Bitcoin Faces Bull-Bear Tug-of-War Amid Split Trader Sentiments

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Bitcoin market sentiment remains deeply divided as the cryptocurrency trades around $87,000, with social media predictions split between a potential drop below $70,000 and a rally toward $130,000. This tug-of-war reflects conflicting economic signals, including fading rate cut hopes and positive tech earnings, creating uncertainty for investors heading into the weekend.

-

Social media buzz shows equal parts bearish forecasts of Bitcoin falling to $20,000-$70,000 and bullish outlooks targeting $100,000-$130,000.

-

Bitcoin dipped below $87,000 on Thursday, marking its lowest level since April amid mixed trader optimism and pessimism.

-

The Crypto Fear & Greed Index stands at 14, indicating extreme fear—up slightly from Thursday’s record low of 11 since February—signaling potential buying opportunities if sentiment bottoms out.

Discover the split in Bitcoin market sentiment as traders debate drops below $70K or rallies to $130K. Analyze key indicators and expert insights for informed decisions in this volatile crypto landscape—stay ahead today.

What is driving the current split in Bitcoin market sentiment?

Bitcoin market sentiment is experiencing a sharp divide due to conflicting macroeconomic news and technical pressures, with the asset trading near $87,000 after dipping below that level on Thursday. Analysts point to reduced expectations for a Federal Reserve rate cut in December clashing with relief from strong earnings in the tech sector, particularly from Nvidia, which has eased fears of an AI market collapse. This push-pull dynamic has left traders evenly split on social platforms, balancing bearish predictions of sub-$70,000 prices against optimistic rallies to $130,000.

How are social media trends influencing Bitcoin price predictions?

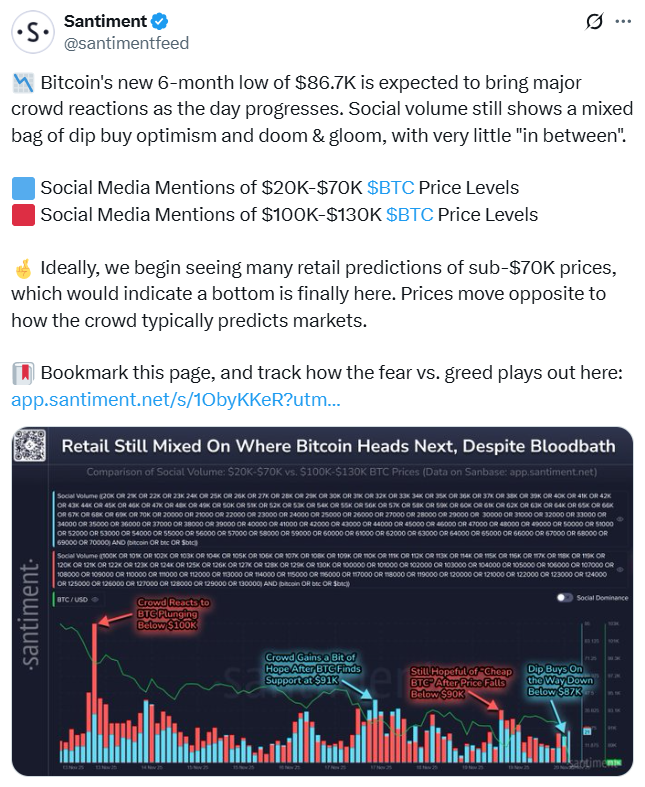

Social media discussions on platforms tracked by market intelligence firm Santiment reveal a balanced yet polarized view of Bitcoin’s trajectory, with mentions roughly evenly divided on Thursday between dire forecasts of prices sinking to $20,000-$70,000 and hopeful projections reaching $100,000-$130,000. As the week progressed into Friday, conversations increasingly leaned toward lower price expectations, highlighting a “mixed bag” of dip-buying enthusiasm and widespread pessimism, according to Santiment’s Sanbase research platform. Nic Puckrin, an analyst at The Coin Bureau, noted that such retail predictions of sub-$70,000 levels could signal an impending bottom, as market prices often move contrary to crowd consensus. This data underscores the role of social volume in amplifying volatility, where extreme bearish chatter might precede a reversal if institutional flows stabilize.

Source: Santiment

“Ideally, we begin seeing many retail predictions of sub-$70K prices, which would indicate a bottom is finally here. Prices move opposite to how the crowd typically predicts markets,” Puckrin explained in a research note.

Frequently Asked Questions

What factors are contributing to the bull-bear tug-of-war in Bitcoin’s market?

The ongoing tug-of-war in Bitcoin’s market stems from dueling economic indicators, including diminishing odds of a December interest rate cut by the Federal Open Market Committee and positive signals from Nvidia’s earnings that have tempered concerns over an AI sector downturn. These conflicting forces have Bitcoin pulled in opposite directions, fostering a divided sentiment among traders as the cryptocurrency navigates weekend uncertainties around the $87,000 mark.

Is extreme fear in the Crypto Fear & Greed Index a buy signal for Bitcoin?

Yes, a reading of 14 on the Crypto Fear & Greed Index signals extreme fear in the Bitcoin market, often marking capitulation points that historically precede rebounds when sentiment shifts. While technical indicators like momentum and volume are declining, reflecting deteriorated confidence, analysts advise caution as recovery depends on improving liquidity and regulatory clarity in the weeks ahead.

Key Takeaways

- Divided Social Sentiment: Trader predictions on social media are split 50-50 between Bitcoin drops to under $70,000 and surges above $100,000, with bearish talks gaining traction as the weekend approaches.

- Macroeconomic Pressures: Fading rate cut prospects clash with tech sector resilience, particularly Nvidia’s strong results, creating a volatile environment for Bitcoin around $87,000.

- Opportunity in Fear: The Fear & Greed Index at extreme fear levels suggests potential bottoms, but investors should monitor institutional activity and liquidity for timely entry points.

The Fear & Greed Index returned a rating of 14, or extreme fear, on Friday. Source: alternative.me

Conclusion

In summary, the split in Bitcoin market sentiment highlights a precarious balance between bearish technical deteriorations and bullish macroeconomic relief, with social trends and the extreme fear reading on the Crypto Fear & Greed Index pointing to heightened volatility near $87,000. As Rachael Lucas, an analyst at BTC Markets, emphasized, “Extreme fear often precedes opportunity, but timing is everything,” underscoring the need for vigilance amid liquidity strains and risk-off moods. Looking forward, shifts in institutional flows and regulatory developments could tip the scales toward recovery—investors are encouraged to track these closely for strategic positioning in the evolving crypto landscape.