BlackRocks IBIT Records $523M Outflow as Bitcoin Dips Below $90K

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

BlackRock’s iShares Bitcoin Trust (IBIT) ETF saw a record $523 million outflow on November 18, 2025, marking the largest single-day redemption in its history as Bitcoin failed to hold above $90,000, signaling shifting institutional confidence in the asset.

-

Record Outflow Magnitude: $523 million exited IBIT, equivalent to significant Bitcoin sales on the market.

-

Broader Impact: This single fund drove over 140% of the entire spot Bitcoin ETF market’s $372.77 million net outflows that day.

-

Price Correlation: Bitcoin dropped 3.15% to $89,989.82, erasing recent gains and highlighting bearish momentum with MACD at -3,755.91.

BlackRock IBIT outflow hits $523M record on Nov 18, 2025: Explore causes, market effects, and Bitcoin price implications. Gain insights into institutional shifts in crypto investments today.

What Caused the Record BlackRock IBIT Outflow?

BlackRock IBIT outflow reached a historic $523 million on November 18, 2025, driven by institutional investors redeeming shares amid Bitcoin’s inability to sustain levels above $90,000. This event, the largest net negative flow since the fund’s inception, reflects client trading activity from the prior day, as BlackRock settles shares on a T+1 basis by buying or selling Bitcoin. Data from Arkham Intelligence underscores the scale, with no prior day approaching this magnitude, indicating a sharp pivot in sentiment after Bitcoin’s repeated failures to reclaim $100,000 in mid-November.

How Did the IBIT Outflow Impact the Broader Bitcoin ETF Market?

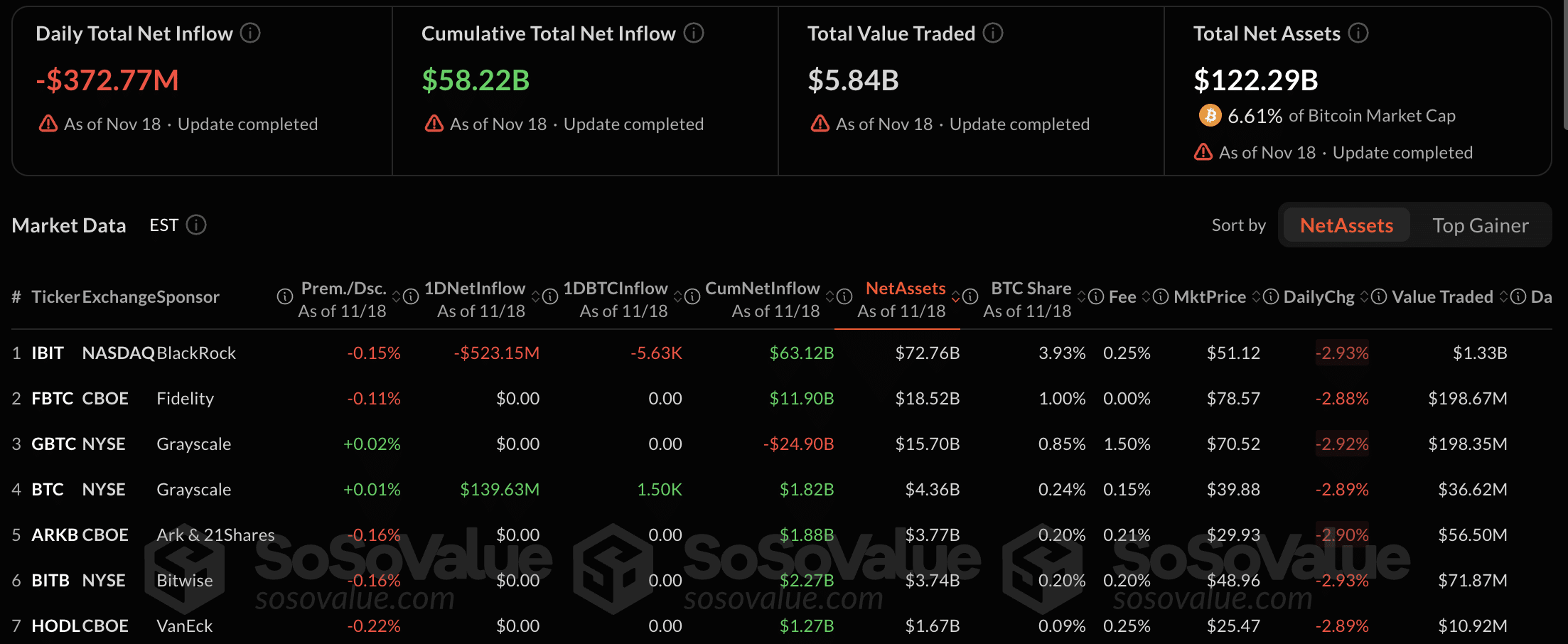

The IBIT outflow dominated the spot Bitcoin ETF sector, overwhelming other funds and contributing to total market outflows of $372.77 million on November 18, 2025, according to SoSo Value data. BlackRock’s fund alone accounted for 140% of these negative flows, as institutional clients offloaded exposure through the most liquid vehicle available. Other major ETFs, including Fidelity’s FBTC, Grayscale’s GBTC, Ark’s ARKB, Bitwise’s BITB, and VanEck’s HODL, registered zero or negligible activity, with only Grayscale’s smaller BTC fund seeing $139.63 million in inflows that failed to counterbalance the exodus. This concentration of selling pressure from IBIT highlights its pivotal role in institutional Bitcoin adoption, where large-scale redemptions force direct Bitcoin sales, amplifying market volatility. Experts note that such events can signal broader caution among allocators, potentially delaying the next wave of inflows until clearer bullish signals emerge. Despite this, IBIT maintains $72.76 billion in net assets, comprising 3.93% of Bitcoin’s total market capitalization and $58.22 billion in cumulative inflows since launch, demonstrating the fund’s enduring scale even amid setbacks.

Source: SoSo Value

What Is the Current State of Bitcoin’s Price After the IBIT Outflow?

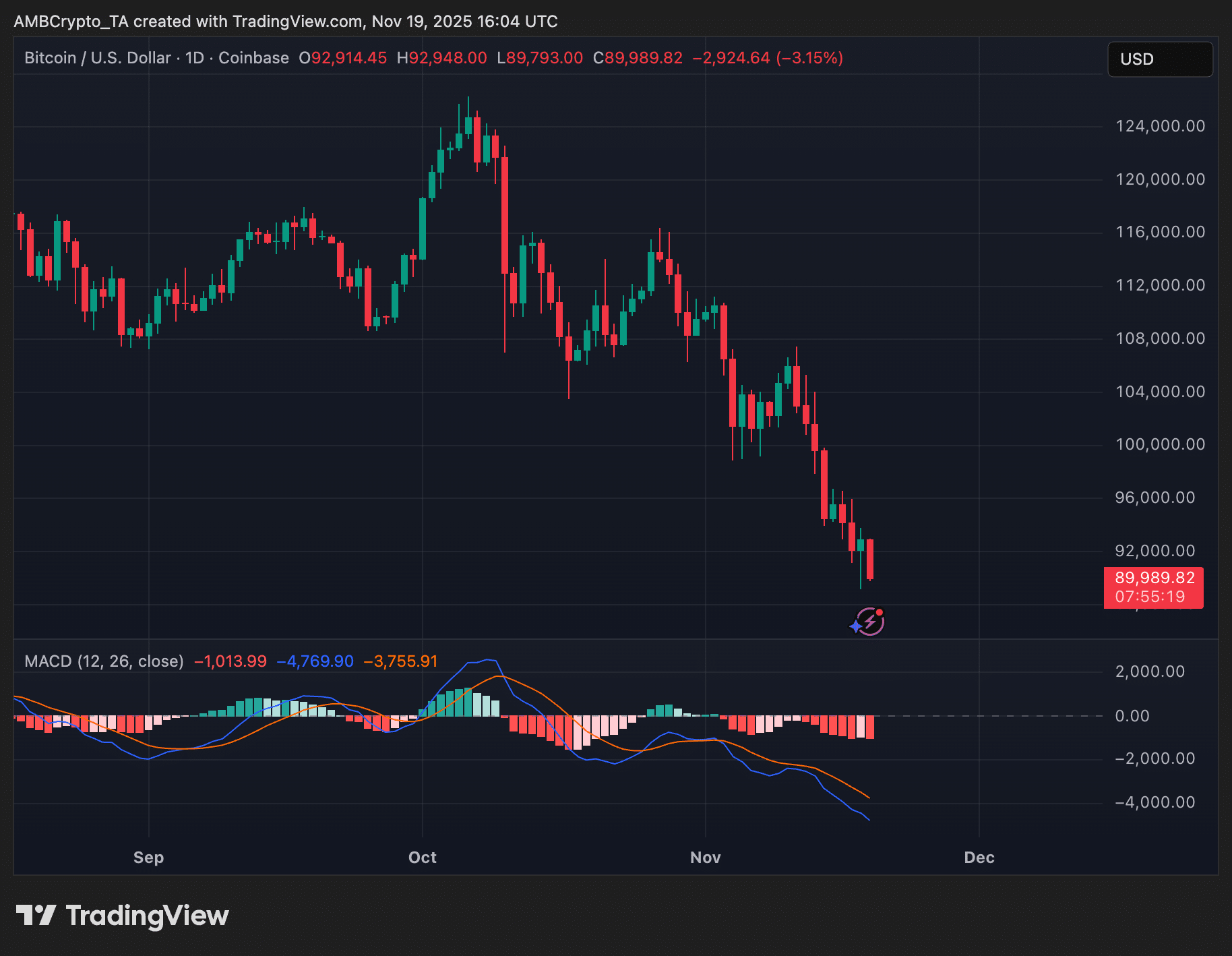

Bitcoin’s price tumbled 3.15% to $89,989.82 on November 18, 2025, as the IBIT-driven selling intensified technical breakdowns evident since mid-November’s $100,000 resistance failures. TradingView charts illustrate this descent, with the asset shedding nearly $10,000 from recent peaks and confirming bearish momentum via a MACD reading of -3,755.91. This real supply influx from ETF redemptions—where BlackRock sells underlying Bitcoin to meet $523 million in share redemptions—pushed prices below critical support, accelerating the correction. Institutional sentiment appears to have shifted, with large holders redeeming amid uncertainty, though Bitcoin’s fundamentals, including its fixed supply and growing adoption, remain intact. Analysts from sources like Bloomberg and CoinDesk emphasize that such drawdowns are common in volatile markets, often preceding recoveries, but warn of prolonged pressure if key levels like $85,000 falter. The event underscores the interplay between ETF flows and spot prices, where IBIT’s actions can sway the entire ecosystem given its market share.

Source: TradingView

Frequently Asked Questions

How Much Did BlackRock’s IBIT ETF Outflow on November 18, 2025?

BlackRock’s iShares Bitcoin Trust (IBIT) recorded a $523 million outflow on November 18, 2025, representing the fund’s largest single-day redemption ever, based on Arkham Intelligence tracking of client activity and settlements.

What Does the IBIT Outflow Indicate for Institutional Bitcoin Investment?

The IBIT outflow signals that institutional investors are reducing Bitcoin exposure as the price struggles to recover above $100,000, with redemptions triggering direct sales that pressured the market downward; this reflects caution but not abandonment of the asset class overall.

Key Takeaways

- Historic Scale: The $523 million IBIT outflow on November 18, 2025, set a new record, dwarfing all prior days and driving 140% of sector-wide negative flows.

- Market Dominance: IBIT’s activity overshadowed peers like FBTC and GBTC, which saw minimal movement, highlighting BlackRock’s central role in Bitcoin ETF dynamics.

- Price Implications: Bitcoin’s drop to $89,989.82 correlates directly with this selling, urging investors to monitor support levels for potential further corrections or rebounds.

Conclusion

The record BlackRock IBIT outflow of $523 million on November 18, 2025, underscores volatility in the spot Bitcoin ETF space, with institutional redemptions amplifying price declines below $90,000 and raising questions about near-term sentiment. While Arkham Intelligence and SoSo Value data confirm the event’s unprecedented nature, IBIT’s substantial $72.76 billion in assets signals resilience in broader adoption trends. As Bitcoin navigates this correction, staying attuned to ETF flows remains essential for understanding institutional moves—consider reviewing your portfolio strategies amid such shifts to capitalize on future opportunities.

Comments

Other Articles

Oil Prices Surge 3% After Trump Cancels Iran Meetings and Promises Protesters ‘Help Is on the Way’ – What It Means for Bitcoin

January 13, 2026 at 05:49 PM UTC

Bitcoin Surges to $93,888: How Venezuela-US Tensions Triggered a Crypto Rally

January 5, 2026 at 07:04 AM UTC

Bitcoin (BTC) Eyes Short-Term Bottom Rebound as On-Chain Flows Align with USDC/USDT Premium and Market Liquidity, but Bearish Longer-Term Outlook Persists

January 1, 2026 at 03:41 PM UTC