Cantor Fitzgerald Lowers MicroStrategy Target but Stays Bullish on Bitcoin’s Long-Term Potential

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Cantor Fitzgerald has slashed its price target for MicroStrategy stock to $229 from $560, a 60% reduction, while maintaining a buy rating. The firm remains bullish on Bitcoin’s long-term potential, dismissing fears of forced liquidations and highlighting sufficient cash reserves for over 21 months of dividends.

-

Cantor Fitzgerald lowers MicroStrategy 12-month price target by 60% to $229 amid Bitcoin market volatility.

-

The firm retains a buy rating, emphasizing MicroStrategy’s strong liquidity position.

-

Bitcoin’s market cap is currently 6.1% of gold’s, potentially reaching $1.58 million per BTC to surpass it, per analyst projections.

Cantor Fitzgerald cuts MicroStrategy stock price target but stays bullish on Bitcoin amid MSCI risks. Discover why the firm sees long-term upside in this crypto-heavy stock. Read more for key insights and market analysis now.

What is Cantor Fitzgerald’s Updated Price Target for MicroStrategy Stock?

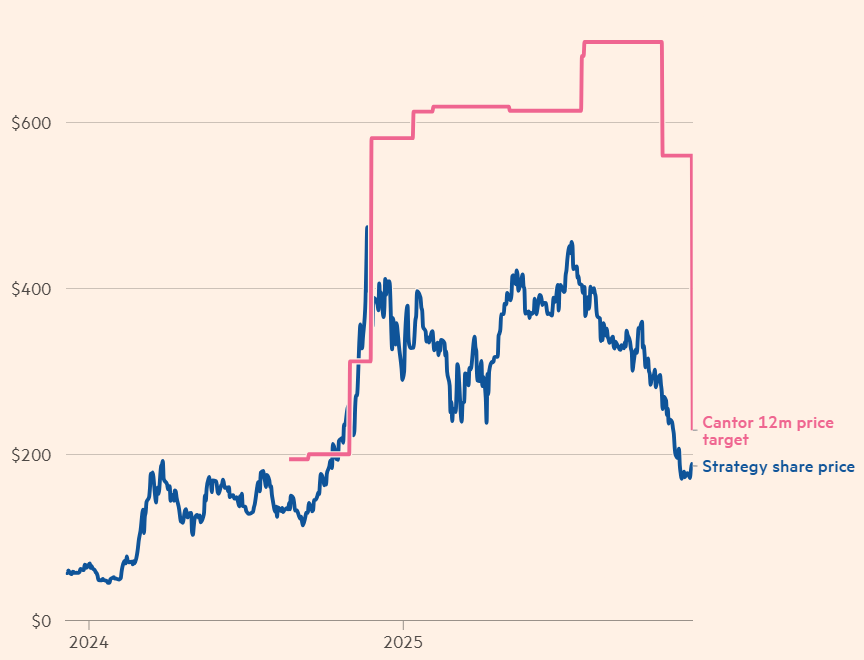

Cantor Fitzgerald has recently adjusted its 12-month price target for MicroStrategy stock downward by 60%, setting it at $229 from the previous $560, as detailed in an analyst note reported by the Financial Times. Despite this revision, the firm upholds its buy rating, citing MicroStrategy’s robust financial position and the enduring bullish outlook for Bitcoin. This move reflects current market dynamics but underscores confidence in the company’s Bitcoin-centric strategy over the long term.

MicroStrategy share prices compared to the Cantor price target. Source: FT.com

MicroStrategy, led by Bitcoin advocate Michael Saylor, has positioned itself as a major player in the cryptocurrency space by holding substantial Bitcoin reserves. The company’s stock performance has been closely tied to Bitcoin’s price fluctuations, experiencing a 27% decline over the past month and a 35% drop year-to-date, trading around $186 at recent levels, based on market data from Google Finance. Cantor Fitzgerald, as the ninth-largest shareholder in MicroStrategy, provides a unique perspective on these developments, balancing short-term pressures with long-term optimism.

The analysts at Cantor Fitzgerald emphasized that concerns over potential forced liquidations of MicroStrategy’s Bitcoin holdings are overstated. They noted that the company maintains enough cash on hand to cover dividend payments for the next 21 months. Furthermore, MicroStrategy has access to equity facilities for additional fundraising if required. As stated in their note, “Absent a 90% pullback from current BTC levels, this fear is not warranted.”

MSTR/USD, year-to-date chart. Source: Google Finance

How Do MSCI Index Risks Impact MicroStrategy’s Stock?

The MSCI Index poses a notable short-term risk to MicroStrategy stock, as it may exclude companies where digital assets exceed 50% of total assets. If implemented, this policy could trigger forced selling of MicroStrategy shares by index-tracking funds, creating a near-term flow headwind. Cantor Fitzgerald acknowledges this as a somewhat warranted concern but views it as temporary rather than a fundamental threat to the company’s value.

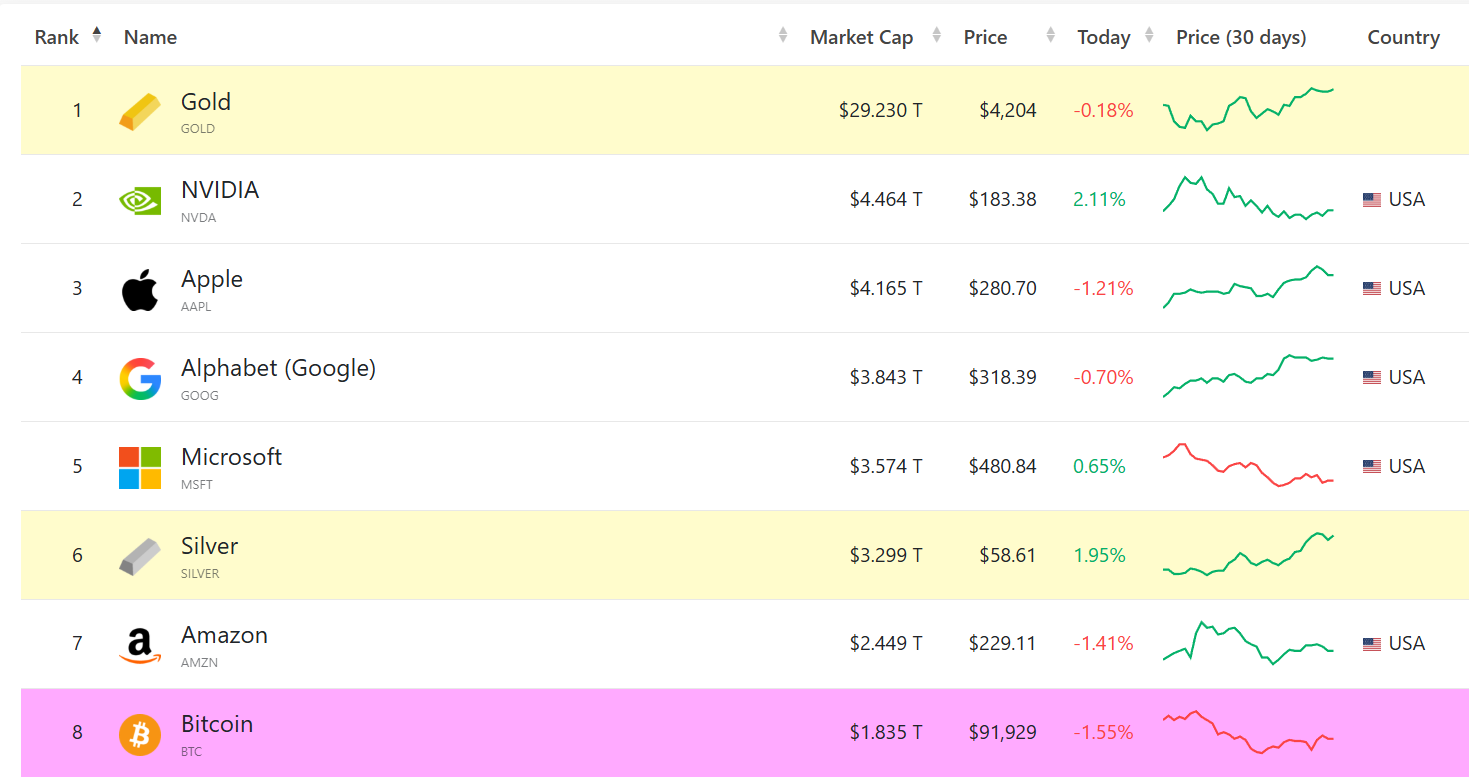

Largest assets by market capitalization. Source: CompaniesMarketCap.com

Expert analysis from financial institutions like Cantor Fitzgerald highlights that such index exclusions, while disruptive, do not alter MicroStrategy’s core strategy of leveraging Bitcoin as a treasury asset. Historical precedents in the crypto market show that regulatory or index-related pressures often lead to short-lived sell-offs, followed by recoveries driven by underlying asset performance. For instance, similar concerns in past cycles for crypto-exposed firms have not derailed long-term growth trajectories. MicroStrategy’s balance sheet, bolstered by its Bitcoin holdings valued at billions, provides a buffer against these pressures, according to data from company filings and market reports.

Beyond immediate risks, Cantor Fitzgerald’s outlook remains firmly positive on Bitcoin’s trajectory. The firm describes the recent Bitcoin price pullback as a “healthy” correction within a broader upward trend. They project that Bitcoin could soon eclipse gold’s market capitalization, a milestone that would significantly bolster MicroStrategy’s position. “We continue to believe that we are not far away from Bitcoin overtaking Gold’s market cap,” the analysts wrote. Currently, Bitcoin’s market cap stands at just 6.1% of gold’s, meaning Bitcoin would need to reach approximately $1,577,860 to surpass it.

Bitcoin, gold, year-to-date chart. Source: Cointelegraph/TradingView

This projection aligns with views from other prominent analysts in the cryptocurrency sector. For example, Joe Burnett, a noted Bitcoin strategist, has forecasted that Bitcoin could exceed $1.8 million by 2035, driven by increasing institutional adoption and macroeconomic shifts favoring digital assets over traditional stores of value. Such growth would represent nearly a 16-fold increase from current levels, underscoring the transformative potential for companies like MicroStrategy deeply invested in Bitcoin.

Year-to-date performance comparisons further illustrate the competitive landscape. Gold has appreciated by 58% since the start of 2025, outperforming Bitcoin’s modest 1.5% decline, as per TradingView data. However, Bitcoin’s volatility is seen as a feature, not a flaw, by proponents who argue it accelerates adoption cycles. MicroStrategy’s strategy of accumulating Bitcoin during dips has historically paid off, with the company’s holdings now representing a significant portion of its enterprise value.

In the broader context of financial markets, firms like Cantor Fitzgerald demonstrate expertise by integrating cryptocurrency analysis with traditional equity research. Their dual perspective—acknowledging risks while emphasizing opportunities—provides investors with a balanced view. MicroStrategy’s approach has been praised by industry experts for pioneering corporate Bitcoin adoption, influencing other public companies to follow suit.

Frequently Asked Questions

What Factors Led to Cantor Fitzgerald’s Price Target Cut for MicroStrategy?

Cantor Fitzgerald reduced its MicroStrategy price target due to recent Bitcoin market volatility and broader economic pressures, adjusting from $560 to $229 in a 60% slash. However, the firm maintained its buy rating, citing the company’s sufficient liquidity to weather short-term challenges without forced asset sales, based on their analyst review reported by the Financial Times.

Will Bitcoin Surpass Gold’s Market Cap Soon?

Bitcoin is poised to potentially overtake gold’s market capitalization in the coming years, according to analysts at Cantor Fitzgerald and others. Currently at 6.1% of gold’s cap, Bitcoin would need to hit around $1.58 million, a level supported by growing institutional interest and its role as a digital store of value—perfect for voice queries on future asset trends.

Key Takeaways

- Cantor Fitzgerald’s Buy Rating Persists: Despite slashing the price target to $229, the firm sees MicroStrategy’s Bitcoin strategy as viable long-term, with cash reserves covering dividends for 21 months.

- MSCI Exclusion Risks Are Temporary: Potential index removal could cause short-term selling pressure, but it won’t undermine MicroStrategy’s fundamental positioning in the crypto market.

- Bitcoin’s Gold Challenge Ahead: Analysts project Bitcoin reaching $1.58 million to eclipse gold, offering substantial upside for Bitcoin-heavy stocks like MicroStrategy—consider monitoring BTC price momentum for investment decisions.

Conclusion

Cantor Fitzgerald’s adjustment to the MicroStrategy stock price target reflects prudent caution amid MSCI Index risks and Bitcoin’s correction, yet the firm’s unwavering buy rating signals strong belief in the cryptocurrency’s trajectory. As Bitcoin edges closer to surpassing gold’s market cap, MicroStrategy stands to benefit from its pioneering role in corporate crypto adoption. Investors should watch for regulatory developments while focusing on the long-term potential of digital assets in diversified portfolios.