Bitcoin Recovery Stalls Amid Declining Stablecoin Inflows and Corporate Buying

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Bitcoin liquidity exhaustion from declining stablecoin inflows to exchanges and slowing corporate treasury buying is hindering price recovery, with BTC dipping back to $88,000 after failing to hold $90,000 gains. Fresh capital has slowed significantly since summer highs.

-

Stablecoin inflows to exchanges have halved from $158 billion in August to $76 billion now, signaling reduced buying interest.

-

The 90-day average of these inflows dropped from $130 billion to $118 billion, indicating a lack of new market liquidity.

-

Corporate Bitcoin accumulation slowed, with only nine new firms adding BTC in Q4 2025 versus 53 in Q3, per data from CryptoQuant.

Bitcoin liquidity exhaustion is stalling recovery amid falling stablecoin flows and corporate buys. Explore key factors and future outlook in this analysis—stay informed on crypto market trends today.

What is Causing Bitcoin Liquidity Exhaustion?

Bitcoin liquidity exhaustion stems primarily from two vital sources—stablecoin inflows to exchanges and corporate treasury purchases—showing clear signs of fatigue, preventing sustained price recovery. After peaking at over $126,000 in October 2025, Bitcoin has struggled to maintain gains, recently falling back to the $88,000 range following a brief push above $90,000. This downturn reflects broader market dynamics where reduced fresh capital entry is amplifying selling pressures.

Why Have Stablecoin Inflows to Exchanges Declined?

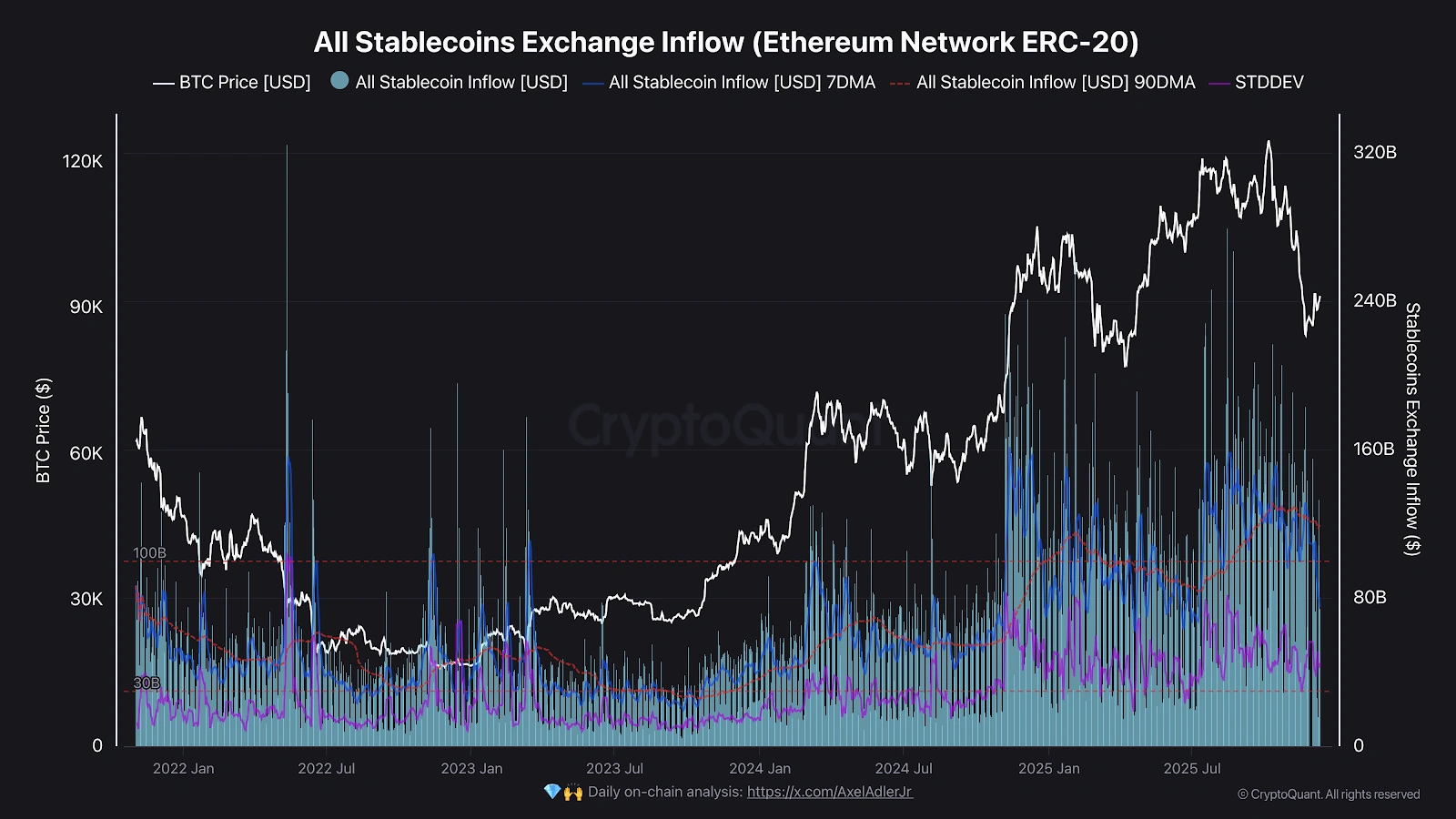

Stablecoins, acting as a key gateway for both institutional and retail investors into cryptocurrency markets, have seen a sharp drop in exchange inflows, underscoring diminished liquidity. Data from CryptoQuant indicates that ERC-20 stablecoin inflows plummeted from $158 billion in August 2025 to approximately $76 billion in recent weeks, highlighting a contraction in available trading capital.

Stablecoin inflow into exchanges on the Ethereum network. Source: CryptoQuant

Stablecoin inflow into exchanges on the Ethereum network. Source: CryptoQuantThe 90-day moving average for these inflows has also eased from $130 billion to $118 billion, suggesting that while outright outflows aren’t surging, the influx of new funds that fueled earlier rallies has waned. CryptoQuant analyst Darkfrost noted, “the trend remains downward, and the slight rebounds we are seeing mainly result from reduced selling pressure rather than renewed buying interest.” This shift positions stablecoins less as a bullish indicator and more as a neutral force in the current environment.

Historically, robust stablecoin movements have correlated with heightened market participation, providing the liquidity needed for price stability and upward momentum. With this drying up, Bitcoin faces increased volatility as traders rely on thinner order books.

How Has Corporate Treasury Buying Slowed for Bitcoin?

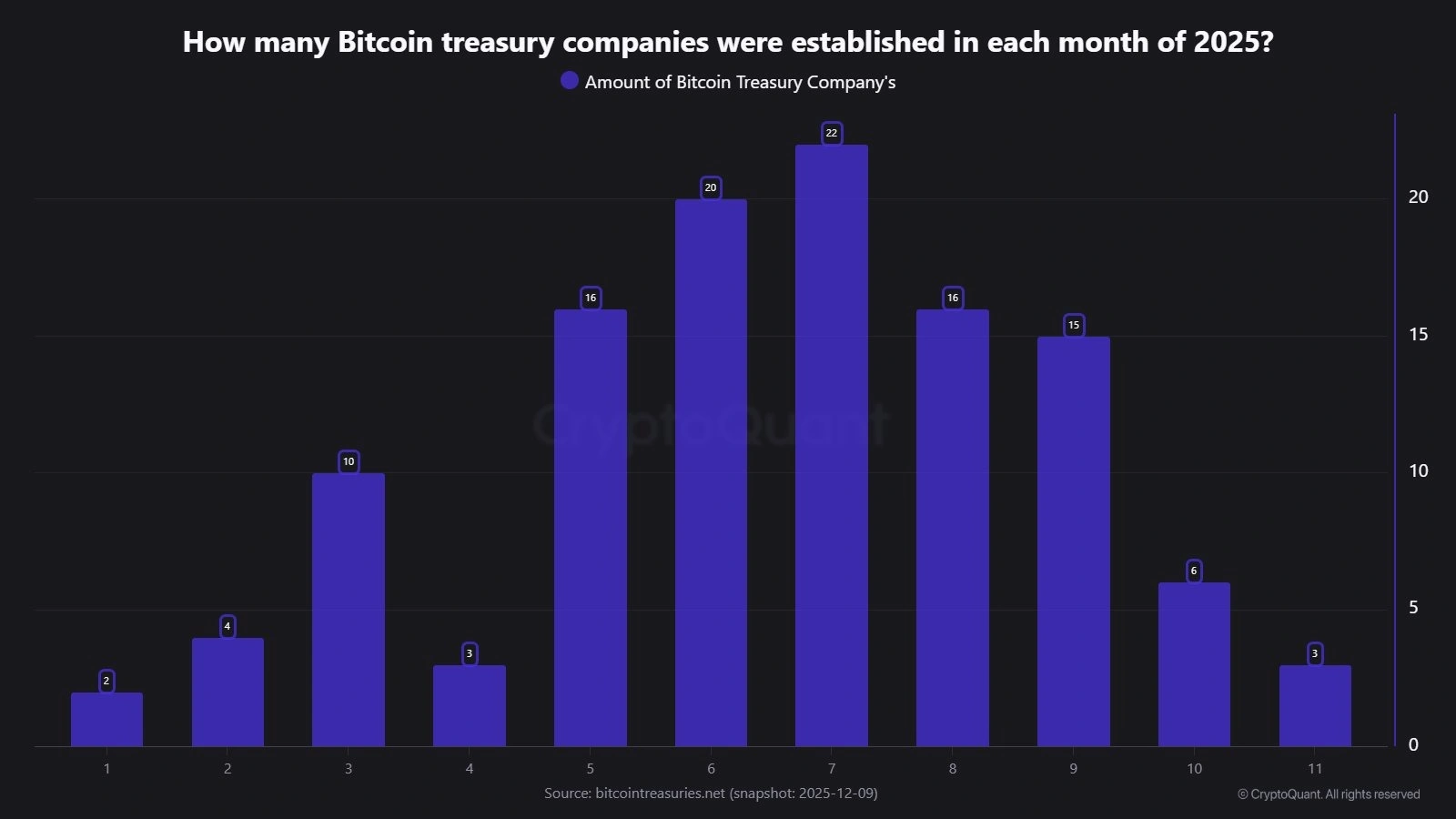

The trend of companies incorporating Bitcoin into their corporate treasuries, a hallmark of 2025’s market expansion, has decelerated notably in the latter part of the year, contributing to overall liquidity exhaustion. While 117 firms added Bitcoin to their balance sheets throughout 2025, the pace has faltered, with just nine new adopters in the fourth quarter to date—compared to 53 in the third quarter and 39 in the second.

Bitcoin DATs purchase record in every month of 2025. Source: CryptoQuant

Bitcoin DATs purchase record in every month of 2025. Source: CryptoQuantMany of these treasury holders maintain conservative positions, as evidenced by 147 companies holding under 500 Bitcoins each, limiting the aggregate impact on market liquidity. Despite this slowdown, prominent players continue selective accumulation. Strategy, a leading advocate for Bitcoin treasuries, recently purchased 10,624 Bitcoins for $962.7 million between December 1 and 7, 2025, elevating its total to 660,624 Bitcoins.

Strategy’s Bitcoin investment by year. Source: CryptoQuant

Strategy’s Bitcoin investment by year. Source: CryptoQuantThis year’s additions for Strategy total $21.48 billion in Bitcoin, nearing its full 2024 haul of $21.97 billion. However, amid recent price weakness, the firm bolstered its cash reserves to $1.44 billion for dividend coverage, signaling a prudent stance amid uncertainties.

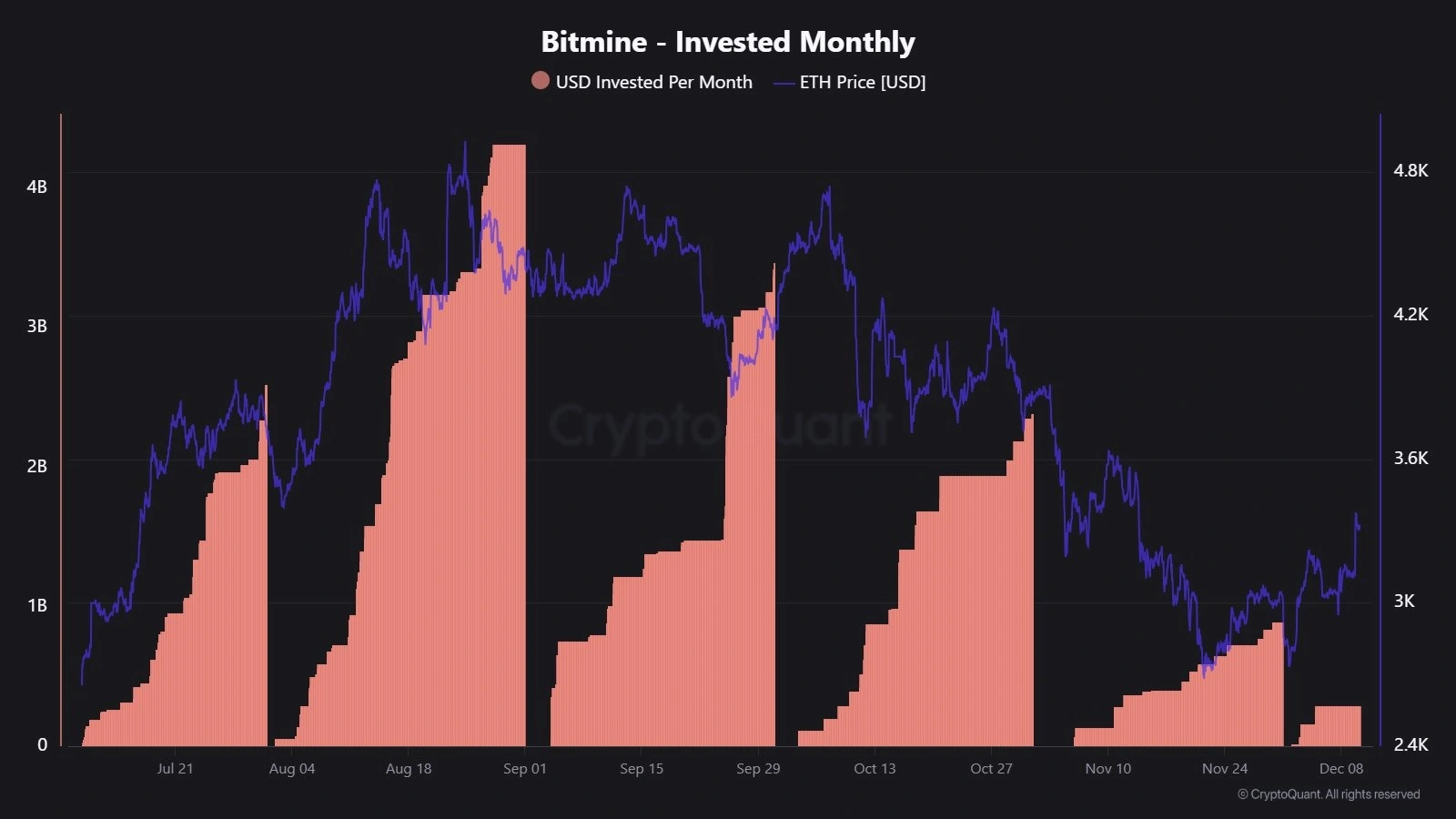

Bitmine ranks as the second-largest corporate buyer, though its scale pales against Strategy’s. It acquired $892 million in Bitcoin during November 2025 and an additional $296 million so far this month, according to CryptoQuant data.

Bitmine BTC purchases by month. Source: CryptoQuant

Bitmine BTC purchases by month. Source: CryptoQuantOther significant holders, such as Japan’s Metaplanet, which amassed 30,823 Bitcoins by September 2025, have paused additions for over two months. Similarly, Evernorth, after investing $950 million in Bitcoin this year, has been inactive for the past six weeks. This pullback among corporates reduces the steady demand that previously supported Bitcoin’s price floor.

Market structure adds further strain, with Strategy potentially facing headwinds from MSCI’s proposal to bar digital asset treasury firms from its indexes. Such a change could compel institutional divestitures, diminishing these stocks’ role as Bitcoin exposure vehicles.

Frequently Asked Questions

What Factors Are Driving Bitcoin’s Current Price Struggles in 2025?

Bitcoin’s price challenges in 2025 arise from exhausted liquidity sources, including halved stablecoin inflows to $76 billion and a sharp drop in new corporate treasury adoptions to nine firms in Q4. These trends, per CryptoQuant, reflect waning investor enthusiasm rather than aggressive selling, keeping BTC below $90,000.

Will Bitcoin Recover from Liquidity Exhaustion Soon?

Recovery from Bitcoin liquidity exhaustion depends on renewed stablecoin flows and corporate buying; analysts suggest BTC may test $99,000 resistance first. Without fresh capital, as observed by market experts, sustained bullish momentum remains elusive, though reduced selling could stabilize prices in the near term.

Key Takeaways

- Declining Stablecoin Inflows: ERC-20 stablecoin transfers to exchanges fell to $76 billion, with the 90-day average at $118 billion, curbing fresh liquidity and market participation.

- Slowing Corporate Accumulation: Only nine new firms added Bitcoin in Q4 2025, down from prior quarters, with most holding modest stakes under 500 BTC, limiting demand support.

- Potential Upside Targets: Despite pressures, Bitcoin could aim for $99,000 and higher if liquidity rebounds; monitor corporate moves and index changes for directional cues.

Conclusion

Bitcoin liquidity exhaustion, driven by contracting stablecoin inflows and decelerating corporate treasury buying, continues to impede a robust price recovery in late 2025, as BTC hovers around the $88,000 level post its October peak. While outliers like Strategy and Bitmine persist in accumulation, the broader slowdown underscores the need for renewed capital inflows to reignite momentum. Investors should watch for signs of revitalized liquidity, positioning for potential climbs toward key resistances as market dynamics evolve.

Comments

Other Articles

Oil Prices Surge 3% After Trump Cancels Iran Meetings and Promises Protesters ‘Help Is on the Way’ – What It Means for Bitcoin

January 13, 2026 at 05:49 PM UTC

Bitcoin Surges to $93,888: How Venezuela-US Tensions Triggered a Crypto Rally

January 5, 2026 at 07:04 AM UTC

Bitcoin (BTC) Eyes Short-Term Bottom Rebound as On-Chain Flows Align with USDC/USDT Premium and Market Liquidity, but Bearish Longer-Term Outlook Persists

January 1, 2026 at 03:41 PM UTC