Bitcoin at Risk of Max Pain Below $80K, Analysts Suggest Possible Rebound or Deeper Decline

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Bitcoin faces max pain if it falls below $80K, analysts warn, as this level acts as key support turning into resistance, potentially driving prices toward $60K amid short-term holder sell-offs and market fear. The correction could signal a bottom or deeper decline, with rebounds possible but uncertain.

-

Bitcoin’s current struggle below its all-time high highlights a critical $73K-$84K max pain zone for traders.

-

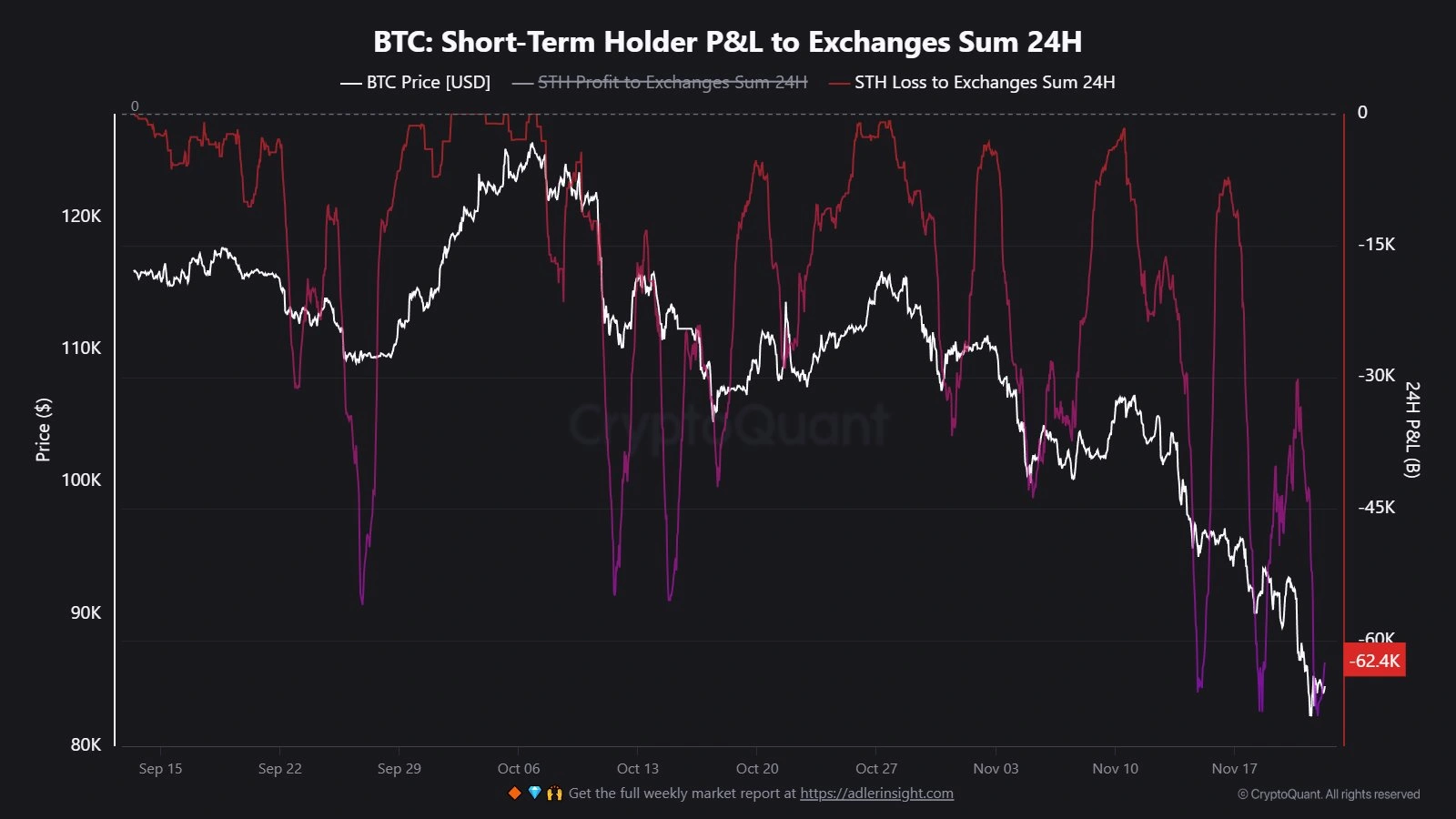

Short-term holders have offloaded over 62,000 BTC at a loss, indicating peak fear and potential seller exhaustion.

-

Mainstream media scrutiny intensifies, with outlets like USA Today labeling November a disastrous month for the asset, amid institutional entries averaging around $80K.

Discover what happens if Bitcoin falls below $80K: analysts predict max pain, potential drops to $60K, and market rebound signals. Stay informed on BTC price correction trends and protect your investments today.

What Happens If Bitcoin Falls Below $80K?

Bitcoin max pain below $80K could trigger significant selling pressure, transforming this psychological support into resistance and pushing prices toward the $60,000 range, according to analysts. This scenario mirrors past mid-cycle corrections where BTC consolidated between $60K and $80K after sharp declines. While short-term rebounds remain possible, sustained drops may lead to prolonged consolidation unless buyer demand strengthens.

Bitcoin has experienced a sharp correction from its all-time high, leaving traders and analysts cautious about the trajectory. The asset struggles to reclaim its peak, with market sentiment divided between potential rebounds and further declines. Factors such as exchange inflows and holder behavior play crucial roles in this uncertainty.

Why Are Short-Term Holders Selling Bitcoin at a Loss?

Short-term holders have dumped approximately 62,000 BTC to exchanges at a loss, with November 22 recording inflows of $81,000—the highest since mid-July—reflecting what analysts describe as peak fear behavior. This surrender phenomenon indicates a shift from bullish to bearish sentiment, as major players like BlackRock and Strategy entered at average costs in the $73,000 to $84,000 range, now a critical max pain band for near-term expiries.

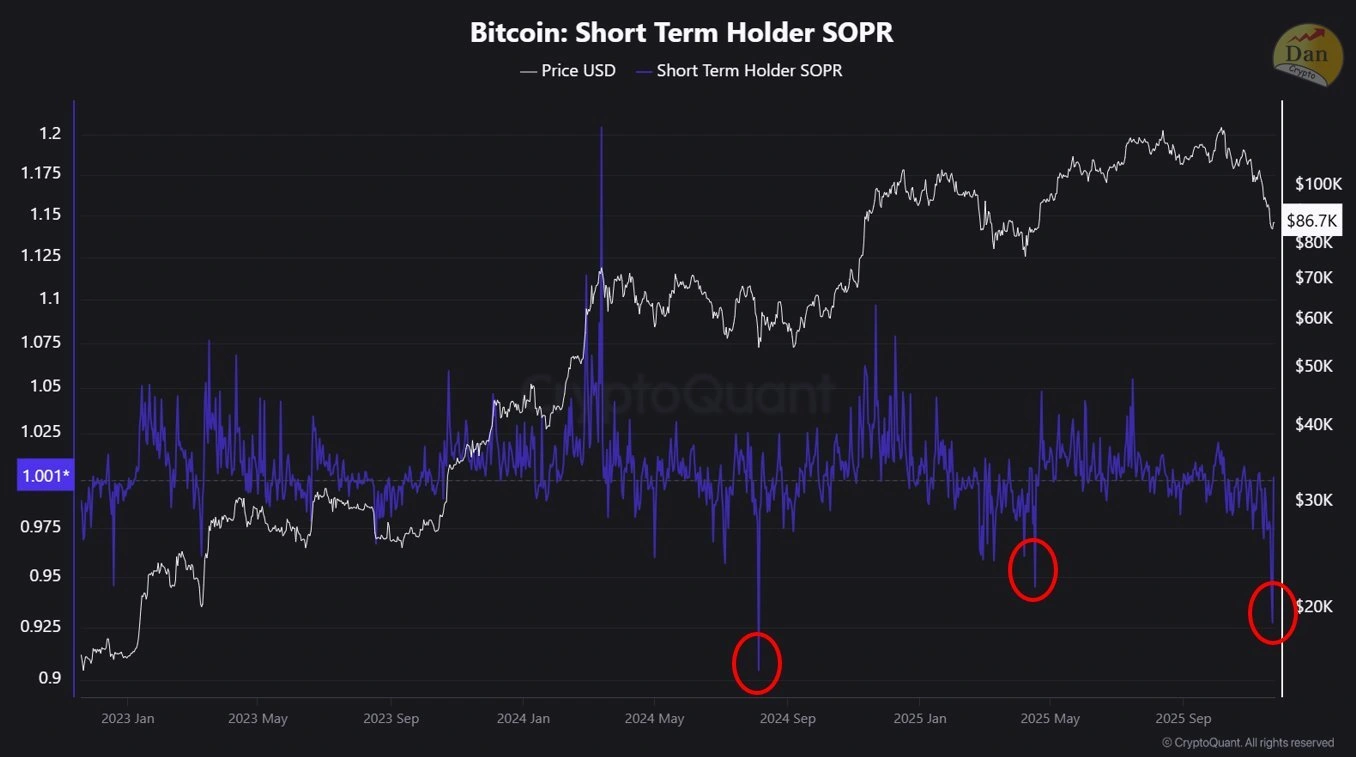

Analyst JA Maartun, via X/Twitter, notes that every past extreme like this has marked seller exhaustion and a major bottom, supported by steady spot demand. Even if the full bottom isn’t confirmed, a technical relief rally appears imminent. Another perspective from analyst DanCoinInvestor highlights the Bitcoin short-term holder SOPR, suggesting that while the correction’s magnitude differs from previous cycles, it captures key movement patterns.

If Bitcoin breaches $80K downward, it could encourage more selling, turning the zone into resistance and leading to consolidation reminiscent of historical patterns. However, the analyst emphasizes that this isn’t indicative of a full bear cycle, ruling out 70% drops from peaks seen in prior downturns. Instead, a short-term rebound might occur, but failure to sustain it could prolong tougher conditions.

Comparison of BTC price with short-term holders selling at a loss. Source: @JA_Maartun via X/Twitter

Comparison of BTC price with short-term holders selling at a loss. Source: @JA_Maartun via X/TwitterThe max pain theory in options trading underscores how prices often gravitate toward points of highest trader losses, amplifying volatility in this range. Institutional participation, while stabilizing long-term, adds weight to these levels, as averaged entries cluster here. Data from on-chain metrics shows realized losses peaking, a classic sign of capitulation that has preceded reversals in 80% of similar historical instances, per Glassnode reports mentioned in analyst discussions.

Expert quotes reinforce this caution: “The dumping from short-term holders is a surrender phenomenon that proves sentiment has flipped,” states one trader. This aligns with broader market dynamics, where exchange reserves swell during fear-driven sell-offs, potentially setting the stage for accumulation by long-term holders.

Bitcoin short-term holder SOPR. Source: @DanCoinInvestor via X/Twitter

Bitcoin short-term holder SOPR. Source: @DanCoinInvestor via X/TwitterIn the context of Bitcoin’s overall cycle, this correction section may already be nearing its bottom if viewed bullishly, but a down cycle interpretation suggests the decline’s end is distant. Analysts advise keeping both scenarios open, adjusting strategies accordingly. Spot demand remains a bullish undercurrent, with ETF inflows providing a floor despite volatility.

Frequently Asked Questions

What Is the Max Pain Zone for Bitcoin and Why Does It Matter?

The max pain zone for Bitcoin, currently $73,000 to $84,000, represents the price level causing the most options contract expirations at a loss for traders. It matters because markets often settle near this point to maximize pain, influencing short-term price action and highlighting key support or resistance based on institutional average costs.

Is Bitcoin’s Current Correction a Sign of a Larger Bear Market?

Bitcoin’s correction doesn’t necessarily signal a full bear market, as on-chain data shows seller exhaustion similar to past bottoms without 70% crashes. While a drop below $80K could extend consolidation to $60K, steady spot demand and historical patterns suggest potential relief, making it more a mid-cycle pause than a cycle end.

Key Takeaways

- Max Pain Threshold: Bitcoin below $80K risks turning support into resistance, potentially leading to $60K tests and mid-cycle consolidation.

- Holder Capitulation: Short-term sell-offs of 62,000 BTC at loss indicate peak fear, often preceding bottoms with spot demand support.

- Media Influence: Mainstream coverage amplifies negativity, but institutional entries provide long-term stability amid volatility.

Conclusion

Bitcoin’s max pain below $80K looms as a pivotal moment in this correction, with short-term holder sell-offs and media scrutiny adding pressure, yet on-chain signals hint at potential relief. Analysts like those from Glassnode underscore seller exhaustion as a rebound precursor, integrating institutional demand for resilience. As the market navigates these uncertainties, staying vigilant with data-driven strategies will be key—consider monitoring exchange flows to anticipate shifts and secure your portfolio against further volatility.

The broader implications extend to investor confidence, where psychological levels like $80K define battles between fear and accumulation. Historical data from previous cycles shows that such capitulation phases, while painful, have resolved into upward momentum when demand stabilizes. For those tracking Bitcoin price correction dynamics, this period tests resolve but offers entry opportunities for prepared participants.

Mainstream media’s portrayal, from USA Today’s grim November assessment to The Wall Street Journal’s critique of unmet expectations under pro-crypto policies, underscores external narratives clashing with on-chain realities. The Guardian’s editorial revives debates on Bitcoin’s utility, yet ignores its role as a hedge in economic uncertainty. Despite these voices, factual metrics like SOPR resets point to adaptive market behavior.

Institutional players, with entries in the contested range, influence outcomes significantly. BlackRock and Strategy’s positions exemplify how ETF-driven inflows mitigate extreme downside, even as short-term volatility persists. Traders should weigh these elements, recognizing that while a deeper dip to $60K-$80K consolidation is plausible, the absence of prior bearish magnitudes suggests limited long-term damage.

Ultimately, Bitcoin’s trajectory hinges on sustaining above key supports or confirming exhaustion through inflows. This balanced view, drawn from analyst insights without speculation, equips readers to interpret developments astutely in the evolving crypto landscape.

Comments

Other Articles

Oil Prices Surge 3% After Trump Cancels Iran Meetings and Promises Protesters ‘Help Is on the Way’ – What It Means for Bitcoin

January 13, 2026 at 05:49 PM UTC

Bitcoin Surges to $93,888: How Venezuela-US Tensions Triggered a Crypto Rally

January 5, 2026 at 07:04 AM UTC

Bitcoin (BTC) Eyes Short-Term Bottom Rebound as On-Chain Flows Align with USDC/USDT Premium and Market Liquidity, but Bearish Longer-Term Outlook Persists

January 1, 2026 at 03:41 PM UTC