Bitcoin’s Mild Rebound Signals Potential Upside Amid Extreme Market Fear

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

The crypto market today experienced a mild rebound, with Bitcoin retesting $88,000 and Ethereum surpassing $2,800, driven by $50 billion in inflows mostly into BTC. However, extreme fear persists, and altcoin participation remains low, indicating cautious sentiment among investors.

-

Crypto market today inflows reached $50 billion, with 60% directed to Bitcoin, signaling a BTC-dominated recovery.

-

The Altcoin Season Index fell to 39, showing limited altcoin momentum despite the overall uptick.

-

The Fear and Greed Index rose slightly to 12 but stays in extreme fear territory, with 95% of liquidations from long positions.

Crypto market today: Bitcoin rebounds to $88K amid $50B inflows, but extreme fear and low altcoin activity signal caution. Explore bullish whale trends and ETF interest for potential upside. Stay informed on market shifts.

What is happening in the crypto market today?

Crypto market today saw a modest recovery as Bitcoin approached $88,000, prompting discussions on whether this marks a bottom or if downward pressure lingers. Ethereum also gained ground, moving above $2,800, while overall market capitalization increased slightly. This rebound reflects selective buying interest but highlights ongoing caution due to concentrated inflows and persistent fear indicators.

How are inflows shaping the crypto market today?

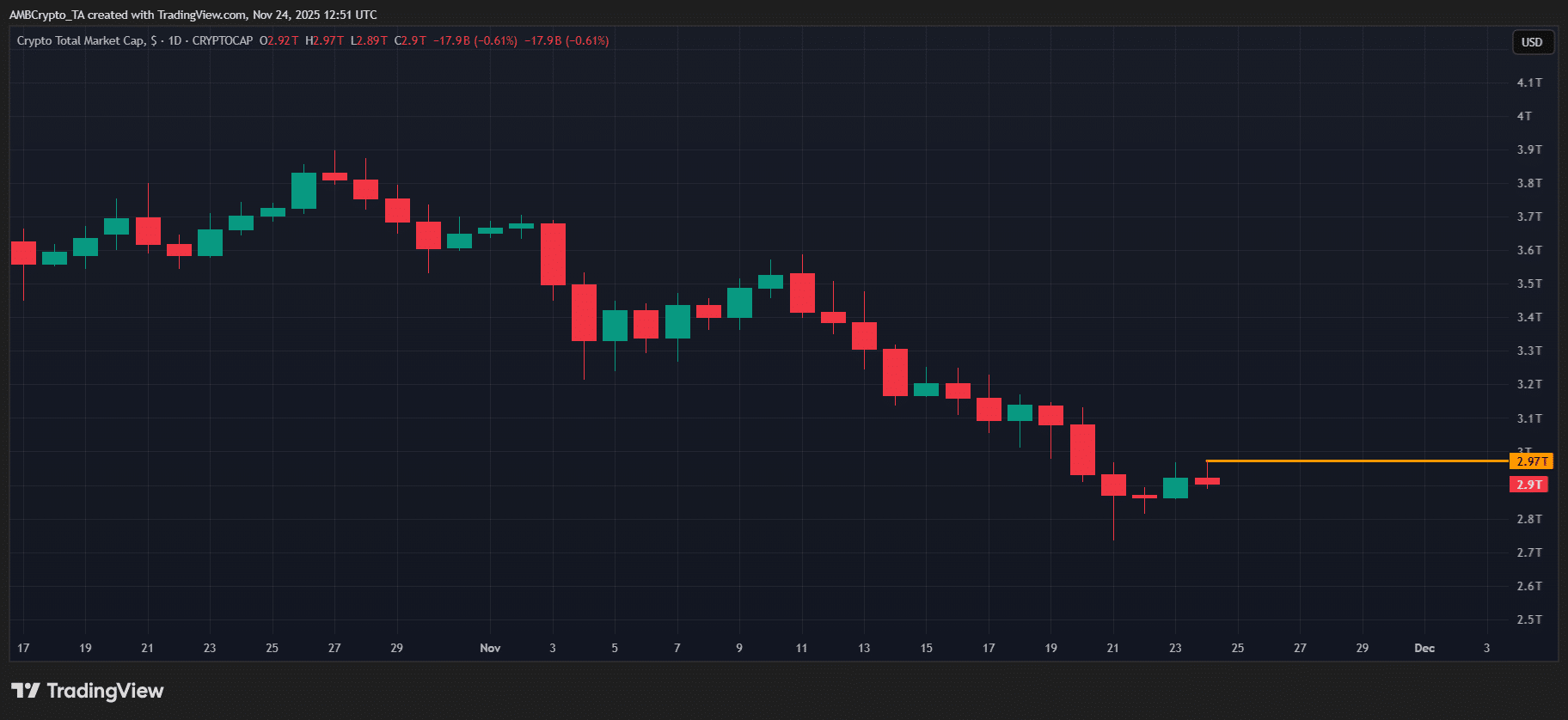

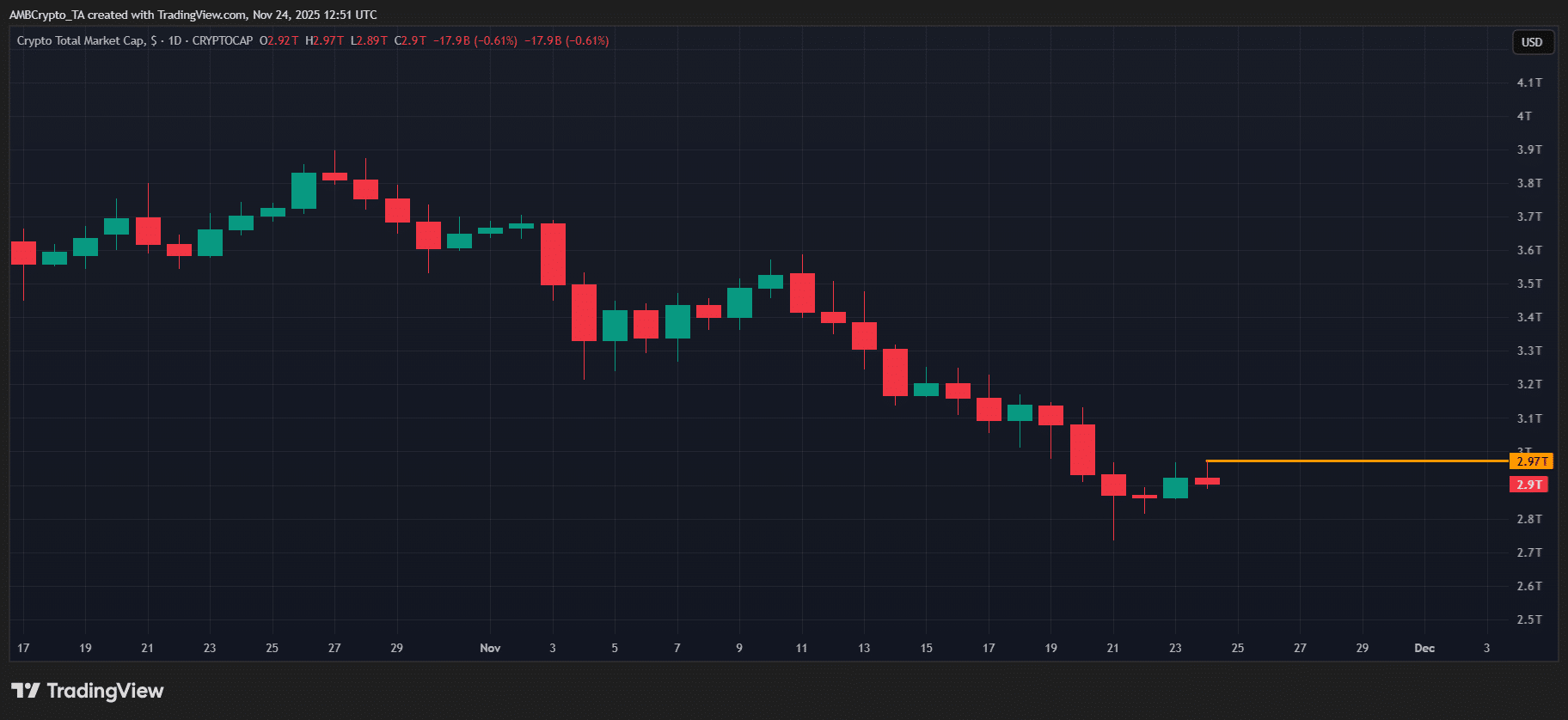

In the last 24 hours, the crypto market today attracted approximately $50 billion in capital, predominantly flowing into Bitcoin at around $30 billion, which accounts for 60% of the total. This dominance underscores a BTC-led cycle, where traders prioritize the leading cryptocurrency over altcoins. As a result, the Altcoin Season Index declined by 3 points to 39, indicating subdued participation from alternative assets. The TOTAL market index dipped 0.38% during the day, suggesting the recovery lacks broad support and a true bottom may not be in place yet.

Source: TradingView (TOTAL/USDT)

Market participation remains restrained, as evidenced by actions from major players. BlackRock transferred 2,822 BTC and 36,000 ETH to Coinbase Prime, actions interpreted as aggressive selling by institutions. Exchange-traded fund inflows for both Bitcoin and Ethereum remained stagnant, pointing to a lack of enthusiasm from large-scale investors. According to data from CryptoQuant, the Fear and Greed Index improved marginally by 2 points to 12, yet it lingers in the extreme fear zone. This aligns with trading dynamics, where 95% of 24-hour liquidations targeted long positions, reflecting heightened risk aversion.

Are there signs of optimism in the crypto market today?

While caution dominates, the crypto market today displayed pockets of positive momentum. Institutional developments, such as Grayscale’s filings for Dogecoin and XRP exchange-traded funds, bolstered investor confidence in the broader digital asset space. A leading market analyst, citing on-chain metrics, dismissed notions of an impending market peak, emphasizing sustained accumulation trends.

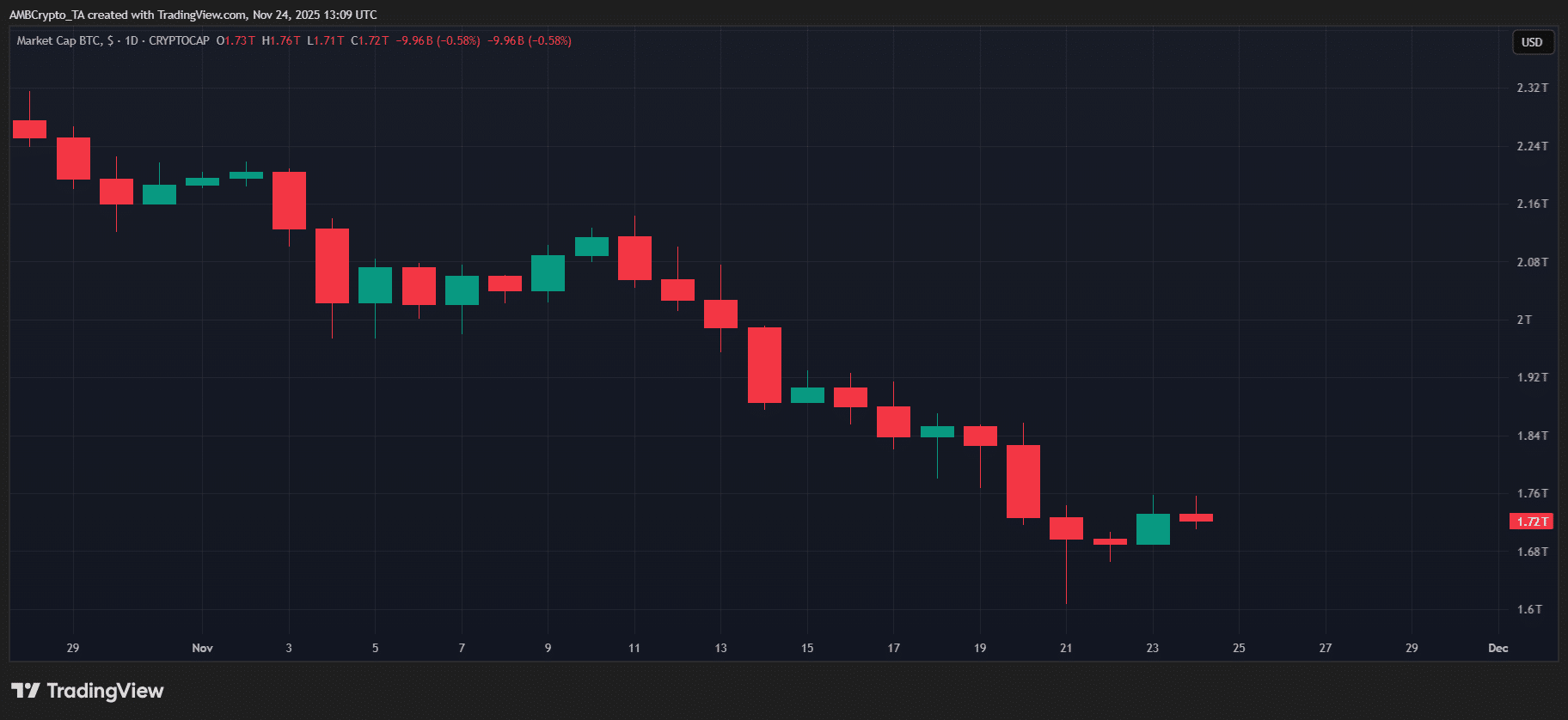

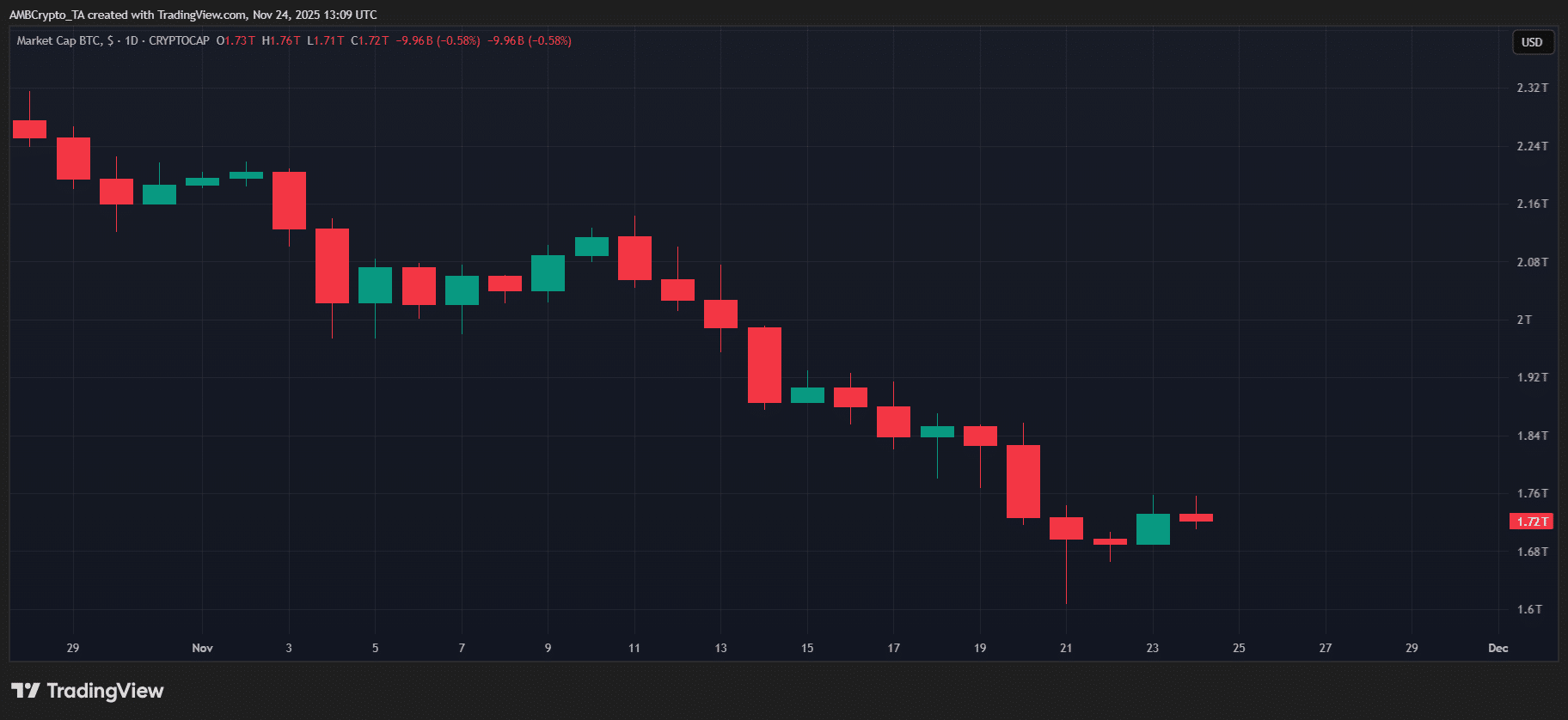

Exchange data reveals that 560,000 BTC were withdrawn from centralized platforms, reducing reserves to their lowest in eight years. Additionally, the number of whale addresses holding more than 10,000 BTC reached a five-month peak. These movements suggest that accumulation persists even amid a defensive market posture, providing underlying support for prices.

Source: TradingView (BTC/USDT)

The recovery in the crypto market today relied on strong bid support at key levels, preventing deeper declines. Nevertheless, the absence of robust institutional drivers, BTC-centric inflows, elevated fear levels, and a declining Altcoin Season Index indicate that widespread capital deployment is not yet underway. This environment keeps sophisticated investors observing rather than committing fully.

Looking ahead, the crypto market today offers a mixed picture: hope from rebounding prices and accumulation signals, tempered by structural caution. Sources like Glassnode and Santiment confirm these on-chain trends, with experts such as those from Fidelity Digital Assets noting that ETF developments could catalyze further interest. While a definitive bottom remains elusive, the foundational bullish elements persist, positioning the market for potential growth without an immediate top in view.

Frequently Asked Questions

What are the main drivers of the crypto market today rebound?

The primary drivers include $50 billion in 24-hour inflows, with heavy emphasis on Bitcoin, alongside whale accumulation that reduced exchange reserves to eight-year lows. Institutional ETF filings for assets like Dogecoin and XRP also contributed, fostering selective optimism amid broader caution.

Is the crypto market today entering a bull phase?

While Bitcoin’s retest of $88,000 and Ethereum’s climb above $2,800 suggest upward momentum, the extreme fear reading on the Fear and Greed Index at 12 and stagnant altcoin performance indicate it’s more of a pause than a full bull entry. Monitor inflows for confirmation.

Key Takeaways

- BTC-Dominated Inflows: $30 billion of $50 billion total poured into Bitcoin, reinforcing its leadership in the crypto market today and limiting altcoin gains.

- Persistent Caution: Extreme fear at 12 on the index and 95% long liquidations highlight risk aversion, with institutional selling like BlackRock’s transfers adding pressure.

- Bullish Undercurrents: Whale holdings at five-month highs and 560k BTC off exchanges signal accumulation; ETF interest in DOGE/XRP points to future potential—consider positioning for upside.

Conclusion

In summary, the crypto market today balanced a mild rebound with underlying caution, as Bitcoin and Ethereum recovered key levels amid BTC-heavy inflows and whale activity. Secondary indicators like stagnant altcoin momentum and extreme fear underscore the need for broader participation. As institutional interest in ETFs grows, per insights from sources like Bloomberg, the outlook remains constructive—investors should watch for sustained catalysts to drive the next phase of growth.