GameStop Q3 Earnings Miss Pressured by Declining Sales and Bitcoin Losses

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

GameStop’s Q3 2025 earnings missed estimates with revenue at $821 million against $987.29 million expected, driven by falling sales and $9 million in unrealized Bitcoin losses, leading to a 4% stock drop.

-

Revenue shortfall: GameStop reported $821 million, below the $987.29 million forecast from analysts.

-

Bitcoin holdings totaled 4,710 BTC, with $9 million unrealized losses in Q3 but $19.4 million year-to-date gains.

-

Stock reaction included an 11% slide post-treasury pivot announcement, amid broader concerns over physical media decline.

GameStop Q3 2025 earnings reveal revenue miss and Bitcoin strategy struggles—explore impacts on stock and crypto pivot. Stay informed on retail-crypto shifts today.

What are the key details of GameStop’s Q3 2025 earnings?

GameStop Q3 2025 earnings showed a significant shortfall, with revenue reaching $821 million compared to analyst expectations of $987.29 million. The miss was attributed to declining core sales in physical video games and used game reselling, compounded by $9 million in unrealized losses on its Bitcoin holdings. Despite these challenges, the company’s Bitcoin position remained positive year-to-date at $19.4 million.

Falling sales and diminished Bitcoin gains pressured earnings, with the stock continuing to retrace its brief rally in March.

GameStop missed analyst estimates in the third quarter of 2025, dragging shares down over 4% on Wednesday, as declining core sales and reduced Bitcoin gains weighed on the quarter.

The company’s Q3 revenue of $821 million fell short of analyst expectations of $987.29 million, according to Seeking Alpha.

GameStop’s Q3 report also shows that it holds 4,710 Bitcoin (BTC), with unrealized losses during the quarter totaling $9 million, though its BTC position remains up $19.4 million for the year.

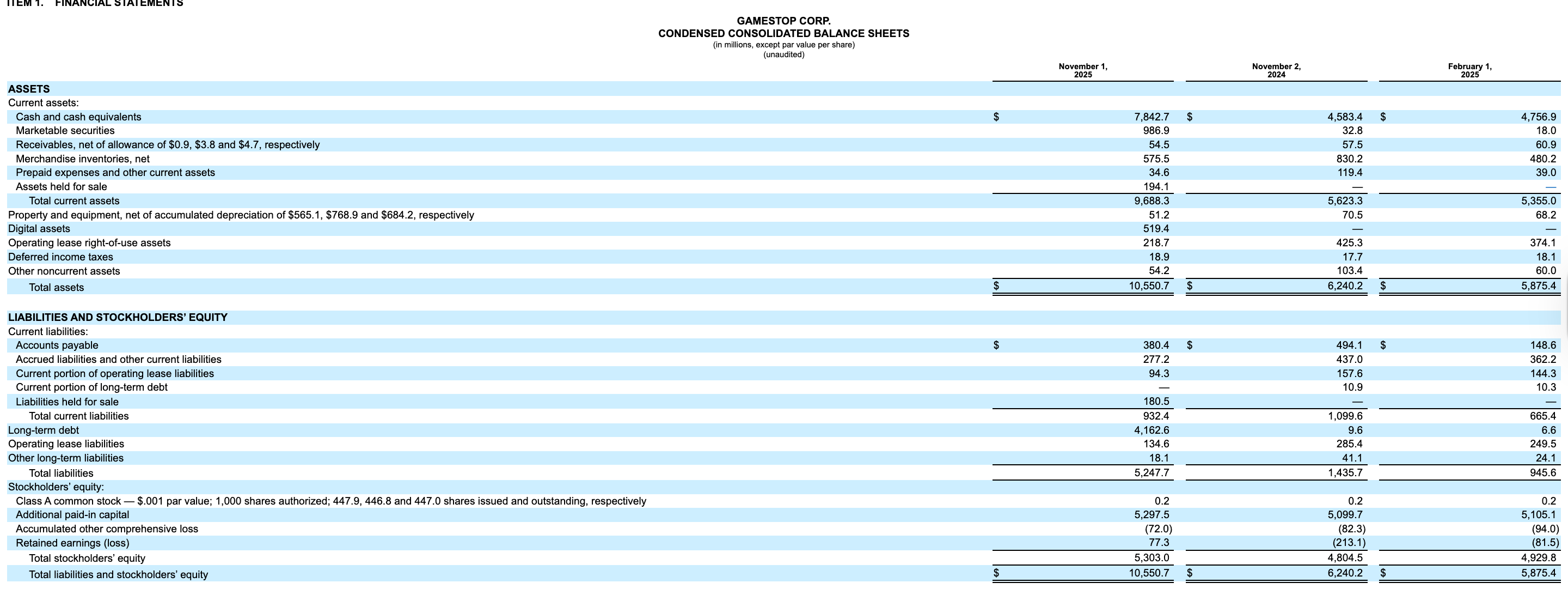

GameStop balance sheet Q3 2025. Source: SEC

The company also missed analyst expectations in Q1, posting revenue of about $732 million, falling short of estimates of $754 million.

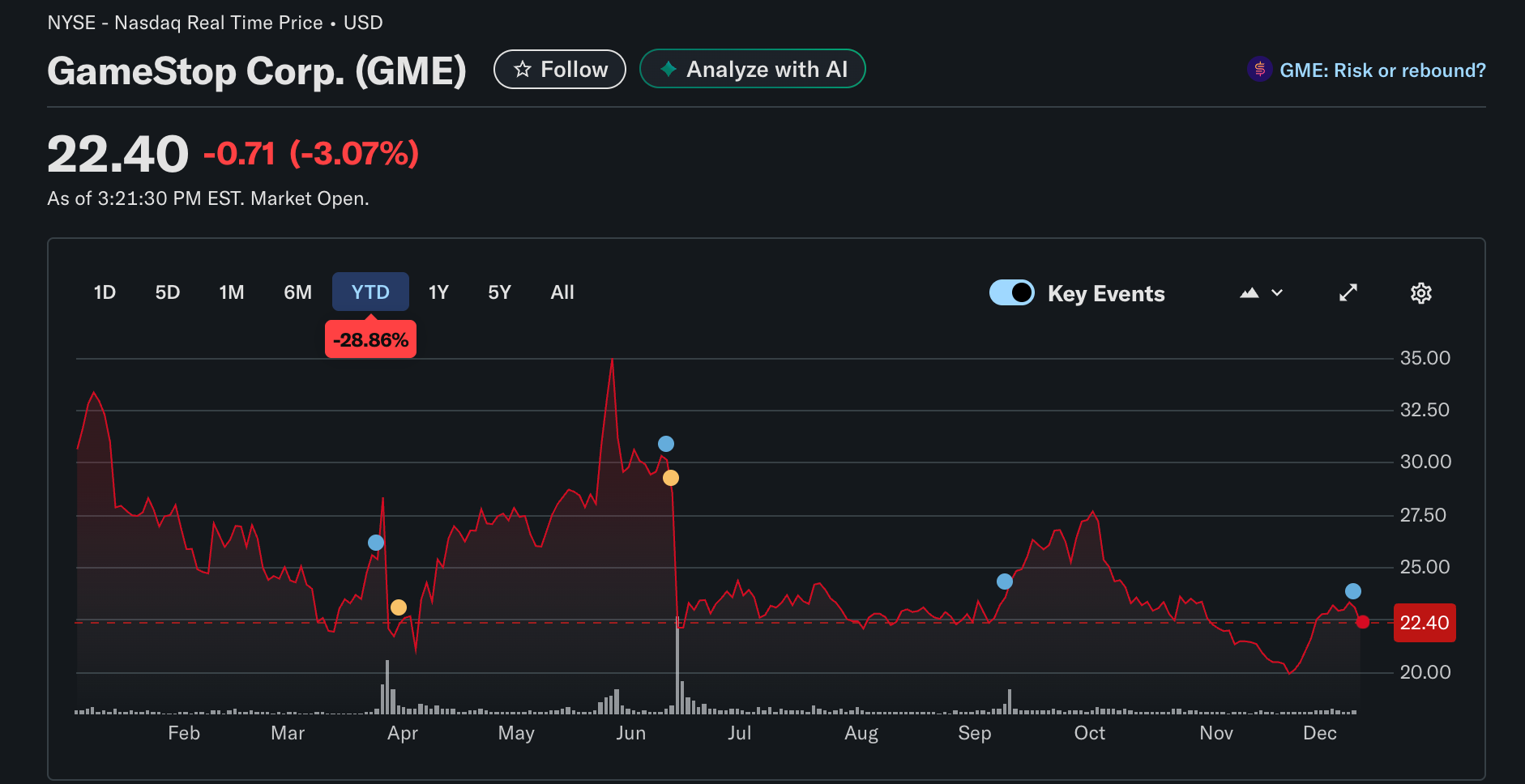

GameStop continues to struggle despite adopting a BTC treasury strategy in March. The move briefly lifted the stock by about 12% to $35 per share, but those gains quickly reversed.

Bitcoin treasury firms enter a ‘Darwinian phase’ as premiums collapse: Galaxy

How has GameStop’s Bitcoin treasury strategy impacted its performance?

GameStop’s pivot to a Bitcoin treasury strategy in March 2025 aimed to diversify beyond its traditional retail model, but it has provided limited relief amid ongoing sales declines. The company raised $1.5 billion in April to acquire 4,710 BTC in May, positioning itself as a digital asset treasury entity. However, shares dropped 11% immediately after the announcement, reflecting investor skepticism.

This strategy builds on broader trends where corporations hold Bitcoin as an inflation hedge, yet GameStop’s core business—centered on physical video games and collectibles—faces headwinds from digital streaming dominance. According to financial analysts, the unrealized Bitcoin losses of $9 million in Q3 contributed to the earnings pressure, despite a net positive of $19.4 million for the year. CEO Ryan Cohen emphasized in July that Bitcoin serves as a safeguard against inflation, and the firm is exploring crypto payments in stores to modernize operations.

Expert commentary from sources like Standard Chartered highlights a market saturation in digital asset treasuries, leading to investor caution and stock volatility. Cohen noted the shift toward collectibles like trading cards to offset rising costs in hardware sales. Data from SEC filings underscores the balance sheet strain, with Q3 results echoing the Q1 miss of $732 million against $754 million expected.

GameStop’s stock has been in decline since its crypto treasury move in March. Source: Yahoo Finance

In a statement, Cohen said, “The ability to actually use crypto within transactions is something that is an opportunity, and it’s something that we’re looking at.” He further added that the company is attempting to reduce reliance on physical hardware and game sales due to rising costs and focus on collectibles like trading cards.

The decline of GameStop’s stock is part of a broader downturn in digital asset treasury companies, which is attributed to market saturation and investor caution, according to Standard Chartered.

Magazine: Quantum attacking Bitcoin would be a waste of time: Kevin O’Leary

Frequently Asked Questions

Why did GameStop miss its Q3 2025 earnings estimates?

GameStop’s Q3 2025 earnings missed due to a revenue drop to $821 million from expected $987.29 million, fueled by declining physical game sales and $9 million in Bitcoin unrealized losses. The shift to digital media continues to erode core revenue streams, as reported in SEC documents.

What is the current status of GameStop’s Bitcoin holdings?

GameStop holds 4,710 Bitcoin as of Q3 2025, acquired through a $1.5 billion raise in April. While Q3 saw $9 million in losses, the position is up $19.4 million year-to-date, serving as an inflation hedge per CEO statements.

Key Takeaways

- Earnings Miss Impact: GameStop’s $821 million Q3 revenue fell short, triggering a 4% stock decline amid sales weakness.

- Bitcoin Strategy Challenges: Despite 4,710 BTC holdings, $9 million quarterly losses highlight volatility in treasury adoption.

- Future Outlook: Explore crypto payments and collectibles to counter physical media decline—monitor for recovery signs.

Conclusion

GameStop’s Q3 2025 earnings underscore persistent challenges in its Bitcoin treasury strategy and core retail operations, with revenue shortfalls and unrealized losses pressuring performance. As the company navigates market saturation in digital assets, per insights from Standard Chartered and Galaxy Research, strategic pivots toward crypto integration could offer long-term resilience. Investors should watch upcoming quarters for signs of stabilization and innovation in this evolving retail-crypto landscape.