Bitcoin Price Analysis: Potential Wave IV Correction Between $85K–$92K Amid Liquidity and Supply Pressures

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

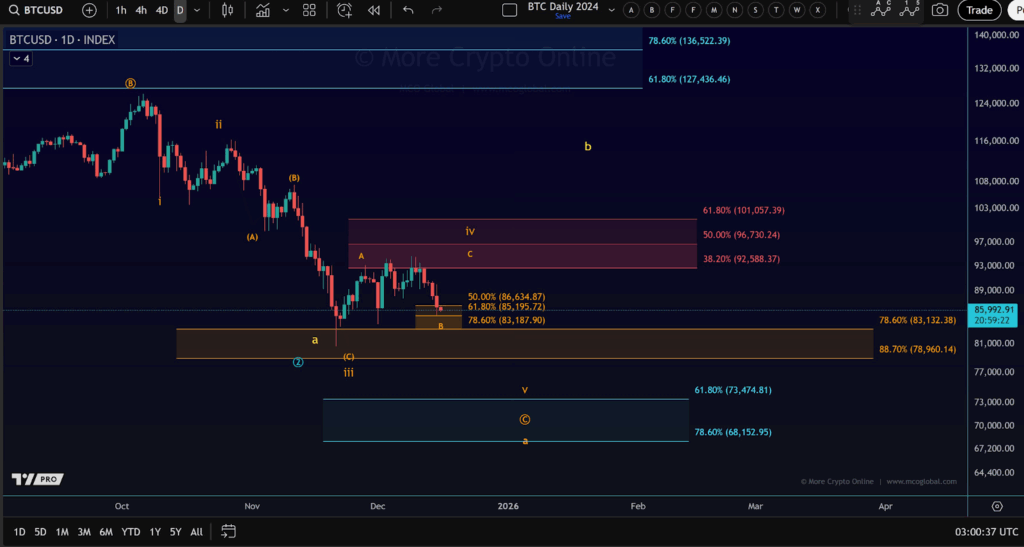

Bitcoin’s current price analysis reveals a wave iv corrective structure trading between $85,000 and $92,000, supported by key Fibonacci levels and liquidity clusters, while Strategy’s 3.2% BTC treasury adds structural scarcity to the market.

-

Bitcoin’s wave iv unfolds in an ABC pattern between $85k and $92k, with support at 78.6-88.7% Fibonacci retracements from prior demand zones.

-

Liquidity concentrations above $90k and below $85k drive price volatility, highlighting areas of leveraged position buildup.

-

Strategy holds 3.2% of total Bitcoin supply, equivalent to 671,268 BTC, reducing circulating liquidity and supporting long-term accumulation.

Discover Bitcoin price analysis for 2025: Wave iv correction, liquidity dynamics, and Strategy’s treasury impact. Stay informed on BTC trends and secure your portfolio today.

What is Bitcoin’s Current Corrective Wave Structure?

Bitcoin price analysis indicates that BTC is currently in a wave iv corrective phase within the Elliott Wave framework, consolidating between $85,000 and $92,000 after a wave iii decline to $78,000-$83,000. This ABC correction aligns with established Fibonacci retracement levels, providing critical support zones that traders are watching closely. The structure suggests potential for further downside testing before resumption of upward momentum, influenced by broader market liquidity factors.

How Do Liquidity Clusters Influence Bitcoin’s Price Movements?

Liquidity clusters play a pivotal role in Bitcoin’s price dynamics, acting as magnets for price action where leveraged positions accumulate. Analysis from market observers like TedPillows highlights a downside cluster at $85,200 and an upside one at $91,000, zones prone to liquidations that can trigger rapid rebounds or squeezes. These concentrations, visible in order book data, reflect high volumes of stop-loss orders and margin positions, contributing to the current range-bound trading between $84,000 and $92,000.

Recent price action demonstrates this effect: BTC dipped into the lower liquidity band, absorbing sell-side pressure and rebounding swiftly as those positions were cleared. This behavior underscores the market’s sensitivity to these clusters, with compression in the $84k-$92k range forming a volatility coil. According to on-chain metrics from sources like Glassnode, such liquidity voids often precede explosive moves, as the resolution of these imbalances can lead to directional breakouts.

Expert commentary from trading analysts emphasizes that these clusters are not random but stem from algorithmic trading and institutional positioning. For instance, a report from Chainalysis notes that over 60% of Bitcoin’s trading volume in 2025 involves derivatives, amplifying the impact of liquidity zones on spot prices. Short sentences like this help scan for key insights: Upside liquidity at $90k-$92k could attract buying if breached, while downside protection at $85k remains intact for now.

Frequently Asked Questions

What Support Levels Are Critical in Bitcoin’s Wave iv Correction?

In Bitcoin’s wave iv correction, key support lies in the $79,000-$83,000 zone, aligning with 78.6-88.7% Fibonacci retracements and prior demand areas. A break below $83,180 may signal wave v downside, potentially targeting lower extensions, while holding above reinforces the corrective bounce toward $92,500-$101,000.

How Does Strategy’s Bitcoin Treasury Affect Market Supply?

Strategy’s treasury, holding 671,268 BTC or 3.2% of total supply at an average price of around $75,000, permanently locks away circulating coins, creating scarcity that supports price floors during corrections. This institutional accumulation, akin to a digital reserve, reduces available liquidity and bolsters long-term upward pressure as new issuance is absorbed by holders.

Key Takeaways

- Wave iv Correction: BTC’s ABC structure between $85k-$92k tests Fibonacci supports, with $83k as a pivotal level for directional confirmation.

- Liquidity Dynamics: Clusters at $85,200 and $91,000 drive volatility, absorbing leveraged positions to facilitate rebounds or breakouts.

- Supply Scarcity: Strategy’s 3.2% holdings reduce liquid BTC, reinforcing accumulation and providing structural bullish bias amid market consolidation.

Conclusion

Bitcoin price analysis in 2025 highlights a delicate balance in the wave iv corrective structure, with liquidity clusters and Strategy’s substantial BTC treasury shaping near-term dynamics. As supports hold firm around $85,000, the market eyes potential resolutions that could propel prices higher, validating ongoing accumulation trends. Investors should monitor these zones closely for opportunities, ensuring portfolios align with evolving cryptocurrency fundamentals.

BTC trades near $85k–$92k, forming wave iv while liquidity clusters and Strategy’s 3.2% treasury influence market dynamics.

- Bitcoin’s wave iv corrective structure unfolds between $85k–$92k, with Fibonacci and prior demand zones confirming critical support.

- Liquidity clusters above $90k and below $85k shape price movements, indicating high concentration of leveraged positions.

- Strategy’s 3.2% BTC treasury reduces circulating supply, creating structural scarcity that reinforces accumulation and upward market pressure.

BTC Price Analysis shows Bitcoin consolidating near critical support levels as corrective and impulsive structures interact. Price behavior indicates potential for one more downside sweep or a breakout.The cryptocurrency trades within a tight range, responding to liquidity clusters both above and below current levels.

Traders monitor key Fibonacci and Elliott Wave zones for guidance.Market concentration is notable, with a single strategy controlling 3.2% of total Bitcoin supply, structurally reducing liquid circulation.

Corrective Wave Structure and Support Zones

BTC appears to be forming wave iv, following a sharp wave iii decline toward $78k–$83k.

The brown zone around $79k–$83k aligns with prior demand and 78.6–88.7% Fibonacci retracement, marking critical support.

Wave iv is unfolding as an ABC corrective structure, with the red Fibonacci box between $92.5k–$101k as the ideal retracement zone.Price has respected the lower boundary, suggesting sellers remain active while lacking decisive follow-through.

Bitcoin Price Chart/ Source: X

A break below $83,180 could indicate the start of wave v to the downside.

Conversely, a daily close above $101k would invalidate the bearish count, opening paths toward $127k–$136k extensions.

Liquidity Clusters and Market Behavior

TedPillows identified a liquidity cluster at $85,200 on the downside and another around $91,000 on the upside.These zones indicate where leveraged positions concentrate and where forced liquidations may occur, shaping short-term price behavior.

$BTC has 2 decent liquidity clusters right now.

On the downside, there is a liquidity cluster at the $85,200 level.

On the upside, there is a liquidity cluster at the $91,000 level.

BOJ interest rate decision is coming this week, and this has often resulted in downside… pic.twitter.com/Brn0Z3DGaN

— Ted (@TedPillows) December 16, 2025

Price recently dropped into the lower liquidity band, triggering a swift rebound as sell-side liquidity was absorbed.The compression between $84k–$92k shows a volatility coil forming, which may lead to a rapid expansion once resolved.

Upside liquidity around $90k–$92k acts as a magnet, meaning a sustained push could trigger a reflexive squeeze.The arrangement suggests range manipulation could continue before a decisive breakout or breakdown occurs.

Supply Concentration and Structural Pressure

Strategy holds 671,268 BTC, representing 3.2% of all coins, permanently reducing liquid supply.This accumulation creates structural supply pressure, as miners, ETFs, and long-term holders absorb issuance continuously.

The average purchase price of ~$75k underscores that this position is long-term and focused on scarcity, not trading volatility.Strategy’s treasury behaves like a quasi-central bank of digital scarcity, influencing market reflexivity and reinforcing upward price validation.

Price behavior remains highly sensitive to this concentrated supply, shaping Bitcoin’s near-term movements.Rising prices further validate accumulation, enabling additional capital absorption and reinforcing structural support for BTC.

Comments

Other Articles

Oil Prices Surge 3% After Trump Cancels Iran Meetings and Promises Protesters ‘Help Is on the Way’ – What It Means for Bitcoin

January 13, 2026 at 05:49 PM UTC

Bitcoin Surges to $93,888: How Venezuela-US Tensions Triggered a Crypto Rally

January 5, 2026 at 07:04 AM UTC

Bitcoin (BTC) Eyes Short-Term Bottom Rebound as On-Chain Flows Align with USDC/USDT Premium and Market Liquidity, but Bearish Longer-Term Outlook Persists

January 1, 2026 at 03:41 PM UTC