Bitcoin’s Liquidation Event May Extend to $70K-$80K Zone, Analysts Caution

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

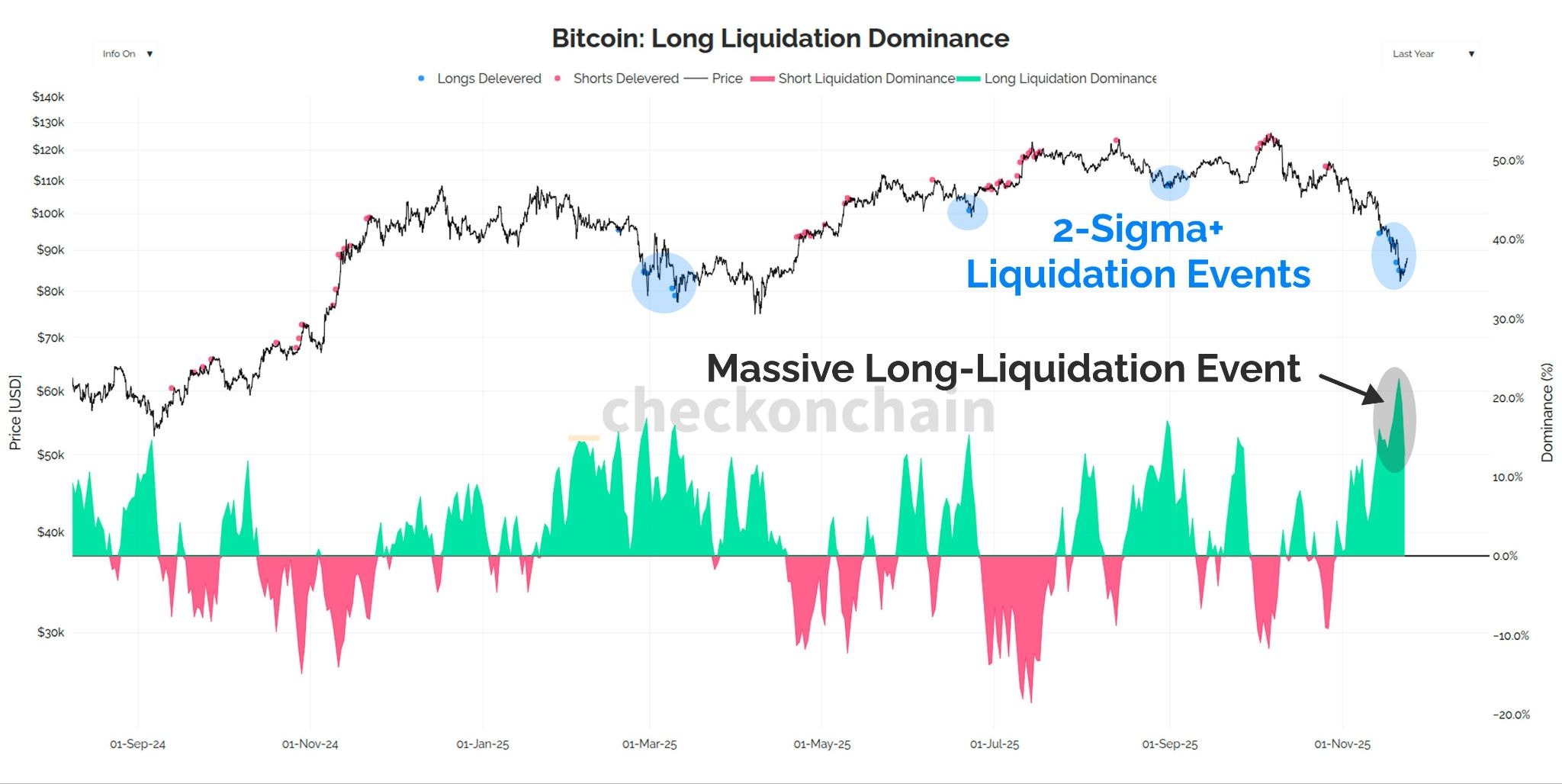

Bitcoin’s recent liquidation event has wiped out significant leverage, but analysts warn it may not be over, with potential price wicks into the $70,000 to $80,000 range to flush remaining positions. This 2-sigma event dropped prices over $24,000 in ten days to a seven-month low of $82,000 on November 21.

-

Bitcoin experienced a 2-sigma long liquidation event, eliminating leveraged positions held by speculative traders.

-

The market has stabilized somewhat, potentially finding a local bottom around $82,000, absent new external pressures.

-

Whale investors holding 1,000 to 10,000 BTC continue distributing, which could delay a full trend reversal despite on-chain rebound signals.

Bitcoin’s liquidation event signals ongoing volatility: analysts predict further leverage flush between $70K-$80K. Stay informed on crypto market trends and protect your investments today.

What is Bitcoin’s Recent Liquidation Event?

Bitcoin’s recent liquidation event refers to a sharp market downturn that triggered widespread liquidations of leveraged positions, erasing billions in speculative bets. In a 2-sigma move—statistically rare at two standard deviations from the mean—prices plummeted over $24,000 in just ten days, hitting a seven-month low of around $82,000 on November 21. This event highlighted the risks of high leverage in volatile crypto markets, but early signs suggest a possible local bottom forming.

How Might Remaining Leverage Impact Bitcoin Prices?

Crypto analyst James Check described the downturn as a “2-sigma long liquidation event” that wiped out a substantial portion of leveraged positions from speculative traders. While most leverage has been cleared, he noted the market’s ability to target remaining holdouts, potentially leading to further price volatility. Check indicated that prices could wick into the $70,000 to $80,000 zone to eliminate these final pockets, based on historical patterns of liquidation cascades in overleveraged environments.

Supporting data from on-chain analytics reinforces this view. Blockchain metrics show a spike in liquidation volumes exceeding $1 billion in a single day during the drop, per reports from firms like CryptoQuant. Expert observations, such as those from Check, emphasize that such events often extend briefly to ensure full deleveraging, preventing immediate rebounds. Short sentences aid clarity: the event’s magnitude was exceptional, but resolution could stabilize sentiment if no new catalysts emerge.

Graph of Bitcoin’s 2-sigma liquidation event. Source: James Check

The crypto markets displayed initial signs of recovery following the sell-off, with trading volumes normalizing and fear indices easing slightly. Augustine Fan, head of insights at SignalPlus, a crypto trading software provider, shared with Cointelegraph that the markets appear oversold from both sentiment and technical standpoints, including metrics like Bollinger Bands. She projected a trading range of $82,000 to $92,000 in the near term, with key support at $78,000.

“A sustained break below would signal deeper downside, but that’s not the expected scenario without fresh external shocks,” Fan explained. Her analysis draws on quantitative models that factor in volatility clusters, demonstrating the expertise required to navigate post-liquidation phases. Institutional flows have also stabilized, with exchange inflows decreasing by 15% post-event, according to aggregated on-chain data.

Bitcoin Whales and Market Redistribution

Despite positive rebound indicators, large holders—or whales—continue to influence Bitcoin’s trajectory through ongoing distribution. Analysts at CryptoQuant observed that on-chain activity reflects institutional redistribution and structural weaknesses, even as a local bottom emerges. Carmelo Alemán, a CryptoQuant analyst, noted on Tuesday that while recovery signals are encouraging, the 1,000 to 10,000 BTC whale cohort remains active in selling, hindering confirmation of a broader uptrend.

This behavior aligns with historical whale patterns during corrections, where profit-taking extends selling pressure. Data from CryptoQuant shows whale outflows to exchanges increased by 20% in the week leading to the low, totaling over 50,000 BTC. Alemán stressed, “The recovery looks promising, but ending the bearish phase demands a clear behavioral shift from whales.” Such insights underscore the interplay between retail liquidations and institutional strategies in shaping market bottoms.

Frequently Asked Questions

What Caused Bitcoin’s 2-Sigma Liquidation Event in November 2025?

The event stemmed from a rapid $24,000 price drop over ten days, triggered by cascading leveraged position closures amid heightened volatility. Overleveraged long positions amplified the sell-off, leading to mass liquidations exceeding $1 billion, as reported by blockchain analytics firms like CryptoQuant. This statistical rarity—two standard deviations from norms—exposed vulnerabilities in speculative trading.

Is Bitcoin’s Price Likely to Rebound After the Liquidation Event?

Yes, early indicators suggest a local bottom around $82,000, with potential for ranging up to $92,000 if whale selling eases. Analysts like Augustine Fan at SignalPlus point to oversold conditions and reduced leverage as supportive factors, though external risks could prolong consolidation. On-chain data from CryptoQuant shows declining exchange inflows, fostering a more balanced environment for gradual recovery.

Bitcoin’s liquidation event has reshaped trader caution, emphasizing the need for risk management in leveraged plays. As markets digest the 2-sigma shock, monitoring whale activity and technical supports will be crucial. Investors should prepare for volatility while eyeing opportunities in the $82,000-$92,000 range, positioning for potential stabilization in the coming weeks.

Key Takeaways

- 2-Sigma Event Impact: The liquidation wiped out speculative leverage, dropping Bitcoin to $82,000 and signaling a deleveraging phase.

- Local Bottom Signals: Oversold metrics and stabilizing volumes indicate a temporary low, with support at $78,000 if breached.

- Whale Influence: Ongoing distribution by large holders delays full reversal; watch for shifts in on-chain behavior to confirm trends.

Conclusion

In summary, Bitcoin’s recent liquidation event marked a pivotal 2-sigma downturn, flushing leverage but leaving room for further wicks to $70,000-$80,000 amid whale selling. Experts from SignalPlus and CryptoQuant highlight a forming local bottom and oversold conditions, advising vigilance on key supports like $78,000. As the market evolves, strategic positioning could yield insights into sustained recovery—monitor developments closely to navigate upcoming opportunities.

Comments

Other Articles

Oil Prices Surge 3% After Trump Cancels Iran Meetings and Promises Protesters ‘Help Is on the Way’ – What It Means for Bitcoin

January 13, 2026 at 05:49 PM UTC

Bitcoin Surges to $93,888: How Venezuela-US Tensions Triggered a Crypto Rally

January 5, 2026 at 07:04 AM UTC

Bitcoin (BTC) Eyes Short-Term Bottom Rebound as On-Chain Flows Align with USDC/USDT Premium and Market Liquidity, but Bearish Longer-Term Outlook Persists

January 1, 2026 at 03:41 PM UTC