Bitcoin Mining Faces Harsh Downturn as Revenues Hit Lows and Payback Periods Extend

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

The Bitcoin mining revenue decline in 2025 stems from plunging hashprices to structural lows around $35 per PH/s, rising operational costs, and Bitcoin prices dropping below $80,000, extending payback periods beyond 1,000 days and challenging even major operators’ profitability.

-

Hashprice falls sharply from $55 to $35 per PH/s, marking the harshest margin environment in Bitcoin mining history.

-

Rising cost-per-hash exposes inefficiencies, widening gaps between average and top-tier operators.

-

Publicly traded miners like MARA and CleanSpark see stock drops of 50% and 37%, respectively, amid broader market pressures.

Explore the Bitcoin mining revenue decline in 2025: hashprice sinks, costs soar, and payback periods exceed 1,000 days. Discover impacts on major operators and future outlook. Stay informed on crypto trends today.

What is causing the Bitcoin mining revenue decline in 2025?

Bitcoin mining revenue decline in 2025 is driven by a combination of falling hashprices, escalating operational costs, and a sharp correction in Bitcoin’s price from near $126,000 in October to below $80,000 in November. This downturn has created the most severe economic pressures in the industry’s 15-year history, forcing even large publicly traded operators to grapple with break-even challenges and increasing debt burdens. According to reports from TheMinerMag, miners are navigating unprecedented margin squeezes that threaten long-term viability.

Mining revenue hits structural lows as hashprice sinks, costs rise and payback periods stretch past 1,000 days, squeezing even the largest operators.

The Bitcoin mining industry has entered what may be its most severe economic downturn in its 15-year history, with even large publicly traded operators struggling to break even amid collapsing mining revenue and rising debt, according to TheMinerMag.

In its latest report, TheMinerMag said miners are operating in the “harshest margin environment of all time,” as hashprice — the revenue earned per unit of computing power — has fallen from an average of about $55 per petahash per second (PH/s) in the third quarter to roughly $35 PH/s, a level the publication characterized as a structural low rather than a temporary dip.

The deterioration followed a sharp correction in the price of Bitcoin (BTC), which fell from a record high near $126,000 in October to below $80,000 in November.

Under these conditions, cost-per-hash has emerged as a revealing metric for miners. It highlights how efficiently miners convert electricity and capital into raw computational output and exposes a widening gap between average operators and only the most efficient survivors.

The data shows that new-generation mining machines now require more than 1,000 days to recoup their costs — a growing concern, given the next Bitcoin halving is roughly 850 days away.

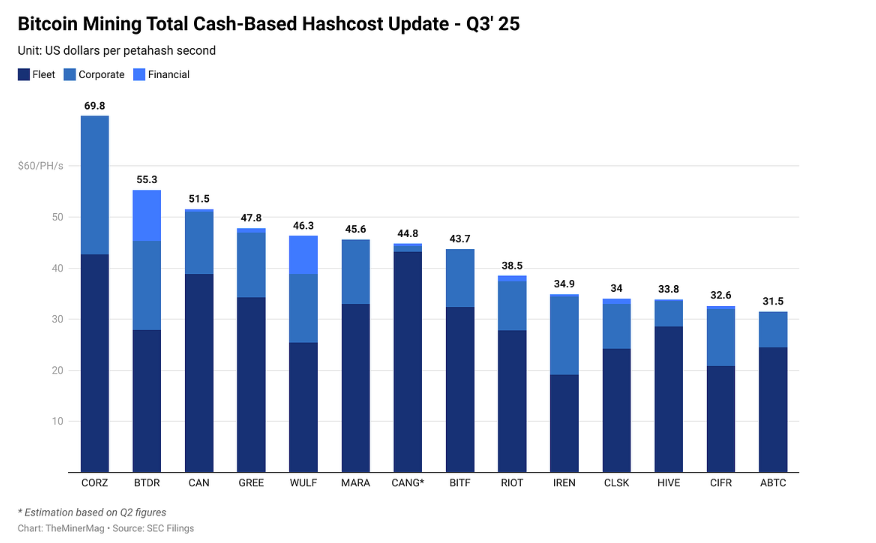

Bitcoin mining costs across major publicly traded miners. Source: TheMinerMag

“Balance sheets are reacting” to the deteriorating economics, TheMinerMag said, pointing to CleanSpark’s recent decision to fully repay its Bitcoin-backed credit line with Coinbase as a sign of the industry’s broader shift toward deleveraging and liquidity preservation.

How are rising costs impacting Bitcoin miners’ efficiency?

Rising costs are severely impacting Bitcoin miners’ efficiency by inflating the cost-per-hash metric, which measures the expense of generating computational power. For many operators, electricity and hardware expenses have surged, pushing payback periods for new mining rigs beyond 1,000 days—far exceeding the roughly 850 days until the next Bitcoin halving. TheMinerMag’s analysis reveals that only the most efficient miners, those with access to low-cost energy sources like hydroelectric power, are maintaining viable margins; others face operational cutbacks or shutdowns.

This efficiency gap is stark: top performers achieve costs as low as 4-5 cents per terahash, while laggards exceed 10 cents, according to industry benchmarks from TheMinerMag. Expert observers note that without innovations in hardware or energy procurement, mid-tier miners risk consolidation or exit from the market. For instance, strategies like relocating to regions with cheaper renewables are gaining traction, but upfront capital demands further strain balance sheets already pressured by debt.

Supporting data from TheMinerMag underscores the urgency: average hashprices at $35 per PH/s mean that for every 1,000 PH/s of capacity, revenue has dropped by over 36% quarter-over-quarter, while costs have climbed 15-20% due to inflation and supply chain disruptions. “The survivors will be those who prioritize efficiency over expansion,” a mining analyst quoted in TheMinerMag’s report emphasized, highlighting the need for data-driven decisions in a contracting market.

Frequently Asked Questions

What is hashprice and why is its decline affecting Bitcoin mining in 2025?

Hashprice represents the revenue generated per unit of Bitcoin mining hashpower, typically measured in dollars per petahash per second. Its decline to $35 PH/s in 2025 has slashed miners’ income by about 36% from recent highs, forcing cost reductions and exposing vulnerabilities in high-expense operations, as detailed in TheMinerMag’s reports.

How has the Bitcoin price correction influenced mining stocks in late 2025?

The Bitcoin price drop from $126,000 to under $80,000 has triggered a sharp sell-off in mining stocks, with companies like MARA losing 50% since mid-October. This voice-search-friendly explanation from market data shows broader economic ties amplifying the revenue crunch for publicly traded miners.

Bitcoin mining stocks take a beating

The slide in Bitcoin prices and the resulting pressure on hashrate have coincided with a broader sell-off across traditional markets, delivering a one-two punch to publicly listed mining companies.

The MinerMag’s third-quarter report flagged a “sharp drawdown in mining equities since mid-October,” with losses accelerating across the sector.

MARA stock’s year-to-date performance. Source: Yahoo Finance

MARA Holdings (MARA) has been among the hardest hit, down roughly 50% from its Oct. 15 closing high. CleanSpark (CLSK) has declined 37% over the same period, while Riot Platforms (RIOT) has dropped 32%. Shares of HIVE Digital Technologies (HIVE) have suffered the steepest decline, plunging 54% from their October peak.

These stock movements reflect investor concerns over sustained low hashprices and the impending halving’s supply reduction, which could further compress revenues without offsetting efficiency gains. Public filings from these companies indicate a pivot toward debt reduction and asset optimization, with CleanSpark’s repayment of its credit line exemplifying proactive financial management amid uncertainty.

Broader implications extend to the Bitcoin network’s security: as less efficient miners offline, hashrate concentration among a few large players raises centralization risks, a point echoed in analyses from TheMinerMag. Investors are closely watching for signs of recovery, such as renewed Bitcoin price momentum or breakthroughs in sustainable mining tech.

Key Takeaways

- Structural hashprice lows: At $35 per PH/s, revenues have hit unprecedented lows, demanding immediate efficiency upgrades from operators.

- Extended payback periods: New rigs now take over 1,000 days to break even, heightening risks ahead of the 2028 halving.

- Stock market fallout: Major miners like MARA and HIVE have seen 50%+ declines, signaling a sector-wide deleveraging push.

Conclusion

The Bitcoin mining revenue decline in 2025 underscores a pivotal moment for the industry, with hashprice drops, rising costs, and stock plunges testing the resilience of even established players. As operators focus on efficiency and liquidity, the path forward hinges on Bitcoin’s price stabilization and innovative adaptations. Looking ahead, miners who navigate this downturn strategically may emerge stronger—consider monitoring key metrics like cost-per-hash for ongoing insights into the evolving crypto mining landscape.

Comments

Other Articles

Oil Prices Surge 3% After Trump Cancels Iran Meetings and Promises Protesters ‘Help Is on the Way’ – What It Means for Bitcoin

January 13, 2026 at 05:49 PM UTC

Bitcoin Surges to $93,888: How Venezuela-US Tensions Triggered a Crypto Rally

January 5, 2026 at 07:04 AM UTC

Bitcoin (BTC) Eyes Short-Term Bottom Rebound as On-Chain Flows Align with USDC/USDT Premium and Market Liquidity, but Bearish Longer-Term Outlook Persists

January 1, 2026 at 03:41 PM UTC