Bitcoin Reclaims Trendline Resistance, Potentially Signaling 10% Rally Toward $92K

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Bitcoin has regained its trendline resistance as buyers drive the price toward $92,000, establishing conditions for a potential 10% bullish rally according to market analysis.

-

Bitcoin regains trendline resistance with buyers returning, paving the way for a possible 10% rally.

-

Market structure indicates rebounds toward $92,000, with resistance zones emerging between $94,000 and $101,000.

-

Support levels near $90,000 to $87,000 remain solid, offering analysts defined bullish and bearish triggers backed by recent trading data.

Discover how Bitcoin’s trendline resistance recovery signals a 10% rally potential to $92K amid buyer momentum. Stay updated on key levels and market structure for informed crypto decisions—read more now.

What is Bitcoin’s Trendline Resistance Recovery?

Bitcoin’s trendline resistance recovery refers to the cryptocurrency’s recent rebound from a downward trendline on short-term charts, where price action has shifted from lower highs and lows to renewed upward pressure. This development, observed after an intraday drop, positions Bitcoin near $92,000 as buyers reclaim control. Analysts highlight this as a setup for a 10% bullish rally if the trendline holds, reflecting improved market sentiment and stable support zones.

If $BTC #Bitcoin Bulls manage to reclaim the Trendline Resistance, we could see +10% Bullish Rally from there.. pic.twitter.com/iX4cRunI1V

— Captain Faibik 🐺 (@CryptoFaibik) November 20, 2025

Bitcoin traded near the $92,000 mark following a recovery from a sharp intraday decline, drawing focus as the price approached a critical trendline. This rebound underscores buyers’ efforts to test established resistance levels, with the overall structure suggesting potential for further gains if momentum sustains.

The one-hour chart illustrates a prior downward pattern interrupted by buyer intervention, forming a green projection area that could extend 10% higher from current levels. Market data indicates a 0.64% daily increase to around $91,994, with a total market capitalization of $1.83 trillion and robust trading volume. Volatility persists near resistance, but the higher pivot point signals stronger participation compared to recent seller-dominated sessions.

How Do Key Support and Resistance Levels Influence Bitcoin’s Rally Potential?

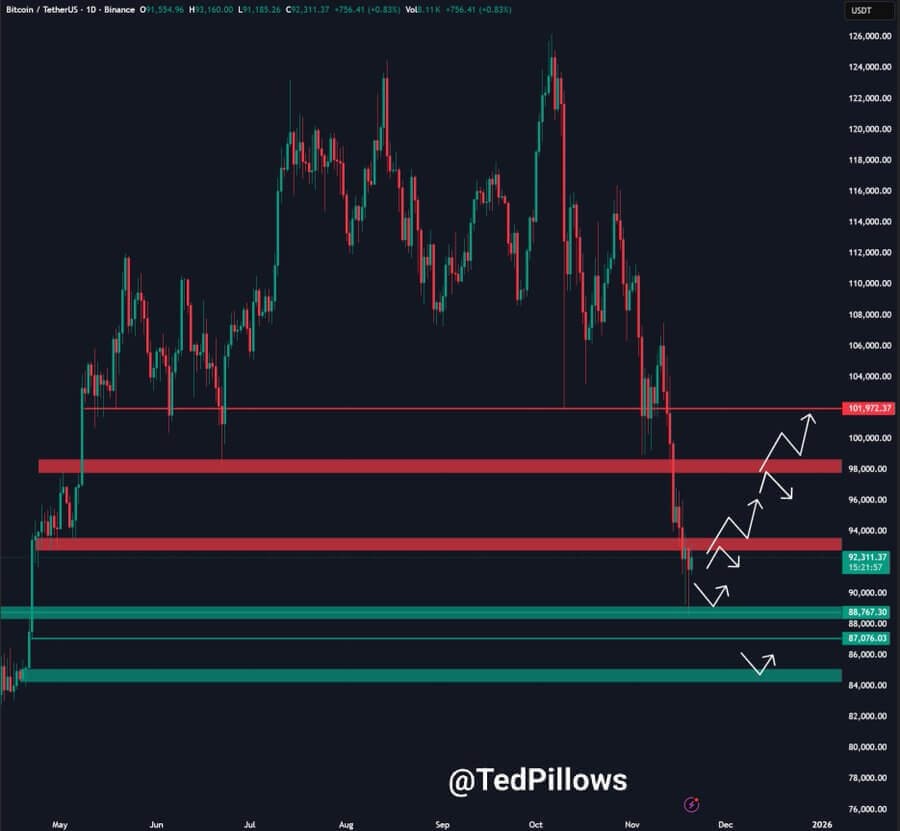

Key support and resistance levels play a pivotal role in Bitcoin’s rally potential by defining clear boundaries for price movements and trader decisions. Bitcoin recently tapped the $89,000 support and bounced back, as noted by analyst Ted Pillows, who emphasized $94,000 as a vital threshold for advancing toward $98,000–$100,000. Supporting data from trading platforms shows resistance clusters between $94,000 and $101,972, while firm supports at $90,000, $88,000, and $87,076 provide downside protection.

A break above $94,000 could accelerate bullish momentum, potentially targeting higher zones, whereas failure to hold $90,000 might test lower supports. Current trading near $92,311 reflects steady buying after the dip, aligning with broader market data from sources like CoinMarketCap. Analysts, including Captain Faibik, project a 10% rally if the trendline resistance holds, supported by increased volume and positive candle formations. This structured overview aids in mapping reactions, with expert insights underscoring the importance of these levels in sustaining the recovery.

Bitcoin regains trendline resistance as buyers lift price toward $92K, forming a setup that analysts note could fuel a 10% bullish rally.

- Bitcoin regains trendline resistance as buyers return, creating conditions for a potential 10% rally.

- Market structure shows rebounds toward $92K with key resistance zones forming between $94K and $101K.

- Support near $90K–$87K holds firm, giving analysts a clear map of bullish and bearish reaction levels.

Frequently Asked Questions

What Triggers a 10% Bullish Rally in Bitcoin After Trendline Recovery?

A 10% bullish rally in Bitcoin following trendline recovery is typically triggered by sustained buying above key resistance levels like $92,000, coupled with increased trading volume. Analysts from platforms such as TradingView note that breaking $94,000 could propel prices toward $100,000, driven by renewed investor confidence and positive market sentiment without speculative overreach.

Why Is Bitcoin’s Support at $90,000 Critical for Current Market Stability?

Bitcoin’s support at $90,000 is critical for market stability because it acts as a psychological and technical floor, preventing deeper corrections during volatility. As prices bounce from this level, it reinforces buyer control, allowing for orderly rebounds toward higher targets like $92,000, making it a focal point for traders monitoring daily charts.

Key Takeaways

- Trendline Rebound Strengthens Outlook: Bitcoin’s recovery above the trendline signals robust buyer interest, potentially leading to a 10% gain if resistance at $94,000 breaks.

- Defined Levels Guide Trading: Supports at $87,000–$90,000 and resistances up to $101,000 provide a clear framework for assessing rally sustainability based on volume data.

- Monitor Volume for Confirmation: Rising trading activity near $92,000 confirms the bullish setup, advising investors to watch for sustained momentum before positioning.

Conclusion

In summary, Bitcoin’s trendline resistance recovery has positioned the asset for a potential 10% bullish rally toward $92,000 and beyond, with key support at $90,000 bolstering stability amid resistance challenges at $94,000. This development highlights evolving market structure and buyer dominance, as evidenced by analyses from experts like Captain Faibik and Ted Pillows. As trading volumes rise, investors should track these levels closely for opportunities, anticipating further upside in the coming sessions while maintaining a disciplined approach to volatility.

Comments

Other Articles

Oil Prices Surge 3% After Trump Cancels Iran Meetings and Promises Protesters ‘Help Is on the Way’ – What It Means for Bitcoin

January 13, 2026 at 05:49 PM UTC

Bitcoin Surges to $93,888: How Venezuela-US Tensions Triggered a Crypto Rally

January 5, 2026 at 07:04 AM UTC

Bitcoin (BTC) Eyes Short-Term Bottom Rebound as On-Chain Flows Align with USDC/USDT Premium and Market Liquidity, but Bearish Longer-Term Outlook Persists

January 1, 2026 at 03:41 PM UTC