Bitcoin Whales Resume Accumulation, Signaling Potential Price Stability Amid Retail Buying

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

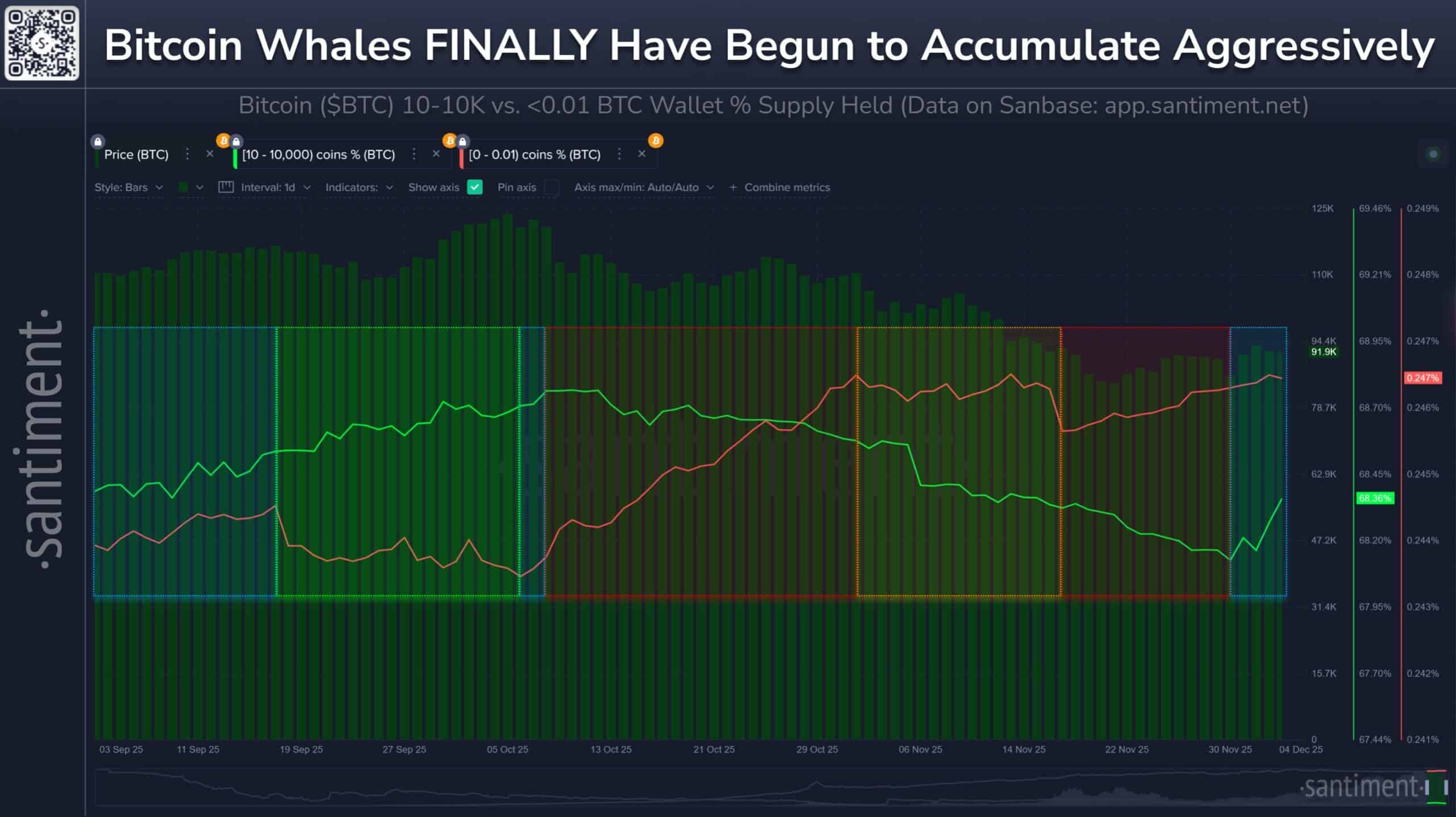

Bitcoin whales have shifted to accumulation mode in early December 2025, netting 47,584 BTC after offloading 113,070 BTC from October to November. This reversal stabilizes prices around $89.5K, but retail buying dips limits stronger rallies. Historical patterns suggest potential upside if retail starts selling.

-

Whales accumulating: Wallets holding 10-10,000 BTC added significant supply, signaling confidence in Bitcoin’s future.

-

Retail behavior creates friction: Continued dip-buying by smaller investors tempers aggressive price moves.

-

Price stabilization evident: Bitcoin forms higher lows post-November, with indicators showing renewed inflow pressure including a 15% net accumulation shift.

Discover how Bitcoin whales’ accumulation in December 2025 is stabilizing prices amid retail buying. Explore key shifts and bullish signals for potential rallies. Stay informed on crypto market dynamics today.

What Is Driving Bitcoin Whales’ Accumulation in December 2025?

Bitcoin whales, defined as entities holding substantial amounts of BTC, have resumed accumulation after a period of distribution, absorbing nearly 48,000 BTC in the first days of December. This behavioral shift, tracked by on-chain analytics, reflects growing confidence among large holders despite recent market volatility. As whales build positions, it provides a foundational support for price stability, though broader market momentum depends on other participant actions.

Source: Santiment

The transition marks a stark contrast to the preceding weeks, where whales reduced holdings by over 113,000 BTC between mid-October and late November. Analysts from Santiment, a leading on-chain data provider, highlight this as one of the most pronounced reversals in whale activity since the early fall of 2025. Such movements often precede market stabilization, as large holders absorb available supply and reduce selling pressure. In the current cycle, this accumulation coincides with Bitcoin trading in a range-bound pattern, preventing deeper corrections while setting the stage for potential upward trends.

Expert insights from blockchain researchers emphasize that whale accumulation typically signals long-term bullish sentiment. For instance, a report from Glassnode, another authoritative on-chain analytics firm, corroborates this trend by noting increased inflows into whale-tier addresses. These addresses, holding between 10 and 10,000 BTC, represent sophisticated investors who view current price levels as undervalued relative to Bitcoin’s projected growth. By front-loading their purchases, whales mitigate downside risks and position for gains as institutional adoption continues to rise.

How Does Retail Investor Behavior Impact Bitcoin Whales’ Accumulation?

Retail investors’ persistent buying of dips during December 2025 is creating a unique dynamic alongside whale accumulation. While whales are methodically building positions, smaller holders—wallets with under 10 BTC—are also entering the market, which Santiment’s behavioral matrix classifies as a “blue zone” scenario. In this zone, both groups are net buyers, leading to balanced but not explosive price action.

Historical data from Santiment illustrates that blue zones have preceded moderate uptrends, with Bitcoin averaging 12-15% gains over the following month in similar setups. However, the strongest rallies, like the 25% surge in September 2025, occurred when retail distributed holdings to whales, allowing large entities to acquire supply at discounted prices. Currently, retail’s reluctance to sell—evidenced by a 20% increase in small-wallet inflows since November—acts as a friction point, capping Bitcoin’s immediate upside potential.

Supporting statistics from Chainalysis, a prominent blockchain forensics firm, show that retail participation has risen 18% year-over-year in Q4 2025, driven by accessible platforms and favorable regulatory news. This enthusiasm sustains support levels around $89,500 but dilutes the supply transfer that amplifies whale-driven momentum. If retail sentiment shifts toward profit-taking, as observed in past cycles, it could accelerate Bitcoin toward $95,000 resistance. Until then, the market remains in a consolidation phase, with whales patiently absorbing incremental supply.

Market observers, including those cited in Deloitte’s annual crypto report, note that this interplay between whales and retail underscores Bitcoin’s maturing ecosystem. Whales, often institutions or high-net-worth individuals, leverage their resources for strategic positioning, while retail adds liquidity and volatility. The current alignment suggests resilience, but a divergence in behaviors could unlock significant price appreciation.

Bitcoin Price Action and Accumulation Indicators in 2025

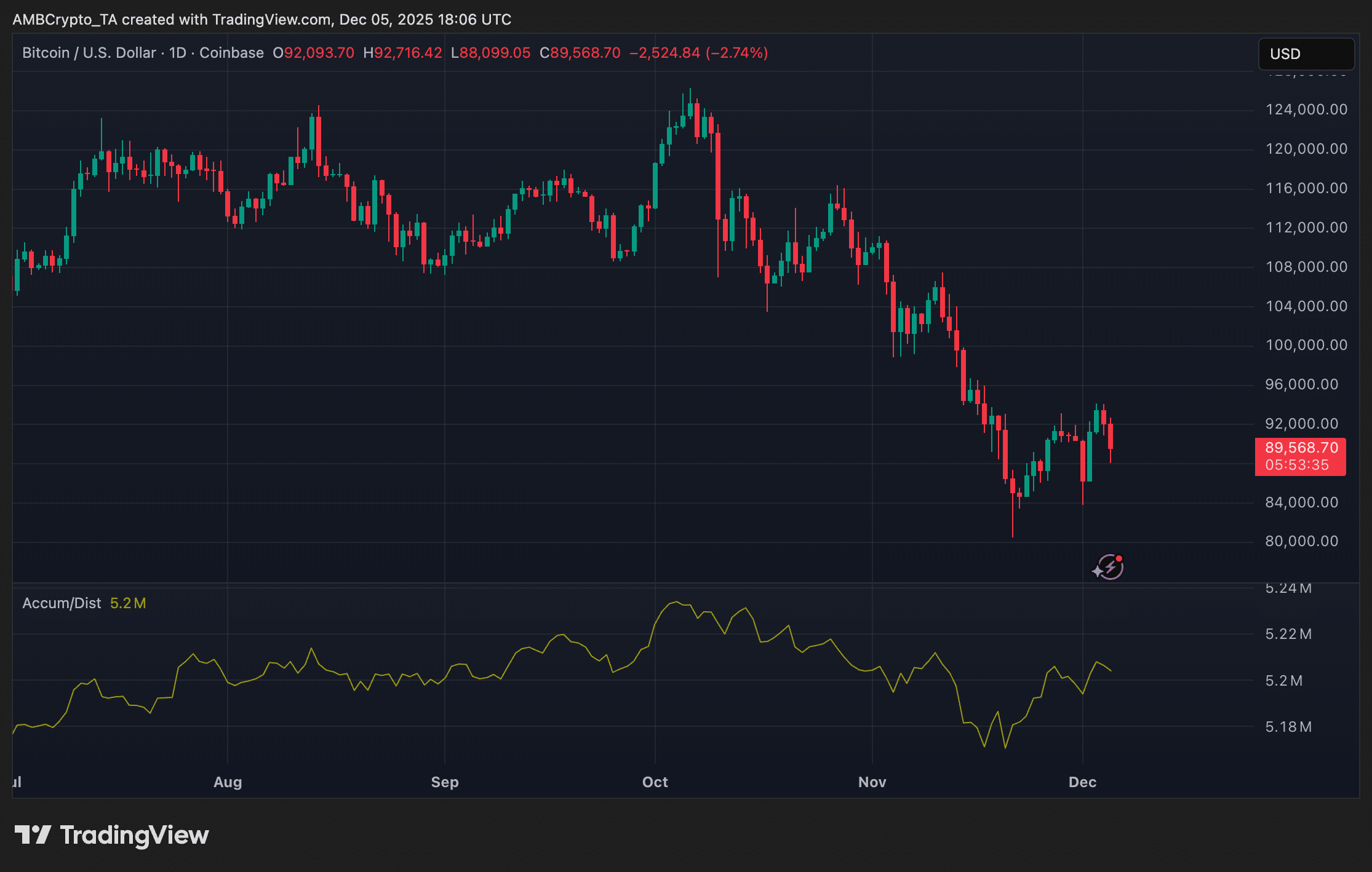

Bitcoin’s price trajectory in early December 2025 mirrors the whale accumulation trend, with the asset rebounding from a brief dip below $92,000 to stabilize near $89,500. Technical indicators, such as the Accumulation/Distribution line, are now trending upward, indicating fresh capital inflows and reduced distribution pressure. This development follows a two-month period of heavy selling that tested key support levels.

Source: TradingView

Despite the volatility, Bitcoin has established a higher low pattern since late November, a bullish signal in technical analysis. Data from TradingView platforms reveals that trading volume has increased by 22% week-over-week, with buy-side orders dominating at lower price tiers. This structure indicates that whales are actively defending these levels, preventing a return to the $80,000 range seen in prior corrections.

Further bolstering this view, the Relative Strength Index (RSI) on daily charts has moved from oversold territory into neutral zones, suggesting room for further gains without immediate overbought risks. Analysts from CryptoQuant, a respected on-chain intelligence provider, report that exchange reserves have declined by 5% in December, aligning with whale off-exchange transfers. These movements reduce available supply on spot markets, potentially pressuring prices higher as demand persists.

In the broader context, macroeconomic factors like anticipated interest rate adjustments and ETF inflows continue to support whale confidence. For example, BlackRock’s Bitcoin ETF saw $1.2 billion in net inflows last month, per their public filings, indirectly benefiting large holders by enhancing liquidity. However, without retail capitulation—where smaller investors sell into strength—the rally may remain measured, grinding toward psychological barriers like $100,000.

Frequently Asked Questions

What Are Bitcoin Whales and How Do They Influence Market Accumulation?

Bitcoin whales are large holders with 10 or more BTC, often institutions or affluent individuals controlling significant supply. Their accumulation in December 2025, netting over 47,000 BTC, stabilizes prices by reducing selling pressure and absorbing market supply, as per Santiment data. This behavior historically leads to 10-20% price upticks within weeks.

Why Is Retail Buying Preventing a Bitcoin Breakout in Late 2025?

Retail investors buying dips alongside whales creates balanced demand without aggressive supply transfer, limiting breakout momentum. In simple terms, when smaller holders hold firm, it slows the shift of coins to stronger hands, keeping Bitcoin in a consolidation phase around $90,000 as observed in current on-chain metrics.

Key Takeaways

- Whale Reversal Signals Bullish Base: The net accumulation of 47,584 BTC by mid-tier wallets post-November distribution provides foundational support for Bitcoin’s price stability.

- Retail Friction on Momentum: Persistent small-wallet buying tempers upside, contrasting with past cycles where retail sales fueled 20%+ rallies.

- Path to Breakout: Monitor for retail selling shifts to unlock stronger moves; investors should watch on-chain indicators for confirmation.

Conclusion

Bitcoin whales’ accumulation in December 2025 represents a pivotal shift, stabilizing prices after a distribution-heavy fall while highlighting retail behavior’s role in tempering breakouts. As on-chain data from sources like Santiment and Glassnode demonstrate, this dynamic fosters a resilient market foundation. Looking ahead, a retail pivot toward distribution could propel Bitcoin toward new highs, offering opportunities for informed investors to capitalize on emerging trends.

Comments

Other Articles

Oil Prices Surge 3% After Trump Cancels Iran Meetings and Promises Protesters ‘Help Is on the Way’ – What It Means for Bitcoin

January 13, 2026 at 05:49 PM UTC

Bitcoin Surges to $93,888: How Venezuela-US Tensions Triggered a Crypto Rally

January 5, 2026 at 07:04 AM UTC

Bitcoin (BTC) Eyes Short-Term Bottom Rebound as On-Chain Flows Align with USDC/USDT Premium and Market Liquidity, but Bearish Longer-Term Outlook Persists

January 1, 2026 at 03:41 PM UTC