BTC Liquidations Persist, Signaling Possible Slide to $85,000 as Shorts Rebuild Near $93,000

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

BTC liquidations have intensified following the recent price dip to the $88,000 range, wiping out long-term accumulated liquidity and causing widespread deleveraging of long positions since October 11. This market event highlights ongoing volatility in Bitcoin’s trading environment.

-

BTC’s slide to $88,000 eliminated six months of built-up long positions, according to liquidation heatmaps.

-

Over $576 million in long liquidations occurred in the past 24 hours, targeting key accumulation levels.

-

Open interest remains at $32 billion with no significant recovery, while the Fear and Greed Index dropped to 11 points, signaling heightened caution among traders.

Discover how BTC liquidations are shaping Bitcoin’s price action amid a dip to $88,000. Explore market impacts, liquidity rebuilds, and trader strategies for 2025. Stay informed on crypto volatility—read now for expert insights.

What Are the Impacts of Recent BTC Liquidations on Bitcoin’s Price?

BTC liquidations refer to the forced closure of leveraged trading positions when market prices move against traders, leading to significant losses and market-wide effects. In the recent dip to the $88,000 range, these liquidations wiped out long-term accumulated liquidity, triggering a cascade of deleveraging for long positions held since October 11. This event has contributed to heightened volatility, with Bitcoin struggling to regain upward momentum despite entering a historically strong quarter.

How Is the Rebuild of Short Liquidity Influencing BTC’s Trading Range?

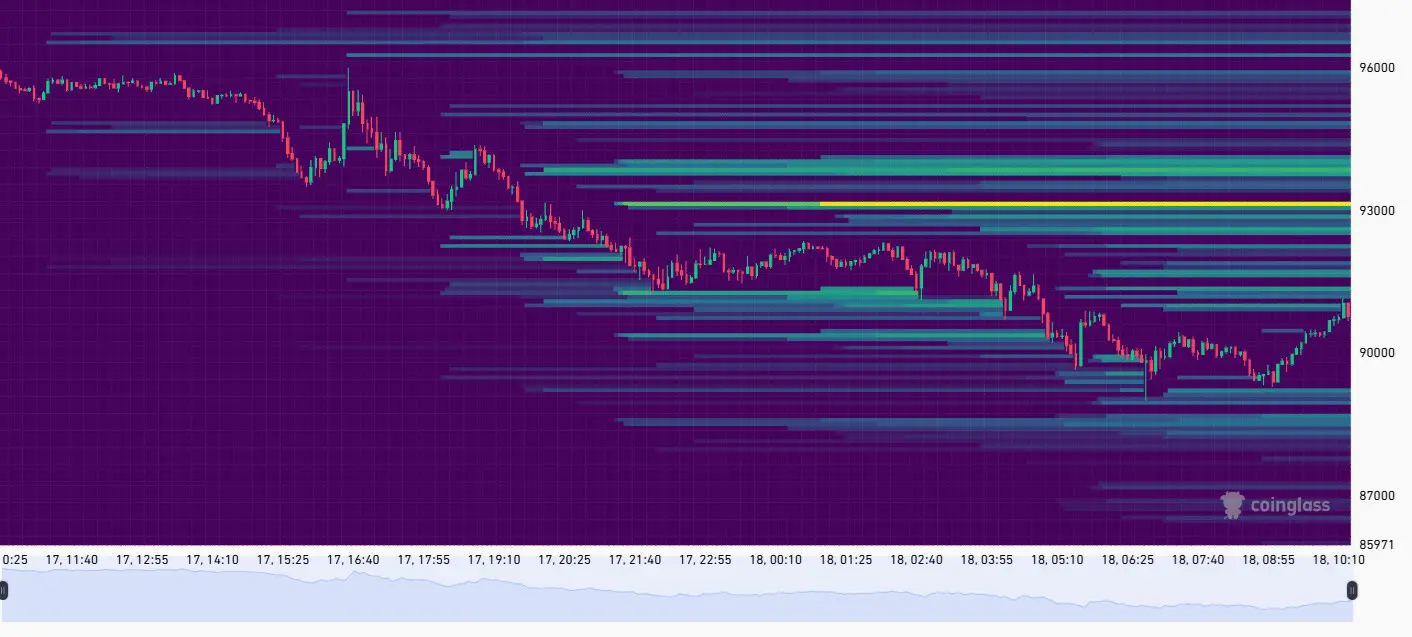

The recent Bitcoin price dip has not only liquidated substantial long positions but also prompted a strategic rebuild of short liquidity, particularly around the $93,000 level. Data from Coinglass indicates that short interest is accumulating in this range following the bounce to $90,700, creating potential pressure points for future price movements. Traders are now positioning for a narrower trading band between $85,000 and $95,000, a shift from the prior $105,000 to $110,000 levels, as evidenced by options market activity and ongoing liquidation patterns. This reconfiguration suggests a cautious market sentiment, with short positions gaining traction amid reduced dominance of Bitcoin at 56.6%. Expert analysis from financial platforms like Cryptopolitan underscores that such liquidity shifts often precede periods of consolidation, where volatility remains elevated due to aggressive trading strategies targeting meme coins and DeFi protocols.

The Bitcoin market’s response to the dip has been marked by continuous liquidations driving price action. Over the past 24 hours, more than $576 million in long liquidations were recorded, a figure that, while within normal ranges, targeted older positions accumulated over six months. This targeted approach indicates deliberate market maneuvers to clear out available liquidity down to the $90,000 support level. As a result, Bitcoin has not initiated a short squeeze to push prices higher, instead settling into expectations of a lower range by year-end.

Open interest for BTC continues to hover around $32 billion, showing no substantial rebuilding since the October liquidation event. This stagnation raises questions about the market’s trajectory—whether it signals a path to recovery or the onset of a deeper bearish phase. The crypto Fear and Greed Index, which measures derivative traders’ sentiment, has plummeted to 11 points from a recent low of 17, reflecting increased reluctance to maintain aggressive long positions. Such metrics, derived from trading volume and position data, provide a clear gauge of market psychology during volatile periods.

Bitcoin’s performance has underperformed compared to traditional assets, with a 0.9% yearly decline that erases gains from earlier in 2024. High volatility over the past two months has created ideal conditions for these liquidations, as reported by industry observers. Projections from options market indicators suggest potential further slides to $85,000, though these are based on current liquidity maps and historical patterns rather than definitive forecasts.

Following the price recovery to over $90,700, short traders have swiftly re-entered the market, focusing on the $93,000 range. This rebuild is visible in liquidation heatmaps, where the largest accumulation of short liquidity clusters just above current levels. The bounce has already triggered minor short liquidations in lower ranges, adding to the dynamic interplay between bulls and bears. With BTC dominance at 56.6%, capital is flowing toward altcoins and other sectors, diluting Bitcoin’s market share and complicating recovery efforts.

BTC is rebuilding short liquidity, with the biggest accumulation around the $93,000 level. | Source: Coinglass

BTC is rebuilding short liquidity, with the biggest accumulation around the $93,000 level. | Source: CoinglassThe shift in trading ranges underscores a broader trend of market adaptation. Previously targeted highs near $110,000 now seem distant, with insufficient short liquidity above $97,000 to fuel a rally beyond $100,000. Traders monitoring these developments emphasize the importance of liquidity levels in dictating short-term price direction, drawing on data from platforms like Coinglass for real-time insights.

In the context of 2025’s market environment, these BTC liquidations highlight the risks of leveraged trading in a high-volatility asset like Bitcoin. Historical data shows that Q4 often brings strength, but current indicators point to tempered expectations. Financial experts, including those cited in reports from Cryptopolitan, advise caution, noting that sustained low open interest could prolong the deleveraging process. By focusing on factual market data—such as liquidation volumes and sentiment indices—investors can better navigate these conditions without succumbing to speculative narratives.

The implications extend to the broader cryptocurrency ecosystem. As Bitcoin’s price stabilizes in a lower range, altcoin traders are capitalizing on rapid pumps in meme tokens and DeFi yields, further pressuring BTC’s dominance. This redistribution of interest reflects a maturing market where diversified strategies mitigate single-asset risks. Nonetheless, the core drivers remain tied to Bitcoin’s liquidity dynamics, which continue to influence global crypto sentiment.

Regulatory and macroeconomic factors also play a role, though the immediate focus stays on on-chain and derivatives data. For instance, the absence of meaningful long position rebuilding post-October suggests a wait-and-see approach among institutional players. This restraint, combined with retail trader caution as indicated by the Fear and Greed Index, paints a picture of a market in flux, poised for potential shifts based on upcoming economic releases or policy announcements.

Frequently Asked Questions

What Caused the Recent Wave of BTC Liquidations in November 2025?

The dip to $88,000 targeted key liquidity pools accumulated over six months, leading to over $576 million in long liquidations in 24 hours. Coinglass data reveals this was a direct attack on high-density long positions, exacerbated by high volatility since fall 2024, resulting in deleveraging without immediate recovery signals.

How Might Rebuilt Short Liquidity Affect Bitcoin’s Price in the Coming Weeks?

Short liquidity rebuilding around $93,000 could cap upside potential, keeping Bitcoin in a $85,000 to $95,000 range. This setup, as shown in liquidation heatmaps from Coinglass, may trigger further volatility if prices test these levels, with traders using natural language queries like this to assess risks in voice search scenarios.

Key Takeaways

- Recent BTC liquidations wiped out long-term liquidity: The slide to $88,000 cleared six months of accumulated positions, driving over $576 million in losses and signaling continued deleveraging.

- Open interest stagnation at $32 billion: No rebuild since October indicates cautious trader sentiment, with the Fear and Greed Index at 11 reflecting reluctance for aggressive longs.

- Short liquidity rebuild sets new range: Positions around $93,000 may limit rallies, urging investors to monitor $85,000 support and diversify amid altcoin opportunities.

Conclusion

In summary, BTC liquidations from the recent Bitcoin price dip have reshaped market dynamics, eliminating long positions and fostering short liquidity rebuilds around key levels like $93,000. As open interest remains subdued and sentiment metrics plummet, the trading range has narrowed, emphasizing volatility’s role in 2025’s crypto landscape. Investors should stay vigilant with data-driven strategies, preparing for potential Q4 strength while exploring diversified opportunities for long-term resilience.

Comments

Other Articles

Oil Prices Surge 3% After Trump Cancels Iran Meetings and Promises Protesters ‘Help Is on the Way’ – What It Means for Bitcoin

January 13, 2026 at 05:49 PM UTC

Bitcoin Surges to $93,888: How Venezuela-US Tensions Triggered a Crypto Rally

January 5, 2026 at 07:04 AM UTC

Bitcoin (BTC) Eyes Short-Term Bottom Rebound as On-Chain Flows Align with USDC/USDT Premium and Market Liquidity, but Bearish Longer-Term Outlook Persists

January 1, 2026 at 03:41 PM UTC