Bitcoin Could Face Resistance Near $106,000 Amid Liquidity Cluster and Mixed On-Chain Signals

BTC/USDT

$17,366,629,629.18

$71,554.95 / $68,531.50

Change: $3,023.45 (4.41%)

-0.0023%

Shorts pay

Contents

-

Bitcoin’s price is consolidating near $105,000 after a recovery from a recent low, with key resistance observed around $106,000.

-

On-chain data reveals a significant liquidity cluster at approximately $106,736, suggesting potential for a breakout toward $109,000.

-

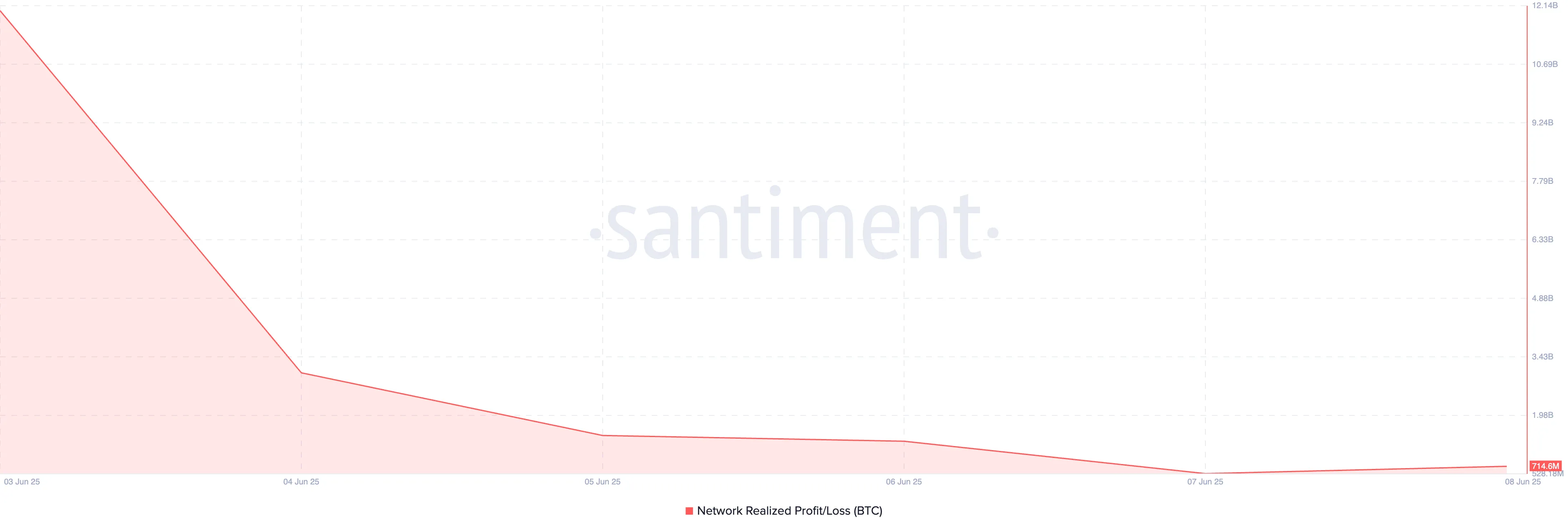

According to COINOTAG, the sharp decline in Bitcoin’s Network Realized Profit/Loss (NPL) indicates reduced selling pressure, supporting a bullish short-term outlook.

Bitcoin consolidates near $105,000 with strong liquidity clusters signaling a potential breakout above $106,000 amid declining selling pressure.

BTC Poised to Clear $105,000 as On-Chain Metrics Signal Bullish Momentum

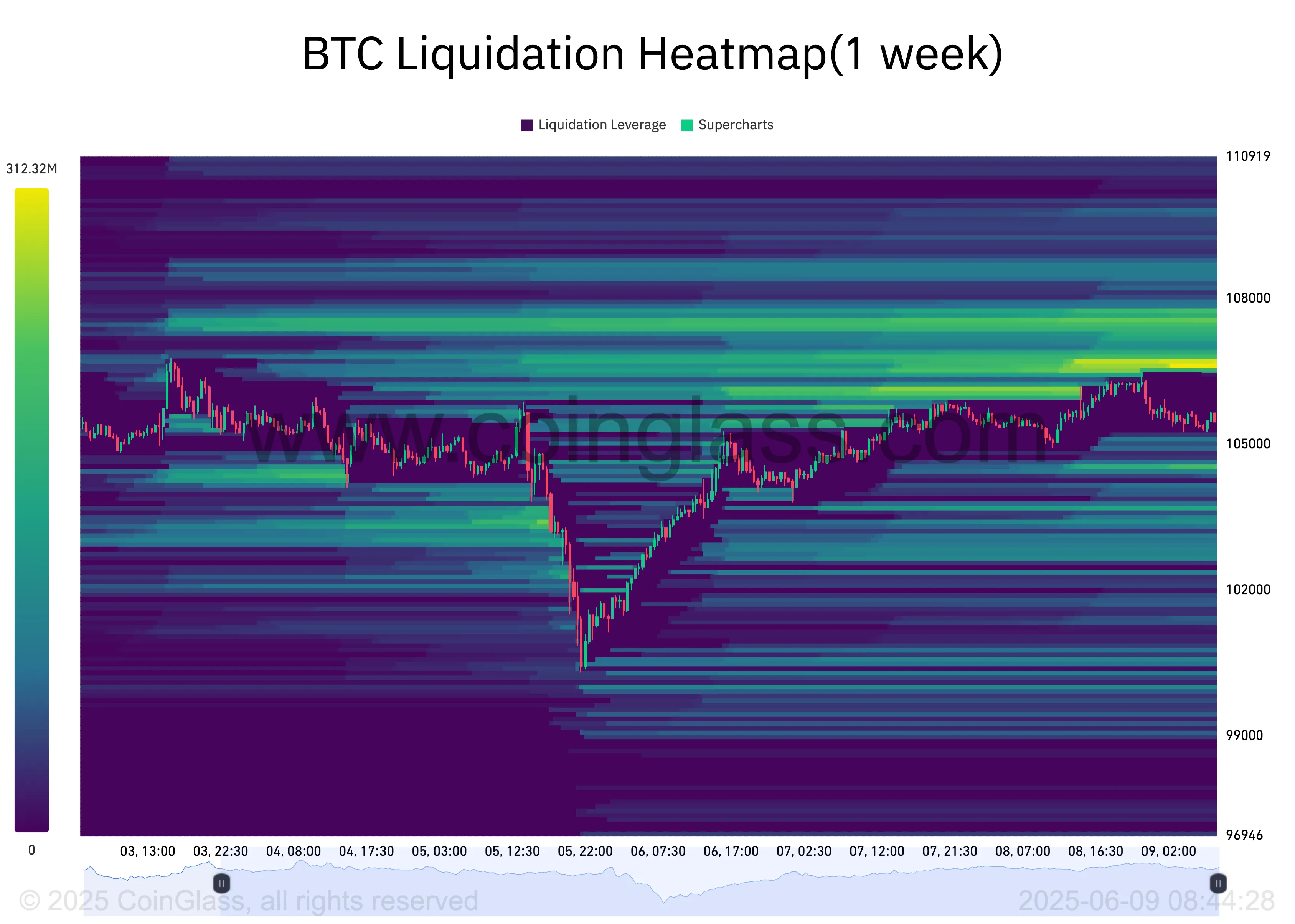

Bitcoin’s recent price action shows consolidation just below the $106,000 resistance level, following a rebound from the $100,424 low on June 5. A key indicator supporting a potential upward move is the presence of a liquidity cluster around $106,736, as identified by liquidation heatmaps. These clusters represent price zones where a high volume of leveraged positions may be liquidated, attracting significant buying interest and often acting as magnets for price movement.

Such liquidity zones typically encourage traders to either close short positions or initiate new long positions, increasing buying pressure. This dynamic enhances the likelihood of Bitcoin breaking through the $105,000 resistance level and advancing toward the $106,000 to $109,000 range.

Moreover, the Network Realized Profit/Loss (NPL) metric has sharply declined to 715 million, down over 90% since June 4. This decline suggests that investors are less inclined to sell at a loss, reducing selling pressure and potentially tightening supply. The combination of these factors creates a favorable environment for Bitcoin’s price to sustain upward momentum in the near term.

Understanding the Impact of Liquidity Clusters and NPL on BTC Price Dynamics

Liquidation heatmaps provide valuable insight into market sentiment by highlighting areas with concentrated leveraged positions. The brighter zones on these maps, such as the one near $106,736, indicate heightened liquidation risk, which can trigger rapid price movements as traders adjust their positions.

Simultaneously, the NPL metric offers a window into investor behavior by measuring realized profits and losses across the network. A declining NPL often correlates with reduced selling activity, as holders prefer to wait for more favorable market conditions rather than liquidate at a loss. This behavioral shift can contribute to a supply squeeze, further supporting price appreciation.

Bitcoin’s Fate Hangs Between $106,000 Breakout and $103,000 Pullback

Currently trading at approximately $105,630, Bitcoin faces a critical juncture. A successful breach of the $106,548 resistance could catalyze a rally toward the liquidity cluster at $106,736, potentially extending gains to the $109,310 target. This scenario would be reinforced by increased market demand and positive momentum from on-chain indicators.

Conversely, if selling pressure intensifies, Bitcoin may remain range-bound or experience a retracement toward the $103,938 support level. Such a pullback would signal caution among traders and could delay any sustained upward movement.

BTC Liquidation Heatmap. Source: Coinglass

BTC’s Network Realized Profit/Loss. Source: Santiment

BTC Price Analysis. Source: TradingView

Conclusion

Bitcoin’s price action in the near term hinges on its ability to surpass the $106,000 resistance, supported by robust liquidity clusters and declining Network Realized Profit/Loss. These factors collectively suggest a favorable environment for a potential breakout toward $109,000. However, traders should remain vigilant for possible pullbacks to $103,000 if selling pressure resurfaces. Monitoring on-chain metrics alongside price movements will be essential for assessing Bitcoin’s trajectory in the coming days.

Comments

Other Articles

Oil Prices Surge 3% After Trump Cancels Iran Meetings and Promises Protesters ‘Help Is on the Way’ – What It Means for Bitcoin

January 13, 2026 at 05:49 PM UTC

Bitcoin Surges to $93,888: How Venezuela-US Tensions Triggered a Crypto Rally

January 5, 2026 at 07:04 AM UTC

Bitcoin (BTC) Eyes Short-Term Bottom Rebound as On-Chain Flows Align with USDC/USDT Premium and Market Liquidity, but Bearish Longer-Term Outlook Persists

January 1, 2026 at 03:41 PM UTC