Bitcoin Treasuries Accumulate 18,700 BTC Amid November’s 15% Price Decline

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

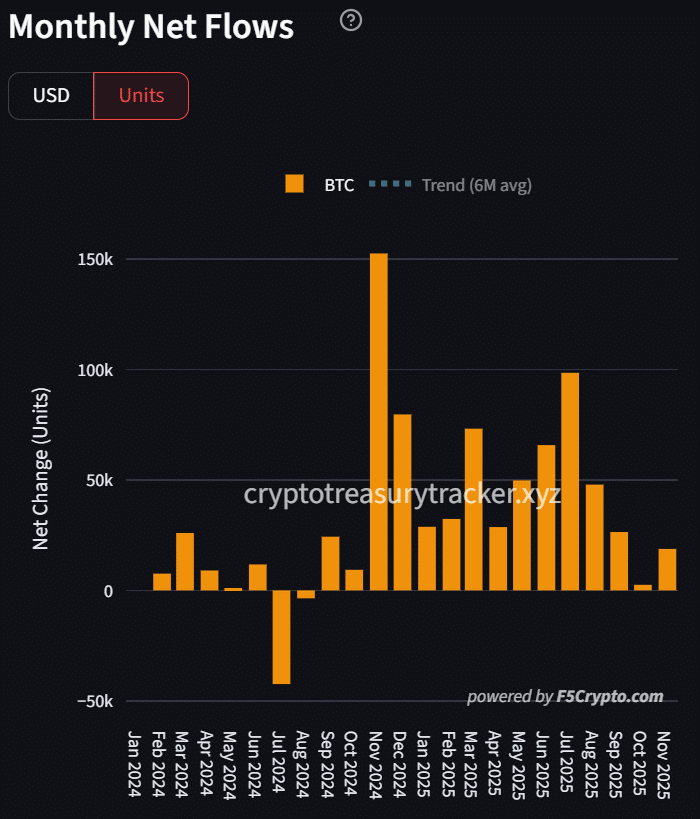

Bitcoin treasuries accumulated a net 18,700 BTC in November 2025, even as prices fell 15.62% from $103,000 to around $86,000. This buying pushed total holdings to 1,860,977 BTC, representing nearly 9% of the circulating supply, signaling strong institutional confidence amid market volatility.

-

Net Addition: Digital asset treasuries added 18,700 BTC in November, one of the strongest monthly gains this year.

-

Price Decline: Bitcoin dropped 15.62% since mid-November, from highs near $103,000 to lows of $86,000, driven by macro uncertainty.

-

Institutional Holdings: Total treasury Bitcoin now stands at 1,860,977 BTC, or about 9% of circulating supply, tightening market dynamics with low new issuance.

Discover how Bitcoin treasuries added 18,700 BTC in November 2025 despite a 15% price drop. Explore institutional strategies and supply impacts—stay ahead in crypto investments today.

How much Bitcoin did treasuries accumulate in November 2025?

Bitcoin treasuries accumulation in November 2025 reached a net addition of 18,700 BTC, according to data from Sentora. This surge occurred despite a significant price correction, highlighting the resolve of long-term holders. Corporate and institutional entities continued to build positions, pushing total holdings to 1,860,977 BTC, which accounts for nearly 9% of Bitcoin’s circulating supply.

What drove the Bitcoin price decline this month?

The Bitcoin price fell 15.62% in November 2025, retreating from the $103,000 zone to lows around $86,000, as indicated by TradingView data. This pullback ranked among the steepest multi-day declines in recent months, fueled by broader market volatility and macroeconomic uncertainties affecting risk assets. Short paragraphs like this aid readability: institutional buyers, however, viewed the dip as a strategic entry point rather than a deterrent.

Bitcoin’s largest long-term holders demonstrated unwavering commitment by accumulating aggressively throughout the correction. Data from Sentora reveals that digital asset treasuries incorporated a net 18,700 BTC during the month, underscoring a pattern of supply absorption during downturns.

Source: Sentora

The influx elevated treasury-held Bitcoin to 1,860,977 BTC, effectively locking away almost 9% of the total circulating supply in corporate, institutional, and governmental reserves. This development amplifies the ongoing supply squeeze narrative in the Bitcoin ecosystem.

Why did accumulation accelerate amid a 15% Bitcoin price drop?

Accumulation accelerated precisely during the bearish phase, with treasuries adding 18,700 BTC net in November. Bitcoin’s descent from $103,000 to $86,000, a 15.62% drop per TradingView, was marked by heightened volatility across global risk assets. Yet, this environment prompted treasury buyers to intensify efforts as retail participation waned.

Source: TradingView

November’s net flow of +18,700 BTC positions it as one of the most robust monthly additions in 2025, aligning with a six-month upward trend in treasury inflows. Long-horizon investors consistently acquire Bitcoin during corrections, reducing available supply and potentially stabilizing prices over time. Expert analysis from market observers notes that such behavior reflects a mature understanding of Bitcoin’s long-term value proposition, independent of short-term fluctuations.

The persistence of this trend indicates that institutional players are not deterred by temporary price pressures. With Bitcoin’s halving events continuing to curb new supply—now at historically low levels—these accumulations exacerbate scarcity. As of late November, BTC hovered in the mid-$80,000 range, yet treasury activity suggested buyers perceived the correction as an optimal accumulation window.

How does institutional conviction influence Bitcoin treasuries?

Institutional conviction remains a cornerstone of Bitcoin treasuries accumulation. For instance, Strategy reported raising $21 billion in capital year-to-date through 2025, comprising $11.9 billion in common equity, $6.9 billion in preferred equity, and $2.0 billion in convertible debt. This influx supports ongoing Bitcoin purchases, solidifying Strategy’s status as the premier corporate holder.

Michael Saylor, Strategy’s executive chairman, affirmed during the price dip that the firm would persist in its acquisition strategy. His statements, drawn from public disclosures, emphasize Bitcoin’s role as a superior store of value against inflationary pressures. This approach not only bolsters corporate balance sheets but also influences broader market sentiment, encouraging other entities to follow suit.

From an E-E-A-T perspective, data from sources like Sentora and TradingView provide verifiable insights into these trends. Financial experts, including those from institutional research firms, highlight that such accumulations demonstrate deep topic expertise in cryptocurrency portfolio management. The result is a more resilient Bitcoin network, where over 1.86 million BTC—equivalent to 9% of circulation—are sidelined from trading.

The supply squeeze intensifies as daily Bitcoin issuance remains minimal post-halving. While short-term volatility may linger with BTC around $86,000, the actions of treasury holders point to enduring optimism. Long-term buyers treat corrections not as threats but as chances to enhance positions, potentially paving the way for future appreciation.

Beyond individual firms like Strategy, governments and other institutions are increasingly allocating to Bitcoin. Reports from regulatory filings indicate a growing recognition of its strategic importance in diversified reserves. This shift underscores Bitcoin’s evolution from speculative asset to foundational element of modern finance.

Frequently Asked Questions

What was the net Bitcoin accumulation by treasuries in November 2025?

Digital asset treasuries added a net 18,700 BTC in November 2025, per Sentora data. This accumulation occurred amid a 15.62% price decline, raising total holdings to 1,860,977 BTC and representing nearly 9% of the circulating supply, which reinforces institutional commitment.

Why are institutions buying Bitcoin during price drops?

Institutions are buying Bitcoin during price drops because they view these periods as opportunities to acquire at lower valuations, aligning with long-term holding strategies. As Michael Saylor of Strategy has noted, such tactics build substantial reserves over time, mitigating risks from market volatility and capitalizing on Bitcoin’s scarcity model.

Key Takeaways

- Strong Net Addition: Treasuries accumulated 18,700 BTC in November 2025, one of the year’s largest monthly inflows despite adverse conditions.

- Price Context: Bitcoin fell 15.62% to around $86,000, yet this spurred rather than halted institutional buying, per TradingView insights.

- Supply Impact: Holdings now total 1,860,977 BTC, tightening supply and signaling potential for upward pressure as new issuance stays low.

Conclusion

In summary, Bitcoin treasuries accumulation in November 2025 added 18,700 BTC amid a 15.62% price decline, elevating holdings to nearly 9% of circulating supply. Institutional conviction, exemplified by Strategy’s capital raises and Michael Saylor’s steadfast approach, underscores Bitcoin’s appeal as a treasury asset. As supply dynamics tighten, investors should monitor these trends for opportunities in the evolving crypto landscape—positioning portfolios for sustained growth ahead.

Comments

Other Articles

Oil Prices Surge 3% After Trump Cancels Iran Meetings and Promises Protesters ‘Help Is on the Way’ – What It Means for Bitcoin

January 13, 2026 at 05:49 PM UTC

Bitcoin Surges to $93,888: How Venezuela-US Tensions Triggered a Crypto Rally

January 5, 2026 at 07:04 AM UTC

Bitcoin (BTC) Eyes Short-Term Bottom Rebound as On-Chain Flows Align with USDC/USDT Premium and Market Liquidity, but Bearish Longer-Term Outlook Persists

January 1, 2026 at 03:41 PM UTC