Crypto Decline and AAVE's DeFi-Focused Move

AAVE/USDT

$252,005,252.94

$124.25 / $112.98

Change: $11.27 (9.98%)

+0.0031%

Longs pay

Contents

Crypto Market Sharp Sell-Offs and Bitcoin Recovery

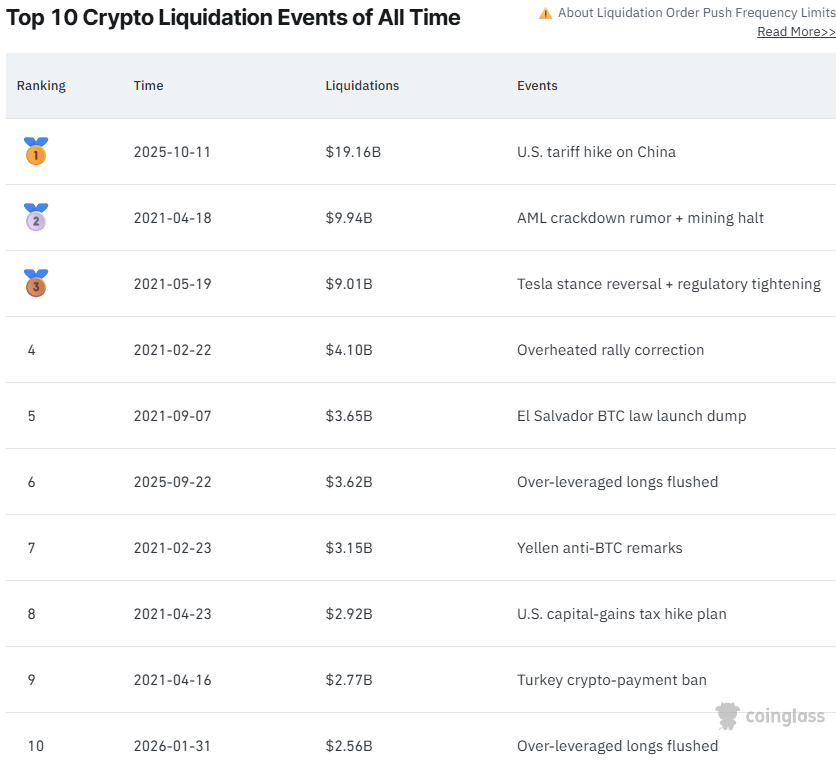

The cryptocurrency markets experienced sharp sell-offs due to rising liquidity concerns following US President Donald Trump’s nomination of Kevin Warsh for Fed chairmanship. There were $431 million outflows from Bitcoin ETFs on Thursday, while the BTC price dropped to $60,074 on Friday and rose above $64,930 as of UTC 7:49. In the last 15 hours, Bitcoin rose approximately 15% from $60,000 to above $68,000. On January 31, $2.56 billion in liquidations occurred (CoinGlass data).

Top 10 largest liquidation events in crypto history. Source: Coinglass

AAVE Latest Developments and DeFi TVL Change

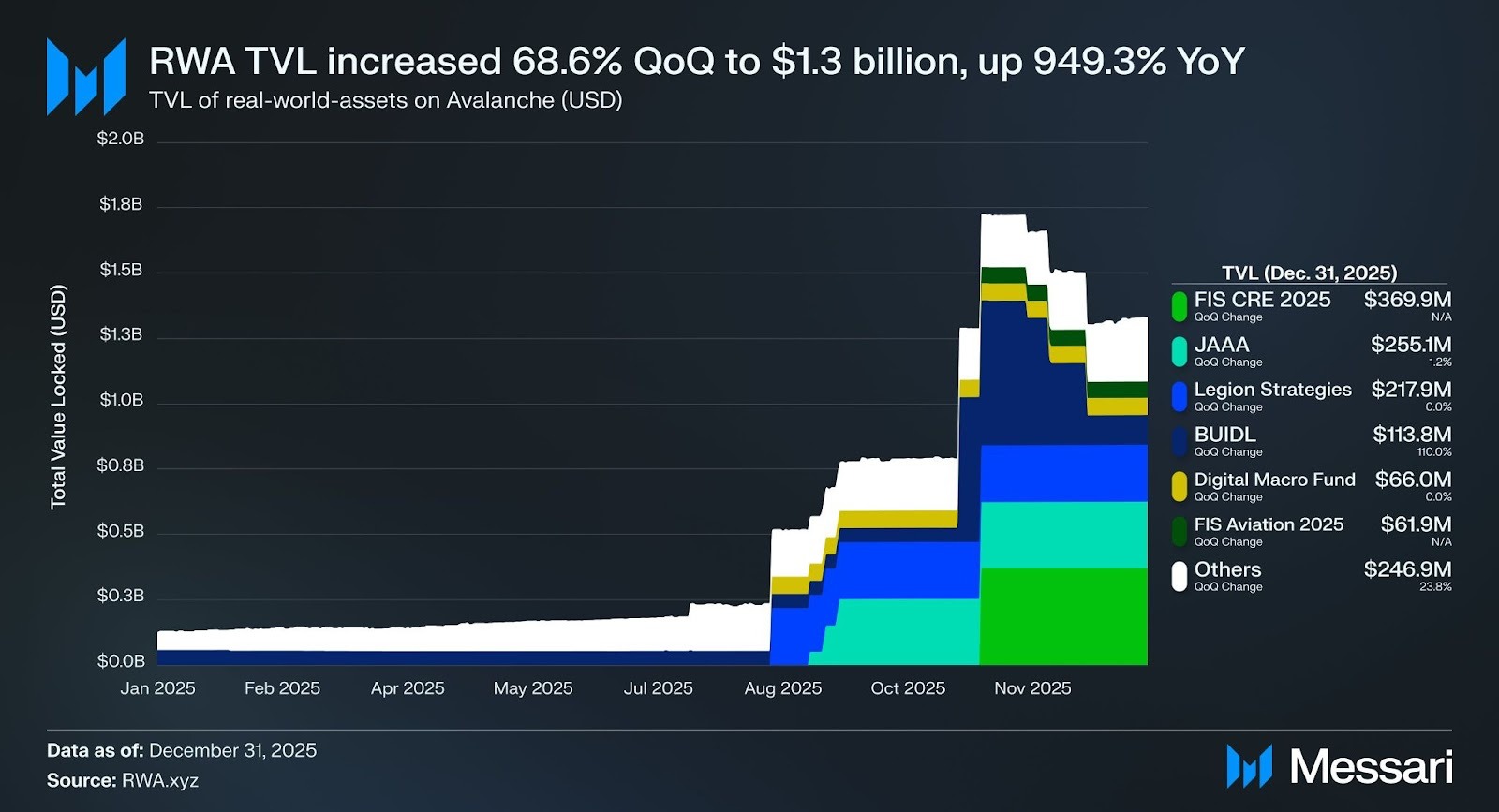

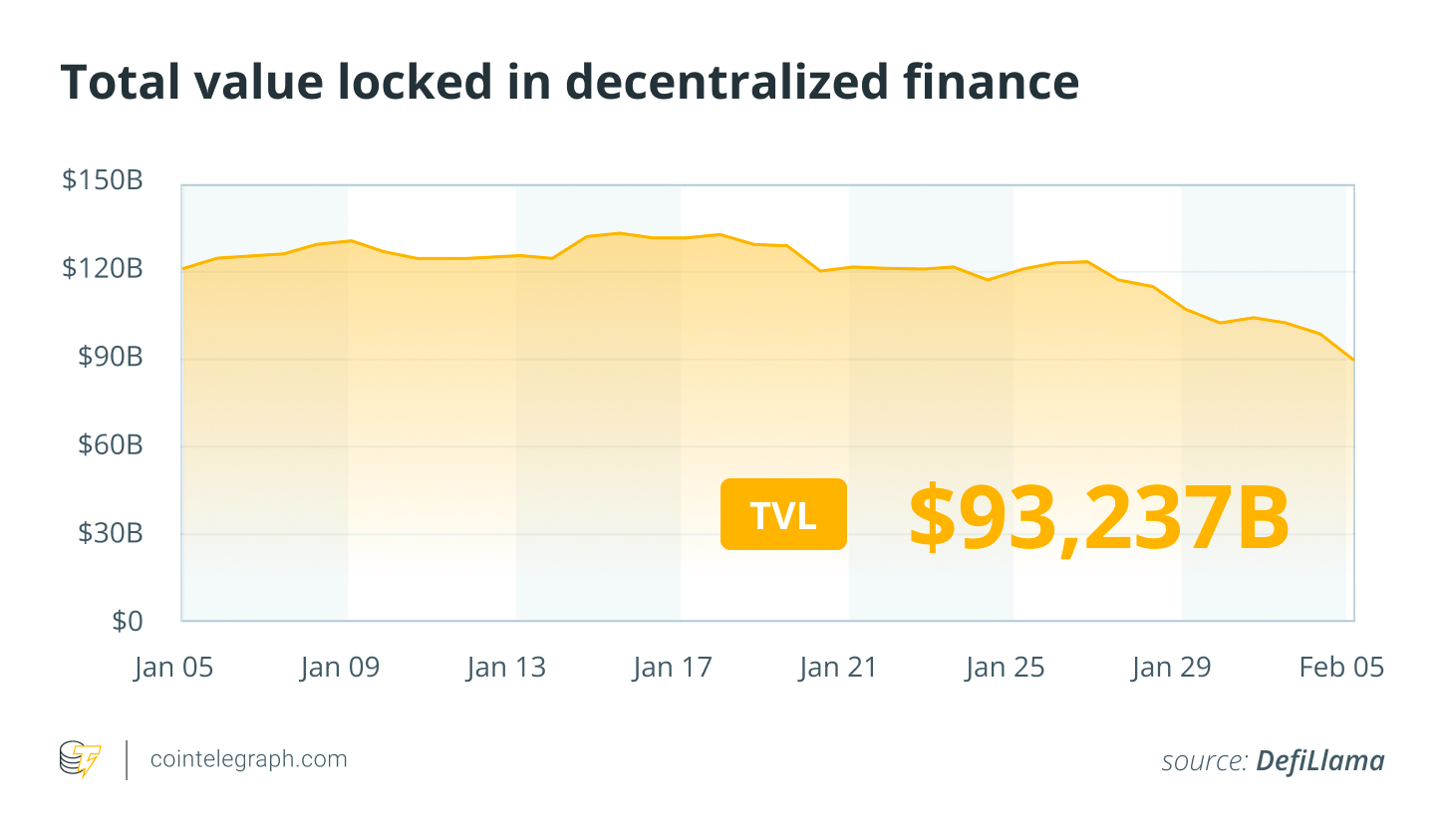

TRM Labs reached a $1 billion valuation with a $70 million Series C investment, becoming a crypto unicorn (led by Blockchain Capital). Tokenized RWAs on Avalanche increased 68.6% in the fourth quarter to $1.3 billion; BlackRock BUIDL contribution is significant (Messari report). ParaFi Capital invested $35 million in Solana-based Jupiter; JUP token rose 9% (CoinGecko). Aave discontinued the Avara brand and Family wallet to focus on DeFi. Click for AAVE detailed analysis. Step Finance treasury wallets were hacked, $27.2 million SOL (approximately 261,854 SOL) stolen (CertiK). The biggest drop in DeFi was ZEC with 35% (Cointelegraph Markets Pro).

Change in Avalanche real-world asset tokenization over the last 12 months. Source: Messari

Total value locked in DeFi. Source: DefiLlama

AAVE Technical Outlook and MicroStrategy Warning

AAVE price $113.37 (+1.69% 24s), RSI 32.75 (oversold signal), showing downtrend and bearish Supertrend. EMA 20: $138.42. Supports: S1 $98.63 (strong, 74% score), S2 $108.76. Resistances: R1 $121.76 (strong), R2 $147.57. Check AAVE futures. MicroStrategy CEO Phong says BTC average below $76,000 complicates debt repayment; emphasized risk of $8,000 BTC in worst-case scenario ($MSTR $IBIT).