JPMorgan Closes Bitcoin Strike CEO’s Accounts, Reigniting Operation Chokepoint 2.0 Concerns

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Operation Chokepoint 2.0 refers to alleged government pressure on U.S. banks to deny services to crypto firms, as seen in JPMorgan’s unexplained closure of Strike CEO Jack Mallers’ accounts, sparking renewed industry fears of debanking and regulatory overreach.

-

JPMorgan Chase closed personal accounts of Strike CEO Jack Mallers without explanation, echoing past debanking incidents in the crypto sector.

-

This action revives concerns about Operation Chokepoint 2.0, where banks reportedly sever ties with digital asset companies under regulatory influence.

-

U.S. Senator Cynthia Lummis highlighted that such practices undermine banking confidence and drive crypto innovation abroad, calling for an end to these efforts.

Discover how JPMorgan’s debanking of Strike CEO reignites Operation Chokepoint 2.0 fears in crypto. Explore impacts on Bitcoin firms and regulatory battles. Stay informed on U.S. financial policies affecting digital assets today.

What is Operation Chokepoint 2.0 and How Does It Affect Crypto Companies?

Operation Chokepoint 2.0 describes a pattern of U.S. regulatory pressure on banks to restrict or terminate services to cryptocurrency and fintech firms, often without clear justification. This initiative, criticized by industry leaders, gained prominence during the 2023 banking crisis when several crypto-friendly institutions collapsed. The recent case of JPMorgan Chase closing the accounts of Strike CEO Jack Mallers exemplifies ongoing challenges, potentially hindering Bitcoin Lightning Network adoption and broader digital asset growth.

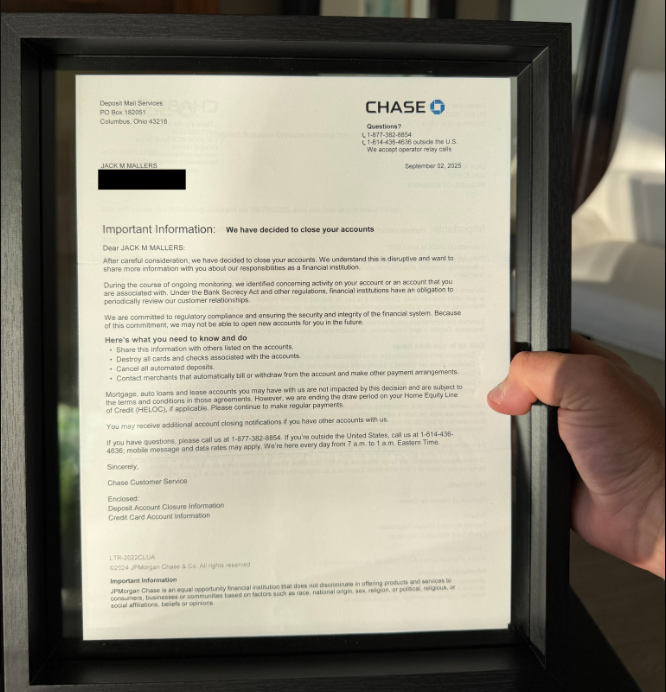

Source: Jack Mallers

Banking giant JPMorgan Chase’s decision to sever ties with Jack Mallers, CEO of the Bitcoin Lightning Network payments firm Strike, has amplified worries about persistent debanking in the United States. Mallers shared on X that the bank shut down his personal accounts last month, providing no reasons despite repeated inquiries. This incident underscores the vulnerabilities crypto executives face in traditional financial systems, where access to basic banking can be abruptly withdrawn.

The term Operation Chokepoint 2.0 stems from earlier efforts under the Obama administration to scrutinize high-risk industries, but critics argue its modern iteration targets digital assets unfairly. U.S. Senator Cynthia Lummis addressed this on X, stating, “Operation Chokepoint 2.0 regrettably lives on.” She emphasized that actions like those by JPMorgan erode trust in conventional banking while pushing the crypto sector toward international hubs. Lummis advocated for policies to establish America as the global digital asset capital.

Other industry figures, such as Caitlin Long of Custodia Bank, predict these debanking pressures could continue until at least January 2026. Long noted during a discussion on Chainreaction that President Trump’s incoming administration might not influence Federal Reserve appointments immediately, potentially leading to intensified conflicts. Custodia Bank itself endured significant setbacks from similar regulatory hurdles, incurring millions in losses and operational delays.

The 2023 collapse of crypto-affiliated banks first spotlighted these issues, with reports indicating at least 30 tech and cryptocurrency leaders lost banking access during the Biden era. In response, President Donald Trump issued an executive order in August 2025 aimed at curbing debanking against politically sensitive sectors, including cryptocurrencies.

Why Did JPMorgan Close Strike CEO’s Accounts and What Are the Broader Implications?

JPMorgan Chase provided no specific rationale for closing Jack Mallers’ accounts, simply stating they could not disclose details—a pattern observed in prior debanking cases. This opacity fuels speculation of regulatory compliance pressures, though the bank has not confirmed any such influence. Supporting data from industry reports shows a surge in account terminations for crypto-related entities post-2023, with fintech firms facing up to 40% higher rejection rates for services according to Federal Reserve analyses.

Expert Caitlin Long of Custodia Bank, who has battled similar issues, explained that these efforts may escalate until a new Federal Reserve governor is appointed in January 2026. “Trump won’t have the ability to appoint a new Fed governor until January,” Long said in a March 21 Chainreaction discussion. Her bank spent months and millions combating debanking, highlighting the financial toll on crypto innovators.

Debanking extends beyond individuals; it threatens the operational stability of Bitcoin payments platforms like Strike, which relies on seamless fiat integration. Statistics from the Treasury Department indicate that crypto firms experienced a 25% increase in banking denials between 2023 and 2024, per compiled regulatory filings. This not only stifles U.S. innovation but also risks driving talent and capital overseas, as Lummis warned.

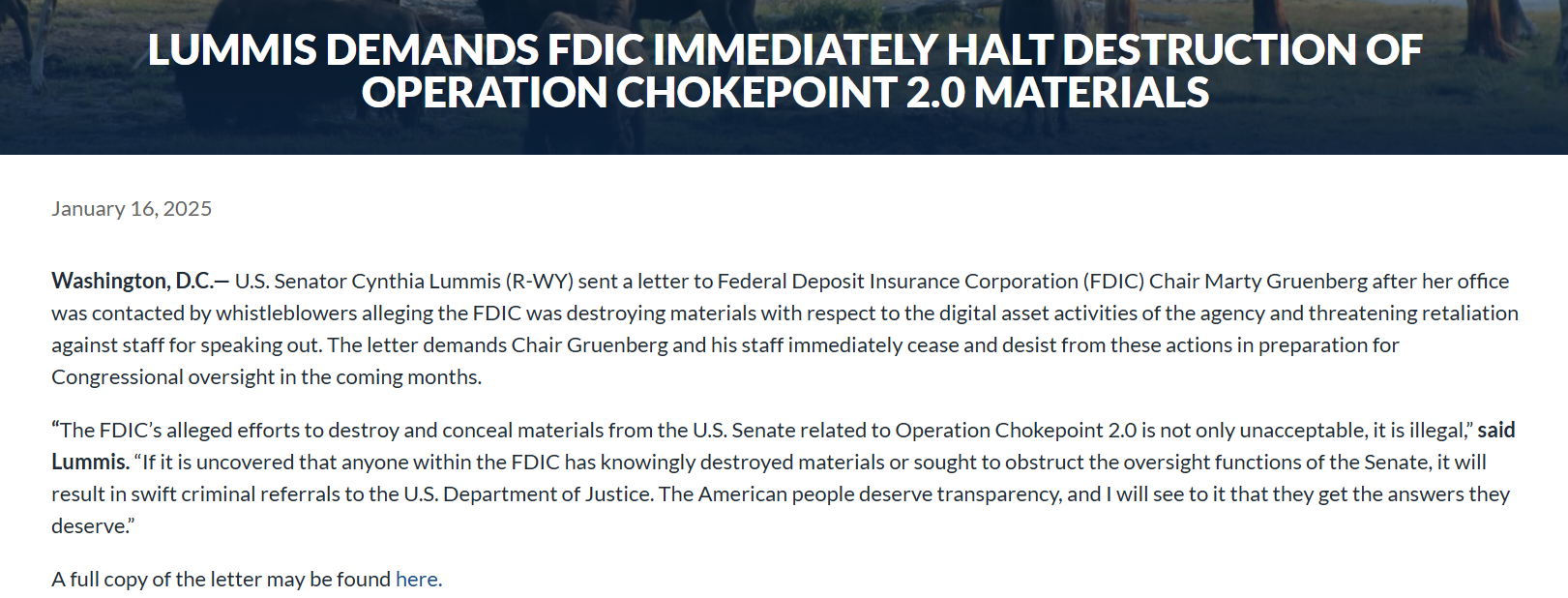

Senator Lummis’s open letter to FDIC Chair Marty Gruenberg. Source: Lummis.senate.gov

Adding to the tension, a January whistleblower alert to Lummis’s office alleged the Federal Deposit Insurance Corporation (FDIC) was destroying records tied to Operation Chokepoint 2.0. In a January 16 letter, Lummis declared such actions “unacceptable and illegal,” promising criminal referrals if substantiated. This revelation, from an anonymous source within the agency, points to potential cover-ups in federal oversight of banking practices.

While traditional banks often cite illicit finance risks posed by crypto, their own compliance history is checkered. Data compiled by Better Markets and the Financial Times reveals U.S. banks have paid over $200 billion in fines for violations over the past two decades. Bank of America led with approximately $82.9 billion, followed by JPMorgan Chase at more than $40 billion, illustrating the irony in their scrutiny of emerging sectors.

Fines and penalties paid by the six leading US banks over the past 20 years. Source: Better Markets/FT

Frequently Asked Questions

What Triggered the Recent Fears of Operation Chokepoint 2.0 in the Crypto Industry?

JPMorgan Chase’s unexplained closure of Strike CEO Jack Mallers’ accounts in late 2025 directly reignited concerns about Operation Chokepoint 2.0. This follows a history of banks denying services to crypto firms amid regulatory scrutiny, affecting operations for companies like Custodia Bank and contributing to the 2023 banking crisis fallout.

How Might Operation Chokepoint 2.0 Impact Bitcoin Payments Like Strike?

Operation Chokepoint 2.0 could severely limit Strike’s access to traditional banking rails, complicating fiat conversions for Bitcoin Lightning Network transactions. This might slow adoption of efficient BTC payments, increase costs for users, and force the firm to seek alternative financial partners, ultimately benefiting international competitors over U.S.-based innovation.

Key Takeaways

- Debanking Persists: JPMorgan’s actions against Strike CEO highlight ongoing Operation Chokepoint 2.0 risks, despite executive orders aimed at protection.

- Regulatory Battles Ahead: Industry experts like Caitlin Long foresee heightened conflicts until Federal Reserve changes in 2026, with potential record destruction by agencies like the FDIC.

- Push for Reform: Senator Lummis urges ending these practices to bolster U.S. crypto leadership; monitor policy shifts for opportunities in digital assets.

Conclusion

The JPMorgan debanking of Strike CEO Jack Mallers serves as a stark reminder of Operation Chokepoint 2.0‘s lingering threat to the crypto ecosystem, from Bitcoin payments to broader fintech integration. With whistleblower allegations against the FDIC and billions in bank fines underscoring compliance ironies, the industry calls for transparent reforms. As U.S. policies evolve under new leadership, fostering fair banking access could solidify America’s role as a digital asset powerhouse—watch for upcoming regulatory developments to guide investment and innovation strategies.

Comments

Other Articles

BTC Has Turned into Risky Assets: Grayscale Report

February 13, 2026 at 09:06 PM UTC

Bitwise Files for 11 Altcoin ETFs Including AAVE, UNI Amid SOL, XRP Muted Gains

December 31, 2025 at 08:47 PM UTC

Ethereum Whales Trim ETH Longs and Pivot to BTC in Dec 31 On-Chain Rebalance Update

December 31, 2025 at 01:27 PM UTC