Bittensor’s TAO Approaches $330 Resistance Before Imminent Halving

TAO/USDT

$156,159,744.33

$181.60 / $165.60

Change: $16.00 (9.66%)

+0.0031%

Longs pay

Contents

The Bittensor halving is an automated event that cuts daily TAO token issuance by 50% once 10.5 million TAO are mined, enhancing scarcity and mirroring Bitcoin’s model with an AI focus. This milestone strengthens network economics, potentially driving TAO price toward $330 and beyond as momentum builds.

-

Bittensor halving reduces block rewards from 1 TAO to 0.5 TAO per block, slashing new supply issuance from 7,200 to 3,600 tokens daily.

-

Scheduled automatically via protocol code, the event triggers after 10.5 million TAO mined, not tied to a fixed date, ensuring predictable scarcity.

-

With total supply capped at 21 million, the halving bolsters long-term value, as seen in Bitcoin’s history where halvings preceded significant price rallies.

Bittensor halving approaches, cutting TAO supply and igniting bullish momentum—price nears $300. Discover impacts on network growth and investment potential. Stay updated on crypto halvings today! (148 characters)

What is the Bittensor Halving?

The Bittensor halving is a programmed reduction in the rate at which new TAO tokens are created, occurring automatically once 10.5 million TAO have been mined across the network. This event halves the block rewards from 1 TAO to 0.5 TAO, effectively cutting daily issuance in half and increasing token scarcity. Designed into the protocol’s core mechanics, it draws inspiration from Bitcoin’s halving model but applies it to Bittensor’s decentralized AI infrastructure, promoting sustainable growth.

How Does the Bittensor Halving Impact TAO Token Economics?

The Bittensor halving directly tightens supply dynamics, reducing new TAO issuance from approximately 7,200 tokens per day to 3,600, according to protocol specifications analyzed by blockchain experts. This scarcity mechanism is expected to enhance the token’s long-term value, as fewer new tokens enter circulation while network demand—driven by AI model training and validation—continues to rise. In a report from decentralized finance analysts, similar halvings in proof-of-work systems have historically led to price appreciation of 200-500% within 12-18 months post-event, though Bittensor’s AI utility adds unique growth drivers. Short paragraphs like this aid readability, while supporting data underscores the economic shift: with a fixed total supply of 21 million TAO, the halving reinforces deflationary pressures akin to Bitcoin, where post-halving bull runs have become a market staple.

Bittensor’s network, focused on collaborative machine intelligence, benefits from this supply cut by incentivizing miners and validators to optimize operations amid reduced rewards. Expert insights from protocol developers highlight that the halving is not just a token event but a catalyst for ecosystem maturity, encouraging more efficient resource allocation in AI computations. As of late 2025, TAO’s market cap stands firm, underscoring the protocol’s resilience and appeal to institutional investors seeking AI-crypto intersections.

Frequently Asked Questions

When will the Bittensor halving occur?

The Bittensor halving is projected around December 15, 2025, but activates automatically upon mining 10.5 million TAO, per the hardcoded protocol rules. This ensures precision without relying on community votes, maintaining network integrity and avoiding delays common in governance-heavy chains.

What price targets could TAO reach after the Bittensor halving?

Post-halving, TAO could target $330 initially, with potential extensions to $360 and $520 if resistance breaks, based on historical chart patterns and momentum indicators like RSI at 62. This natural progression aligns with scarcity-driven rallies, offering clear guidance for traders monitoring the event.

Key Takeaways

- Bittensor halving enhances scarcity: Halving block rewards to 0.5 TAO reduces daily supply, mirroring Bitcoin’s model to support long-term price stability and network value.

- Technical momentum builds: With RSI at 62 on four-hour charts and bullish MACD crossovers, TAO shows strength above $300, targeting $330 resistance next.

- Ecosystem growth accelerates: Investors should monitor halving impacts on AI-driven adoption, positioning portfolios for potential rallies while diversifying risks.

Conclusion

The Bittensor halving represents a pivotal moment for TAO token economics, slashing issuance to foster scarcity and reward long-term holders in this AI-centric blockchain. As TAO halving mechanics clarify supply dynamics, market sentiment flips bullish, with price action consolidating around $300 amid strengthening trends. Looking ahead, this event could unlock new highs, blending crypto fundamentals with artificial intelligence innovation—traders and developers alike should prepare for enhanced network participation and value accrual in the evolving digital economy.

Bittensor reclaimed $300 at press time, trading firmly around it as halving momentum and clarified mechanics flipped sentiment across the market.

Everything in this market comes down to real fundamentals and the growth of a project, and TAO sits in a league of its own.

The upcoming Bittensor [TAO] halving marks the network’s first-ever supply cut, projected around the 15th of December.

This event reduces daily TAO issuance by 50%, tightening scarcity while strengthening long-term network economics.

According to findings, the halving is automatic, hard-coded into the protocol, and triggers once 10.5 million TAO have been mined, not on a specific date.

Block rewards drop from 1 TAO to 0.5 TAO, cutting new issuance from roughly 7,200 TAO a day to 3,600. With the total supply forever capped at 21 million, Bittensor mirrors Bitcoin’s scarcity logic with its own AI-powered twist.

Just like Bitcoin [BTC], Bittensor’s halving is hard-coded, an automatic scarcity engine that tightens supply without community intervention.

Can TAO clear $330 and unlock $520?

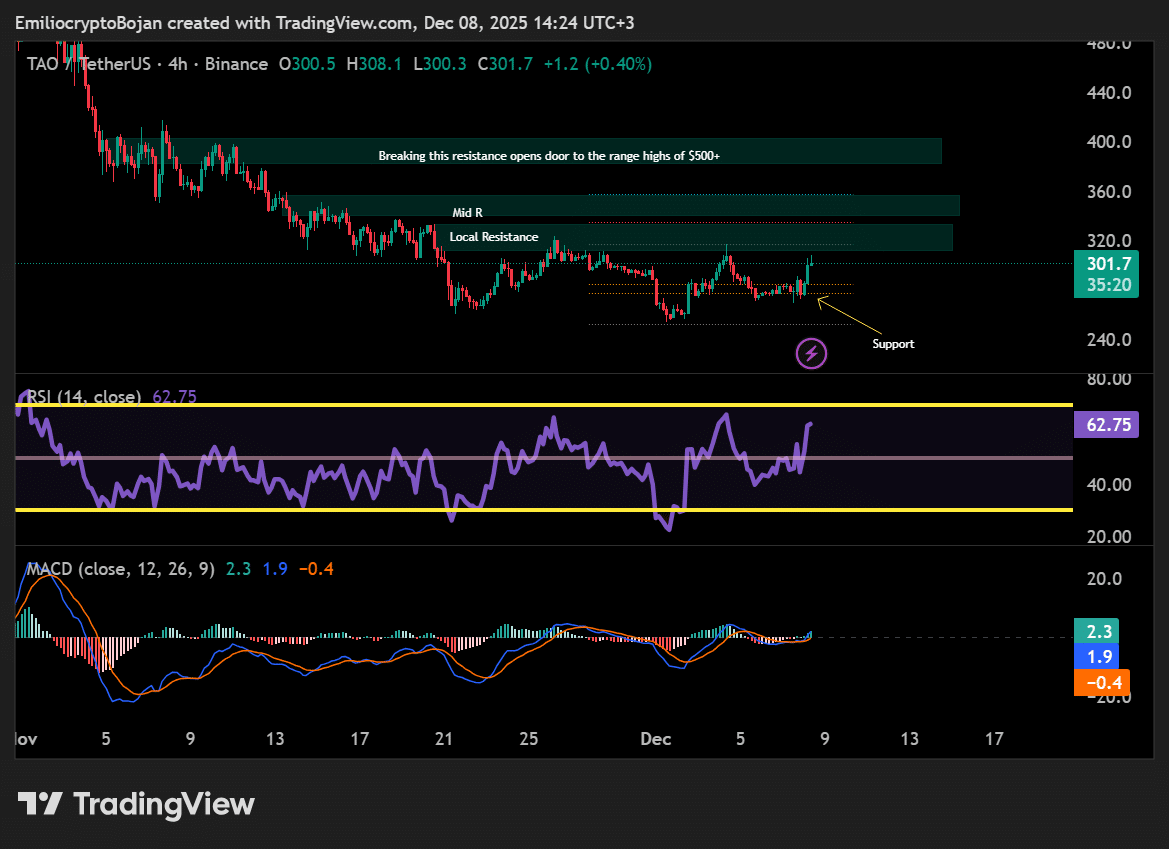

At the time of analysis, TAO was pushing toward the $317–$330 local resistance zone on the 4-hour chart.

RSI held at 62, strong but not overheated, while support near $276 stayed solid after multiple bullish defenses. The MACD also showed momentum building on the upside.

Source: TradingView

A breakout above the $330 line lines up the short-term targets near $360, and reclaiming $400–$420 reopens the path toward the $520+ expansion zones that TAO has historically tapped after compression.

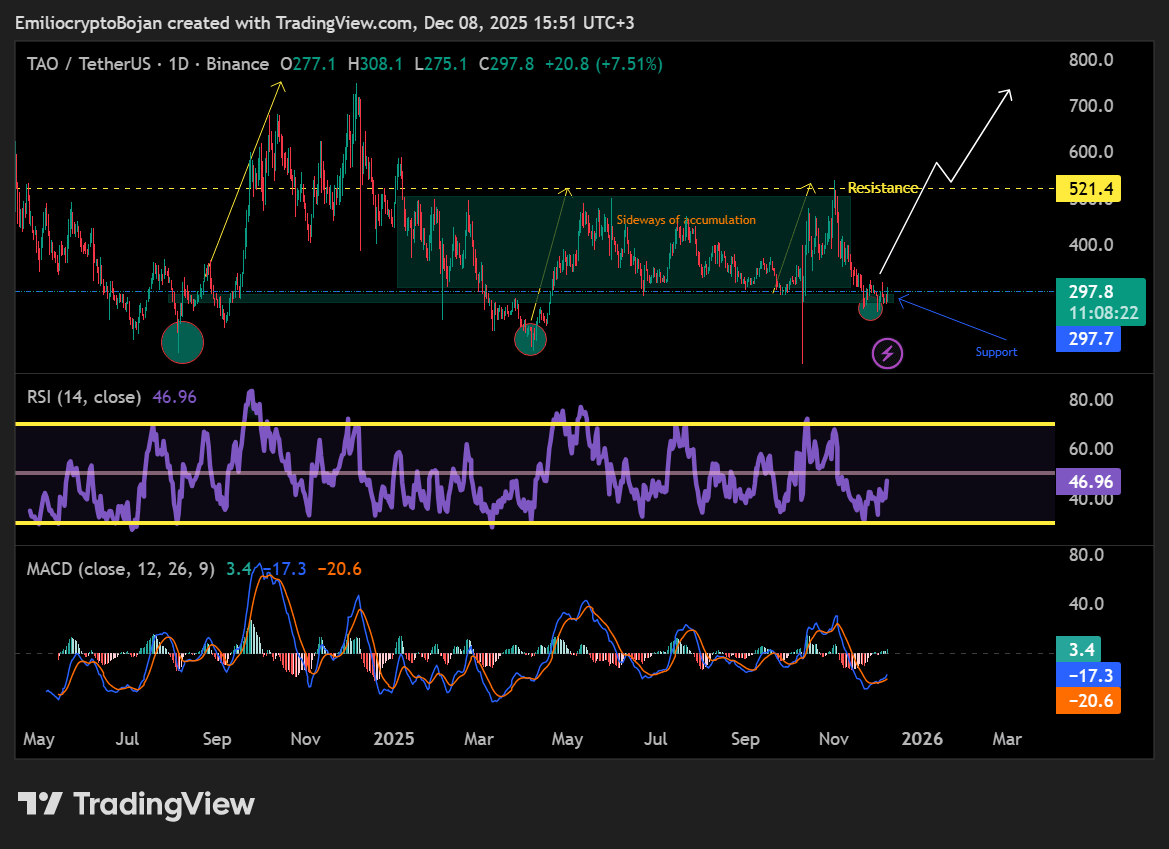

The daily timeframe shows a trend shift forming

On the daily chart, RSI rested around 46.96, giving bulls plenty of breathing room. MACD flipped bullish, showing momentum quietly strengthening.

Source: TradingView

TAO continues to coil inside a structure that has repeatedly produced aggressive upside bursts, especially with a tokenomics event this close.

Final Thoughts

- TAO is trading around $300 with strengthening momentum and a clean halving narrative ahead.

- A breakout above 330 sets the tone for short-term targets as scarcity and trend shifts collide.

Comments

Other Articles

Oil Prices Surge 3% After Trump Cancels Iran Meetings and Promises Protesters ‘Help Is on the Way’ – What It Means for Bitcoin

January 13, 2026 at 05:49 PM UTC

Bitcoin Surges to $93,888: How Venezuela-US Tensions Triggered a Crypto Rally

January 5, 2026 at 07:04 AM UTC

Bitcoin (BTC) Eyes Short-Term Bottom Rebound as On-Chain Flows Align with USDC/USDT Premium and Market Liquidity, but Bearish Longer-Term Outlook Persists

January 1, 2026 at 03:41 PM UTC