Deutsche Börse: Tokenization Market Evolution

BTC/USDT

$17,272,160,469.17

$68,476.22 / $66,621.06

Change: $1,855.16 (2.78%)

+0.0011%

Longs pay

Contents

Deutsche Börse Group executive Carlo Kölzer emphasized that tokenization is a natural evolution of traditional market infrastructure and does not pose a threat to traditional markets. Digital assets head and 360T CEO Kölzer shared the company's vision for a hybrid market integrating tokenized and traditional assets. On February 9, 360T began offering customers tokenized shares of companies like Nvidia, Google, and Circle by integrating the Kraken-backed xStocks platform.

Efficiency Gains from Tokenization in RWAs

Kölzer stated that tokenization of real-world assets (RWA) will bring flexibility and efficiency to capital markets. Tokenization strengthens traditional institutions' roles in risk management and transparency. Progress is being made in Europe with MiFID regulations, while the market has grown 18% since the beginning of the year. However, regulatory gaps and stablecoin concerns persist. Deutsche Börse promises regulated infrastructure against "paper Bitcoin" criticisms. Securitize called for an update to the EU's DLT Pilot Regime.

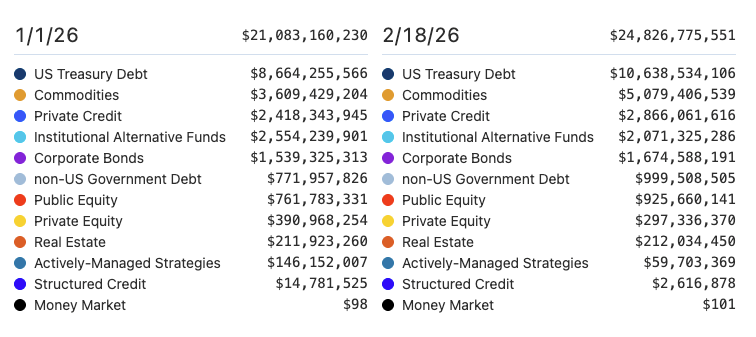

RWA market valuation by categories (Jan. 1 versus Feb. 18, 2026). Source: App.RWA.xyz

BTC Technical Analysis: Support and Resistance Levels

- Price: $66,116.87 (-1.49% 24s)

- Supports: S1 $65,143 (Strong, 78% score), S2 $62,910 (66% score)

- Resistances: R1 $69,657 (70% score), R2 $77,219 (68% score)

- Trend: Bearish (RSI 32.37, Supertrend Bearish)

With RWA growth, institutional interest in BTC is increasing, while Google searches for 'Will Bitcoin go to zero?' are rising. Despite this, institutions are accumulating BTC. Click for detailed BTC analysis.

Frequently Asked Questions About Tokenization and RWA

What is RWA tokenization? The process of bringing real-world assets to the blockchain, which increases liquidity.

How is Deutsche Börse involved in tokenization? Integrating traditional and digital assets through hybrid platforms.

Is BTC tokenization safe? Yes with regulated infrastructure; updates like BIP-360 against quantum threats are on the way (will take 7 years). Check BTC futures.