Arthur Hayes Sees Bitcoin Potentially Hitting $200K as ETF Outflows Ease with Liquidity Boost

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Bitcoin ETF outflows reached $2.59 billion in November 2025, with BlackRock’s IBIT accounting for $1.26 billion due to hedge funds unwinding basis trades amid declining yields. Arthur Hayes predicts a short-term dip to $80k-$85k before a surge to $200k on improved liquidity.

-

Bitcoin ETF outflows: Negative flows for four weeks, accelerating sell-off.

-

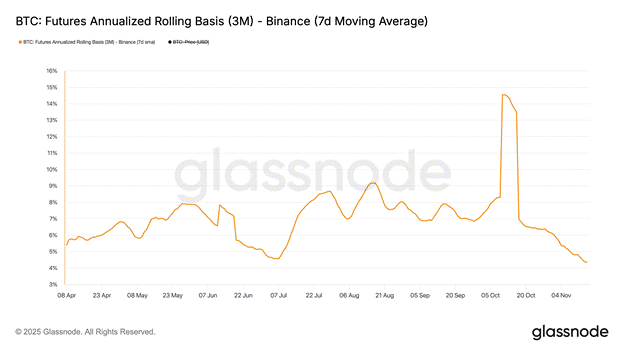

Hedge funds liquidating positions as basis trade yields drop from 14% to below 5%.

-

Liquidity boost expected in December 2025 from Fed’s QT end, potentially driving BTC to $200k.

Bitcoin ETF outflows hit $2.59B in Nov 2025, led by BlackRock. Arthur Hayes explains hedge fund exits and predicts BTC surge to $200k. Stay informed on crypto trends—explore more insights today.

What Are the Reasons Behind Recent Bitcoin ETF Outflows?

Bitcoin ETF outflows have intensified in November 2025, with $2.59 billion exiting U.S. spot Bitcoin exchange-traded funds over the month. BlackRock’s flagship IBIT ETF saw the largest share at $1.26 billion, driven primarily by institutional players like hedge funds unwinding leveraged positions. This trend marks the fourth consecutive week of negative flows, exacerbating a broader market sell-off in risk assets.

How Are Hedge Funds Influencing These Bitcoin ETF Outflows?

Hedge funds have been key contributors to the recent Bitcoin ETF outflows, as explained by Arthur Hayes, founder of BitMEX. These institutions previously engaged in basis trades, purchasing spot Bitcoin ETFs while shorting Bitcoin futures on the Chicago Mercantile Exchange to capture the premium spread between spot and futures prices. Yields from this strategy, which offered extra returns above Federal Reserve rates, have plummeted from approximately 14% in October to below 5% now, rendering it unprofitable. As a result, firms like Goldman Sachs and others have liquidated their holdings, triggering a cascade of outflows.

Hayes notes that this institutional exit has created a negative feedback loop. Retail investors, observing the heavy selling from major players, interpret it as a lack of confidence in Bitcoin, prompting them to sell as well. This further compresses the basis trade opportunity, encouraging more institutional divestment. Data from SoSo Value illustrates the severity, showing BlackRock’s IBIT leading the pack in net outflows.

Source: SoSo Value

Glassnode’s on-chain metrics corroborate this shift, highlighting a decline in futures premium that has directly impacted ETF positioning. Hayes emphasized in his analysis, “Now retail believes these same investors don’t like Bitcoin and creates a negative feedback loop that influences them to sell, which decreases the basis, finally causing more institutional investors to sell the ETF.” This dynamic underscores the interconnectedness of institutional and retail behaviors in the cryptocurrency market.

Source: Glassnode

How Will Liquidity Conditions Affect Bitcoin’s Price Trajectory?

Beyond hedge fund activities, broader macroeconomic factors are at play in the current Bitcoin ETF outflows. Demand from corporate Bitcoin treasuries has waned, with major holders adopting a cautious stance amid volatility. Arthur Hayes points to tightening dollar liquidity as a significant drag, exacerbated by the U.S. Treasury’s General Account (TGA) balance fluctuations.

The TGA serves as the U.S. government’s primary cash account at the Federal Reserve, directly influencing market liquidity. An increase in TGA balance means the Treasury is drawing funds from the private sector, effectively draining liquidity and pressuring risk assets like Bitcoin. Conversely, a drawdown injects liquidity back into the system. Hayes’ chart from Bloomberg shows a sharp TGA uptick in late October 2025, which coincided with deepened market routs.

Source: Bloomberg/Arthur Hayes (Treasury General Account, TGA balance)

Looking ahead, Hayes anticipates relief from the Federal Reserve’s planned end to Quantitative Tightening in early December 2025. This policy shift could reinject liquidity into financial markets, benefiting risk assets. He forecasts Bitcoin potentially dipping to $80,000–$85,000 in the near term due to ongoing pressures but rebounding sharply to $200,000 by year-end if liquidity conditions improve as expected.

Hayes also highlighted resilience in privacy-focused cryptocurrencies. Despite altcoin weakness, he has shifted holdings toward Zcash [ZEC], citing its strong privacy narrative as a hedge against broader market turbulence. This move reflects his view that certain niches may outperform during periods of uncertainty.

Frequently Asked Questions

What Caused the $2.59 Billion Bitcoin ETF Outflows in November 2025?

The outflows stem from hedge funds unwinding basis trades as yields fell from 14% to under 5%, with BlackRock’s IBIT seeing $1.26 billion in exits. Institutional selling has spooked retail investors, creating a feedback loop that intensified the four-week negative flow trend, per data from SoSo Value.

Will Bitcoin Reach $200,000 by the End of 2025?

According to Arthur Hayes, yes, if liquidity improves in early December from the Fed ending Quantitative Tightening. A short-term drop to $80k-$85k is likely first, driven by TGA drains and hedge fund exits, but reinjected dollars could propel Bitcoin to $200k by year-end.

Key Takeaways

- Hedge Fund Exits Drive Outflows: Basis trade declines led institutions to liquidate $2.59B from Bitcoin ETFs, half from BlackRock’s IBIT.

- Liquidity Pivot Ahead: Fed’s QT end in December could boost risk assets, reversing current TGA-induced drains.

- Bullish Long-Term Outlook: Arthur Hayes sees BTC hitting $200k post-dip, with privacy coins like Zcash showing resilience.

Conclusion

The ongoing Bitcoin ETF outflows in November 2025, spearheaded by BlackRock and fueled by hedge fund basis trade unwinds, highlight short-term vulnerabilities tied to liquidity squeezes and TGA dynamics. Yet, as Arthur Hayes observes, an impending shift in Federal Reserve policy could catalyze a strong recovery, potentially lifting Bitcoin to $200,000. Investors should monitor macroeconomic indicators closely for opportunities in this evolving landscape—position yourself for the liquidity-driven rebound ahead.

Comments

Other Articles

Oil Prices Surge 3% After Trump Cancels Iran Meetings and Promises Protesters ‘Help Is on the Way’ – What It Means for Bitcoin

January 13, 2026 at 05:49 PM UTC

Bitcoin Surges to $93,888: How Venezuela-US Tensions Triggered a Crypto Rally

January 5, 2026 at 07:04 AM UTC

Bitcoin (BTC) Eyes Short-Term Bottom Rebound as On-Chain Flows Align with USDC/USDT Premium and Market Liquidity, but Bearish Longer-Term Outlook Persists

January 1, 2026 at 03:41 PM UTC