Bitcoin ETFs May See Renewed Institutional Interest Amid Steady Inflows and Market Volatility

BTC/USDT

$17,366,629,629.18

$71,554.95 / $68,531.50

Change: $3,023.45 (4.41%)

-0.0023%

Shorts pay

Contents

-

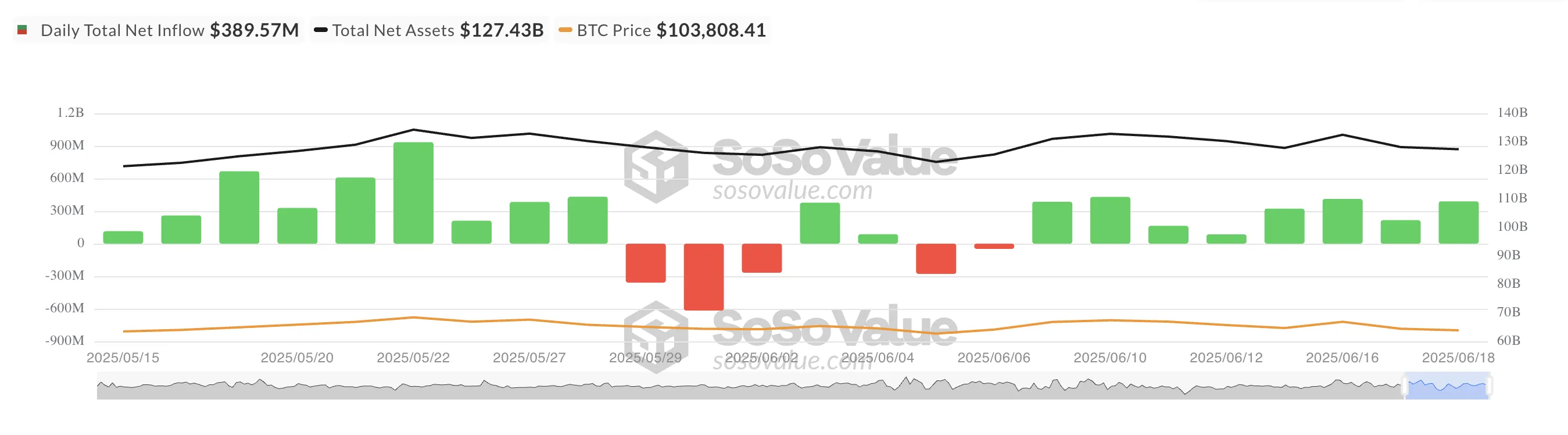

US-listed Bitcoin ETFs have recorded inflows for the eighth consecutive day, underscoring growing institutional confidence in Bitcoin despite ongoing market volatility.

-

Wednesday’s inflows surged to $390 million, an 80% increase from the previous day, signaling renewed investor interest amid geopolitical tensions.

-

BlackRock’s IBIT ETF led the inflows with $2.8 billion, bringing its total assets under management to $51 billion, reflecting strong demand for regulated BTC exposure.

US-listed Bitcoin ETFs see sustained inflows, with $390M added in one day, led by BlackRock’s IBIT, highlighting institutional demand amid market uncertainty.

Bitcoin ETFs See $390 Million Inflows

On Wednesday, Bitcoin ETFs listed in the US recorded net inflows totaling nearly $390 million, marking the eighth consecutive day of positive capital movement into the sector. This figure represents an 80% increase compared to the $216 million inflow reported the day before, emphasizing a strong resurgence of institutional interest in Bitcoin investment vehicles.

This inflow uptick coincided with Bitcoin briefly surpassing the critical $105,000 price level during trading, a psychological milestone that often influences investor behavior. Although Bitcoin has since experienced a minor retracement of approximately 0.44%, it remains resilient within this price range, signaling sustained market strength.

Among the Bitcoin ETFs, BlackRock’s spot BTC ETF, IBIT, led the inflows with a net addition of $279 million on Wednesday alone. This brings IBIT’s cumulative net inflows to an impressive $51 billion, underscoring the fund’s dominant position and investor trust in BlackRock’s management of Bitcoin exposure.

Traders Turn Bullish on Bitcoin

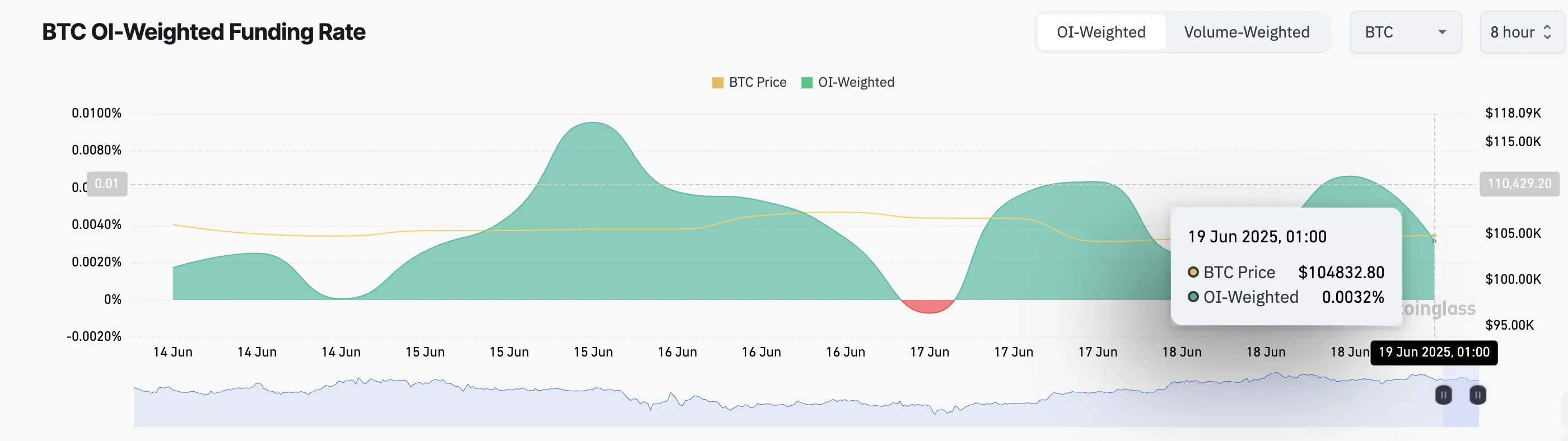

Bitcoin’s attempt to stabilize near the $105,000 mark is further supported by derivatives market data, which reveals a cautiously optimistic outlook among traders. The funding rate for Bitcoin perpetual futures contracts remains positive at 0.0032%, indicating that long-position holders are paying shorts, a classic sign of bullish market sentiment.

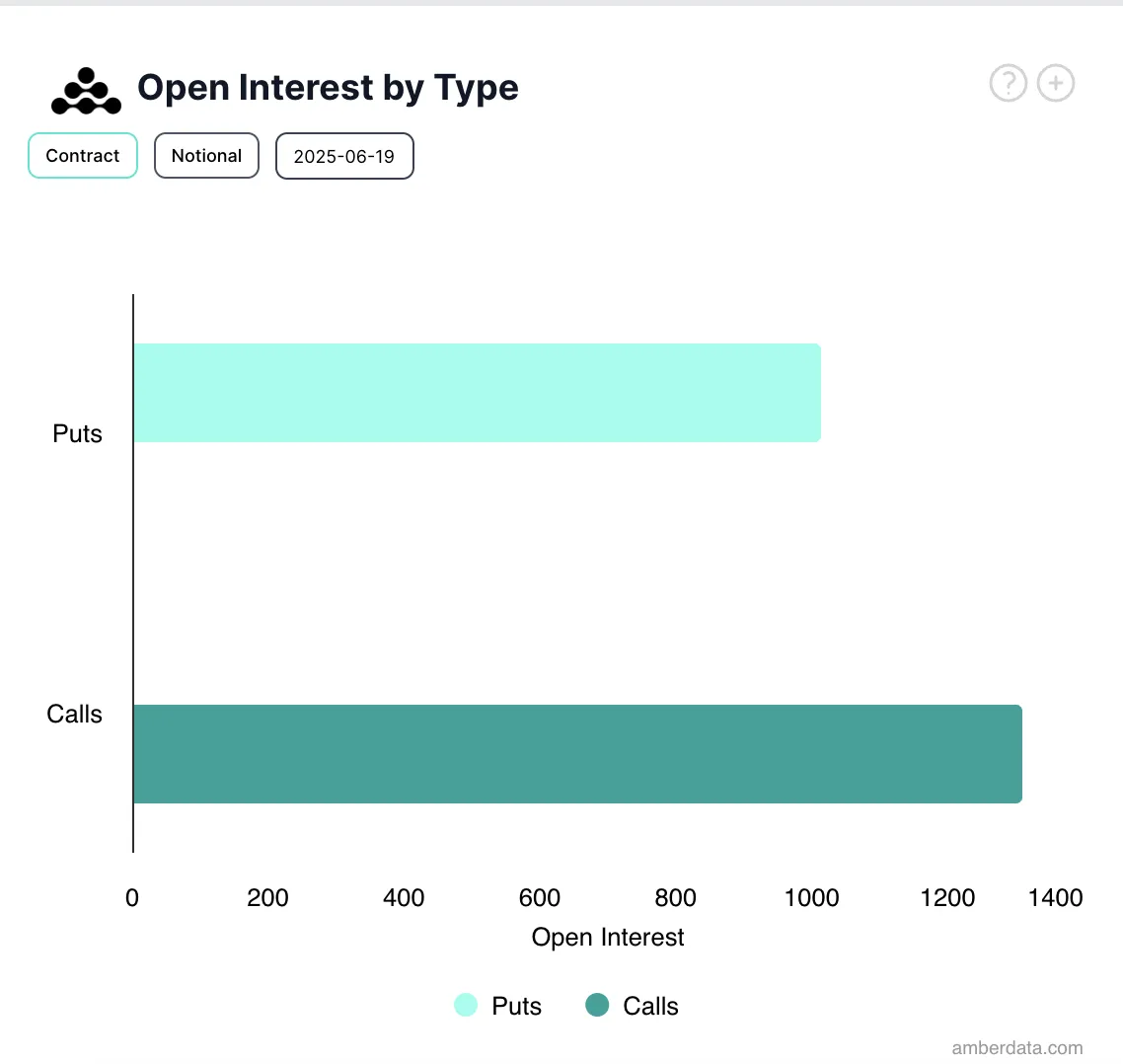

The funding rate mechanism ensures that perpetual futures prices stay aligned with the spot price, and a positive rate typically reflects confidence in upward price movement. Additionally, the options market is showing increased demand for call options, suggesting that traders anticipate a potential price reversal or rally in the near term.

This surge in call option interest, combined with steady ETF inflows, highlights a growing bullish consensus despite ongoing geopolitical and macroeconomic uncertainties. Institutional investors appear to view Bitcoin as a strategic asset for portfolio diversification and a hedge against market turbulence.

Conclusion

The sustained inflows into US-listed Bitcoin ETFs, led by BlackRock’s IBIT, coupled with positive derivatives market indicators, reflect a robust institutional appetite for Bitcoin. This trend underscores Bitcoin’s evolving role as a credible store of value amid global uncertainty. Investors should continue monitoring ETF flows and derivatives data as key indicators of market sentiment and potential price direction.

Comments

Other Articles

Oil Prices Surge 3% After Trump Cancels Iran Meetings and Promises Protesters ‘Help Is on the Way’ – What It Means for Bitcoin

January 13, 2026 at 05:49 PM UTC

Bitcoin Surges to $93,888: How Venezuela-US Tensions Triggered a Crypto Rally

January 5, 2026 at 07:04 AM UTC

Bitcoin (BTC) Eyes Short-Term Bottom Rebound as On-Chain Flows Align with USDC/USDT Premium and Market Liquidity, but Bearish Longer-Term Outlook Persists

January 1, 2026 at 03:41 PM UTC