty.

ABTC stock faced a steep decline on Tuesday. Source: Yahoo Finance

Bitcoin itself has undergone one of its most significant corrections since mid-October, dropping from a high near $126,000 to below $80,000 by late November. American Bitcoin’s operations are intrinsically linked to BTC’s performance, making its stock particularly sensitive to these fluctuations. The company’s focus on mining and accumulating Bitcoin reserves amplifies exposure, as revenue and profitability hinge on network rewards and asset appreciation.

How Has the Crypto Market Downturn Affected Mining Stocks?

The ongoing crypto market downturn has led to a widespread repricing of equities tied to digital assets, especially Bitcoin miners and treasury holders. This reassessment comes even as American Bitcoin Corp reported a turnaround to profitability in the third quarter, with net income of $3.47 million and revenue surging to $64.2 million. These figures demonstrate operational resilience, yet external market forces overshadowed the positive earnings.

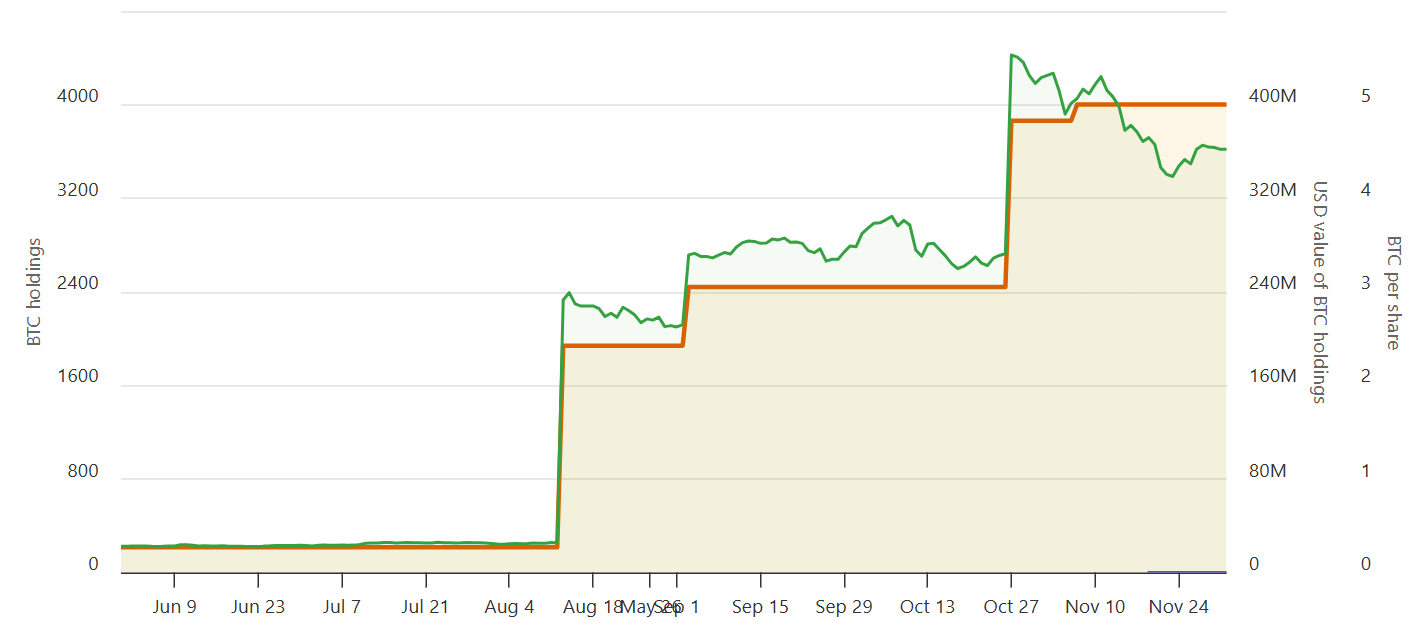

In the same period, the company bolstered its balance sheet by adding 3,000 Bitcoin to its holdings, bringing total reserves to over 4,000 BTC. Such accumulation strategies are common among mining firms aiming to leverage long-term BTC appreciation, but short-term price drops erode investor confidence and stock values. Data from BitcoinTreasuries.NET illustrates this trend, showing how treasury sizes influence market caps during volatile phases.

American Bitcoin’s BTC accumulation. Source: BitcoinTreasuries.NET

Eric Trump, a key figure in the company’s leadership, commented last month on the volatility, stating it serves as an opportunity for strategic accumulation at lower prices. This perspective aligns with broader industry views, where executives like Michael Saylor of Strategy (formerly MicroStrategy) emphasize holding through corrections. Saylor’s firm, a major BTC holder, has seen its shares plummet over 50% recently, with market capitalization dipping below the value of its Bitcoin assets—a stark indicator of the sector’s challenges.

Analysts from sources like Yahoo Finance note that profit-taking in technology shares has compounded the pressure on crypto-linked stocks. The absence of a single trigger for Tuesday’s sell-off points to systemic factors, including regulatory uncertainties and macroeconomic tightening. For mining companies, reduced BTC prices directly impact mining economics, squeezing margins and prompting sell-offs. Despite these headwinds, American Bitcoin’s Q3 performance—marked by revenue growth from efficient operations—signals potential for recovery if market sentiment improves.

Broader implications extend to the entire ecosystem. As Bitcoin’s halving cycles and adoption trends evolve, miners must adapt to lower rewards and higher energy costs. Expert insights from financial reports highlight that firms with diversified treasuries, like American Bitcoin, may weather storms better than pure-play miners. However, the current environment demands caution, with volatility indices for crypto equities remaining elevated.

Frequently Asked Questions

What Factors Contributed to the Recent ABTC Stock Decline?

The ABTC stock decline stems from a crypto market correction, with Bitcoin dropping from $126,000 to under $80,000. This triggered repricing in mining and treasury stocks, affecting American Bitcoin Corp despite its Q3 profits of $3.47 million and 4,000 BTC holdings, as reported by Yahoo Finance.

Is American Bitcoin Corp’s Business Model Sustainable Amid Volatility?

Yes, American Bitcoin Corp’s model, focused on mining and BTC accumulation, shows sustainability through Q3 revenue of $64.2 million and profitability. Led by Eric Trump, the firm views volatility as a buying opportunity, aligning with strategies from industry leaders like Michael Saylor to hold assets long-term for eventual gains.

Key Takeaways

- Market Linkage: ABTC’s performance mirrors Bitcoin’s price, with a 78% drop from September highs amid a sector-wide retreat.

- Financial Resilience: Q3 results included $3.47 million net income and added BTC reserves, highlighting operational strength per company filings.

- Investor Strategy: Eric Trump advises using volatility for accumulation, urging long-term focus over short-term fluctuations.

Conclusion

The ABTC stock plunge exemplifies the interconnected risks in the crypto mining and treasury space, where Bitcoin’s downturn directly impacts firms like American Bitcoin Corp. Despite positive Q3 metrics and strategic BTC holdings exceeding 4,000 coins, market repricing has led to significant equity losses. As the digital asset sector stabilizes, investors should monitor Bitcoin’s trajectory and regulatory developments. For those eyeing opportunities, this volatility could present entry points, but thorough due diligence remains essential in navigating crypto-linked equities.

Comments

Other Articles

Oil Prices Surge 3% After Trump Cancels Iran Meetings and Promises Protesters ‘Help Is on the Way’ – What It Means for Bitcoin

January 13, 2026 at 05:49 PM UTC

Bitcoin Surges to $93,888: How Venezuela-US Tensions Triggered a Crypto Rally

January 5, 2026 at 07:04 AM UTC

Bitcoin (BTC) Eyes Short-Term Bottom Rebound as On-Chain Flows Align with USDC/USDT Premium and Market Liquidity, but Bearish Longer-Term Outlook Persists

January 1, 2026 at 03:41 PM UTC