Despite Negative Data in Bitcoin, Long-Term Investors Remain Steadfast

BTC/USDT

$17,366,629,629.18

$71,554.95 / $68,531.50

Change: $3,023.45 (4.41%)

-0.0023%

Shorts pay

Contents

- Data revealed why Bitcoin’s price growth has been slow recently. The decline in two key BTC metrics and one stablecoin metric has significantly affected this slow progress.

- Both BTC spot and derivative trading volumes did not show significant daily increases compared to previous months. The highest volumes recorded in July were on the 6th and 14th days.

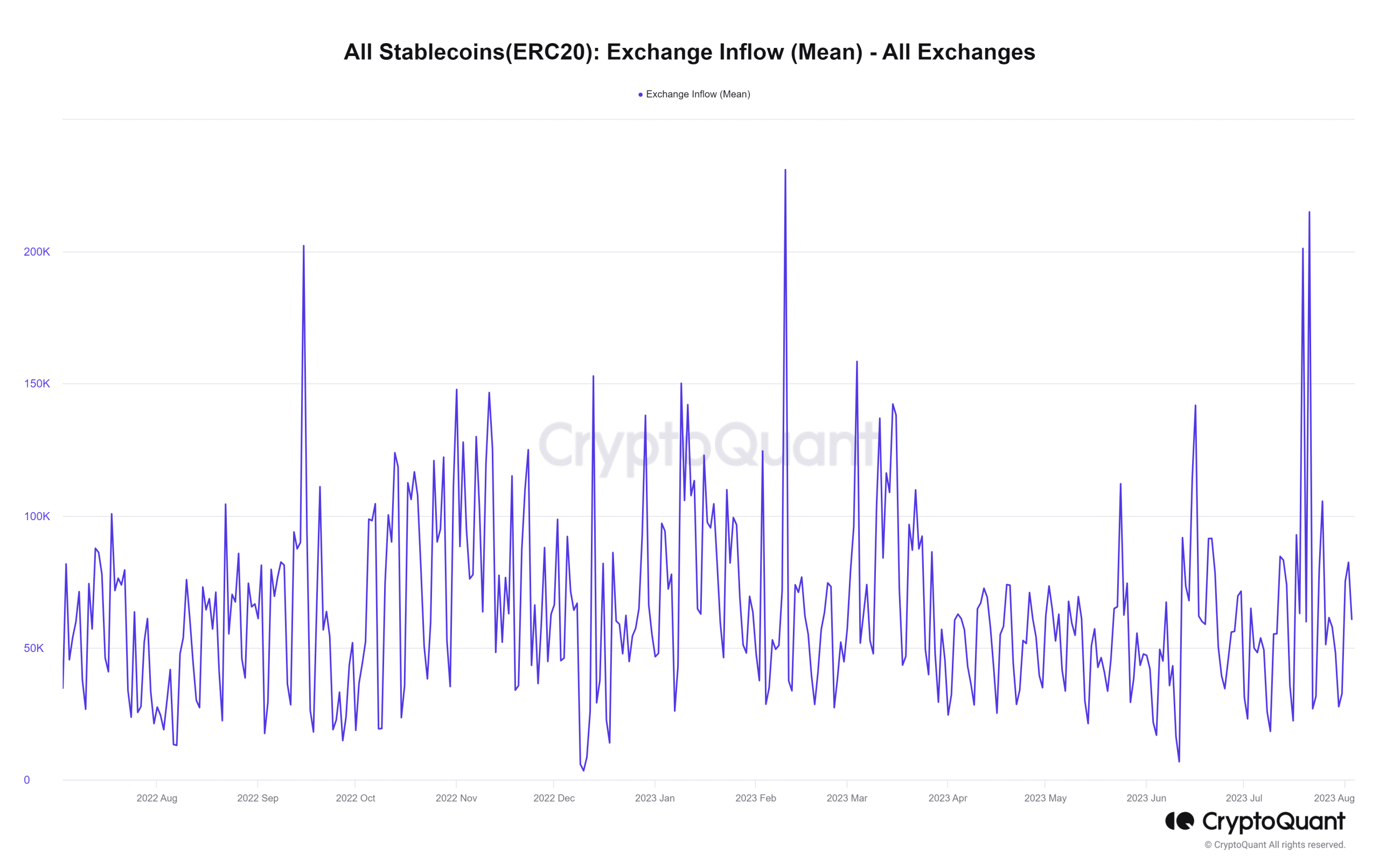

- The stablecoin exchange inflow metric also showed a notable decline. The chart indicated a decrease in buying pressure by showing a sharp drop in stablecoin inflows to exchanges.

Despite the decrease in volume and the downward trend in price, long-term holders of Bitcoin continued to hold and accumulate more.

Bitcoin Decline Did Not Affect Long-Term Investors

Bitcoin’s upward trend faced a hurdle in recent months, slowing its growth and increasing concerns. The decline in specific metrics has been a contributing factor to this slow progress.

However, amidst this apparent stagnation, the number of strong long-term holders remained remarkably stable, demonstrating resilience. According to CryptoQuant data, it revealed why Bitcoin’s price growth has been slow recently. The decline in two key BTC metrics and one stablecoin metric has significantly affected this slow progress. The key metrics were BTC transaction volume, exchange outflow, and stablecoin inflow.

An analysis of these metrics for July showed a decline. According to CryptoQuant, both BTC spot and derivative trading volumes did not show significant daily increases compared to previous months. The highest volumes recorded in July were on the 6th and 14th days. On July 6th, spot trading volume was approximately 114,000, while derivatives exceeded 1.3 million. On July 14th, spot trading volume was 104,000, and derivatives exceeded 988,000.

However, these high levels were lower than those reached in previous months, indicating a decrease in overall trading activity.

Additionally, the decrease in the amount of BTC exiting exchanges in July was also shown by the BTC exchange outflow chart. While some days showed impressive outflow amounts, the overall trend indicated more holders depositing their BTC into exchanges rather than withdrawing.

Furthermore, the analyzed metric of stablecoin exchange inflow also showed a notable decline. The chart indicated a decrease in buying pressure by showing a sharp drop in stablecoin inflows to exchanges.

The declines in these key metrics indicated negative sentiment around Bitcoin at the time of writing. As a result, it is believed that BTC may struggle to achieve significant gains in price.

Increasing Number of Bitcoin Long-Term Holders

Despite Bitcoin’s stagnant growth, the community of long-term holders remains steadfast and continues to grow. An analysis by Glassnode on the activity of supply over a two-year period revealed an upward trend in a graph showing the percentage of supply last active.

This band represented approximately 47% of the total supply at the beginning of the year. However, at the time of writing, this ratio has exceeded 56%.

This significant increase indicated that more holders were withdrawing their assets from exchanges. Additionally, these assets remained untouched by transaction activity in the past two years. Essentially, this shows an increasing number of investors committed to holding their Bitcoins long-term.

The daily timeframe chart of Bitcoin shows that the price decline continues. At the time of writing, it is trading around $29,100 with a decrease of less than 1%, indicating the continuation of the downward trend. This decline is also confirmed by the decrease in the Relative Strength Index (RSI), indicating strong selling pressure.