Bitcoin Dominance Steady in Q4 Downturn, Signaling Possible Holiday Short Squeeze

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Bitcoin faces a potential short squeeze in late 2025 amid Q4 weakness, with $5.8 billion in leveraged shorts clustered around $95k and strong dominance at 60%. Technical indicators like undervalued MVRV and RSI near 35 signal a possible holiday rally, targeting resistance at $95k if bulls activate.

-

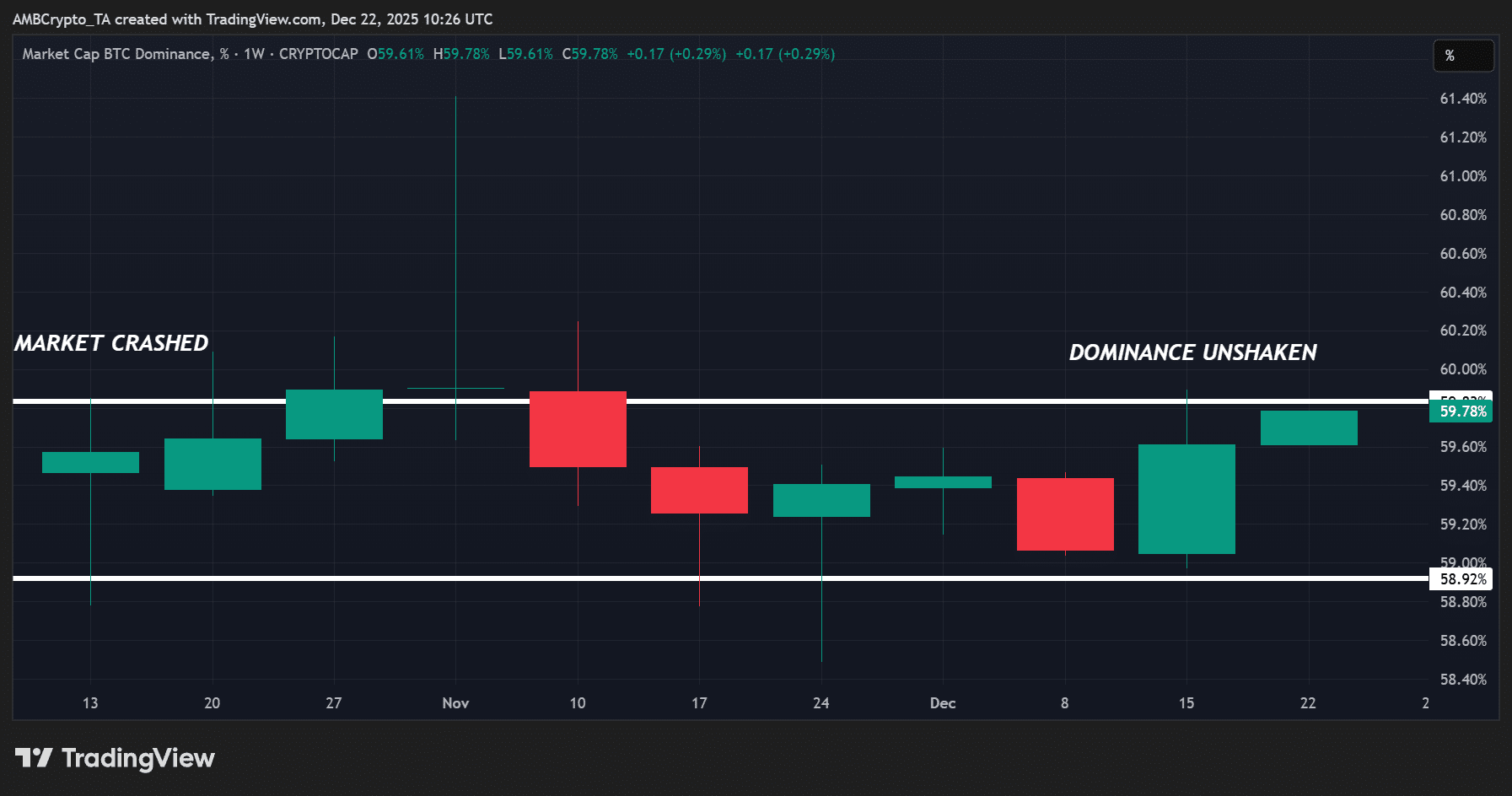

Bitcoin dominance steady at 60% despite 63% pullback from Q2-Q3 gains, showing investor confidence.

-

Altcoin dominance hits five-year low of 6.73%, indicating limited risk appetite beyond Bitcoin.

-

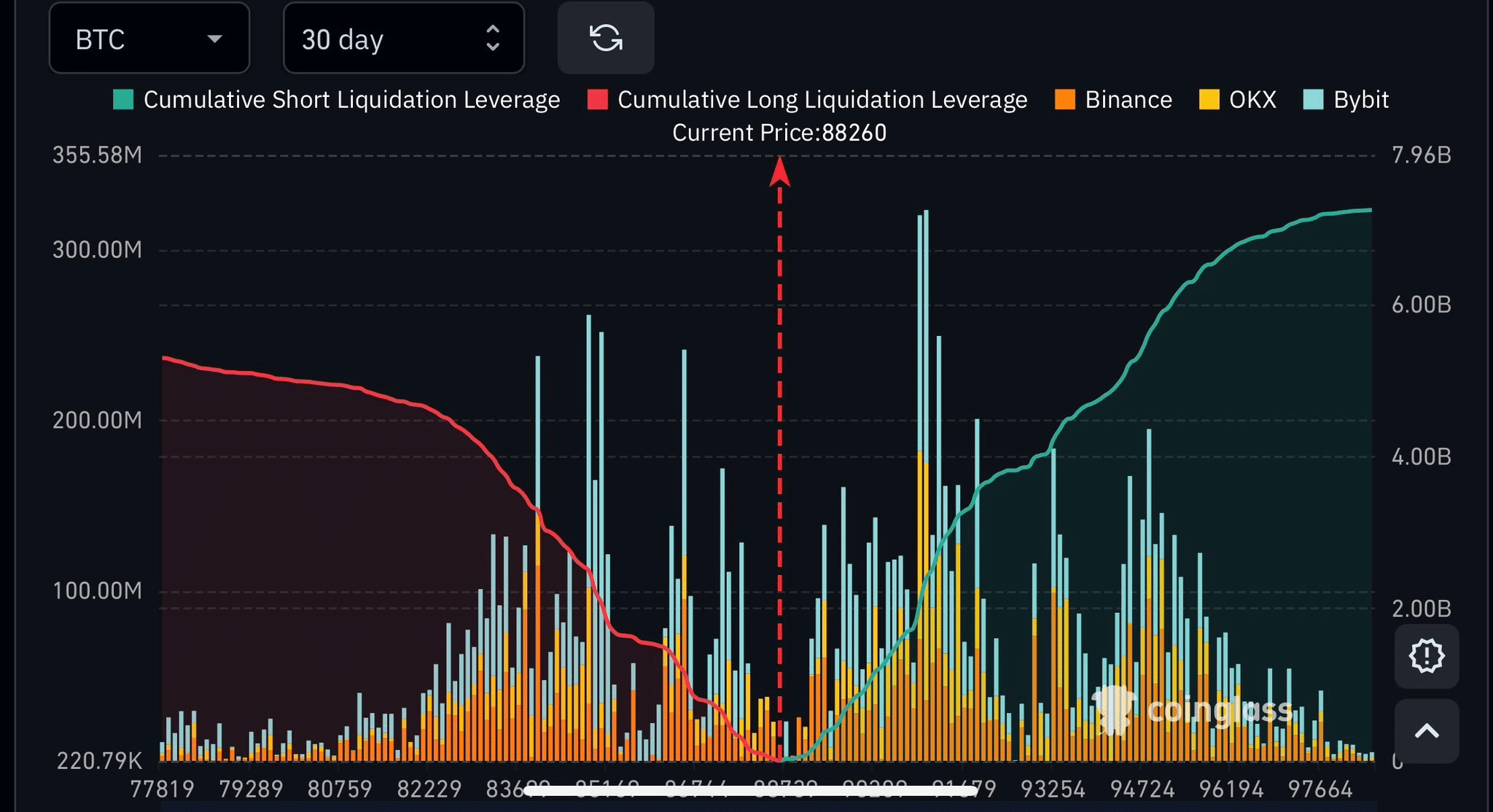

Over $5.8 billion in shorts above $90k creates liquidity target, with MVRV undervaluation adding rally potential per TradingView data.

Discover Bitcoin’s short squeeze setup in Q4 2025: dominance holds firm amid pullback, shorts pile up for potential holiday bounce. Stay informed on BTC recovery signals and trade wisely today.

What is setting up a Bitcoin short squeeze in late 2025?

Bitcoin short squeeze in late 2025 is emerging from Q4 market dynamics, where a 63% pullback from earlier highs has left many investors cautious, yet Bitcoin’s dominance remains robust at around 60%. This stability reflects parked capital rather than outflows, while technical undervaluation via MVRV metrics suggests a reversal opportunity as holiday liquidity thins out.

Source: TradingView (BTC.D/USDT)

The cryptocurrency market in Q4 2025 has proven challenging, marking the weakest quarter of the year with significant drawdowns. Bitcoin, trading approximately 25% below its peak of $126k, has endured persistent fear, uncertainty, and doubt (FUD) from macroeconomic pressures. However, this has not eroded its market position. Data from on-chain analytics platforms indicate that Bitcoin’s dominance metric has stabilized near 60%, a level that underscores sustained investor trust. In typical market cycles, declining Bitcoin dominance would signal capital rotation into altcoins, but the current environment shows the opposite trend.

Altcoins, excluding the top 10 by market cap, have seen their collective dominance shrink to 6.73%, the lowest in five years. This compression highlights a concentrated risk appetite, where investors prefer the relative safety of Bitcoin over speculative altcoin plays. Market observers, drawing from historical patterns analyzed by firms like Glassnode, note that such dominance levels often precede consolidation phases before broader recoveries. With only a week remaining in 2025, the onset of holiday periods introduces thin liquidity, which can amplify price movements. This timing is critical, as reduced trading volumes may facilitate sharper reactions to positive catalysts.

How does Bitcoin’s holiday rally potential align with current technicals?

Bitcoin’s potential for a holiday rally in 2025 ties directly to accumulating short positions and undervalued on-chain signals. Over the past month, since Bitcoin briefly surpassed $90k, traders have positioned heavily with shorts, creating liquidity pools just above key support levels. According to aggregated exchange data from Coinglass, more than $5.8 billion in leveraged short positions cluster around the $95k mark, presenting a high-reward target for bullish reversals.

Source: Coinglass

The holiday season arrives opportunely, coinciding with these technical setups. Bitcoin’s Market Value to Realized Value (MVRV) ratio currently indicates undervaluation, a metric historically associated with accumulation zones before uptrends, as per research from CryptoQuant. The Relative Strength Index (RSI) lingers at 35 on daily charts, deep in oversold territory, while price action has consolidated below $90k for six weeks. This prolonged chop could transform the $90k level from resistance to support upon breakout.

Experts in cryptocurrency analysis, such as those from Santiment, emphasize that short squeezes often ignite when macro FUD subsides, allowing bulls to target liquidity. In this scenario, a flip to risk-on sentiment—potentially driven by year-end institutional buying or regulatory clarity—could cascade through the $95k short clusters, exerting upward momentum. Historical precedents, like the 2021 holiday rallies following similar setups, saw Bitcoin gain 20-30% in compressed timeframes. However, thin liquidity cuts both ways; volatility remains a risk, but the reward asymmetry favors upside if dominance holds.

Beyond technicals, on-chain metrics reinforce this outlook. Active addresses and transaction volumes, while subdued, show no mass capitulation, per data from Blockchain.com. Exchange inflows have stabilized, suggesting HODLers are not panicking. This resilience, combined with Bitcoin’s role as digital gold amid global economic uncertainties, positions it for a rebound. As 2025 closes, the interplay of shorts, undervaluation, and seasonal factors creates a compelling case for a late-year surge.

Frequently Asked Questions

What factors could trigger a Bitcoin short squeeze in December 2025?

A Bitcoin short squeeze in December 2025 could be triggered by a breakout above $90k, targeting $5.8 billion in clustered shorts at $95k, alongside cooling macro FUD and holiday liquidity dynamics. Undervalued MVRV and oversold RSI provide the technical foundation, with dominance at 60% indicating sustained capital support, potentially leading to rapid liquidation cascades.

Is Bitcoin’s dominance a sign of upcoming altcoin recovery in 2025?

Bitcoin’s dominance at 60% in late 2025 signals concentrated risk but no immediate altcoin recovery, as alt dominance sits at a five-year low of 6.73%. This setup suggests capital remains parked in BTC; a broader rally would require Bitcoin stabilization first, followed by rotation, aligning with historical cycles observed in past bull markets.

Key Takeaways

- Strong Bitcoin Dominance: Holding near 60% despite Q4’s 63% pullback, it reflects investor confidence and limited capital rotation to altcoins.

- Short Liquidity Target: $5.8 billion in positions above $90k sets up a classic squeeze, bolstered by MVRV undervaluation and RSI at 35.

- Holiday Opportunity: Thin liquidity could amplify a bear-trap reversal, targeting $95k resistance for a potential year-end rally.

Conclusion

In summary, the Bitcoin short squeeze dynamics of late 2025, driven by unwavering dominance and mounting short liquidity, offer a pathway for recovery amid Q4 challenges. With technical indicators pointing to undervaluation and the holiday rally window approaching, the market appears poised for bulls to reclaim ground. Investors should monitor key levels closely, as 2026 could build on this momentum toward renewed growth in the cryptocurrency sector.

Comments

Other Articles

Oil Prices Surge 3% After Trump Cancels Iran Meetings and Promises Protesters ‘Help Is on the Way’ – What It Means for Bitcoin

January 13, 2026 at 05:49 PM UTC

Bitcoin Surges to $93,888: How Venezuela-US Tensions Triggered a Crypto Rally

January 5, 2026 at 07:04 AM UTC

Bitcoin (BTC) Eyes Short-Term Bottom Rebound as On-Chain Flows Align with USDC/USDT Premium and Market Liquidity, but Bearish Longer-Term Outlook Persists

January 1, 2026 at 03:41 PM UTC