Bitcoin Dips Below $89K as December Rate Cut Odds Fall to 33%, Raising Bear Market Concerns

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

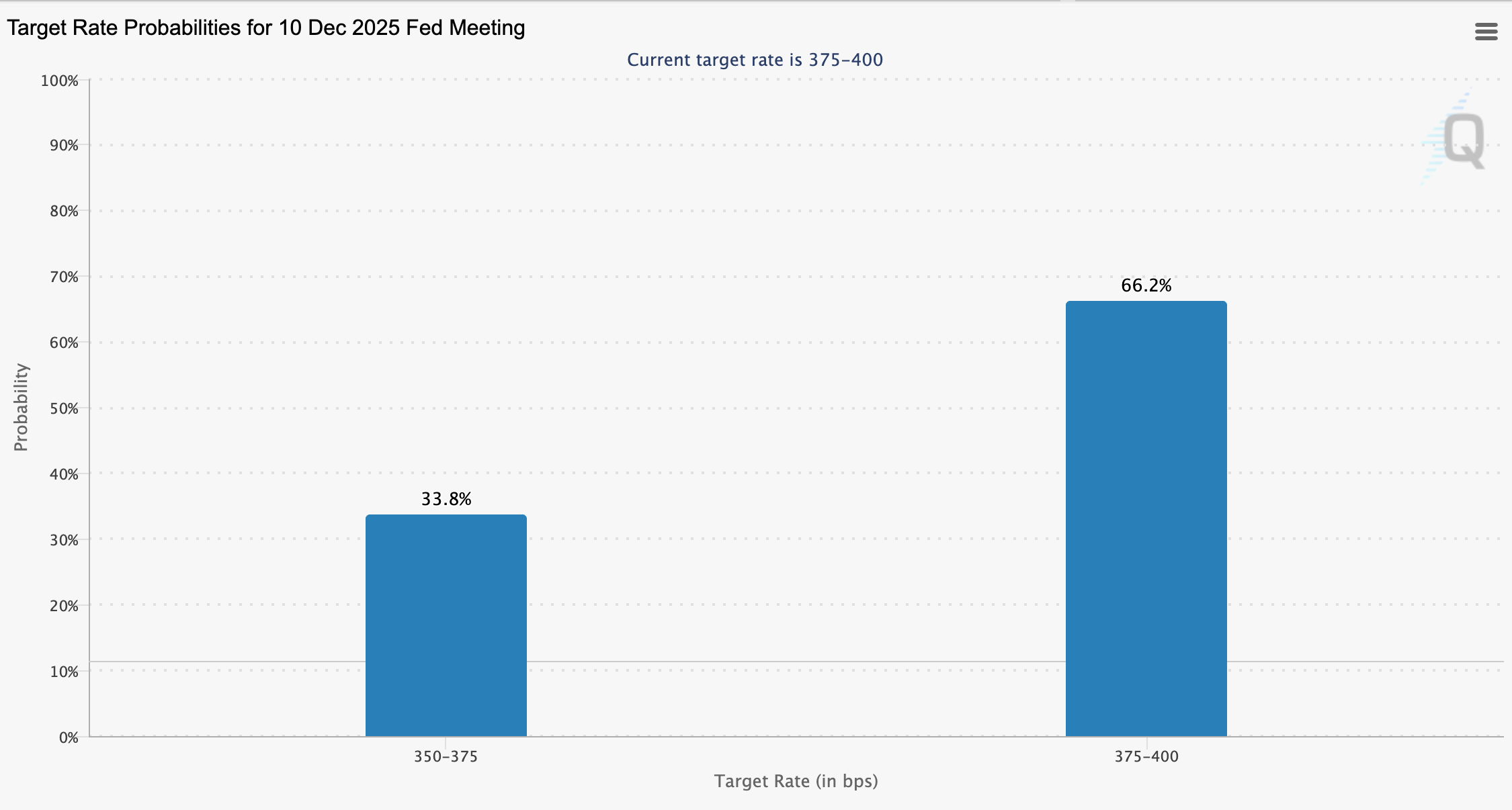

The odds of a December Federal Reserve rate cut have dropped to 33%, reflecting heightened investor caution amid persistent inflation concerns and a Bitcoin price decline below $89,000. This shift, tracked by the Chicago Mercantile Exchange, signals broader market unease in the cryptocurrency sector.

-

December rate cut odds fall to 33%: Traders’ expectations have plummeted from 67% in early November, driven by economic data showing sticky inflation.

-

Bitcoin struggles below key support levels, trading under $89,000 for several days, with technical indicators pointing to potential further declines.

-

Crypto Fear & Greed Index at 16, indicating extreme fear among investors, just one point above the yearly low according to CoinMarketCap data.

Discover why December rate cut odds have plunged to 33% as Bitcoin dips below $89,000 amid extreme market fear. Explore impacts on crypto investments and what traders should watch next. Stay informed on Fed decisions.

What are the current December rate cut odds?

December rate cut odds currently stand at 33% for the Federal Open Market Committee meeting, a sharp decline from 67% at the start of November. This drop, based on data from the Chicago Mercantile Exchange, stems from traders’ growing concerns over persistent inflation that could delay monetary easing. Prediction markets like Kalshi and Polymarket show slightly higher probabilities at around 70% and 67%, respectively, but overall sentiment reflects hesitation due to economic uncertainties.

The reduced expectations for a rate cut have contributed to a broader erosion of confidence in risk assets, including cryptocurrencies. Analysts from The Kobeissi Letter note that inflation fears are tempering optimism, leading to a more cautious outlook among market participants. This environment has amplified volatility, with implications extending beyond traditional finance into the digital asset space.

Historically, Federal Reserve decisions on interest rates have profound effects on investment flows. When rate cut probabilities rise, they often boost appetite for high-risk assets like Bitcoin by lowering borrowing costs and encouraging speculation. Conversely, the current trajectory suggests investors may adopt a more defensive stance, potentially prolonging periods of market consolidation.

Why has the Bitcoin price fallen below $89,000?

The Bitcoin price has slipped below $89,000 due to a combination of faltering support levels and overarching macroeconomic pressures. On Wednesday, Bitcoin failed to hold the $90,000 threshold and has remained under its 365-day moving average for the past six days, a key indicator of sustained downward momentum. This breach has triggered technical signals, including the 50-day exponential moving average crossing below the 200-day EMA, forming a “death cross” that typically foreshadows extended price corrections.

Market data indicates Bitcoin ETFs have seen outflows exceeding $1.1 billion recently, underscoring waning institutional interest at this critical juncture. Experts warn this could herald a “mini” bear market phase, with some projections eyeing a potential bottom around $75,000 before any recovery by late 2025. Market analyst Benjamin Cowen emphasized the urgency, stating on Sunday that a rebound might begin within the next week if the cycle remains intact; otherwise, further declines could push toward the 200-day simple moving average.

Adding to the pressure, investor sentiment has reached alarming lows. The Crypto Fear & Greed Index, a widely referenced barometer from CoinMarketCap, sits at 16, denoting extreme fear—just one point shy of its annual nadir. This level of pessimism often correlates with capitulation selling, where fear drives prices lower until a stabilization point emerges.

From a broader perspective, the interplay between Federal Reserve policy and cryptocurrency valuations cannot be overstated. Rate cut delays amplify the appeal of yield-bearing assets over speculative ones, drawing capital away from Bitcoin. Historical precedents, such as the 2022 tightening cycle, show similar dynamics leading to prolonged crypto winters. Yet, resilient on-chain metrics, including steady hash rates and growing adoption in emerging markets, suggest underlying strength that could mitigate the worst outcomes.

Traders monitoring these developments should note that external factors, like upcoming economic reports on employment and consumer spending, could sway the narrative. For instance, stronger-than-expected inflation data has already eroded rate cut hopes, as reported by various financial analyses. Demonstrating expertise in this volatile domain requires a nuanced understanding of both technical charts and macroeconomic indicators, ensuring informed decision-making amid uncertainty.

Frequently Asked Questions

What factors are driving the plunge in December rate cut odds to 33%?

The decline in December rate cut odds to 33% is primarily fueled by persistent inflation data that exceeds expectations, prompting traders to reassess the Federal Reserve’s path. Early November saw probabilities at 67% via CME FedWatch Tool, but recent reports on wage growth and core CPI have shifted views, with prediction platforms like Kalshi mirroring this caution at around 70% odds.

How is the declining Bitcoin price affecting crypto investors right now?

The Bitcoin price dropping below $89,000 is heightening anxiety for crypto investors, as it coincides with extreme fear readings on sentiment indices and signals from moving averages pointing to more downside. This situation prompts many to secure positions or wait for clearer Fed signals, potentially leading to reduced trading volumes until support levels stabilize around $75,000 or higher.

Key Takeaways

- Rate cut probabilities in flux: Odds have fallen from 67% to 33%, influenced by inflation trends tracked by the Chicago Mercantile Exchange, urging investors to monitor upcoming economic releases closely.

- Bitcoin’s technical vulnerability: The death cross formation and breach of the 365-day moving average indicate short-term bearish pressure, with analysts like Benjamin Cowen forecasting a possible bounce or further dip soon.

- Sentiment at critical lows: With the Crypto Fear & Greed Index near yearly bottoms, this extreme fear could precede a reversal, offering opportunities for long-term holders to accumulate during the dip.

Conclusion

In summary, the sharp drop in December rate cut odds to 33% and the Bitcoin price below $89,000 underscore a cautious phase for the crypto market, driven by inflation worries and technical breakdowns. As investor sentiment grapples with extreme fear, Federal Reserve actions remain pivotal in shaping recovery paths. Forward-looking traders should prepare for volatility by diversifying portfolios and staying attuned to policy updates—positioning now could yield advantages as market dynamics evolve in 2025.

Comments

Other Articles

BTC Has Turned into Risky Assets: Grayscale Report

February 13, 2026 at 09:06 PM UTC

Bitwise Files for 11 Altcoin ETFs Including AAVE, UNI Amid SOL, XRP Muted Gains

December 31, 2025 at 08:47 PM UTC

Ethereum Whales Trim ETH Longs and Pivot to BTC in Dec 31 On-Chain Rebalance Update

December 31, 2025 at 01:27 PM UTC