BTC Rally Potential Remains Amid Institutional Selling and Mixed Market Sentiment

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

-

Bitcoin (BTC) faces a tipping point as institutional sell-offs clash with emerging bullish sentiment among retail investors.

-

The recent market dynamics indicate that while sell-offs have intensified, significant accumulation efforts from long-term holders could reshape the price trajectory.

-

According to CryptoQuant, one address linked to over-the-counter (OTC) trades has amassed over 28,000 BTC, demonstrating deepening market confidence.

Explore the latest developments in Bitcoin’s market activity as institutional selling pressures compete with strong retail accumulation trends.

U.S. investors and institutions panic-sell BTC

The recent decline in Bitcoin interest from both retail and institutional players is evident, reflecting broader market anxiety. The Coinbase Premium Index (CPI) has notably fallen below zero, highlighting a surge in selling pressure.

Source: CryptoQuant

Despite recent bullish undertones observed on February 17, marked by a price surge, subsequent ETF movements suggest a contrasting sentiment. Notably, Bitcoin spot ETFs notched up $70.60 million in inflows but experienced a sharp $129.10 million outflow shortly thereafter.

Source: Coinglass

This flow pattern appears to be a continuation of outflows witnessed from the 10th to the 13th of February, indicating ongoing selling activity among institutions.

Bullish sentiment stays strong

In stark contrast to the selling pressure, data from CryptoQuant reveals that specific addresses, particularly those engaged in long-term holdings, have significantly accumulated BTC. These addresses have collectively secured over 28,000 BTC, valued at more than $2.6 billion, potentially initiating a supply squeeze affecting market availability.

This recent accumulation trend is echoed in the wider spot market, where buyers have outstripped sellers by $314.70 million in just the past week. Positive asset netflow data corroborates consistent accumulation patterns since January 2025, bolstering a continued bullish outlook.

Source: Coinglass

Low liquidity levels threaten an upward move

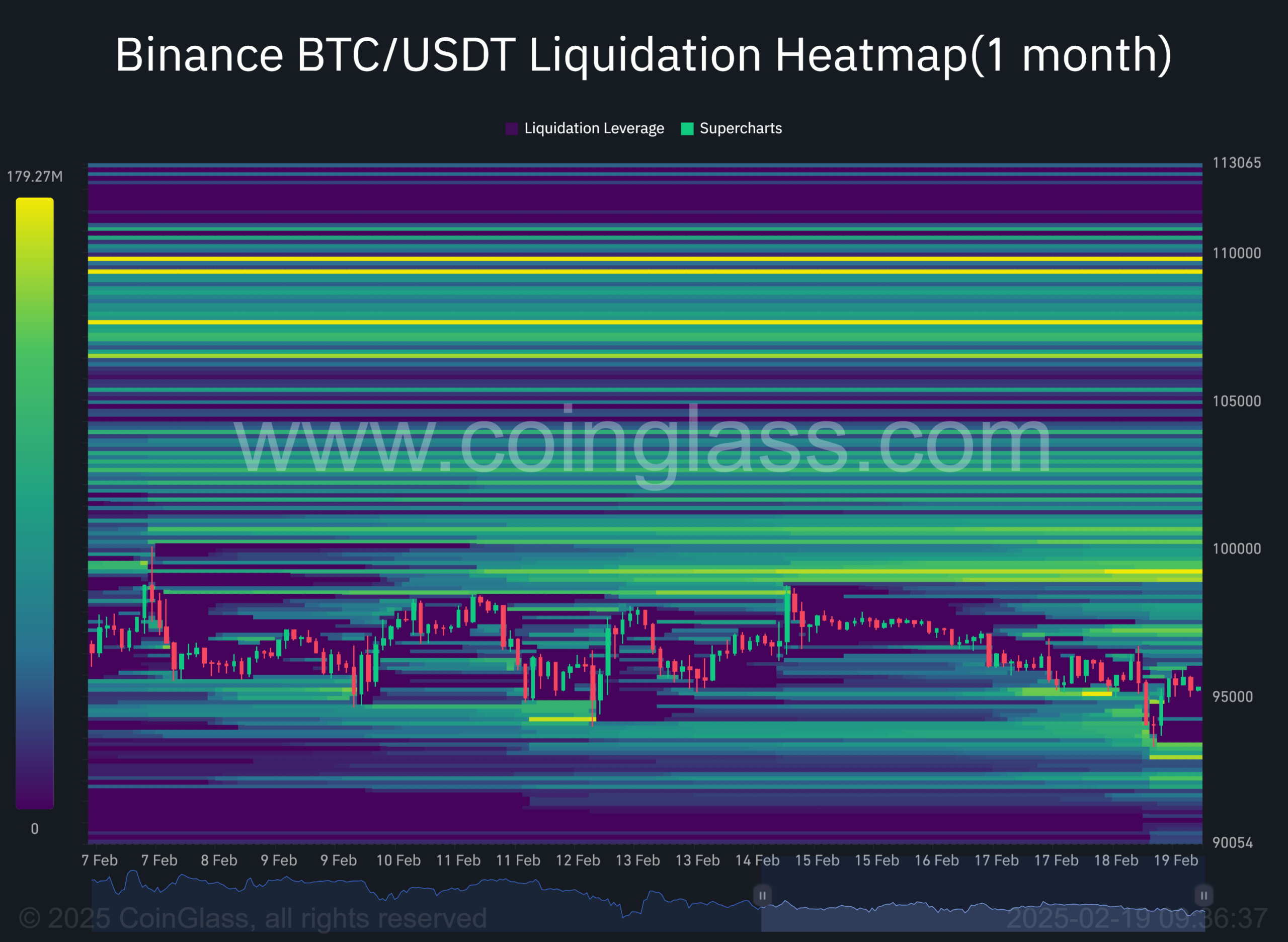

The current market also faces challenges due to low liquidity levels. Data from Binance’s liquidation heatmap indicates a key liquidity level around $92,930.28, where a substantial buy order pool of $136.1 million in BTC is located.

Source: Coinglass

Typically, these liquidation levels can influence price movements as they often attract buyers and sellers alike. Should BTC approach this liquidity zone, we may witness a brief pullback before a potential rebound emerges.

For now, mixed market sentiments underline the uncertainty ahead, and continued monitoring of on-chain data and buying trends will be essential in forecasting BTC’s future price movements.

Conclusion

In summary, while institutional sell-offs create immediate pressure on BTC’s price, the ongoing accumulation by retail and long-term investors suggests that the market isn’t entirely bearish. The interplay between liquidity levels and investor sentiment will play a crucial role in determining whether BTC can achieve a significant rally in the near future. As the landscape continues to evolve, stakeholders should remain vigilant and informed.

Comments

Other Articles

Oil Prices Surge 3% After Trump Cancels Iran Meetings and Promises Protesters ‘Help Is on the Way’ – What It Means for Bitcoin

January 13, 2026 at 05:49 PM UTC

Bitcoin Surges to $93,888: How Venezuela-US Tensions Triggered a Crypto Rally

January 5, 2026 at 07:04 AM UTC

Bitcoin (BTC) Eyes Short-Term Bottom Rebound as On-Chain Flows Align with USDC/USDT Premium and Market Liquidity, but Bearish Longer-Term Outlook Persists

January 1, 2026 at 03:41 PM UTC