Bitcoin’s Divergence from Gold Signals Potential Market Rotation Ahead

BTC/USDT

$30,482,073,707.86

$69,550.00 / $63,820.50

Change: $5,729.50 (8.98%)

+0.0004%

Longs pay

Contents

Bitcoin vs Gold performance in 2025 shows gold surging 62% to $4,282 per ounce amid economic uncertainty, while Bitcoin trades at $86,000 after a selloff, highlighting a temporary divergence in safe-haven assets.

-

Gold’s rally driven by Federal Reserve rate cut expectations and central bank purchases.

-

Bitcoin faces pressure from liquidations, trading 30% below its October peak of $126,210.

-

Analysts predict a potential rotation back to Bitcoin, with RSI against gold at historic lows.

Explore Bitcoin vs Gold dynamics in 2025: Gold hits new highs while BTC lags. Discover expert insights on potential market rotation and investment strategies for safe-haven assets.

What is the current Bitcoin vs Gold performance?

Bitcoin vs Gold performance reveals a stark contrast in 2025, with gold achieving a remarkable 62% year-to-date gain, reaching $4,282 per ounce, fueled by anticipated Federal Reserve rate cuts and strong central bank demand. In comparison, Bitcoin has experienced volatility, trading around $86,000 following a significant selloff that led to $200 million in liquidations. This divergence underscores shifting investor preferences toward traditional safe havens amid macroeconomic pressures, though analysts foresee a possible rebound for Bitcoin.

How does Bitcoin’s relative strength against gold signal market shifts?

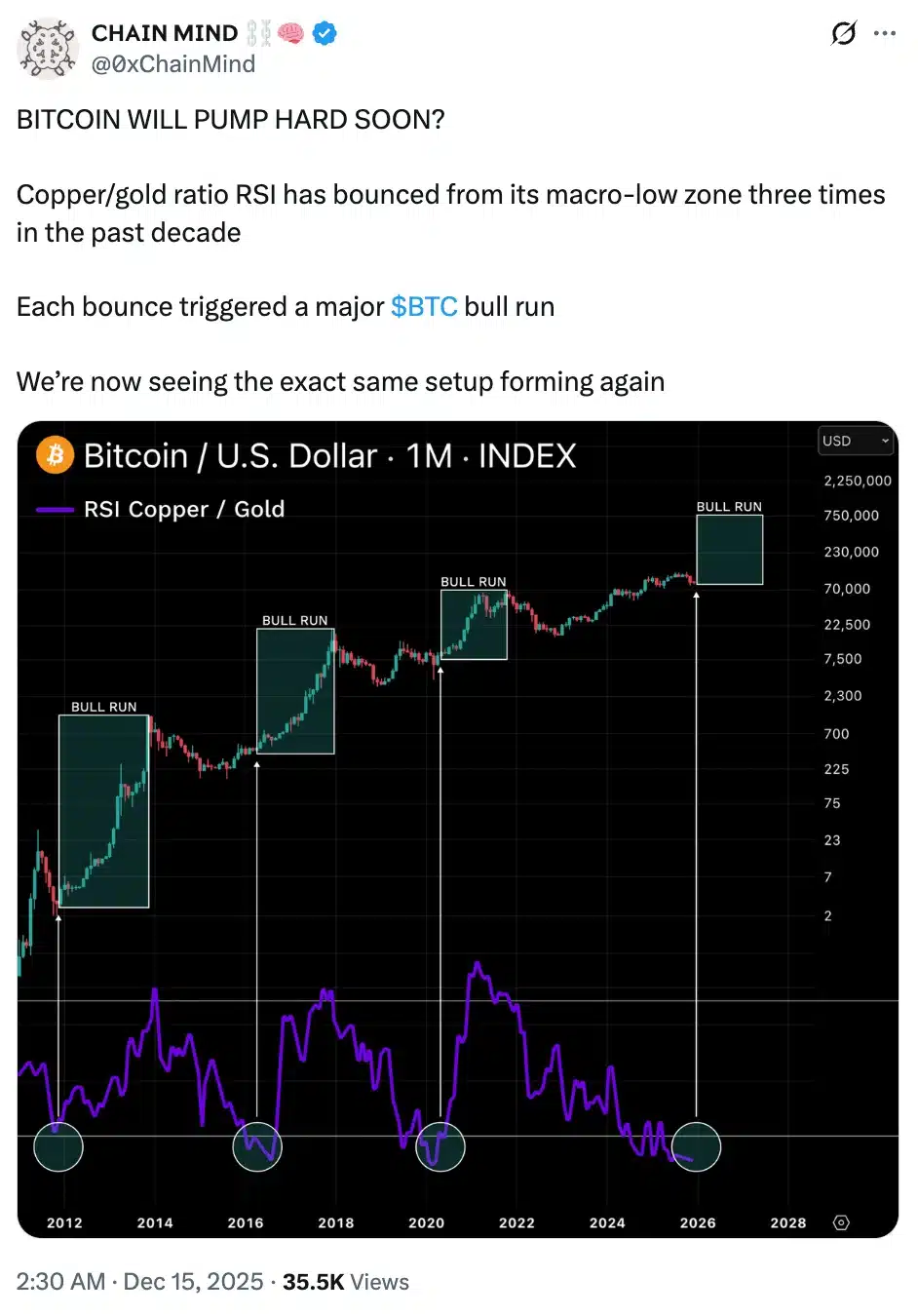

The Relative Strength Index (RSI) for Bitcoin against gold has dropped below 30 for the fourth time in its history, a level that previously marked bottoms during major bear markets in 2015, 2018, and 2022. Crypto analyst Michaël van de Poppe emphasized this pattern, noting it often precedes capital rotation rather than sustained weakness. Supporting data from on-chain metrics, such as those analyzed by Chain Mind, indicate Bitcoin’s oversold conditions relative to gold, with the BTC/GOLD ratio appearing fundamentally undervalued. Van de Poppe further pointed to the widening gap between Bitcoin’s price and its 20-week moving average, describing it as “massive” and historically linked to trend reversals. Expert Ray Youssef, CEO of NoOnes, added that gold’s rise to new highs creates bearish headwinds for Bitcoin but suggested a breakout above $94,000 could restore confidence, while a fall below $80,000 risks further liquidations. These insights, drawn from market observations and historical precedents, highlight the potential for Bitcoin to regain ground as liquidity improves into 2026.

Source: Michaël van de Poppe/X

Market participants are closely monitoring these technical indicators, as they provide a framework for understanding broader asset rotations. Gold’s current overextension, up 62% this year—its best performance since 1979—contrasts with Bitcoin’s consolidation, prompting discussions on whether this reflects a broader demand for scarce assets or a temporary flight to tradition. Institutional factors, including ETF inflows for gold and steady Bitcoin ETF holdings, further complicate the narrative, suggesting resilience in both but with gold temporarily leading.

Frequently Asked Questions

Why is gold outperforming Bitcoin in late 2025?

Gold’s outperformance stems from expectations of Federal Reserve rate cuts, robust central bank purchases, and ETF inflows, driving a 62% yearly surge to $4,282 per ounce. Bitcoin, meanwhile, has faced selloffs and liquidations, trading at $86,000, about 30% below its October high, amid reduced optimism for year-end rallies, according to COINOTAG data.

Could Bitcoin surpass silver’s market position again soon?

Bitcoin briefly overtook silver earlier in 2025, reaching an eighth-largest asset ranking with a $1.75 trillion market cap near $90,000. Current Infinite Market Cap rankings place silver fifth and Bitcoin eighth, but with improving liquidity and institutional support, Bitcoin could reclaim that spot if it breaks key resistance levels in early 2026.

Source: Chain Mind/X

Analyst Martin Pelletier echoed this optimism on X, stating, “Gold $GLD is now playing catch up to #BTC. One hell of a pair trade.” On-chain analysis reinforces this view, showing metrics like fading long-term holder selling and expanding liquidity that position Bitcoin for an upward move against gold and other precious metals.

Key Takeaways

- Gold’s dominance: A 62% year-to-date gain solidifies gold as a top safe-haven during uncertainty, supported by central bank activity.

- Bitcoin’s oversold signals: Historic RSI lows and a massive deviation from the 20-week moving average suggest an impending reversal.

- Market rotation potential: Investors should watch for Bitcoin breaking $94,000, which could trigger capital shifts and renewed growth.

Conclusion

In the ongoing Bitcoin vs Gold saga of 2025, gold’s surge to $4,282 per ounce amid rate cut expectations contrasts with Bitcoin’s consolidation at $86,000, raising questions about safe-haven preferences and digital asset resilience. Experts like Ray Youssef and Michaël van de Poppe highlight historical patterns pointing to a likely rotation back to Bitcoin, bolstered by on-chain data and institutional flows. As 2026 nears, with pivotal events like the Bank of Japan meeting on December 19 potentially influencing liquidity, investors are advised to monitor these dynamics closely for opportunities in both assets.

Comments

Other Articles

Oil Prices Surge 3% After Trump Cancels Iran Meetings and Promises Protesters ‘Help Is on the Way’ – What It Means for Bitcoin

January 13, 2026 at 05:49 PM UTC

Bitcoin Surges to $93,888: How Venezuela-US Tensions Triggered a Crypto Rally

January 5, 2026 at 07:04 AM UTC

Bitcoin (BTC) Eyes Short-Term Bottom Rebound as On-Chain Flows Align with USDC/USDT Premium and Market Liquidity, but Bearish Longer-Term Outlook Persists

January 1, 2026 at 03:41 PM UTC