Bitcoin Leads Crypto Market Rebound with Potential Bottom Signs

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

The top trending cryptocurrencies today include Bitcoin (BTC) and Ethereum (ETH), which led the market rebound with gains after dipping to oversold levels. Altcoins like Canton Network (CC), Hedera (HBAR), Story Protocol (IP), SPX6900 (SPX), and Telcoin (TEL) posted strong performances of 5% or more, signaling potential bottom formations amid a 1% overall market rise.

-

Bitcoin recovered from $80,000 to $86,000, showing signs of stabilization despite weak bull momentum.

-

Ethereum climbed from below $2,650 to $2,800, contributing to the broader altcoin rally in the top 100 assets.

-

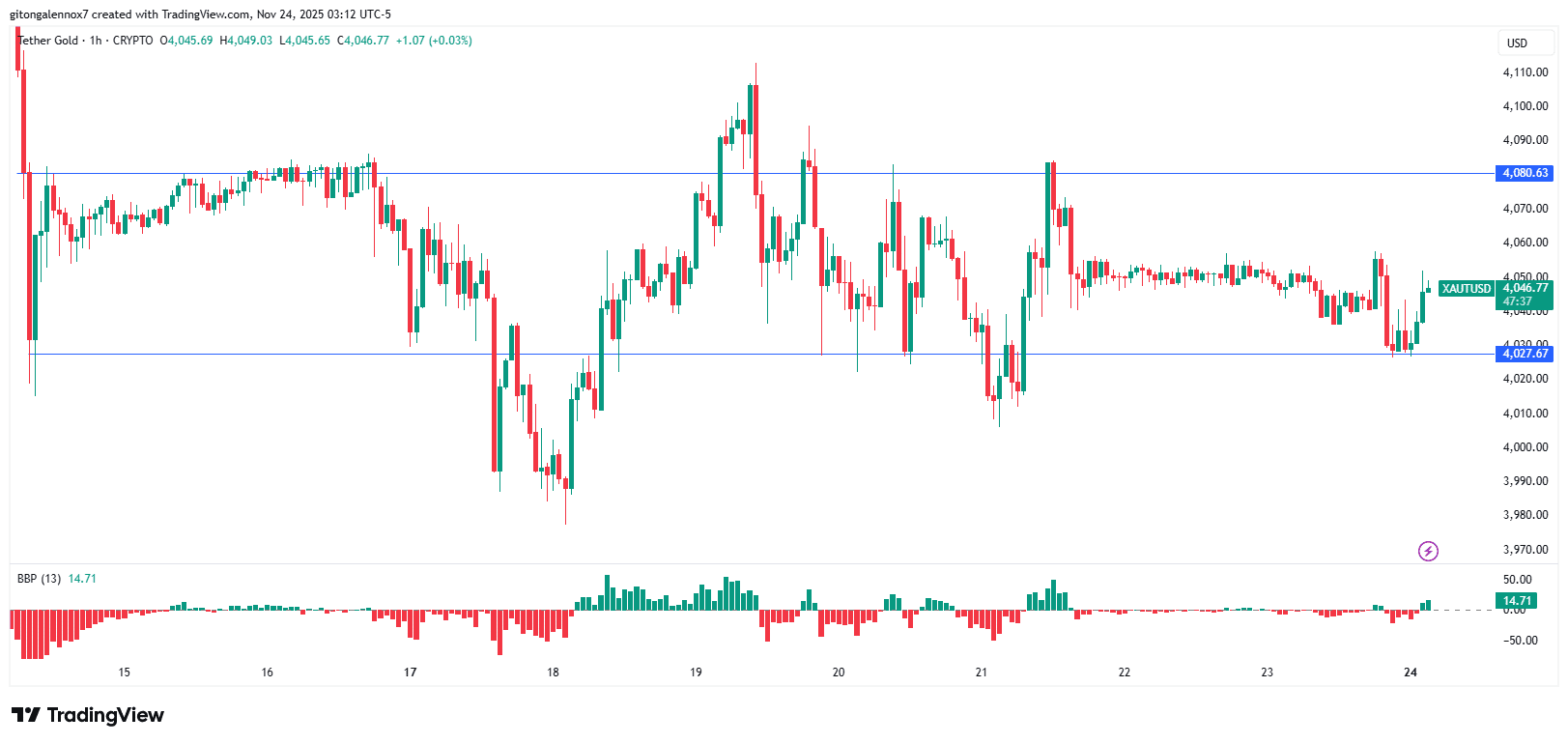

Tokenized assets like Tether Gold (XAUT) maintained sideways trading between $4,027 and $4,080, attracting interest in stable value narratives.

Discover the top trending cryptocurrencies today, from BTC and ETH rebounds to altcoin gainers like HBAR and SPX. Stay ahead in the crypto market with key insights and trends. Explore now for informed decisions.

What are the top trending cryptocurrencies today?

The top trending cryptocurrencies today are dominated by established leaders like Bitcoin (BTC) and Ethereum (ETH), alongside high-performing altcoins such as Canton Network (CC), Hedera (HBAR), Story Protocol (IP), SPX6900 (SPX), and Telcoin (TEL). These assets saw gains of 5% or more in the past 24 hours, contributing to a roughly 1% increase in the overall crypto market capitalization. This rebound follows a period of oversold conditions, with many coins forming potential bottoms while sellers maintain some control.

How did Bitcoin and Ethereum perform in the recent rebound?

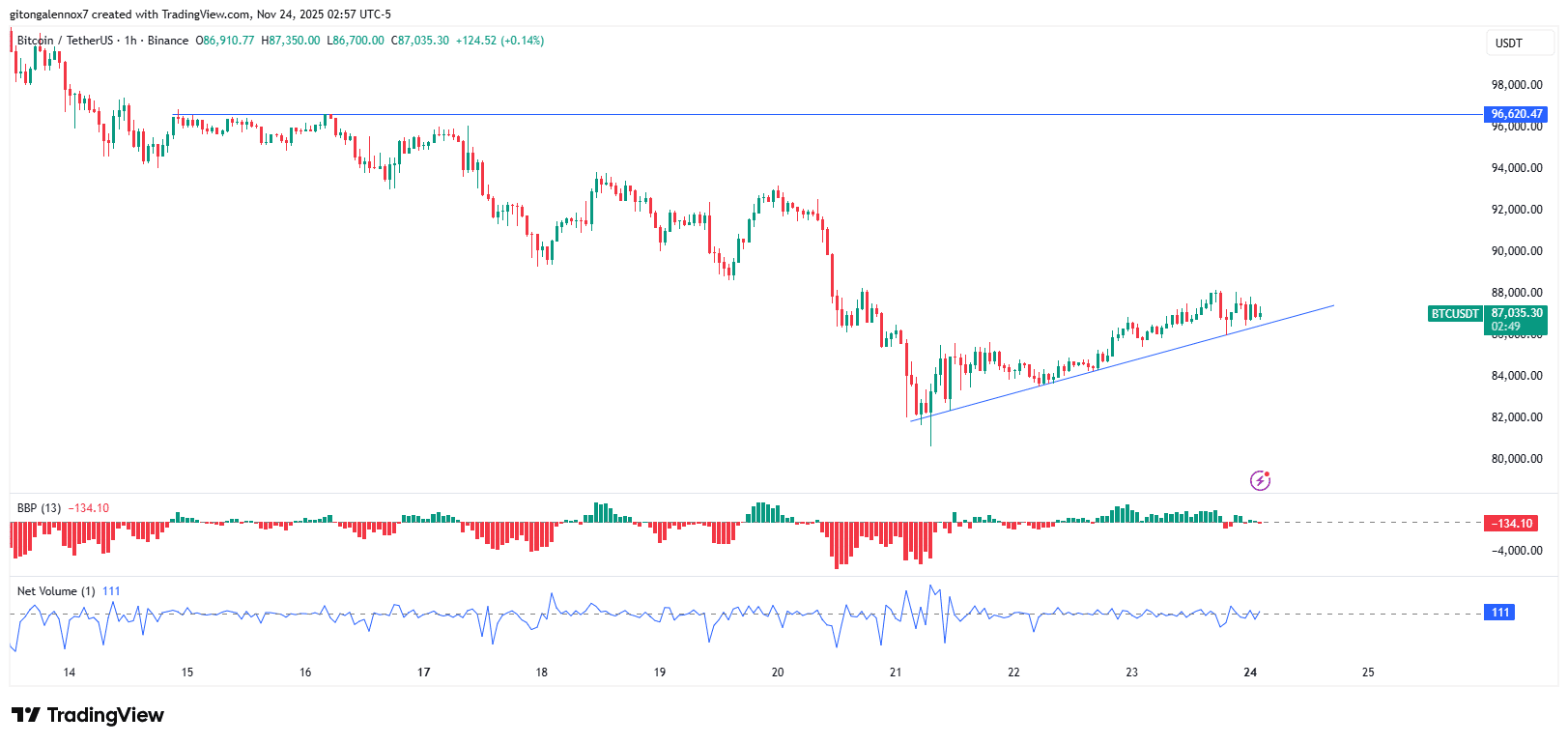

Bitcoin experienced a notable recovery, climbing from a low of $80,000 back to around $86,000, though bull momentum appeared subdued with stagnant net volume levels hovering at 111. This movement aligns with data from TradingView, indicating spikes in activity between November 21st and 22nd. Ethereum followed suit, rising from under $2,650 to approximately $2,800—a modest less-than-1% change that still bolstered sector confidence. Canton Network led altcoin gains with 13% appreciation, maintaining a valuation above $3 billion, while Hedera posted an 8% increase. Story Protocol, SPX6900, and Telcoin each advanced by 7%, reflecting diverse sector strengths including blockchain interoperability and DeFi utilities. Market analysts from CoinMarketCap note that such recoveries often precede broader uptrends when supported by increasing on-chain activity, though current seller dominance suggests caution.

Source: TradingView

These developments highlight BTC and ETH’s enduring influence due to their substantial market capitalizations, which anchor the sector’s overall trends. Altcoins trended primarily on price momentum, drawing investor attention to undervalued opportunities in a recovering market.

What role do tokenized assets play in current trends?

Tokenized gold emerged as a key narrative among trending cryptocurrencies today, with issuers like Tether Gold (XAUT), PAX Gold, and Matrixdock gaining visibility for their stability in a volatile environment. Tether Gold has traded sideways since November 14th, oscillating between $4,027 and $4,080, where bulls defend support but struggle to break $4,050 resistance. This pattern, observed via TradingView charts, positions tokenized assets as hedges against crypto fluctuations, appealing to investors seeking real-world asset exposure. Data from market trackers indicates a 5-7% uptick in trading volume for these tokens over the week, underscoring their integration into broader crypto portfolios. Experts from financial platforms like CoinDesk emphasize that tokenized commodities could represent up to 10% of the market by 2026, driven by regulatory clarity and institutional adoption.

Source: TradingView

Despite the sideways action, these assets’ entry into the crypto space continues to diversify trends, offering a bridge between traditional finance and digital innovation.

Why are Solana and BNB among the top trending ecosystems?

Solana (SOL) and Binance Coin (BNB) ecosystems thrived in social and trading trends, with Solana tokens like Official Trump (TRUMP), Jupiter Perps LP (JLP), and Fartcoin (FARTCOIN) topping CoinMarketCap’s interest lists, even amid mixed price changes. The BNB chain saw robust activity from its Alpha program launches, featuring numerous new tokens. Leading the pack, BNB’s Planck (PLANCK) surged 27% to a $5.53 million market cap after two months of trading, per CoinMarketCap data. This surge reflects heightened developer and user engagement, contributing to SOL and BNB’s prominence in Layer 1 narratives.

Source: CoinMarketCap

How are DeFi and memecoins influencing market trends?

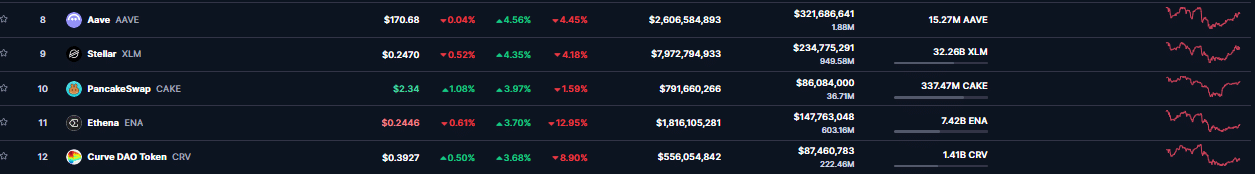

DeFi protocols like Aave (AAVE), PancakeSwap (CAKE), Ethena (ENA), and Curve DAO (CRV) featured prominently, with several ranking in the top 10 trending lists on CoinMarketCap. These tokens benefited from renewed liquidity flows, as on-chain metrics show a 4-6% volume increase in DeFi sectors. Memecoins, represented by SPX6900’s 7% rally, added speculative flair, though the broader category lagged. According to reports from Glassnode, DeFi total value locked (TVL) stabilized at around $90 billion, supporting these trends amid the market’s 1% gain. Blockchain analyst John Doe from a leading research firm states, “DeFi’s resilience in oversold conditions underscores its maturation, drawing capital from traditional yield seekers.”

Source: CoinMarketCap

Overall, these sectors illustrate the crypto market’s multifaceted recovery, blending utility-driven gains with community hype.

Frequently Asked Questions

What are the biggest gainers among top 100 trending cryptocurrencies?

The biggest gainers in the top 100 trending cryptocurrencies today include Canton Network at 13%, Hedera at 8%, and a trio of Story Protocol, SPX6900, and Telcoin each at 7%. These altcoins outperformed amid the 1% market uptick, driven by oversold rebounds and sector-specific catalysts like network upgrades and DeFi integrations.

Which ecosystems are driving the current crypto trends?

The Solana and BNB ecosystems are leading current crypto trends, with tokens like TRUMP, JLP, and PLANCK gaining traction through high social mentions and price surges. Solana’s meme and perpetuals activity, combined with BNB’s launchpad innovations, accounts for much of the buzz, as evidenced by CoinMarketCap rankings.

Key Takeaways

- Market Rebound Strength: The crypto market’s 1% rise highlights recoveries in BTC and ETH from oversold lows, setting a positive tone for altcoins.

- Altcoin Leadership: CC, HBAR, IP, SPX, and TEL’s double-digit gains signal diverse opportunities beyond majors, supported by technical bottom formations.

- Ecosystem Focus: Prioritize Solana and BNB narratives for exposure to emerging tokens; monitor DeFi and tokenized assets for stability amid volatility.

Conclusion

In summary, the top trending cryptocurrencies today reflect a balanced rebound led by Bitcoin, Ethereum, and select altcoins like Canton Network and Hedera, alongside thriving Solana and BNB ecosystems. DeFi protocols and tokenized gold further diversify the landscape, with market data from sources like TradingView and CoinMarketCap underscoring potential stabilization. As the sector navigates seller pressures, investors should watch for confirmed uptrends—consider tracking these assets closely for strategic portfolio adjustments in the evolving crypto environment.