BlackRock Files for Staked Ethereum ETF Amid Rising Institutional Accumulation

ETH/USDT

$15,764,184,570.61

$1,937.17 / $1,835.36

Change: $101.81 (5.55%)

-0.0004%

Shorts pay

Contents

BlackRock’s iShares Staked Ethereum Trust ETF filing introduces a new way for institutions to earn staking rewards on Ethereum holdings, building on its existing $11 billion Ethereum fund and signaling a shift toward yield-focused crypto investments amid regulatory changes.

-

BlackRock files for iShares Staked Ethereum Trust ETF to provide direct access to ETH staking rewards for U.S. institutional clients.

-

This ETF expands on the firm’s successful Ethereum Trust, emphasizing protocol-level yield over pure price speculation.

-

Regulatory shifts under new SEC leadership may clarify staking rules, with over 138,000 ETH accumulated by institutions like Bitmine recently, valued at billions.

Discover BlackRock’s iShares Staked Ethereum Trust ETF filing and how it unlocks Ethereum staking rewards for institutions. Stay ahead with insights on ETH accumulation and SEC policy shifts. Explore now for crypto investment strategies.

What is BlackRock’s iShares Staked Ethereum Trust ETF?

BlackRock’s iShares Staked Ethereum Trust ETF is a proposed exchange-traded fund that aims to offer investors exposure to Ethereum’s price performance alongside staking rewards generated from its holdings. This product builds on BlackRock’s established iShares Ethereum Trust, which already manages over $11 billion in assets, by introducing a yield-generating mechanism tied to Ethereum’s proof-of-stake protocol. By filing this ETF, BlackRock positions itself to capture growing institutional demand for blockchain-driven returns in a regulated U.S. structure.

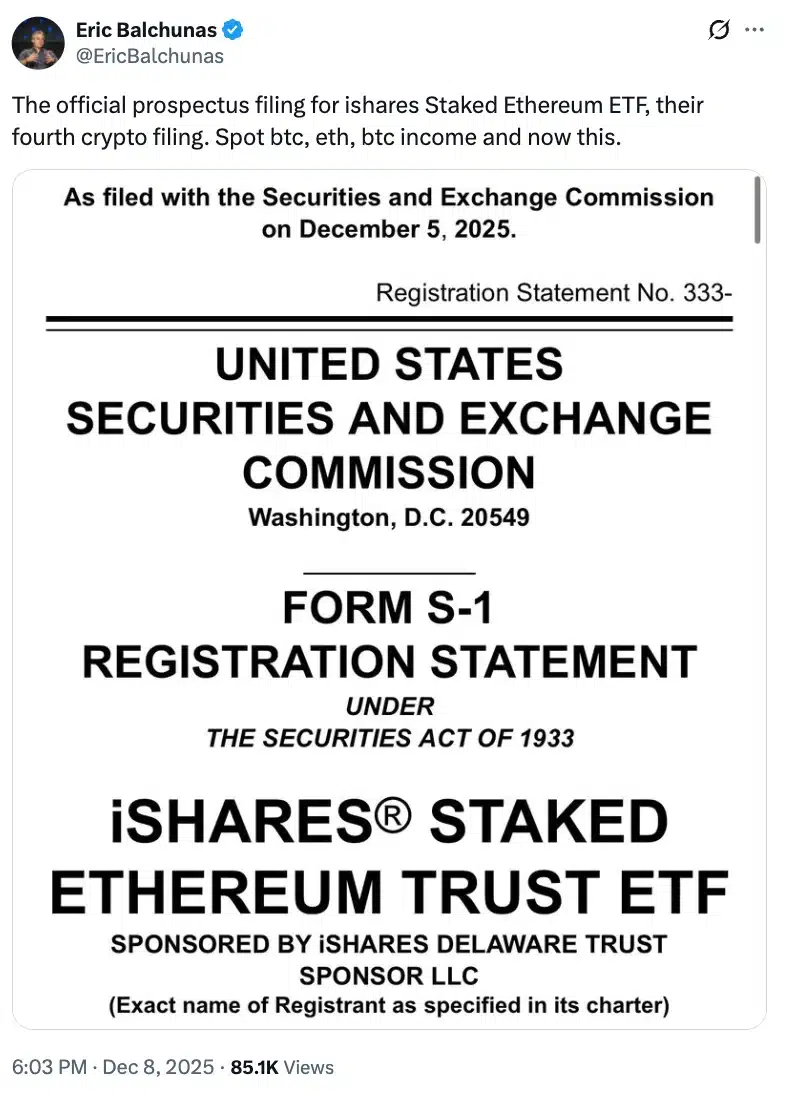

Source: Eric Balchunas/X

The ETF’s structure is designed as a hybrid fund, where a portion of the Ethereum holdings would be staked to produce rewards that accrue to the fund’s net asset value. This approach allows participants to benefit from Ethereum’s network security contributions without the complexities of direct staking. According to Bloomberg ETF analyst Eric Balchunas, who first reported the filing on X, this development reflects BlackRock’s confidence in the maturing infrastructure of digital assets. Balchunas noted the significance of this move, stating, “This tells you everything about where demand is heading. They don’t file for products like this unless they’re confident massive capital is waiting to flow in.”

BlackRock’s initiative comes at a pivotal time for the cryptocurrency market, where institutional adoption is accelerating. The firm, known as the world’s largest asset manager with trillions under oversight, has been a frontrunner in bridging traditional finance and blockchain technology. This ETF filing underscores a broader trend: institutions are increasingly viewing cryptocurrencies not just as speculative assets but as components of diversified portfolios that generate sustainable yields.

How has the SEC’s stance on Ethereum staking ETFs evolved?

The U.S. Securities and Exchange Commission (SEC) has historically approached staking in cryptocurrency ETFs with caution, but recent changes indicate a more accommodating regulatory environment. Under former SEC Chair Gary Gensler, staking features were excluded from initial Ethereum ETF approvals in July 2024, with the agency classifying staking services from platforms like Kraken and Coinbase as potential unregistered securities offerings. This led issuers, including BlackRock, to launch spot Ethereum ETFs without yield mechanisms, focusing solely on price tracking.

With Paul Atkins now leading the SEC, the agency’s position appears to be evolving toward greater flexibility. BlackRock’s filing for the iShares Staked Ethereum Trust ETF, alongside amendments from competitors like VanEck, represents a direct challenge to past restrictions. The new SEC leadership’s willingness to entertain staking-enabled products could resolve longstanding uncertainties around how staking rewards are treated under federal securities laws. For instance, Grayscale achieved a breakthrough in October 2024, becoming the first to offer staking rewards through its U.S.-listed spot Ethereum ETFs, ETHE and ETH Mini. This approval set a precedent, demonstrating that regulated yield generation is feasible within ETF wrappers.

Industry experts view this shift as a boon for Ethereum’s ecosystem. According to reports from financial analysts, the inclusion of staking could enhance ETF attractiveness by providing annual yields estimated at 3-5% based on current network participation rates. REX-Osprey’s recent launches of staking-enabled funds for Solana and Ethereum further illustrate the momentum, as institutions seek to integrate proof-of-stake economics into mainstream investment vehicles. However, operational challenges remain, such as ensuring secure staking processes and transparent reward distribution, which BlackRock addresses by maintaining separation between its original Ethereum Trust and the new staked version.

The evolution also ties into broader market dynamics. Ethereum’s transition to proof-of-stake in 2022 reduced its energy consumption by over 99% and introduced staking as a core feature, rewarding validators for securing the network. As of late 2025, over 30 million ETH are staked, representing more than 25% of the total supply, according to on-chain data trackers. This high participation rate underscores the protocol’s robustness and appeal to yield-seeking investors.

Frequently Asked Questions

What makes BlackRock’s iShares Staked Ethereum Trust ETF different from existing Ethereum funds?

Unlike traditional Ethereum ETFs that only track price, BlackRock’s iShares Staked Ethereum Trust ETF incorporates staking rewards to boost returns, targeting institutional investors seeking yield from Ethereum’s proof-of-stake system. This new fund keeps the original $11 billion iShares Ethereum Trust separate, allowing choice between pure exposure and yield-enhanced options while navigating regulatory requirements.

Will the iShares Staked Ethereum Trust ETF approval impact Ethereum’s price?

Approval of the iShares Staked Ethereum Trust ETF could drive increased institutional inflows into Ethereum, potentially supporting price stability or growth by broadening access to staking yields. With major accumulations like Bitmine’s 138,452 ETH addition, bringing holdings to 3.86 million ETH worth $12.4 billion, such products may accelerate adoption and positively influence ETH’s market value over time.

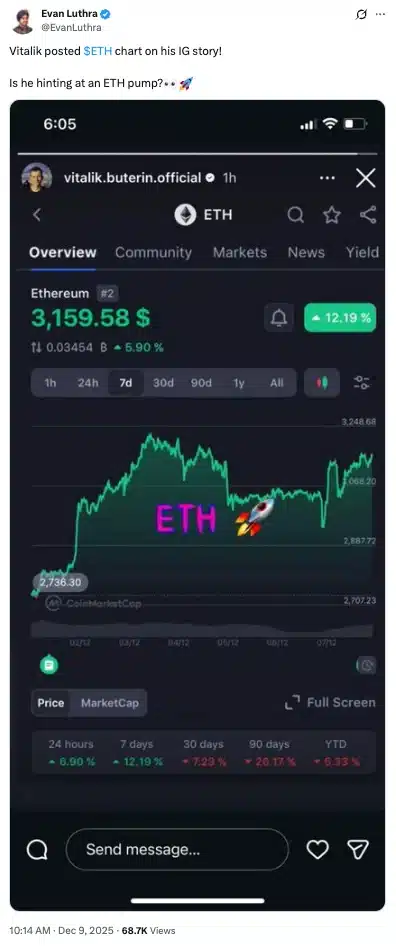

Source: X

Institutional interest in Ethereum remains robust, as evidenced by recent on-chain movements. Data from Lookonchain highlights significant withdrawals from exchanges like Binance, including 6,000 ETH by Amber Group and 3,000 ETH by Metalpha in quick succession. These actions point to strategic positioning by large players anticipating network upgrades or market upturns. Ethereum co-founder Vitalik Buterin recently shared insights on X, posting a chart that suggests an approaching rally for ETH, even as the asset traded at around $3,114 following a minor 1.67% daily decline.

Buterin’s commentary aligns with observable trends in the ecosystem. Ethereum’s ongoing developments, such as layer-2 scaling solutions and improved interoperability, continue to attract capital. The combination of ETF innovations and accumulation patterns indicates that Ethereum is poised for deeper integration into global financial systems.

Key Takeaways

- Regulatory Progress: The SEC’s evolving stance under Paul Atkins enables staking in ETFs, aligning U.S. policy with proof-of-stake mechanics and fostering institutional participation.

- Institutional Accumulation: Firms like Amber Group, Metalpha, and Bitmine are aggressively building ETH positions, with Bitmine’s latest addition pushing its portfolio to $12.4 billion, signaling confidence in future growth.

- Yield Opportunities: BlackRock’s ETF offers a regulated path to Ethereum staking rewards, potentially yielding 3-5% annually and attracting billions in new capital to the ecosystem.

Conclusion

BlackRock’s iShares Staked Ethereum Trust ETF filing represents a landmark in the convergence of traditional finance and blockchain technology, emphasizing Ethereum staking rewards as a viable income source for institutions. With the SEC’s softened approach to staking ETFs and surging on-chain accumulation by major players, Ethereum’s infrastructure is strengthening its role in global markets. As regulatory clarity emerges, investors can anticipate enhanced adoption and innovation, positioning ETH for sustained relevance in diversified portfolios—consider exploring yield strategies to capitalize on this momentum.