Binance CEO Suggests Bitcoin Volatility Mirrors Major Asset Classes in Risk-Off Phase

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Bitcoin volatility in 2025 aligns with major asset classes like stocks and commodities, driven by broader market deleveraging rather than crypto-specific issues. Binance CEO Richard Teng notes this as normal cyclical behavior, with Bitcoin trading over double its 2024 levels despite recent declines, signaling healthy consolidation.

-

Bitcoin’s current volatility reflects risk-off trends across global markets, not isolated to crypto.

-

Recent price drops stem from investors deleveraging positions amid economic uncertainty.

-

Data from BitBo shows Bitcoin’s 60-day volatility peaking at 2.44% this year, comparable to volatile tech stocks like Tesla at over 65% annualized.

Explore Bitcoin volatility trends in 2025: Why it’s matching traditional assets and what it means for investors. Delve into expert insights from Binance CEO Richard Teng for informed crypto strategies today.

What is Driving Bitcoin Volatility in 2025?

Bitcoin volatility in 2025 is primarily influenced by broader market dynamics, including investor deleveraging and risk aversion across asset classes. Binance CEO Richard Teng emphasized during a media roundtable in Sydney that these movements are not unique to cryptocurrency but reflect cyclical patterns seen in stocks, bonds, and commodities. Despite a recent slide to around $82,000, Bitcoin remains more than double its value from 2024, indicating sustained long-term growth amid temporary corrections.

Bitcoin’s one-year price chart. Source: CoinMarketCap

Richard Teng, CEO of the leading cryptocurrency exchange Binance, provided clarity on the ongoing market fluctuations. In comments reported by Reuters on a Friday, Teng highlighted that all major asset classes experience volatility and cycles. “What you’re seeing is not only happening to crypto prices,” he stated, underscoring the interconnected nature of global financial markets.

This perspective comes at a time when Bitcoin has declined nearly 35% from its October 6 all-time high of over $126,000, according to data from CoinMarketCap. The total cryptocurrency market capitalization stands at $2.84 trillion, marking a 33.6% drop from its peak of $4.28 trillion. Teng attributes this downturn to a period of deleveraging, where investors reduce leveraged positions to mitigate risks. “At this point in time, there’s a bit of risk (off) and deleveraging happening,” he explained, aligning Bitcoin’s behavior with trends in traditional finance.

Such market actions are not alarming but part of a natural maturation process for digital assets. Over the past 1.5 years, the cryptocurrency sector has delivered exceptional performance, prompting profit-taking among investors. Teng views this consolidation as beneficial: “Any consolidation is actually healthy for the industry, for the industry to take a breather, find its feet.” This sentiment reinforces the idea that current volatility supports long-term stability rather than signaling distress.

Is Bitcoin’s Volatility Comparable to Traditional Markets?

Bitcoin’s volatility has long been a point of discussion, but recent data suggests it is increasingly in line with traditional asset classes. According to BitBo data, the 60-day BTC-USD volatility in 2025 has fluctuated between short dips near 1% and highs of nearly 2.44%, a range that mirrors periods of instability in equities and other investments.

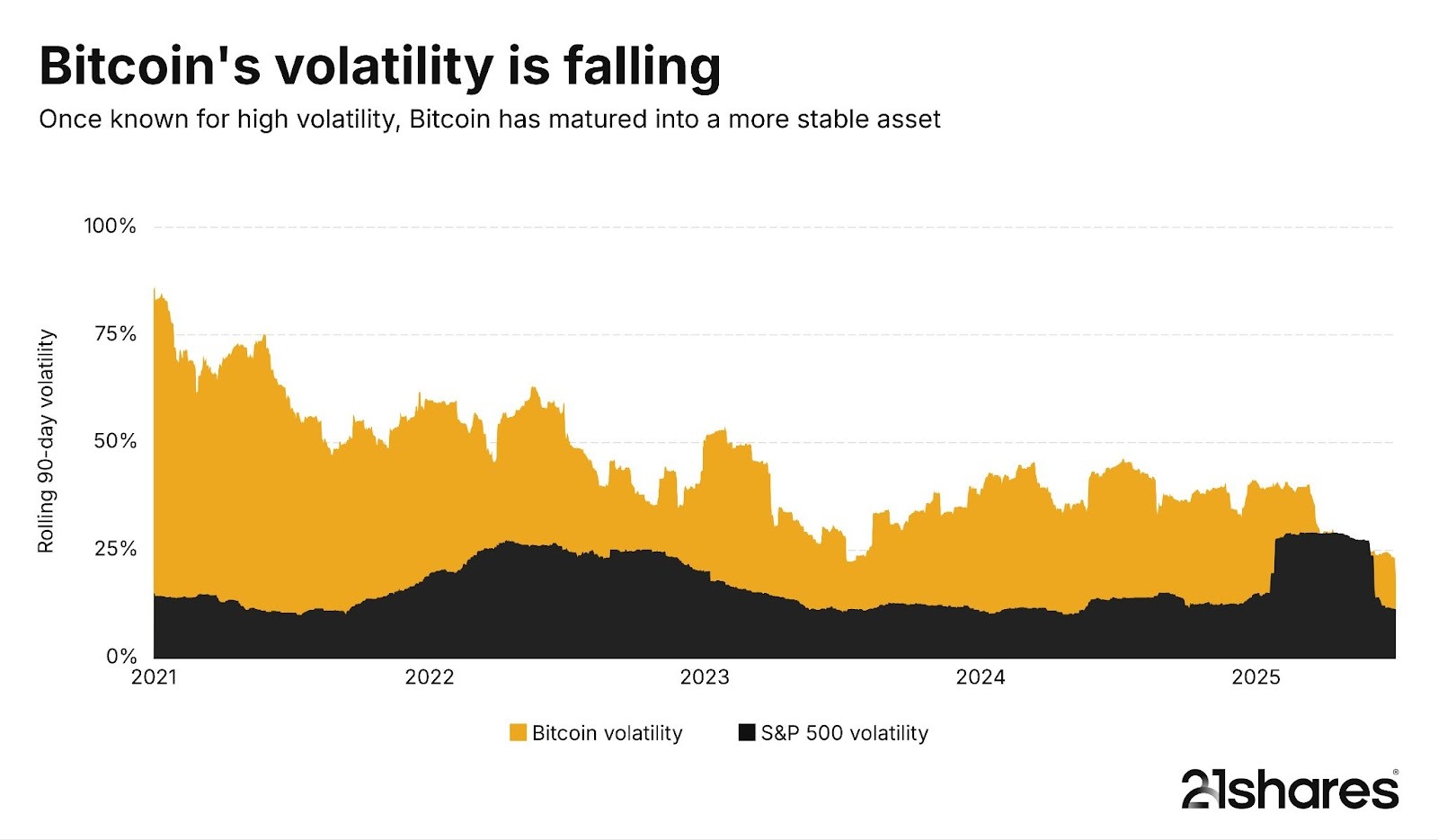

Historical trends further support this normalization. Research from 21Shares indicates that Bitcoin’s annualized volatility hit an all-time high of 181% in 2013 but has since declined significantly, reaching as low as 23% this year. This reduction correlates with growing adoption, institutional involvement, and improved liquidity in the crypto market, making it behave more like established financial instruments.

Bitcoin-S&P500 volatility chart. Source: 21Shares

A comparative analysis from 21Shares reveals intriguing insights during this year’s market turmoil. The S&P 500’s annualized volatility briefly exceeded Bitcoin’s, driven by uncharacteristically high fluctuations in traditional markets that have since subsided. Currently, V-Lab data shows Bitcoin’s annualized volatility at over 50%, while the S&P 500 hovers around 15%. However, within the technology sector, several stocks exhibit higher volatility: Tesla at over 65%, AMD at over 73%, Super Micro Computer at 73%, and Palantir at 63%.

These examples illustrate that while Bitcoin remains more volatile than broad indices, it is not an outlier when benchmarked against high-growth tech equities. Teng’s assertion challenges the prevailing narrative that cryptocurrency is inherently riskier, positioning it instead as part of a diverse ecosystem of volatile yet rewarding assets. Experts in financial analysis, such as those cited in 21Shares reports, emphasize that as Bitcoin’s market cap expands—now approaching $1.6 trillion—its volatility will continue to moderate, fostering greater investor confidence.

Moreover, this alignment with traditional markets underscores the maturation of cryptocurrency. Institutional investors, including hedge funds and pension plans, are increasingly allocating to Bitcoin, treating it akin to alternative assets like gold or venture capital. Data from Bloomberg shows that Bitcoin’s correlation with the S&P 500 has risen to 0.4 in 2025, up from near zero a decade ago, indicating shared responses to macroeconomic factors like interest rate changes and geopolitical events.

In essence, Bitcoin volatility is no longer the wild frontier it once was. Teng’s comments, backed by empirical data, suggest that investors should view current dips as opportunities within a broader bull cycle. This perspective is echoed by market analysts who point to on-chain metrics, such as stablecoin inflows and reduced exchange reserves, as signs of underlying strength despite surface-level turbulence.

Frequently Asked Questions

What Causes Bitcoin’s Recent Price Decline in 2025?

Bitcoin’s drop to around $82,000 in 2025 stems from widespread deleveraging and risk aversion among investors, as explained by Binance CEO Richard Teng. This mirrors trends in stocks and bonds, where leveraged positions are unwound amid economic uncertainty. Despite the decline, Bitcoin trades over double its 2024 levels, reflecting robust fundamentals.

How Does Bitcoin Volatility Compare to Stock Market Volatility?

Bitcoin’s volatility is increasingly similar to that of the stock market, especially during turbulent periods. While Bitcoin’s annualized rate exceeds 50%, volatile tech stocks like Tesla surpass 65%, and even the S&P 500 briefly overtook Bitcoin earlier this year. As adoption grows, Bitcoin’s swings are aligning with traditional assets, per data from V-Lab and 21Shares.

Key Takeaways

- Market Cycles Are Universal: Bitcoin volatility reflects broader risk-off deleveraging, not crypto isolation, as noted by Binance’s Richard Teng.

- Declining Historical Volatility: From 181% in 2013 to 23% lows in 2025, Bitcoin is maturing with greater liquidity and institutional interest.

- Investment Opportunity: View consolidations as healthy; consider accumulating during dips for long-term gains in this evolving asset class.

Conclusion

In summary, Bitcoin volatility in 2025 is aligning with major asset classes amid deleveraging and cyclical adjustments, as articulated by Binance CEO Richard Teng. This normalization, supported by data from sources like 21Shares and BitBo, highlights cryptocurrency’s integration into mainstream finance. As volatility moderates, investors are poised for continued growth; stay informed on market trends to capitalize on emerging opportunities in the digital asset space.

Comments

Other Articles

Oil Prices Surge 3% After Trump Cancels Iran Meetings and Promises Protesters ‘Help Is on the Way’ – What It Means for Bitcoin

January 13, 2026 at 05:49 PM UTC

Bitcoin Surges to $93,888: How Venezuela-US Tensions Triggered a Crypto Rally

January 5, 2026 at 07:04 AM UTC

Bitcoin (BTC) Eyes Short-Term Bottom Rebound as On-Chain Flows Align with USDC/USDT Premium and Market Liquidity, but Bearish Longer-Term Outlook Persists

January 1, 2026 at 03:41 PM UTC