Ethereum’s Taker Buy Ratio Hits 4-Month High After Fusaka Upgrade, Signaling Potential Buyer Shift

ETH/USDT

$15,764,184,570.61

$1,937.17 / $1,835.36

Change: $101.81 (5.55%)

-0.0004%

Shorts pay

Contents

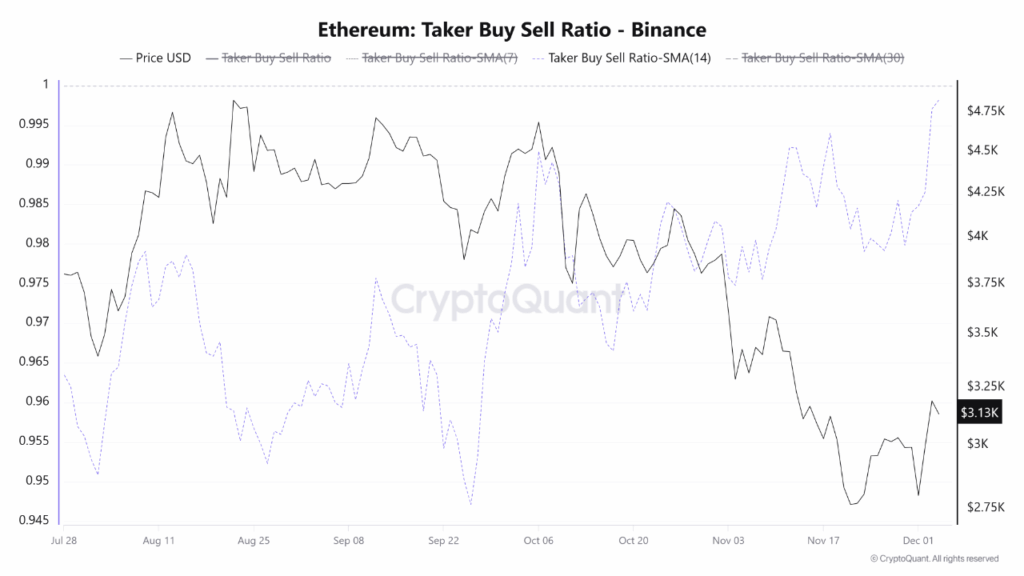

Ethereum’s taker buy sell ratio reached a four-month high of 0.998 following the Fusaka upgrade on December 3, 2025, indicating heightened buyer activity in futures markets and renewed trader confidence amid stable prices around $3,130.

-

Ethereum’s taker buy sell ratio surged to 0.998 post-Fusaka upgrade, reflecting stronger futures participation and shifting market dynamics toward buyers.

-

The ratio’s rapid climb outpaces price action at $3,130, suggesting early positioning by traders for potential upward momentum.

-

Crossing above 1.0 could signal the end of November’s correction, with futures eyeing targets between $3,500 and $4,000 based on historical patterns.

Ethereum taker buy sell ratio hits four-month high after Fusaka upgrade: Explore rising buyer activity, futures demand, and market implications for ETH traders in 2025. Stay informed on crypto trends—read now for key insights!

What is the Impact of the Fusaka Upgrade on Ethereum’s Taker Buy Sell Ratio?

Ethereum’s taker buy sell ratio climbed to 0.998 shortly after the Fusaka upgrade on December 3, 2025, marking its highest level in four months and signaling a notable increase in buyer-driven activity within derivatives markets. This metric, which measures the volume of buy orders versus sell orders from aggressive traders on platforms like Binance, reflects growing confidence among market participants. The upgrade’s enhancements to network efficiency appear to have spurred this shift, as traders position for potential price appreciation while ETH holds steady near $3,130.

How Does the Rising Taker Buy Sell Ratio Influence Ethereum Futures Markets?

The taker buy sell ratio’s ascent to 0.998 demonstrates a clear pivot toward buyer dominance in Ethereum’s futures trading environment. According to data from CryptoQuant, this level surpasses recent lows of 0.945, which had indicated subdued engagement during periods of market caution. Short sentences highlight the trend: Buyers are now initiating more trades at market prices, outpacing sellers. This behavior often precedes broader market rallies, as futures traders anticipate structural improvements from the Fusaka upgrade, such as reduced transaction costs and enhanced scalability.

Source: Cryptoquant

Supporting statistics from on-chain analytics firm CryptoOnchain show that aggressive buying intensified immediately post-upgrade, with long positions accumulating steadily. Expert analysis from market observers, including comments from CryptoOnchain’s recent updates, emphasizes that such ratios above 0.95 historically correlate with 15-20% price gains in the following weeks for Ethereum. The current setup, where the ratio advances faster than ETH’s spot price, underscores proactive trader sentiment. This dynamic allows for early detection of momentum shifts, as futures markets frequently lead spot price movements by several days.

In practical terms, the ratio nearing 1.0 suggests sellers are losing ground, potentially stabilizing ETH above key support levels. Traders monitoring this indicator view it as a reliable gauge of market health, especially after network upgrades like Fusaka that address longstanding scalability issues. Data indicates that during similar post-upgrade periods in Ethereum’s history, taker buy volumes have increased by up to 25%, fostering environments ripe for upward trends.

Frequently Asked Questions

What Does Ethereum’s Taker Buy Sell Ratio of 0.998 Mean for Traders in 2025?

A taker buy sell ratio of 0.998 on Ethereum futures signals that buyers are nearly matching or exceeding sellers in aggressive trading volume, a bullish indicator after the Fusaka upgrade. This four-month high, as reported by CryptoQuant, points to renewed confidence and potential for price recovery from November’s correction, helping traders anticipate shifts toward $3,500 targets.

Why Is the Ethereum Taker Buy Sell Ratio Rising Faster Than Price After Fusaka?

The Ethereum taker buy sell ratio is climbing quicker than price because futures traders often act ahead of spot markets, positioning for expected gains from the Fusaka upgrade’s efficiency boosts. As shared by CryptoOnchain analysts, this early buyer surge at levels around 0.998 reflects optimism about network improvements, making it a key voice search metric for understanding crypto market signals in natural, conversational terms.

Key Takeaways

- Buyer Momentum Post-Fusaka: The taker buy sell ratio hitting 0.998 showcases strong futures participation, driven by upgrade benefits like faster transactions.

- Early Trend Indicator: Ratio growth outpacing price at $3,130 suggests traders are preparing for rallies, supported by historical data from CryptoQuant showing similar patterns leading to 15%+ gains.

- Watch for 1.0 Threshold: Breaching this could confirm correction end, urging investors to monitor Ethereum’s path to $3,500-$4,000 with diversified strategies.

Conclusion

The surge in Ethereum’s taker buy sell ratio to a four-month high following the Fusaka upgrade underscores a pivotal moment for futures markets, with buyer activity signaling potential upward trajectories amid stable prices. As on-chain data from sources like CryptoQuant and CryptoOnchain illustrate, this shift highlights Ethereum’s evolving network resilience and trader optimism in 2025. Looking ahead, maintaining this momentum could propel ETH toward key resistance levels, encouraging investors to stay vigilant on derivatives trends for informed decision-making.

Comments

Other Articles

Vitalik Buterin: The AI Revolution in DAO Management

February 23, 2026 at 02:58 PM UTC

BitMine Boosts Ethereum Stake to 461K ETH, Eyes Network Share Growth

January 1, 2026 at 08:06 PM UTC

Ethereum Inflow to Binance Surges to 24,500 ETH, Hinting at Short-Term Bearish Pressure

January 1, 2026 at 05:00 PM UTC