Bitcoin’s Potential Post-Christmas Bounce Amid Q4 Losses and Fading Demand

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

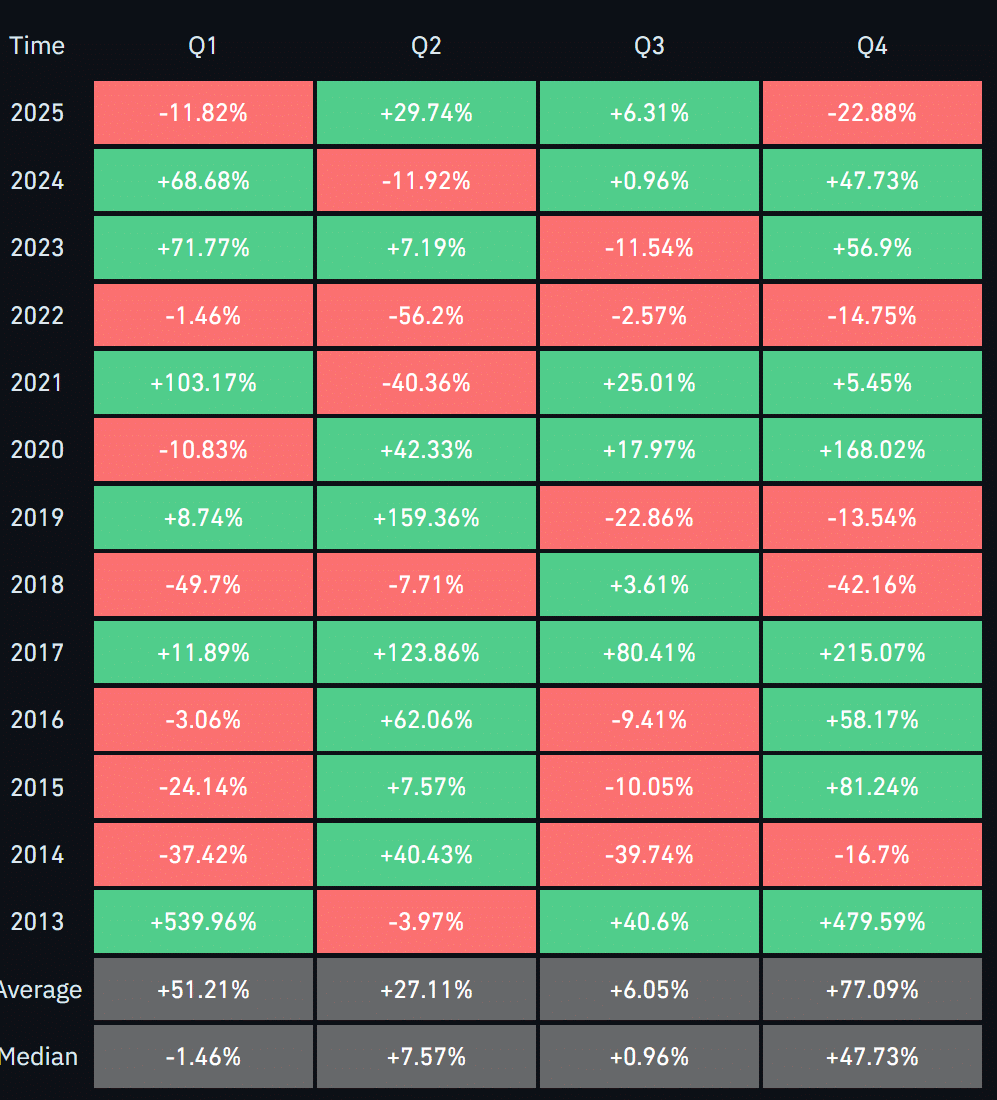

Bitcoin’s Q4 2025 performance has declined by 22.8% so far, marking the second-worst quarterly showing in its history and reinforcing holiday season losses above $85,000. Despite bearish pressures, options data suggests potential volatility and a possible post-Christmas bounce amid easing downside positioning.

-

Bitcoin faces Christmas blues with a 22.8% Q4 drop, consolidating above $85K.

-

Broader assets like gold outperformed with 69% yearly gains, while Bitcoin lagged at a 5% annual loss.

-

Options expiry on December 26 could trigger swings, with upside calls at $100K indicating tentative rally optimism; demand slowdown raises longer-term bearish risks.

Explore Bitcoin’s challenging Q4 2025 performance and potential post-Christmas recovery amid volatility. Discover key market insights for informed decisions. Stay updated on crypto trends today.

What is Bitcoin’s Q4 2025 Performance?

Bitcoin’s Q4 2025 performance has been notably weak, with the cryptocurrency posting a 22.8% decline so far this quarter, positioning it as the second-worst Q4 in its historical record. This downturn has amplified the so-called Christmas blues, as Bitcoin consolidates its losses just above the $85,000 mark. In comparison to other assets, gold has shone brightly with 69% annual gains, underscoring Bitcoin’s underperformance at a 5% yearly loss across major categories.

Market observers note that this quarter’s struggles stem from a combination of reduced investor appetite and broader economic uncertainties. Historical data from platforms like CoinGlass highlights how such seasonal pressures often lead to range-bound trading, but underlying metrics suggest the current consolidation may not persist indefinitely. As the year-end approaches, attention turns to upcoming events that could influence trajectory.

Will Bitcoin Experience a Post-Christmas Bounce in 2025?

Analysts from the crypto trading desk QCP indicate that thin liquidity during the Christmas holiday, coupled with a significant options expiry on December 26, 2025, could heighten volatility in Bitcoin’s price. They observe that downside positioning has moderated, with open interest in $85,000 puts decreasing, while calls at $100,000 remain steady, hinting at cautious optimism for a Santa rally.

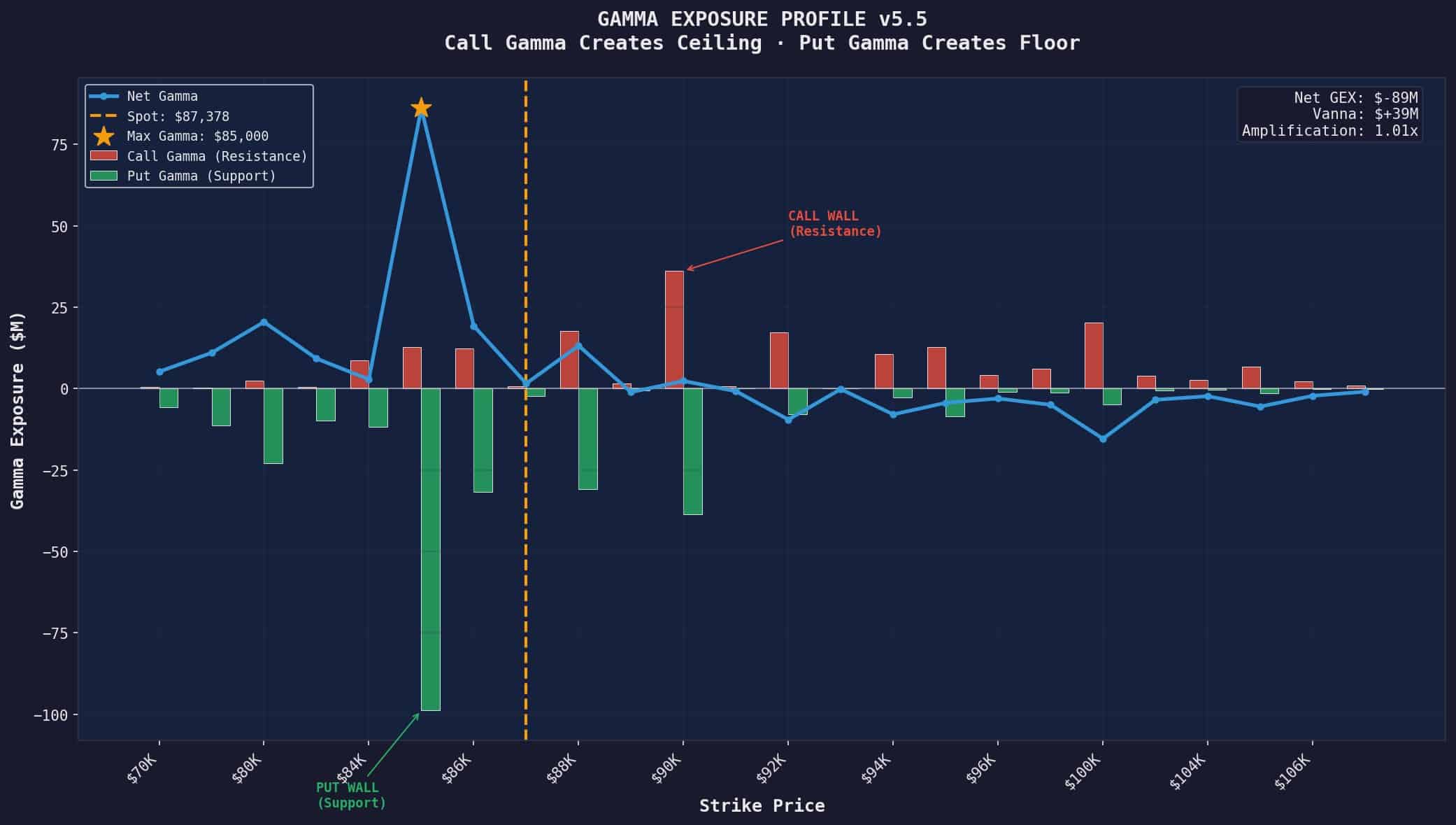

Options analyst David, sharing insights on X, projects a potential explosive upside following Christmas Day. He describes current market dynamics as “choppy until Christmas, followed by a potential explosive move once the pin is released,” pointing to large players maintaining price pins between $85,000 and $90,000 through substantial gamma exposure estimated at $300 million. This setup, involving put walls for bearish bets and call walls for bullish ones, could lead to a breakout post-expiry on Boxing Day.

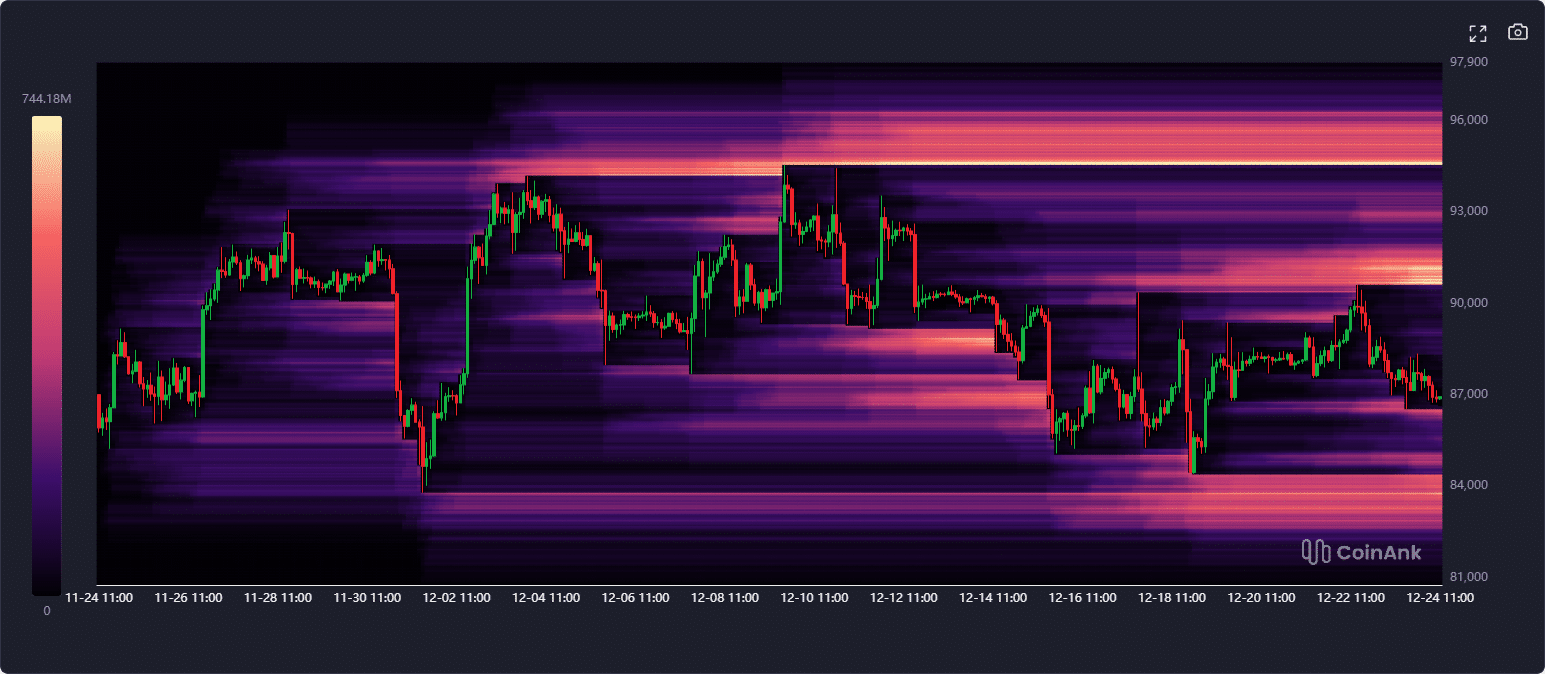

Liquidation heatmaps further support this view, revealing concentrated upside liquidity from short positions at $90,000 and $95,000, alongside downside levels at $84,000. Such configurations often result in sharp swings toward these thresholds, as evidenced by past cycles where similar imbalances triggered rapid price movements. Data from CoinAnk illustrates these pools, emphasizing the risk of wild fluctuations as holiday trading resumes.

Bitcoin is on track to post the second-worst Q4 performance in history. So far in Q4 2025, the crypto asset has declined by 22.8%, reinforcing Christmas blues as it consolidates losses above $85k.

Source: CoinGlass

Bearish sentiment has eased somewhat, yet markets may stay range-bound through December 31, 2025. QCP’s analysis aligns with historical patterns where year-end expiries often catalyze shifts, though sustained momentum would require renewed buying interest. Expert commentary underscores that while short-term upside exists, structural factors warrant vigilance.

Frequently Asked Questions

What Factors Are Driving Bitcoin’s Weak Q4 2025 Performance?

Bitcoin’s Q4 2025 performance is pressured by seasonal liquidity dips, profit-taking after earlier gains, and comparisons to outperforming assets like gold, which saw 69% annual returns. Declines of 22.8% this quarter reflect broader investor caution, with consolidation above $85,000 signaling potential stabilization before year-end catalysts.

How Might Options Expiry Affect Bitcoin Price After Christmas 2025?

The December 26, 2025, options expiry could unleash volatility in Bitcoin’s price, potentially breaking the current $85,000 to $90,000 range. With $300 million in gamma exposure and liquidity pools at key levels like $90,000 and $84,000, analysts anticipate sharp moves—upward if calls dominate, or downward if puts prevail—ideal for voice searches on market swings.

Key Takeaways

- Second-Worst Q4 on Record: Bitcoin’s 22.8% decline in Q4 2025 highlights holiday blues and underperformance versus gold’s 69% gains.

- Volatility from Options Expiry: December 26 event may trigger a breakout, supported by easing bearish positioning and $100,000 call interest.

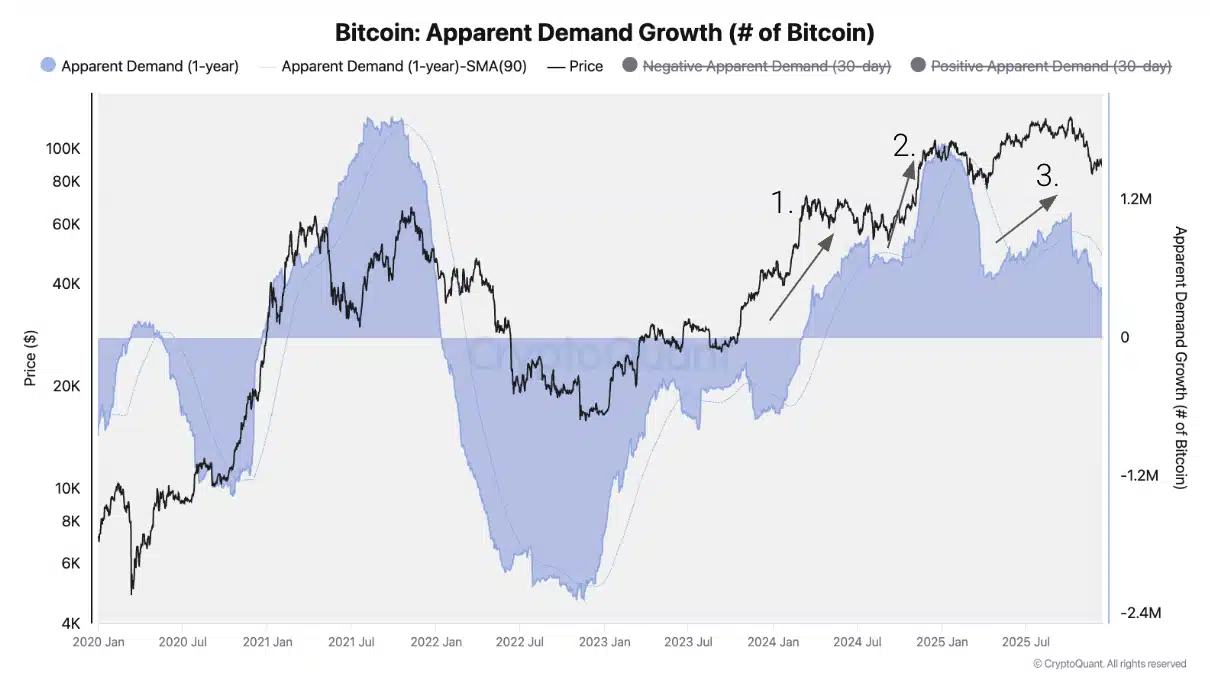

- Demand Slowdown Risks: CryptoQuant warns of contracting demand, potentially leading to a bear market bottom at $56,000 with near-term support at $70,000.

In fact, across broader asset categories, gold was the best performer, with 69% annual gains, while Bitcoin was the worst performer, with a 5% loss.

A potential BTC bounce post-Christmas?

According to the crypto trading desk, QCP, the Christmas holiday’s thin liquidity and the massive Options expiry on the 26th of December, would trigger volatility. But QCP analysts were slightly optimistic and added,

“Downside positioning has eased as 85k Put open interest drifts lower, while 100k Calls persist, pointing to tentative Santa rally optimism.”

The firm also highlighted that bearish sentiment has eased, but the markets could still remain range-bound until the 31st of December.

However, Options analyst David projected an explosive upside move after Christmas Day.

“Expect chop until Christmas, followed by a potential explosive move once the pin is released.”

Source: David/X

David highlighted that big players were pinning price between $85K-$90K via put wall (bearish bets) and call wall (bullish bets), translating to $300 million in gamma exposure.

However, after the expiry on Boxing Day, BTC could potentially break out of its range.

A similar positioning was painted by liquidation heatmaps. Upside liquidity pools (short positions) were concentrated at $90K and $95K, while downside positions were at $84K.

This suggested potential wild swings that could tag these levels.

Source: CoinAnk

BTC demand has evaporated

That being said, CryptoQuant cautioned that BTC’s demand has contracted and could usher in deeper bear market capitulation. Part of the analytics firm’s report read,

“The demand growth entered a slowdown period since early October and is now growing below trend. As such, we believe most of this cycle’s demand growth has passed, with the corresponding bearish effect on price.”

Source: CryptoQuant

CryptoQuant added that BTC’s bear market could bottom out at $56k with immediate support at $70K, citing historical data.

Conclusion

Bitcoin’s Q4 2025 performance underscores a challenging quarter with 22.8% losses and evaporating demand, potentially signaling deeper bear market capitulation toward $56,000. Yet, post-Christmas options dynamics offer hope for a volatility-driven bounce beyond the $85,000-$90,000 range. As markets evolve, investors should monitor liquidity shifts and support levels closely for strategic positioning into 2026.

Comments

Other Articles

Oil Prices Surge 3% After Trump Cancels Iran Meetings and Promises Protesters ‘Help Is on the Way’ – What It Means for Bitcoin

January 13, 2026 at 05:49 PM UTC

Bitcoin Surges to $93,888: How Venezuela-US Tensions Triggered a Crypto Rally

January 5, 2026 at 07:04 AM UTC

Bitcoin (BTC) Eyes Short-Term Bottom Rebound as On-Chain Flows Align with USDC/USDT Premium and Market Liquidity, but Bearish Longer-Term Outlook Persists

January 1, 2026 at 03:41 PM UTC