Analysts Skeptical of US Stablecoin Targets as Tether Boosts T-Bill Demand

JST/USDT

$7,530,661.71

$0.04813 / $0.04602

Change: $0.002110 (4.58%)

-0.0180%

Shorts pay

Contents

The US stablecoins plan aims to expand the market to $2-4 trillion by 2028-2030, supporting demand for short-term US Treasury bills through regulated growth following the GENIUS Act. However, analysts like those at JPMorgan project a more modest $700 billion increase, citing legal restrictions on interest-paying stablecoins and global pushback.

-

Stablecoin market surpasses $300 billion post-GENIUS Act, driven by issuers like Tether and Circle holding $155 billion in T-bills.

-

White House targets massive growth to bolster US debt servicing, but experts warn of ambitious timelines amid bans in countries like China.

-

Projections from S&P Global indicate stablecoin issuers could add $50-55 billion in T-bill purchases by year-end, positioning them as key marginal buyers.

Explore the US stablecoins plan’s ambitious $2-4 trillion target by 2030 and its impact on Treasury demand. Discover analyst views, growth projections, and global challenges in this detailed analysis. Read now for crypto insights.

What is the US stablecoins plan and how does it aim to support Treasury demand?

The US stablecoins plan is a strategic initiative to foster the growth of dollar-pegged stablecoins, projecting a market size of $2 to $4 trillion by 2028-2030, primarily to increase demand for short-term US Treasury bills and aid in managing the nation’s fiscal debt. Enacted through the GENIUS Act in July, this plan has already propelled the stablecoin sector beyond $300 billion in market supply, with major issuers like Tether and Circle backing their tokens with substantial T-bill holdings. By encouraging regulated stablecoin issuance, the plan positions these assets as efficient payment tools while indirectly supporting US debt markets, though growth faces hurdles from legal and international constraints.

How realistic is the projected growth of the US stablecoins market?

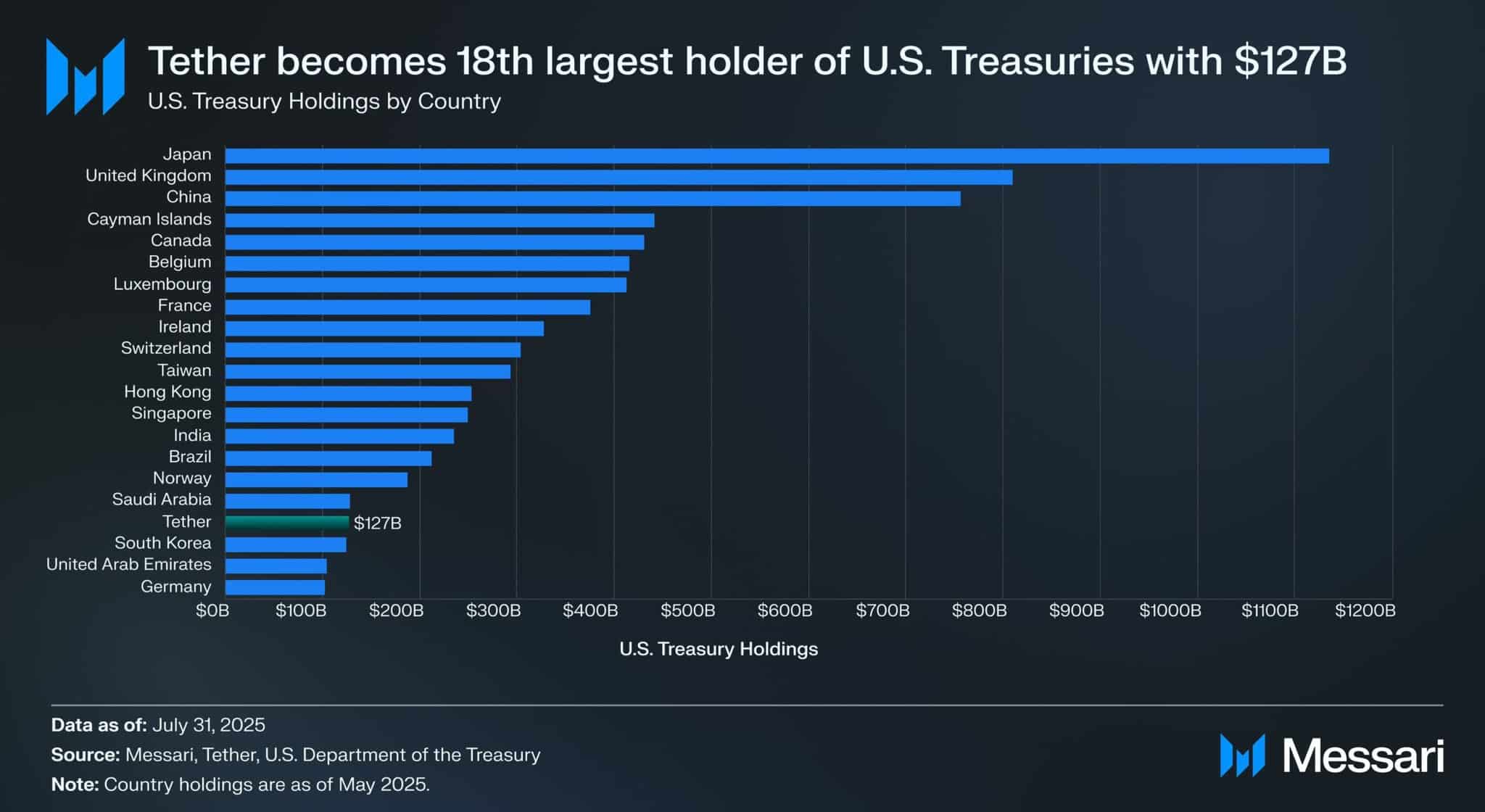

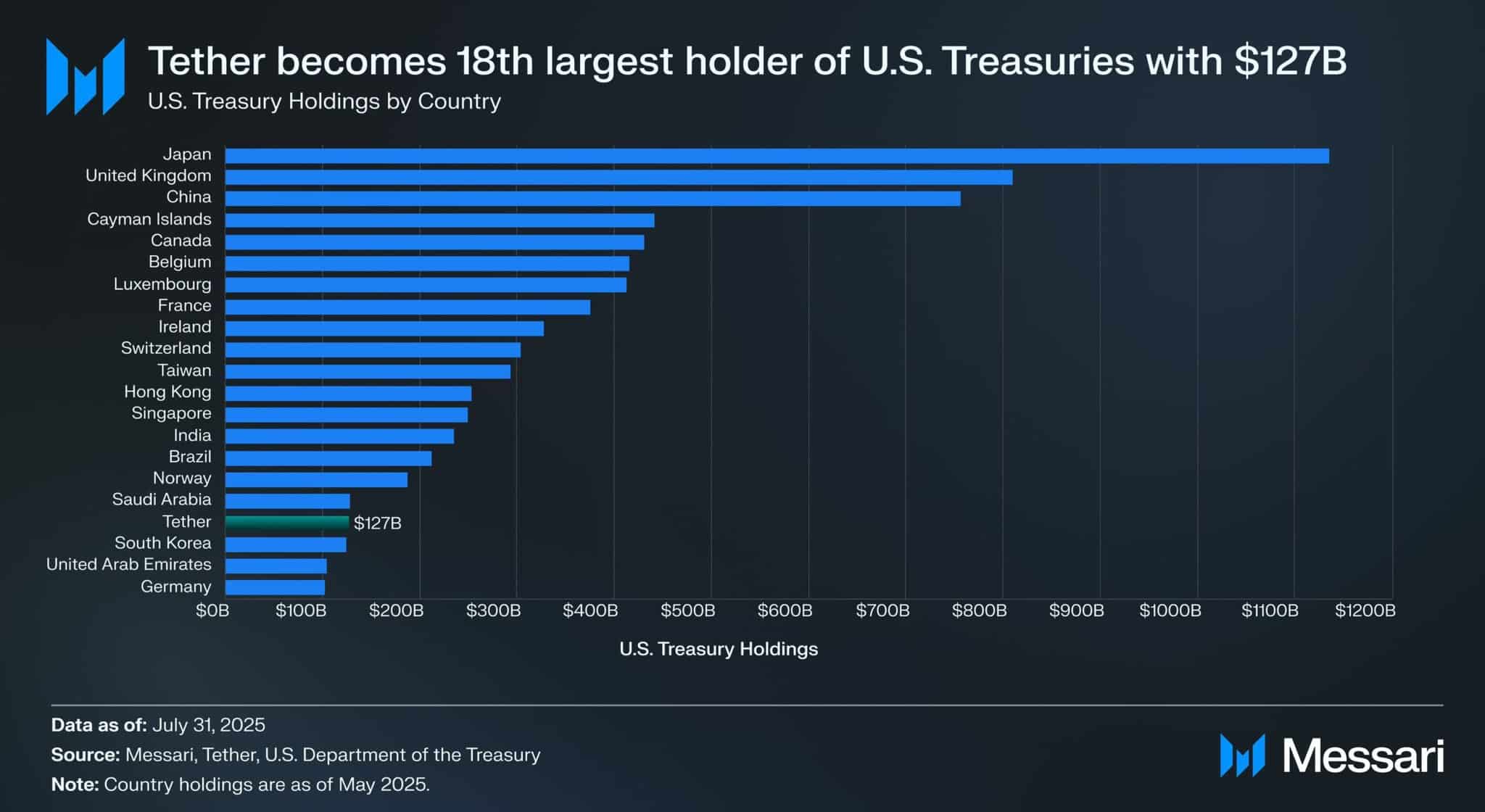

Analysts offer mixed assessments on the feasibility of the US stablecoins plan’s ambitious targets. Teresa Ho, Head of US short-duration strategy at JPMorgan, acknowledges the positive momentum since the GENIUS Act but cautions against rapid expansion, stating, “But the speed at which it’s going to grow — I don’t think it’s going to grow to $2, $3, $4 trillion in just a couple years of time.” JPMorgan forecasts a more tempered growth to around $700 billion in the coming years, limited by current prohibitions on interest-paying stablecoins under US law. This conservative outlook contrasts with optimistic views from supporters who see stablecoins evolving into everyday payment staples, backed predominantly by short-term US Treasuries, potentially easing the burden of the $38 trillion US fiscal debt. S&P Global data as of October 2025 shows top issuers holding $155 billion in T-bills, representing 2.5% of the total market—significant but dwarfed by the 33% share of US money market funds and even the 6.8% held by foreign officials. The firm projects an additional $50-55 billion in T-bill acquisitions by issuers by year’s end, emphasizing that if the $2 trillion market cap is achieved in three years, stablecoin participants would emerge as pivotal marginal buyers in the short-term Treasury space. Tether’s launch of a compliant onshore stablecoin, USAT, further signals structured growth, with the company reporting $127 billion in US Treasury bill holdings as of July, ranking it as the 17th largest holder of US debt. Despite these developments, challenges persist, including the nascent stage of the market and regulatory barriers that could cap adoption rates.

Source: Messari

Frequently Asked Questions

What impact has the GENIUS Act had on stablecoin market growth under the US stablecoins plan?

The GENIUS Act, passed in July 2025, has significantly boosted the stablecoin sector, expanding its total market supply beyond $300 billion from over $50 billion pre-passage. It provides a regulatory framework that encourages compliant issuance, leading to increased holdings in US Treasuries by major players like Tether, which now ranks among the top US debt holders with $127 billion in T-bills.

Why are some countries like China opposing dollar-based stablecoins in the US stablecoins plan?

Countries such as China are implementing crackdowns on dollar-based stablecoins like USDT and USDC to safeguard their financial stability and prevent capital outflows. Standard Chartered estimates potential $1 trillion in outflows from emerging markets to stablecoins by 2028, raising concerns over economic sovereignty and prompting bans that could hinder the broader adoption envisioned in the US stablecoins plan.

Key Takeaways

- Post-GENIUS Act Surge: The stablecoin market has grown rapidly to over $300 billion, with issuers becoming notable buyers of US T-bills, holding $155 billion as of October 2025.

- Ambitious but Tempered Projections: While the White House eyes $2-4 trillion by 2030, JPMorgan limits forecasts to $700 billion due to legal bans on interest-bearing stablecoins and global regulatory hurdles.

- Global Risks and Debt Support: Stablecoins could marginally aid US debt servicing but face opposition in nations like China; investors should monitor regulatory shifts for long-term viability.

Conclusion

The US stablecoins plan represents a pivotal step in integrating digital assets with traditional finance, leveraging the GENIUS Act to drive market expansion and enhance demand for short-term US Treasury bills amid a $38 trillion debt landscape. Quotes from experts at JPMorgan and insights from S&P Global underscore both the potential and limitations, with stablecoin growth projected to add substantial T-bill purchases while navigating international bans and legal constraints. As the sector matures, stakeholders in the US stablecoins market should stay informed on evolving regulations to capitalize on opportunities in this dynamic space.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

3/1/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/28/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/27/2026

DeFi Protocols and Yield Farming Strategies

2/26/2026