Bitcoin’s Post-Quantum Migration Could Take 5-10 Years, Experts Say

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Migrating Bitcoin to post-quantum standards will take at least 5-10 years due to its decentralized protocol, which poses a unique collective action problem compared to centralized systems, as noted by Bitcoin core developer Jameson Lopp. Quantum computers do not pose a near-term threat, but preparation is essential.

-

Bitcoin’s upgrade to quantum resistance requires coordinated effort across its distributed network.

-

Experts like Jameson Lopp emphasize that thoughtful protocol changes and fund migrations could span 5-10 years.

-

Current quantum advancements show no immediate risk, with estimates indicating viable threats may not emerge until well beyond 2030, per industry analyses.

Explore the quantum threat to Bitcoin and why migration to post-quantum standards may take 5-10 years. Learn expert insights from Jameson Lopp on preparation strategies for BTC’s future security. Stay informed on crypto evolution today.

How Long Will It Take for Bitcoin to Achieve Quantum Resistance?

Bitcoin quantum resistance involves upgrading the network’s cryptographic protocols to withstand potential attacks from quantum computers, a process estimated to take at least 5-10 years according to Bitcoin core developer Jameson Lopp. This timeline accounts for the complexities of altering a decentralized protocol through consensus among nodes worldwide. Preparation must begin now to ensure a smooth transition without disrupting the network’s integrity.

Bitcoin is a decentralized software protocol that has a collective action problem, unlike centralized companies, according to Jameson Lopp.

Migrating Bitcoin (BTC) to post-quantum standards will take at least 5-10 years, according to Bitcoin core developer and co-founder of crypto custody company Casa, Jameson Lopp, who weighed in on the ongoing quantum computer debate.

Lopp agreed with Adam Back, the CEO of crypto infrastructure company Blockstream, that there is no near-term threat to Bitcoin from quantum computers. Lopp said in an X post.

“Quantum computers won’t break Bitcoin in the near future. We’ll keep observing their evolution. Yet, making thoughtful changes to the protocol and an unprecedented migration of funds could easily take 5 to 10 years.

Source: Jameson Lopp

We should hope for the best, but prepare for the worst,” he added. In a separate post, he said the Bitcoin protocol is more challenging to upgrade to post-quantum standards than centralized software because of its distributed consensus model.

What Challenges Does Bitcoin Face in Upgrading to Post-Quantum Cryptography?

The primary challenge lies in Bitcoin’s decentralized nature, requiring broad consensus from miners, developers, and users to implement changes without central authority. Unlike centralized systems that can deploy updates swiftly, Bitcoin’s upgrades demand rigorous testing and adoption phases to avoid forks or vulnerabilities. Jameson Lopp highlights that this collective action problem could extend the timeline significantly, with estimates from cryptographic experts suggesting 5-10 years for full migration. Supporting data from quantum research institutions indicates that current quantum hardware, such as IBM’s systems, lacks the qubits needed to break elliptic curve cryptography used in Bitcoin signatures. Pierre Rochard, a Bitcoin maximalist, notes that quantum-resistant solutions are feasible but require coordinated funding from non-profits and venture capitalists. Industry reports from sources like the National Institute of Standards and Technology (NIST) emphasize the need for standardized post-quantum algorithms, such as lattice-based cryptography, which Bitcoin could integrate via soft forks. Samson Mow, CEO of JAN3, adds skepticism about quantum capabilities, stating they struggle with basic factoring without specialized algorithms. Despite these hurdles, ongoing developments in blockchain security demonstrate proactive measures, ensuring Bitcoin’s long-term resilience against emerging computational threats.

The debate over the quantum threat and possible solutions continues to be a major topic of discussion in the Bitcoin community, with a growing schism between Bitcoin maximalists, who urge caution in prompting changes to the protocol, and venture capitalists (VCs), who say the quantum threat is imminent.

Related: Blockchains quietly prepare for quantum threat as Bitcoin debates timeline

Bitcoin OGs, Developers and Whales Clash with Venture Capitalists

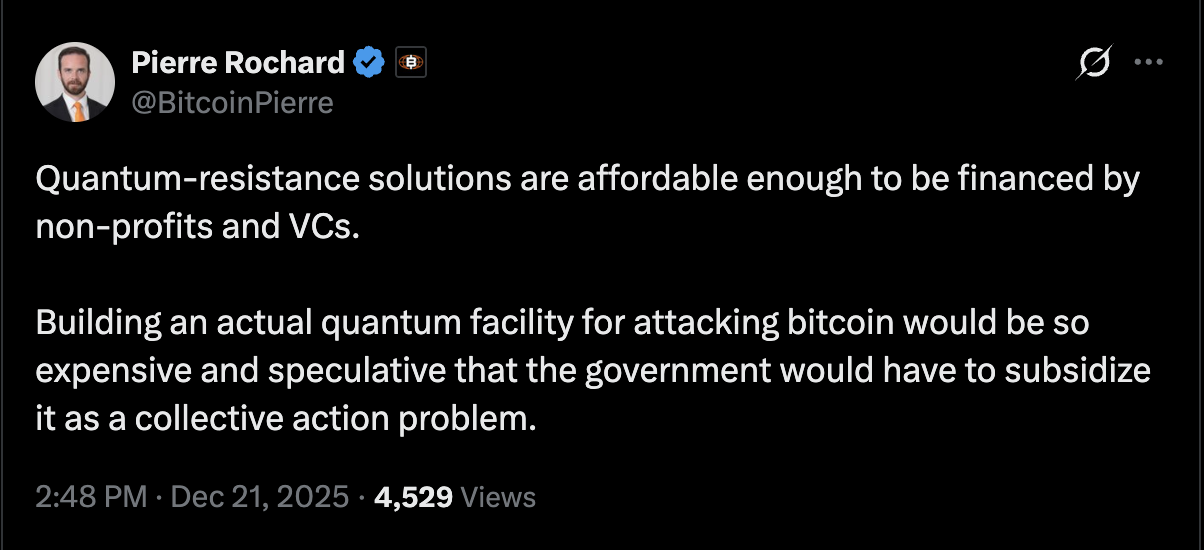

“Quantum-resistance solutions are affordable enough to be financed by non-profits and VCs,” Bitcoin maximalist Pierre Rochard said.

Rochard added that it would be so expensive to attack Bitcoin through quantum computers that the government would be forced to “subsidize it as a collective action problem.”

Source: Pierre Rochard

Samson Mow, a Bitcoin investor and CEO of wallet company and advocacy group JAN3, also cast doubt on the ability of a quantum computer to crack Bitcoin’s security.

“In reality, quantum computers can’t factor the number 21 — not 21 million — 21, without heavy customization to the algorithm,” Mow said.

Despite this, venture capitalists and other investment firms warn that BTC’s price is being impacted by the threat, or perceived threat, from quantum computers.

The price of BTC could dip below $50,000 if the protocol is not quantum-ready by 2028, according to Charles Edwards, the founder of digital asset investment fund Capriole.

Edwards called for Bitcoin node operators to enforce Bitcoin Improvement Proposal (BIP) 360, which introduces a quantum-ready signature scheme for BTC.

Magazine: Quantum attacking Bitcoin would be a waste of time: Kevin O’Leary

Frequently Asked Questions

Is There an Imminent Quantum Threat to Bitcoin Wallets?

No, there is no imminent quantum threat to Bitcoin wallets, as current quantum computers lack the computational power to break ECDSA signatures effectively. Experts like Jameson Lopp and Adam Back confirm that viable threats are years away, allowing time for protocol upgrades. Monitoring advancements remains key to proactive security measures.

How Can Bitcoin Prepare for Future Quantum Computing Risks?

Bitcoin can prepare for quantum risks by developing and implementing post-quantum cryptographic algorithms through community-driven proposals like BIP 360. Node operators and developers should collaborate on testing quantum-resistant signatures, such as those based on hash functions or lattice cryptography. This gradual migration ensures network stability while addressing potential vulnerabilities in a spoken, natural way for voice queries.

Key Takeaways

- Decentralized Challenges: Bitcoin’s upgrade process faces unique hurdles due to its consensus model, extending timelines to 5-10 years for quantum resistance.

- Expert Consensus: Figures like Jameson Lopp and Pierre Rochard agree on no near-term threats but stress preparation through non-profit funding.

- Market Implications: Venture capitalists warn of price dips if unprepared, urging adoption of proposals like BIP 360 for enhanced security.

Conclusion

The discussion on Bitcoin quantum resistance underscores the need for balanced preparation amid differing views from maximalists and investors. With experts like Jameson Lopp advocating for a measured 5-10 year migration to post-quantum standards, the community can fortify BTC against future threats. As quantum technology evolves, staying vigilant will safeguard Bitcoin’s role as a secure digital asset—consider engaging with protocol development to contribute to its resilient future.

Comments

Other Articles

Oil Prices Surge 3% After Trump Cancels Iran Meetings and Promises Protesters ‘Help Is on the Way’ – What It Means for Bitcoin

January 13, 2026 at 05:49 PM UTC

Bitcoin Surges to $93,888: How Venezuela-US Tensions Triggered a Crypto Rally

January 5, 2026 at 07:04 AM UTC

Bitcoin (BTC) Eyes Short-Term Bottom Rebound as On-Chain Flows Align with USDC/USDT Premium and Market Liquidity, but Bearish Longer-Term Outlook Persists

January 1, 2026 at 03:41 PM UTC