Grayscale Files for ZCash Trust Amid ZEC Rally, Potential NYSE Arca Listing

ZEC/USDT

$444,176,201.48

$223.96 / $203.50

Change: $20.46 (10.05%)

+0.0004%

Longs pay

Contents

Grayscale Investments has filed for a ZCash Trust, marking a significant step toward launching the first ZEC exchange-traded product. This move follows a strong rally in ZEC prices, enhancing accessibility for accredited investors through an OTC-traded trust that could evolve into a full ETF.

-

Grayscale’s ZCash Trust filing introduces ZEC to institutional portfolios, potentially boosting liquidity and mainstream adoption.

-

The trust targets accredited investors, offering exposure to ZEC’s privacy-focused blockchain without direct ownership.

-

ZEC has surged over 100% against BTC in the past month, trading at $503.61 with open interest steady at $711 million.

Discover Grayscale’s ZCash Trust filing and its impact on ZEC adoption for investors. Explore details on NYSE Arca listing and treasury strategies in this comprehensive crypto news update. Stay informed on emerging ETPs today.

What is Grayscale’s ZCash Trust and How Does It Work?

Grayscale’s ZCash Trust is a new investment vehicle filed by Grayscale Investments to provide exposure to ZCash (ZEC), a privacy-centric cryptocurrency. The trust, ticker ZCSH, will trade on the over-the-counter (OTC) market initially and aims for listing on NYSE Arca. It allows accredited investors to gain indirect access to ZEC’s value without managing the asset directly, using a structure that creates and redeems shares based on net asset value (NAV) to maintain price alignment.

How Will the ZCash Trust Benefit Accredited Investors?

The ZCash Trust opens ZEC to a broader investor base, particularly those seeking privacy-enhanced digital assets. According to Grayscale’s filing details, shares will be issued in baskets of 10,000 units, with daily adjustments to reflect ZEC’s market price. This mechanism supports arbitrage opportunities until full liquidity is achieved on major exchanges like NYSE Arca. ZEC’s anonymous transaction features, powered by zk-SNARKs technology, have historically limited institutional interest due to regulatory concerns, but this trust addresses that by offering a compliant, tokenized exposure. Data from market trackers shows ZEC’s recent performance, with a 100% gain against Bitcoin over the past month, underscoring its potential volatility and reward profile for sophisticated investors.

1/ We just filed Grayscale Zcash Trust’s (Ticker: ZCSH) initial registration statement on Form S-3.

This is an important step for launching the first ZEC ETPs. pic.twitter.com/O9scaH2yZY

— Craig Salm (@CraigSalm) November 26, 2025

Grayscale, a leader in cryptocurrency investment products, continues to expand its portfolio with assets like ZEC, which emphasize privacy in blockchain transactions. The firm’s Chief Legal Officer, Craig Salm, highlighted the filing as a key milestone for ZEC-based exchange-traded products (ETPs). This development aligns with Grayscale’s strategy of supporting high-potential, albeit riskier, tokens through structured trusts that could transition to ETFs, providing liquidity and regulatory clarity.

Prior to this filing, ZEC had seen limited institutional adoption due to its shielded transaction capabilities, often trading in de-anonymized forms or tokenized wrappers. The trust changes this dynamic by exposing ZEC to accredited investors—defined as U.S. individuals or entities with a net worth exceeding $1 million or annual income over $200,000. Shares under ZCSH will be created or redeemed to balance supply with demand, ensuring the trust’s price tracks ZEC’s spot value closely. Grayscale anticipates this will foster a more efficient market, reducing premiums or discounts to NAV through ongoing issuance.

Reliance Global Group’s ZEC Treasury Strategy

In parallel with Grayscale’s announcement, Reliance Global Group, Inc. (RELI) has integrated ZEC into its digital asset treasury (DAT) as its primary holding. The company deployed additional cash to build this position, reflecting confidence in ZEC’s long-term value. Moshe Fishman, Director of Insurtech at Reliance and a member of its Crypto Advisory Board, stated, “We deployed additional cash into our Zcash position because our ongoing analysis supports our decision to maintain ZEC as our primary digital asset exposure within our treasury strategy.”

This corporate adoption signals growing enterprise interest in ZEC amid its price recovery. ZEC climbed to $503.61 from a recent low near $480, driven by retail enthusiasm and whale accumulations. Over the past two months, the asset has benefited from consistent buying pressure, with open interest holding steady at $711 million and subdued short positions. Against Bitcoin, ZEC has appreciated by more than 100% in the last month, currently trading at 0.0059 BTC. Analysts note that while volatility persists, ZEC’s technical setup positions it for a potential breakout toward $700, contingent on sustained market momentum.

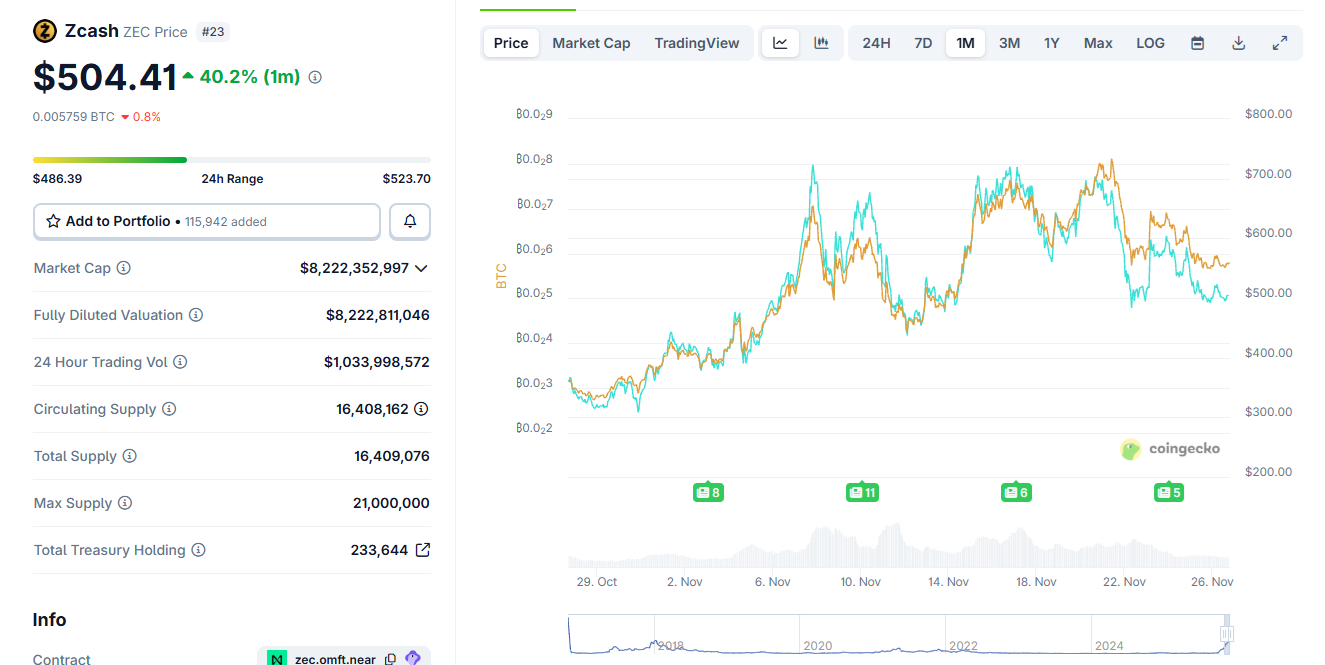

ZEC was more volatile in the past month, but still managed to appreciate by over 100% against BTC | Source: Coingecko

ZEC was more volatile in the past month, but still managed to appreciate by over 100% against BTC | Source: CoingeckoGrayscale’s entry into ZEC products follows one of the token’s strongest rallies since 2018, underscoring a shift in perception toward privacy coins. The trust’s structure, similar to Grayscale’s existing ETPs for assets like Bitcoin and Ethereum, emphasizes liquidity and accessibility. By limiting initial access to accredited investors, it mitigates regulatory risks while paving the way for wider distribution. Market data indicates ZEC’s resilience, with flat open interest suggesting balanced sentiment despite recent dips.

Broader implications include enhanced legitimacy for privacy-focused blockchains. ZCash, launched in 2016 as a fork of Bitcoin, uses zero-knowledge proofs to enable optional private transactions, appealing to users prioritizing confidentiality. Grayscale’s involvement could accelerate ZEC’s integration into traditional finance, especially as regulatory frameworks evolve to accommodate such innovations. The firm’s track record with over $30 billion in assets under management demonstrates its expertise in bridging crypto and institutional investing.

Frequently Asked Questions

What Does Grayscale’s ZCash Trust Filing Mean for ZEC Investors?

Grayscale’s ZCash Trust filing introduces ZCSH shares for accredited investors, providing a regulated way to invest in ZEC without direct custody. It starts on the OTC market with plans for NYSE Arca listing, potentially improving liquidity and price discovery for the privacy coin.

Is ZCash Trust Available to All Investors Right Now?

Currently, the ZCash Trust is restricted to accredited investors meeting U.S. SEC criteria, such as high net worth or income thresholds. This ensures compliance while Grayscale prepares for broader accessibility through future ETF conversions or expanded offerings.

Key Takeaways

- Grayscale’s ZCash Trust Expands Access: The filing for ZCSH enables accredited investors to gain ZEC exposure via an ETP structure, with OTC trading and NYSE Arca ambitions.

- ZEC’s Market Surge Continues: Up over 100% against BTC in a month, ZEC trades at $503.61, supported by whale activity and steady open interest of $711 million.

- Corporate Adoption Grows: Reliance Global Group’s ZEC treasury strategy highlights institutional confidence, urging investors to monitor privacy coin developments for portfolio diversification.

Conclusion

Grayscale’s ZCash Trust filing represents a pivotal advancement for ZCash Trust adoption, integrating ZEC into mainstream investment options while addressing privacy coin challenges. With Reliance Global Group’s treasury commitment and ZEC’s robust price performance, the ecosystem shows maturing appeal. As regulatory landscapes evolve, investors should evaluate these ETP opportunities to capitalize on emerging digital asset trends.

Comments

Other Articles

Oil Prices Surge 3% After Trump Cancels Iran Meetings and Promises Protesters ‘Help Is on the Way’ – What It Means for Bitcoin

January 13, 2026 at 05:49 PM UTC

Bitcoin Surges to $93,888: How Venezuela-US Tensions Triggered a Crypto Rally

January 5, 2026 at 07:04 AM UTC

Bitcoin (BTC) Eyes Short-Term Bottom Rebound as On-Chain Flows Align with USDC/USDT Premium and Market Liquidity, but Bearish Longer-Term Outlook Persists

January 1, 2026 at 03:41 PM UTC