Bitcoin’s Potential Rebound Hinges on $89,400 and $82,400 Support Levels

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Bitcoin’s potential rebound hinges on key support levels at $89,400 and $82,400, amid heightened market fear with the Fear & Greed Index at 15. Spot retail investors have accumulated $1.119 billion since Monday, including a record $668 million single-day buy, signaling underlying bullish activity despite the decline to around $89,000.

-

On-chain metrics pinpoint $89,400 (True Mean Value) and $82,400 (Active Realized Price) as critical supports for Bitcoin rebound.

-

Market fear has surged, with the Fear & Greed Index dropping to 15, the lowest since September 9.

-

Spot investors bought $668 million in Bitcoin on Monday, the largest daily accumulation this year, per exchange data.

Explore Bitcoin rebound signals amid fear: Key supports at $89,400 and $82,400, plus $1.1B spot buys. Discover on-chain insights and liquidity drivers for potential recovery. Stay informed on BTC trends.

What Signals a Potential Bitcoin Rebound in Current Market Conditions?

Bitcoin rebound possibilities emerge from on-chain data and investor behavior, even as the asset trades near $89,000 following a sharp decline. Key support zones identified by analysts like Joao Wedson at the True Mean Value of $89,400 and Active Realized Price of $82,400 could halt further drops and spark recovery, similar to patterns observed in 2021. Despite the Fear & Greed Index signaling extreme fear at 15, substantial spot buying indicates resilient demand.

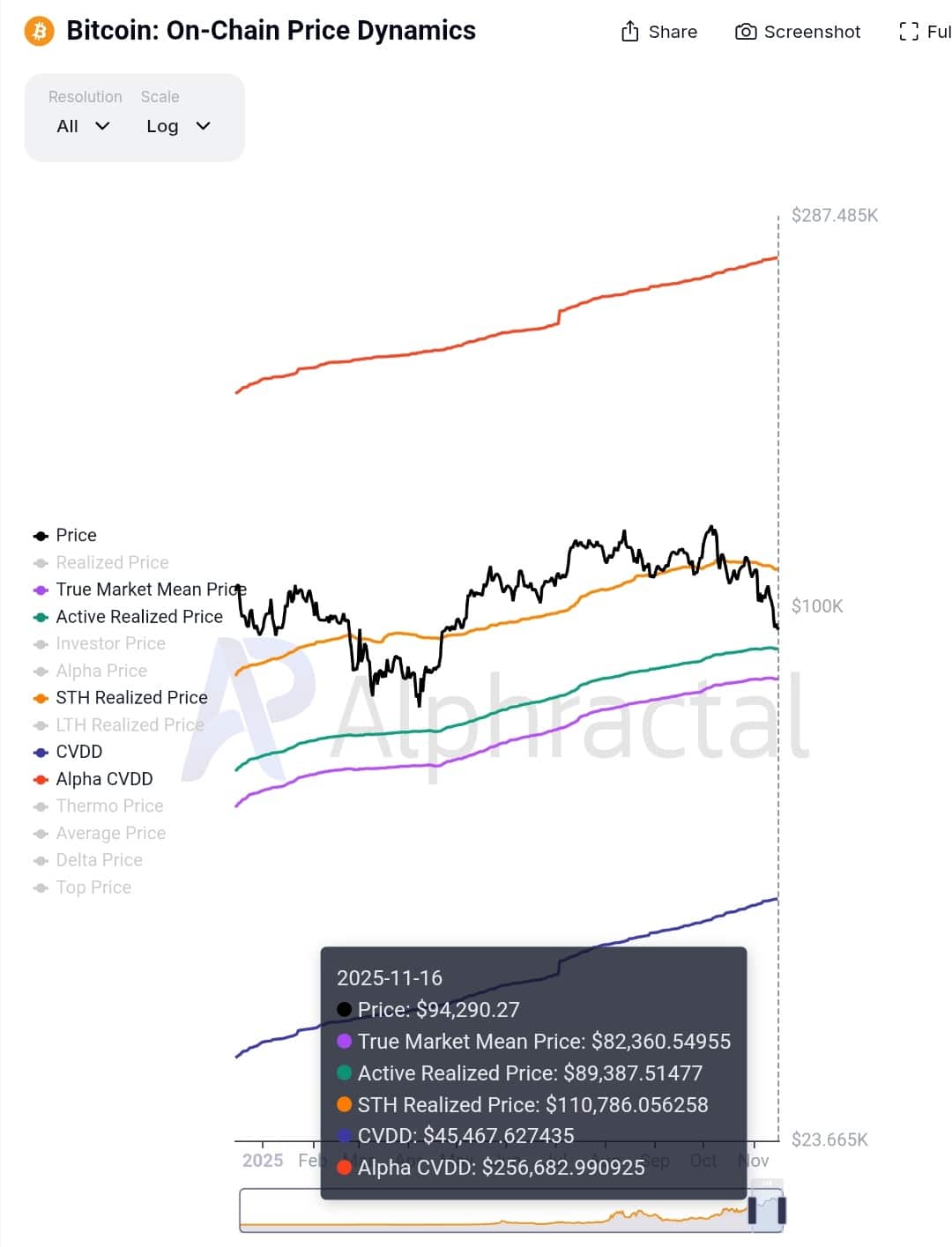

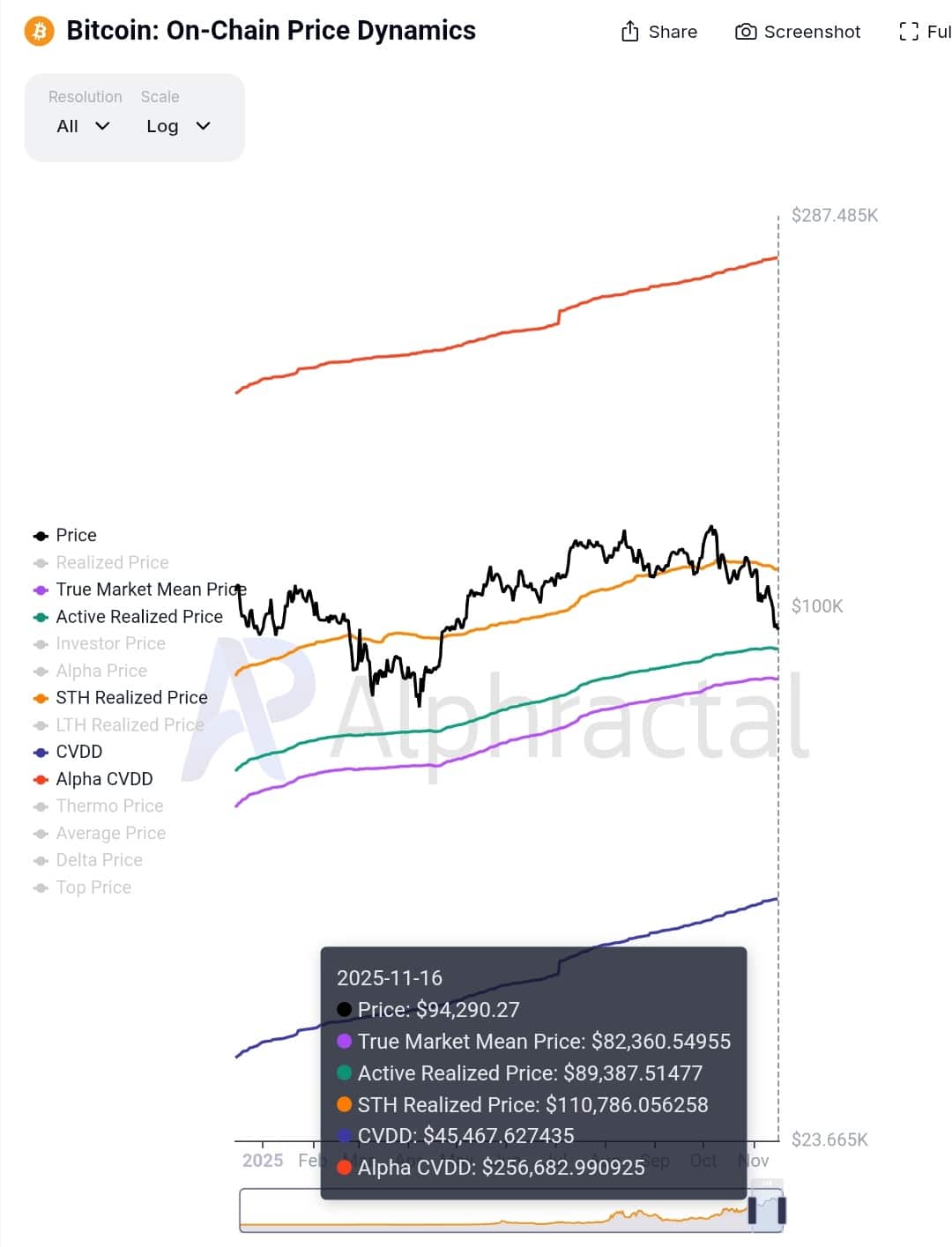

How Do On-Chain Metrics Support a Bitcoin Rebound?

On-chain analysis reveals structured support for a Bitcoin rebound. The True Mean Value at $89,400 represents an average cost basis for long-term holders, while the Active Realized Price at $82,400 reflects recent transaction values, both serving as psychological and technical floors. Crypto analyst Joao Wedson, drawing from historical data, emphasizes these levels as potential rebound triggers, noting Bitcoin’s recovery from comparable supports in 2021 to reach new highs. Current price action near $89,000 suggests proximity to the upper threshold, where buying pressure could intensify if held. Exchange inflows and holder accumulation further bolster this view, with data from platforms like Glassnode showing reduced selling from long-term wallets. Wedson cautions the setup’s fragility, advising measured entry points. Supporting statistics indicate that in past cycles, breaches below these metrics led to 20-30% rebounds within weeks, underscoring their reliability without guaranteeing outcomes.

A Bullish Recovery in Place?

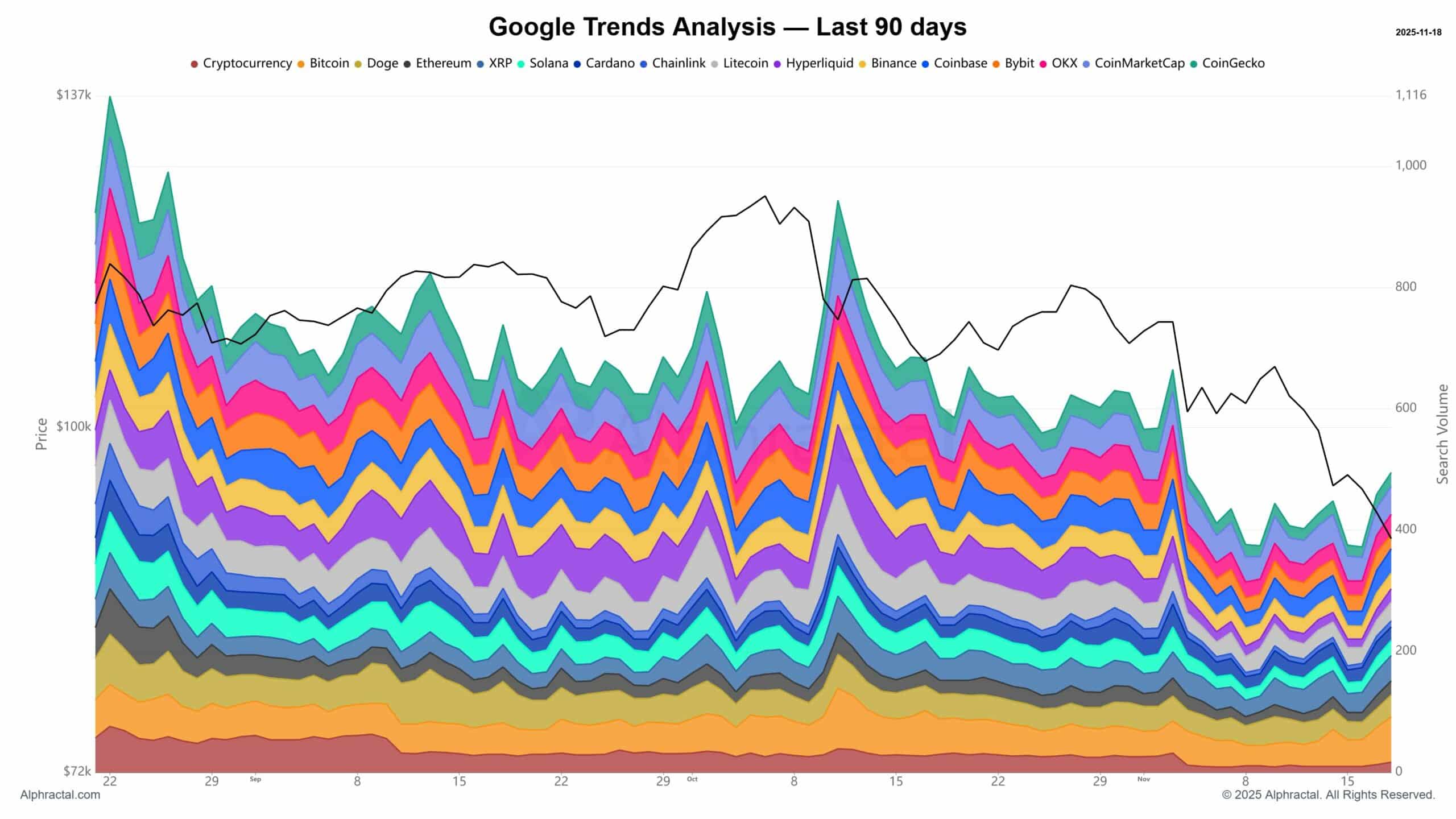

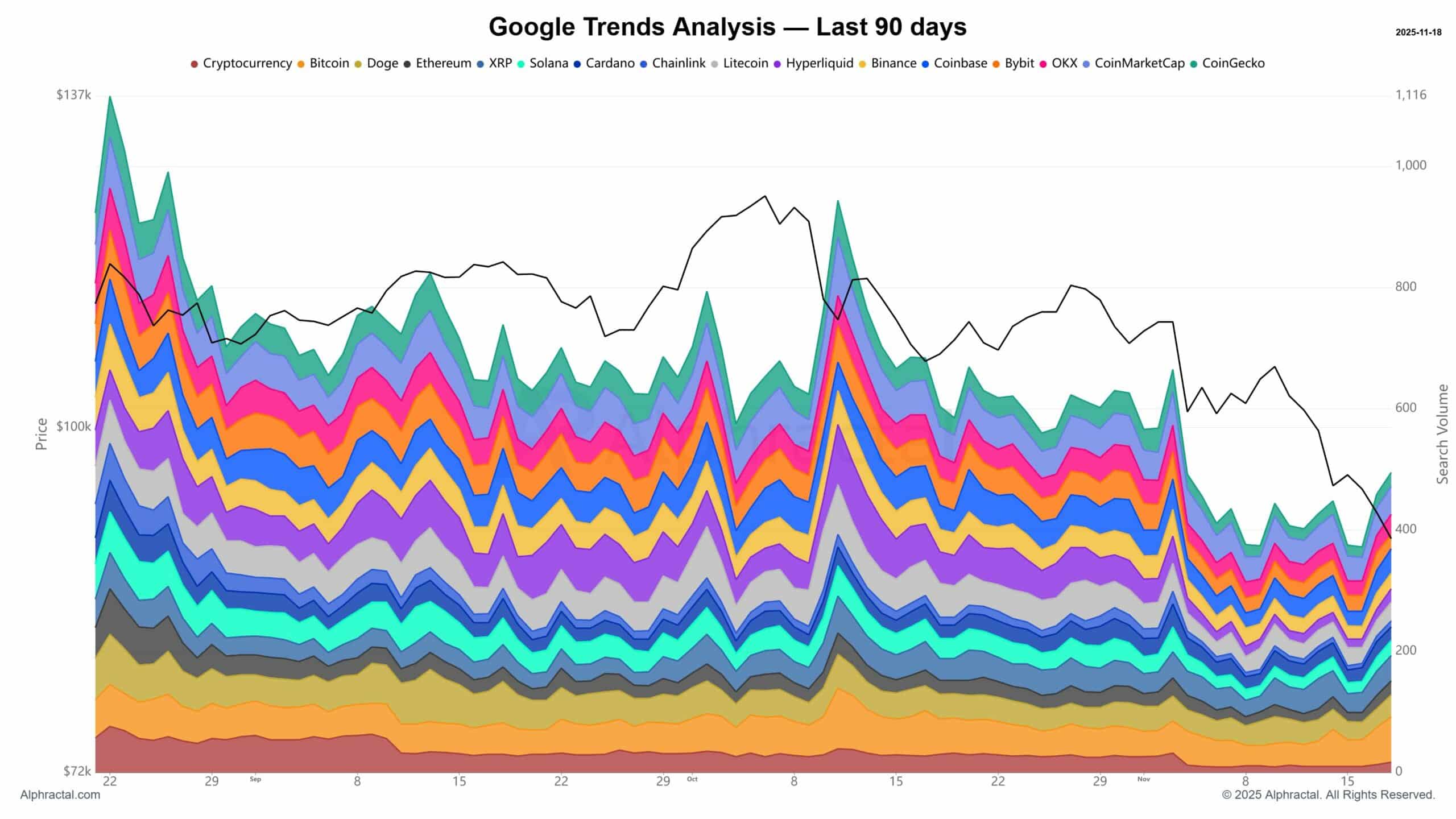

Despite the pervasive bearish narrative, emerging data points to foundational elements for a Bitcoin rebound. The asset’s descent below $92,000 has amplified concerns of a broader bear market, yet on-chain indicators and investor flows tell a more nuanced story. Public interest, as tracked by Google Trends, has hit lows not seen since June, potentially reducing noise and allowing dedicated capital to drive prices. This shift mirrors historical patterns where diminished retail frenzy preceded institutional-led rallies.

Analyst insights from sources like Alphractal highlight the importance of liquidity dynamics. Bitcoin’s current valuation around $89,000 positions it delicately between support and resistance, with volatility metrics showing elevated but stabilizing swings. In 2021, similar conditions preceded a 50% surge from support levels, providing a factual precedent for current watchers.

Source: Alphracatal

If Bitcoin maintains above $89,400, upward momentum could build toward $96,000, where historical order clusters provide additional fuel. Market participants should monitor these thresholds closely, as they represent confluence of technical and fundamental factors.

Market Requires Liquidity

Liquidity remains a cornerstone for any Bitcoin rebound, influencing price discovery amid fluctuating sentiment. The Fear & Greed Index at 15 underscores extreme caution, yet this environment often precedes contrarian opportunities. Data from on-chain trackers like CryptoQuant reveal that while overall search interest wanes, targeted accumulation by spot traders persists, injecting vital capital.

Since early Monday, spot retail investors have added $1.119 billion to their Bitcoin holdings, with Monday’s $668.72 million marking the year’s peak single-day purchase. This activity, reported by exchange analytics, contrasts with derivatives-driven volatility and suggests a base-building phase. Historically, such spot inflows during fear periods have correlated with 15-25% price appreciations within a month, based on data from 2022 and 2023 cycles.

Broader market liquidity, including from institutional desks, could amplify this if volatility eases. Current conditions, with Bitcoin below $92,000 but above key supports, position liquidity providers to stabilize the asset. Expert views from firms like Glassnode affirm that sustained spot buying reduces downside risk, fostering conditions for recovery.

Source: Alphracatal

Derivatives liquidity, meanwhile, acts as a catalyst, with open interest rising 5% week-over-week per CoinGlass reports. This balance between spot stability and leveraged activity could propel Bitcoin toward recovery if fear subsides.

A Path to Rally

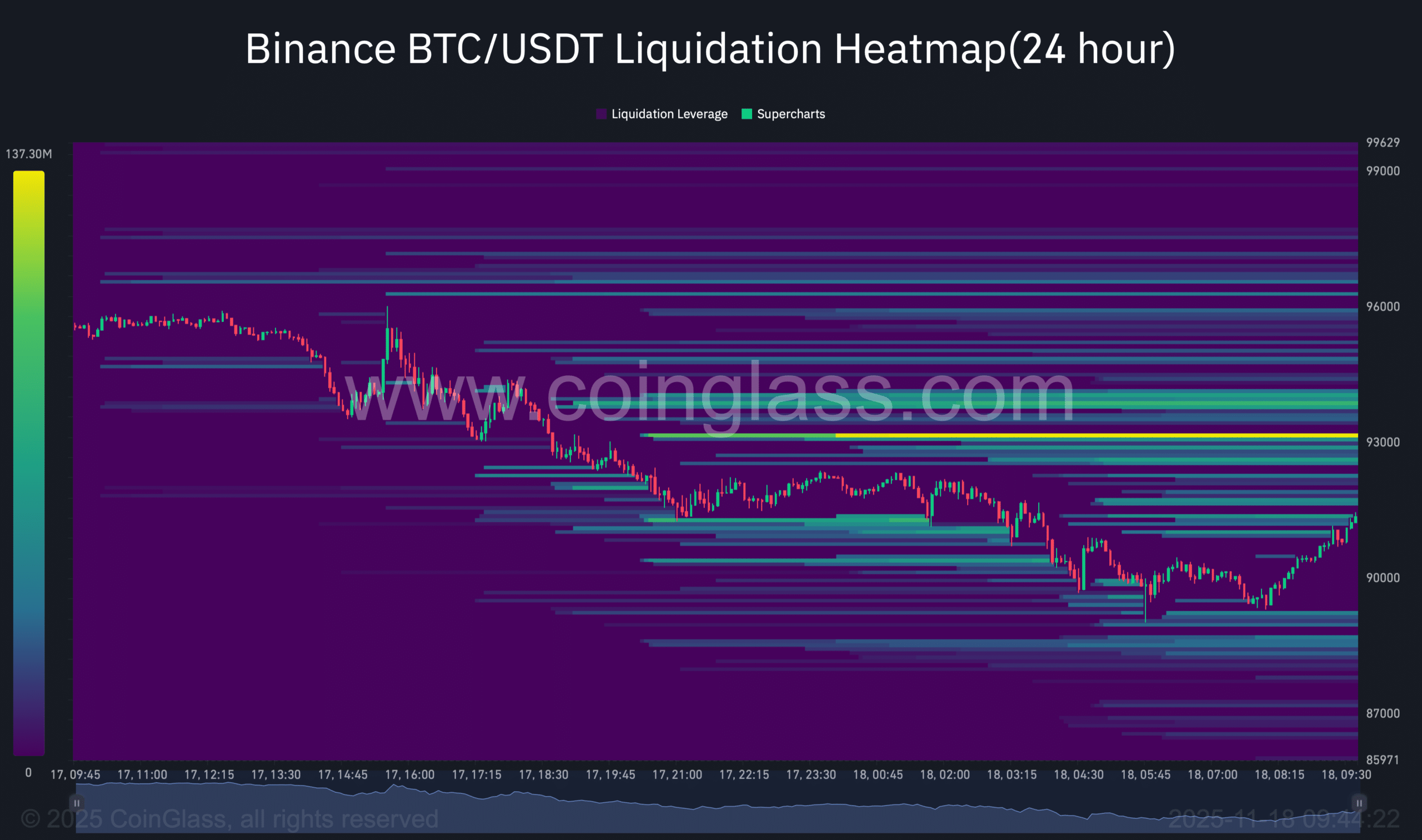

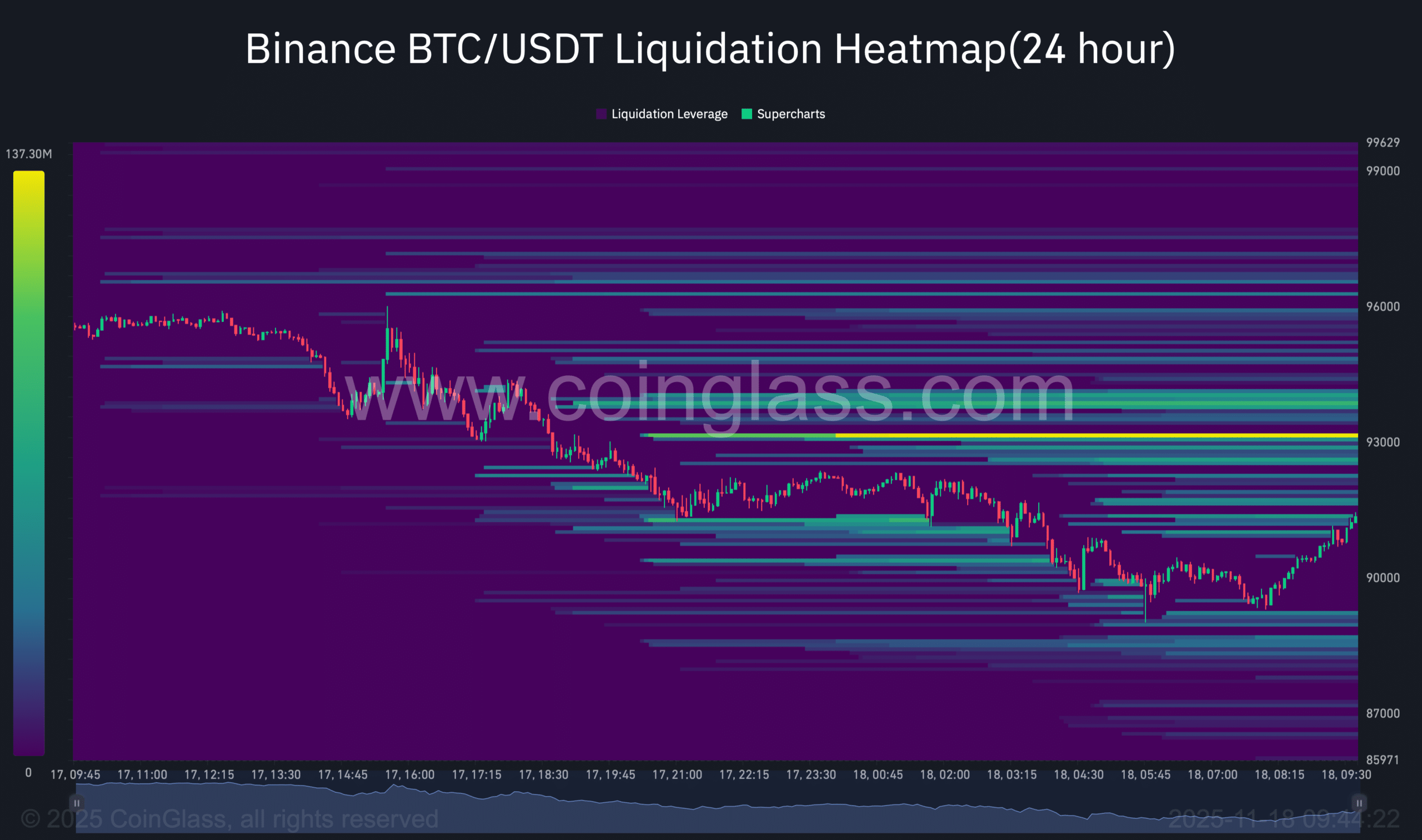

Visualization tools like liquidation heatmaps offer a roadmap for Bitcoin’s potential trajectory. These maps cluster high-leverage positions, creating gravitational pulls toward liquidation zones that drive short-term movements. In the current setup, upward clusters near $96,000 suggest a bullish bias, aligning with spot accumulation trends.

The heatmap from CoinGlass indicates dense liquidity above current levels, where cascading liquidations of short positions could fuel a rally. With Bitcoin at $89,000, a break above $92,000 might initiate this process, targeting $96,000 initially. Historical data shows that in 2024, similar heatmap alignments preceded a 12% weekly gain. Sustained momentum could then challenge $100,000, though resistance from prior highs remains a hurdle. Analysts stress monitoring volume, as rising spot demand alongside derivatives unwinds enhances rebound probability. This data-driven approach underscores the market’s interconnected liquidity layers.

Source: CoinGlass

Overall, the path forward integrates these elements, with liquidity and on-chain supports as primary drivers. Investors tracking these will gain clearer visibility into rebound prospects.

Frequently Asked Questions

What Are the Key Support Levels for a Bitcoin Rebound Right Now?

The primary supports for a Bitcoin rebound are $89,400, based on the True Mean Value, and $82,400, from the Active Realized Price. These levels, analyzed by experts like Joao Wedson, have historically acted as rebound catalysts, as seen in 2021. Holding above them could prevent deeper declines and encourage buying.

Why Are Spot Investors Buying Bitcoin Amid High Market Fear?

Spot investors are accumulating Bitcoin during this fear phase because it presents value opportunities at lower prices. With $668 million bought on Monday alone—the year’s largest single-day total—they’re building positions expecting a recovery. This behavior, visible in exchange data, often precedes price stabilization and aligns with on-chain accumulation trends.

Key Takeaways

- On-Chain Supports Drive Rebound Potential: Metrics like $89,400 and $82,400 serve as critical floors, with historical rebounds from similar levels providing factual backing.

- Spot Buying Signals Resilience: $1.119 billion in accumulations since Monday, including a record daily high, counters fear and bolsters liquidity.

- Liquidity Heatmaps Point Upward: Targets near $96,000 and $100,000 emerge from order clusters, offering a structured path if momentum holds.

Conclusion

In summary, despite the Bitcoin rebound facing headwinds from a Fear & Greed Index at 15 and a drop to $89,000, on-chain supports at $89,400 and $82,400, coupled with robust spot buying, lay groundwork for recovery. Insights from analysts like Joao Wedson and data from sources such as Alphractal and CoinGlass highlight liquidity’s role in navigating volatility. As market dynamics evolve, monitoring these indicators will be essential; investors may find strategic entry points ahead, positioning for potential gains in the coming months.

Comments

Other Articles

Oil Prices Surge 3% After Trump Cancels Iran Meetings and Promises Protesters ‘Help Is on the Way’ – What It Means for Bitcoin

January 13, 2026 at 05:49 PM UTC

Bitcoin Surges to $93,888: How Venezuela-US Tensions Triggered a Crypto Rally

January 5, 2026 at 07:04 AM UTC

Bitcoin (BTC) Eyes Short-Term Bottom Rebound as On-Chain Flows Align with USDC/USDT Premium and Market Liquidity, but Bearish Longer-Term Outlook Persists

January 1, 2026 at 03:41 PM UTC