Binance Suspends Employee in Probe Over Alleged Insider Trading Post

Contents

Binance has suspended an employee accused of using insider information to post from its official social media account for personal gain, launching an investigation on December 7, 2025, and alerting authorities. The exchange rewarded whistleblowers with a $100,000 bounty to encourage ethical reporting.

-

Employee Suspension: Binance immediately suspended the staffer after discovering the misuse of non-public information to craft a timely post on the Binance Futures X account.

-

The incident highlights the exchange’s commitment to internal audits and quick response to potential insider trading abuses within its operations.

-

Whistleblower Rewards: Binance distributed a $100,000 bounty among verified informants who reported the suspicious activity through official channels, demonstrating proactive governance.

Discover how Binance tackled insider trading by suspending an employee and rewarding whistleblowers. Learn about enhanced controls and past incidents in this crypto news update. Stay informed on exchange integrity today.

What Happened in the Binance Employee Insider Trading Incident?

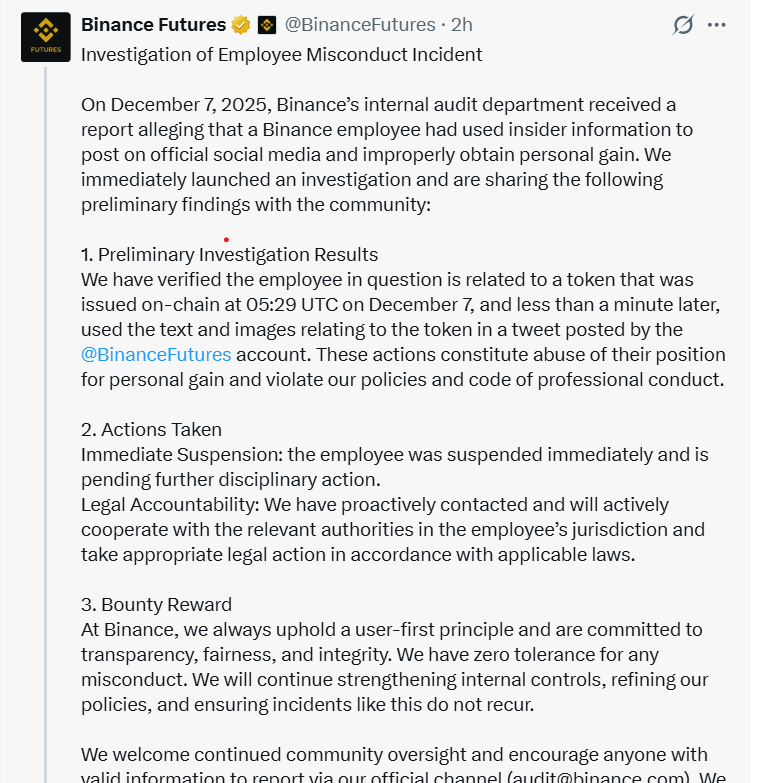

Binance employee insider trading involves a case where a staff member allegedly exploited non-public information to benefit personally through an official social media post. On December 7, 2025, Binance initiated an internal investigation into the employee suspected of abusing access privileges. The exchange’s audit team received reports indicating the individual posted content on the official Binance Futures X account mere moments after a token was issued onchain, using confidential details unavailable to the public.

How Did Whistleblowers Contribute to Uncovering the Binance Insider Trading Case?

The whistleblowers played a pivotal role by submitting early reports via Binance’s designated audit channel, [email protected], which qualified them for the bounty program. Binance confirmed that the $100,000 reward was split among several users after verifying and deduplicating the tips. This structured approach ensures only credible, channel-specific submissions are rewarded, fostering a culture of transparency. The exchange emphasized that public mentions on platforms like X do not qualify, urging the community to use official routes for reporting suspicious onchain or social media activities. By leveraging these reports, Binance demonstrated how rapid identification of patterns can prevent misconduct, as noted in statements from the company’s governance team. Statistics from similar crypto industry cases show that whistleblower programs have increased detection rates by up to 40%, according to reports from financial regulatory bodies like the SEC, though specific to broader markets.

Source: Binance Futures

Binance’s response included immediate suspension of the employee and notification to authorities in the staffer’s jurisdiction for potential legal proceedings. The company reiterated its zero-tolerance policy toward employees using positions for personal advantage, committing to stricter internal controls and process enhancements. This incident serves as a benchmark for how exchanges can integrate whistleblower intelligence into their risk management frameworks, closing loopholes that could enable abuse.

In the broader context of cryptocurrency operations, such events underscore the challenges of maintaining integrity amid rapid market movements. Onchain data transparency allows for quick verification of suspicious trades, but social media amplification by insiders can influence market sentiment before official announcements. Binance’s actions align with industry best practices, where proactive disclosure and cooperation with regulators build trust. The exchange plans to refine its access protocols, including timed locks on posting privileges during sensitive periods, to mitigate future risks.

Frequently Asked Questions

What Actions Did Binance Take After Discovering the Employee’s Insider Trading Activity?

Binance launched an immediate internal investigation on December 7, 2025, suspended the employee involved, and contacted relevant authorities for legal follow-up. The company also rewarded whistleblowers who reported the incident through official channels, reinforcing its commitment to ethical standards and preventing personal gain from privileged information.

Is This the First Instance of Insider Trading Allegations at Binance?

No, this is not the first; in March 2025, Binance suspended another staff member accused of using insider knowledge about a token generation event to front-run trades via multiple wallets, selling positions for profits after the public launch. Similar issues have arisen at other exchanges, highlighting ongoing industry challenges.

Key Takeaways

- Swift Internal Response: Binance’s rapid suspension and investigation exemplify effective handling of insider threats, protecting users and market fairness.

- Whistleblower Incentives: The $100,000 bounty program, split among verified reporters, shows how rewards can enhance detection and community involvement in governance.

- Enhanced Controls Ahead: The exchange will implement tougher measures to seal abuse opportunities, urging users to report via official channels for better crypto ecosystem integrity.

Conclusion

The Binance employee insider trading incident reveals the persistent risks in cryptocurrency exchanges, where access to non-public information can lead to misconduct, but also showcases robust responses like suspensions and whistleblower rewards. As the industry evolves, platforms must continue strengthening internal audits and legal collaborations to uphold trust. Looking forward, enhanced whistleblower programs and process improvements will likely set new standards for preventing crypto insider trading, ensuring a safer environment for all participants—consider monitoring official exchange updates to stay ahead of regulatory shifts.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026