Bitcoin May Test $80K Support as BOJ Rate Hike Sparks Deleveraging Fears

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

The Bank of Japan’s 75 basis points interest rate hike, its largest in over 30 years, has triggered Bitcoin price volatility and deleveraging among investors. Historical patterns show such moves often lead to double-digit Bitcoin drawdowns as foreign capital exits amid higher borrowing costs.

-

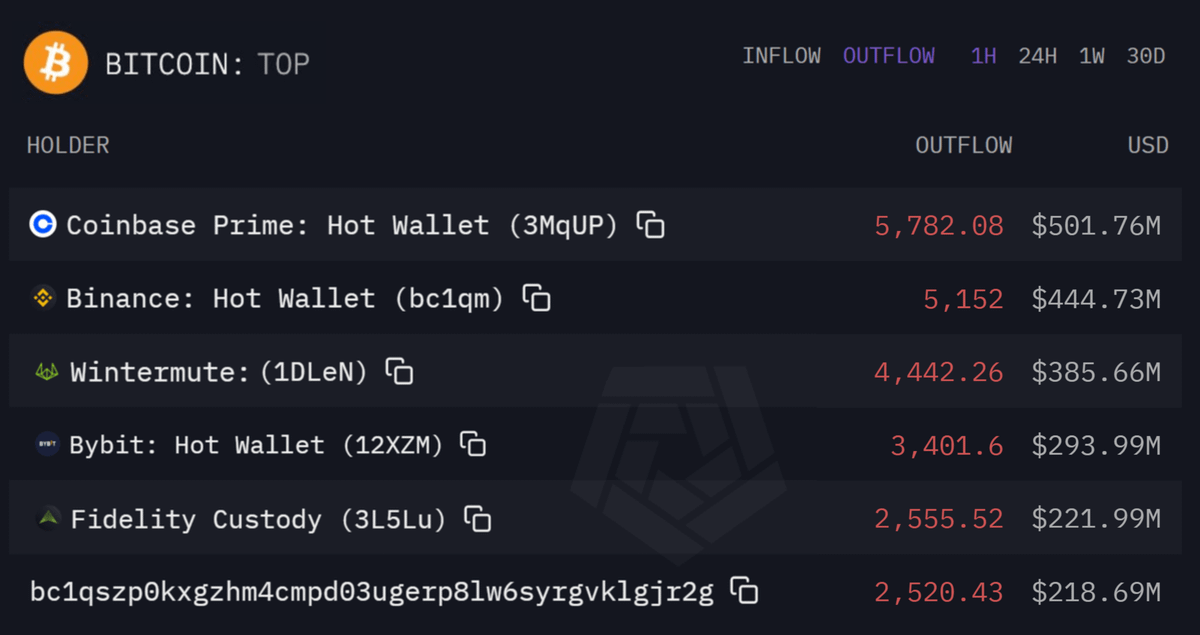

BOJ rate hike sparks $2 billion in Bitcoin selling pressure from large holders.

-

On-chain metrics indicate ongoing losses for long-term holders with cost bases near $101,000, now 16% underwater.

-

Bitcoin open interest remains 30% below pre-crash peaks, signaling caution and potential support at $85,000.

Discover how the BOJ’s recent rate hike is influencing Bitcoin’s trajectory amid liquidation pressures. Stay informed on crypto market shifts and prepare for potential volatility—explore key insights now.

What is the impact of the BOJ rate hike on Bitcoin price?

The Bank of Japan’s 75 basis points interest rate hike has introduced significant macroeconomic headwinds for Bitcoin, prompting increased selling pressure and deleveraging in the cryptocurrency market. As reported by financial analysts, this marks the BOJ’s most substantial adjustment in more than three decades, historically correlating with Bitcoin drawdowns of 10% or more due to elevated leverage costs for international investors. Current on-chain data reinforces this, showing realized losses and capitulation among long-term holders, though reduced open interest suggests a possible stabilization around key support levels.

If history is any guide, the crypto market faces a notable bearish influence. The Bank of Japan (BOJ) has raised interest rates by 75 basis points, representing its largest increase in over 30 years.

Financial reports from COINOTAG indicate that BOJ rate hikes have previously resulted in double-digit declines for Bitcoin, as higher borrowing expenses encourage foreign investors to reduce risk exposure and liquidate positions, amplifying short-term uncertainty.

This cycle mirrors past events. Market observers have highlighted substantial Bitcoin outflows prior to the BOJ announcement, with major entities offloading 24,000 BTC—equivalent to more than $2 billion in market pressure.

Source: X

On-chain indicators confirm this activity.

Bitcoin’s primary metrics continue to reflect realized losses in real time. Specifically, long-term holders with acquisition costs around $101,000 are approximately 16% below their break-even point, underscoring persistent downward pressure.

In light of these developments, the BOJ’s policy shift adds a formidable external challenge to Bitcoin’s momentum.

Both historical precedents and current blockchain data point to investors repositioning their portfolios, preparing for possible near-term corrections. This raises concerns about whether Bitcoin could soon test levels below $80,000.

How are Bitcoin liquidations responding to the BOJ rate hike?

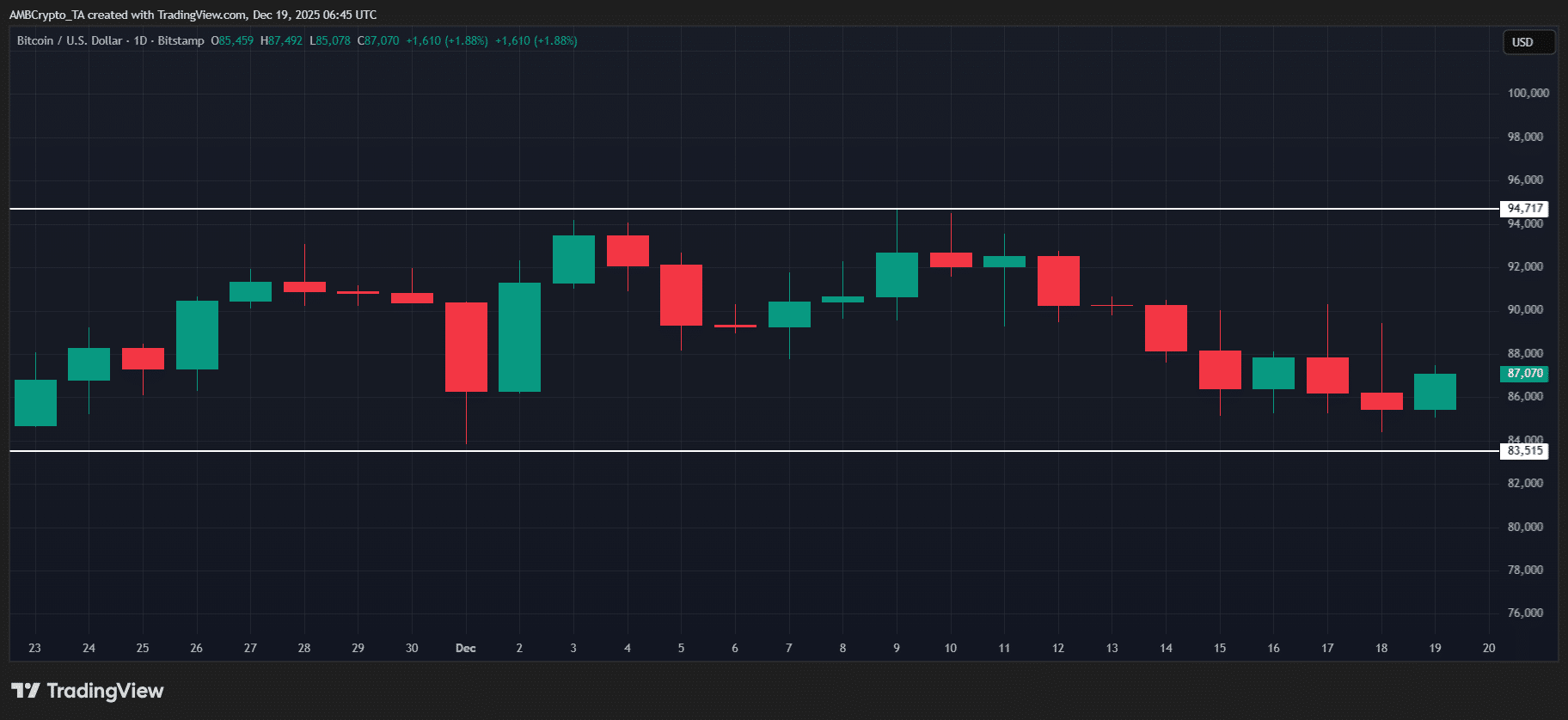

The BOJ rate hike has intensified Bitcoin’s liquidation dynamics, with long positions facing disproportionate pressure compared to shorts. On December 18, a sharp $3,000 drop in Bitcoin’s price on 30-minute charts eliminated around $140 million in leveraged longs, according to TradingView data. This pattern extends to broader trends, where long liquidations outpace shorts by a factor of 2 to 3, keeping Bitcoin confined near $90,000 as large investors manage overheating risks.

Q4 2025 is emerging as a period marked by heightened cryptocurrency market fluctuations driven by institutional activities.

On shorter-term charts, Bitcoin exhibits pronounced volatility, primarily from large-scale liquidations orchestrated by major holders. For example, on the 30-minute timeframe dated December 18, BTC experienced a $3,000 decline, resulting in approximately $140 million in long position wipeouts.

Source: TradingView (BTC/USDT)

These dynamics are evident in the underlying metrics.

As of the latest reports, Bitcoin’s open interest stands roughly 30% lower than the elevated leverage observed prior to the October downturn, reflecting a conservative stance among traders who avoid aggressive short-term pursuits.

Given this context, even with uncertainty from the BOJ decision, a severe breakdown appears tempered. As market sentiment stabilizes and positions adjust, the $85,000 threshold may solidify as a foundational support for Bitcoin’s subsequent trajectory.

Experts from institutions like Glassnode emphasize that sustained low leverage environments often precede recoveries, providing a buffer against external shocks such as central bank policies. Blockchain analysis from CryptoQuant further supports this, noting a 15% reduction in exchange inflows compared to prior rate hike episodes, indicating less panic selling overall.

Frequently Asked Questions

What caused the recent $2 billion Bitcoin sell-off following the BOJ rate hike?

The sell-off stemmed from large institutional players offloading 24,000 BTC ahead of the BOJ’s announcement, driven by expectations of higher global borrowing costs. This action, tracked via on-chain data, aligns with historical responses to Japanese monetary tightening, where foreign capital seeks safer assets, resulting in immediate price pressure on Bitcoin.

Will the BOJ rate hike lead to Bitcoin dropping below $80,000?

While the hike has fueled short-term volatility and liquidations, current open interest levels 30% below peaks suggest reduced leverage risk. Historical data shows recoveries often follow such events once initial fear subsides, with $85,000 potentially serving as support rather than a pathway to sub-$80,000 levels.

Key Takeaways

- BOJ Rate Hike Effects: The 75 basis points increase has prompted deleveraging and $2 billion in Bitcoin sales, echoing past double-digit price corrections tied to Japanese policy shifts.

- Liquidation Patterns: Long positions dominate losses at 2-3 times the rate of shorts, confining Bitcoin near $90,000 while low open interest signals trader caution.

- Support Formation: With metrics showing 16% underwater long-term holders, $85,000 emerges as a potential base, advising investors to monitor stabilization for entry opportunities.

Conclusion

The BOJ’s landmark 75 basis points rate hike has undeniably pressured Bitcoin’s price through heightened liquidations and investor repositioning, as evidenced by on-chain metrics and historical parallels. Yet, with open interest notably subdued and structural supports forming around $85,000, the cryptocurrency market demonstrates resilience against macroeconomic headwinds. As global policies continue to evolve, staying attuned to these dynamics will be crucial for navigating Bitcoin’s path forward—consider reviewing portfolio allocations in light of these developments.

Comments

Other Articles

Oil Prices Surge 3% After Trump Cancels Iran Meetings and Promises Protesters ‘Help Is on the Way’ – What It Means for Bitcoin

January 13, 2026 at 05:49 PM UTC

Bitcoin Surges to $93,888: How Venezuela-US Tensions Triggered a Crypto Rally

January 5, 2026 at 07:04 AM UTC

Bitcoin (BTC) Eyes Short-Term Bottom Rebound as On-Chain Flows Align with USDC/USDT Premium and Market Liquidity, but Bearish Longer-Term Outlook Persists

January 1, 2026 at 03:41 PM UTC