Bitcoin ETFs Shaken by Outflows: XRP Inflow

XRP/USDT

$2,191,074,169.94

$1.4769 / $1.3404

Change: $0.1365 (10.18%)

+0.0065%

Longs pay

Contents

$545 Million Outflow from Bitcoin Spot ETFs

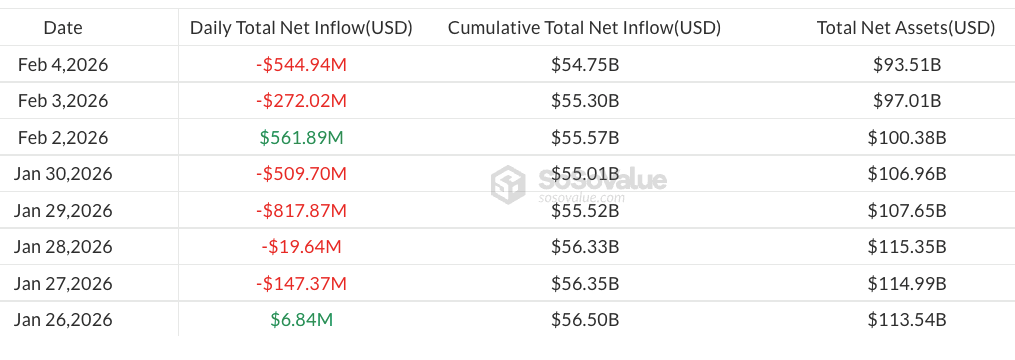

Bitcoin exchange-traded funds (ETFs) continued their losses on Wednesday, as pressure increased in the digital asset markets with BTC price approaching the $70,000 level. According to SoSoValue data, spot Bitcoin ETFs recorded a $545 million outflow that day, with weekly net outflow reaching $255 million. Since the beginning of the year, the funds attracted $3.5 billion in inflows while experiencing $5.4 billion in redemptions, resulting in a net loss of $1.8 billion and managed assets declining to $93.5 billion.

Spot Bitcoin ETF flows since Jan. 26, 2026. Source: SoSoValue

Crypto Market Capitalization Drops 20%

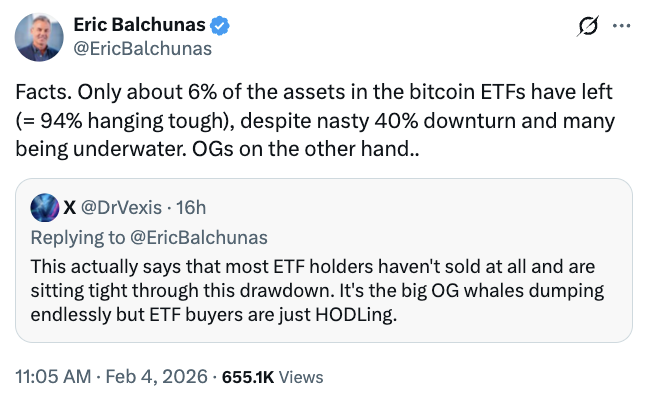

Crypto market capitalization has fallen approximately 20% since the beginning of the year, dropping from 3 trillion to 2.5 trillion dollars (CoinGecko). According to Bloomberg analysts Eric Balchunas and James Seyffart, investors are largely holding their positions, with only 6% of total assets withdrawn. BlackRock's iShares Bitcoin ETF (IBIT) has declined from its peak of 100 billion dollars to 60 billion dollars.

Source: Eric Balchunas

$4.8 Million Inflow in XRP ETFs: Technical Outlook

Despite general pressure, XRP detailed analysis shows positive signals. XRP funds experienced $4.8 million inflow. Current price $1.37, 24-hour change -14.09%. RSI at 20.40 is in the oversold region, although the downtrend continues with Supertrend bearish. EMA 20: $1.7534. Strong supports: S1 $1.3422 (78/100 score, -2% distance), S2 $0.9827. Resistances: R1 $1.4091 (+2.88%), R2 $1.4929 (+9%). These levels are critical for XRP futures.

Outflows in ETH and SOL ETFs: Impact of Vitalik's L2 Vision

In altcoin funds, ETH ETFs recorded $79.5 million outflow, SOL ETFs $6.7 million outflow. Recent statements by Ethereum founder Vitalik Buterin indicating that the original vision for L2s has deviated from extreme scalability may increase pressure on ETH. While investors shift to BTC dominance, assets like XRP are showing resilience.